File Form 2553 S Corp

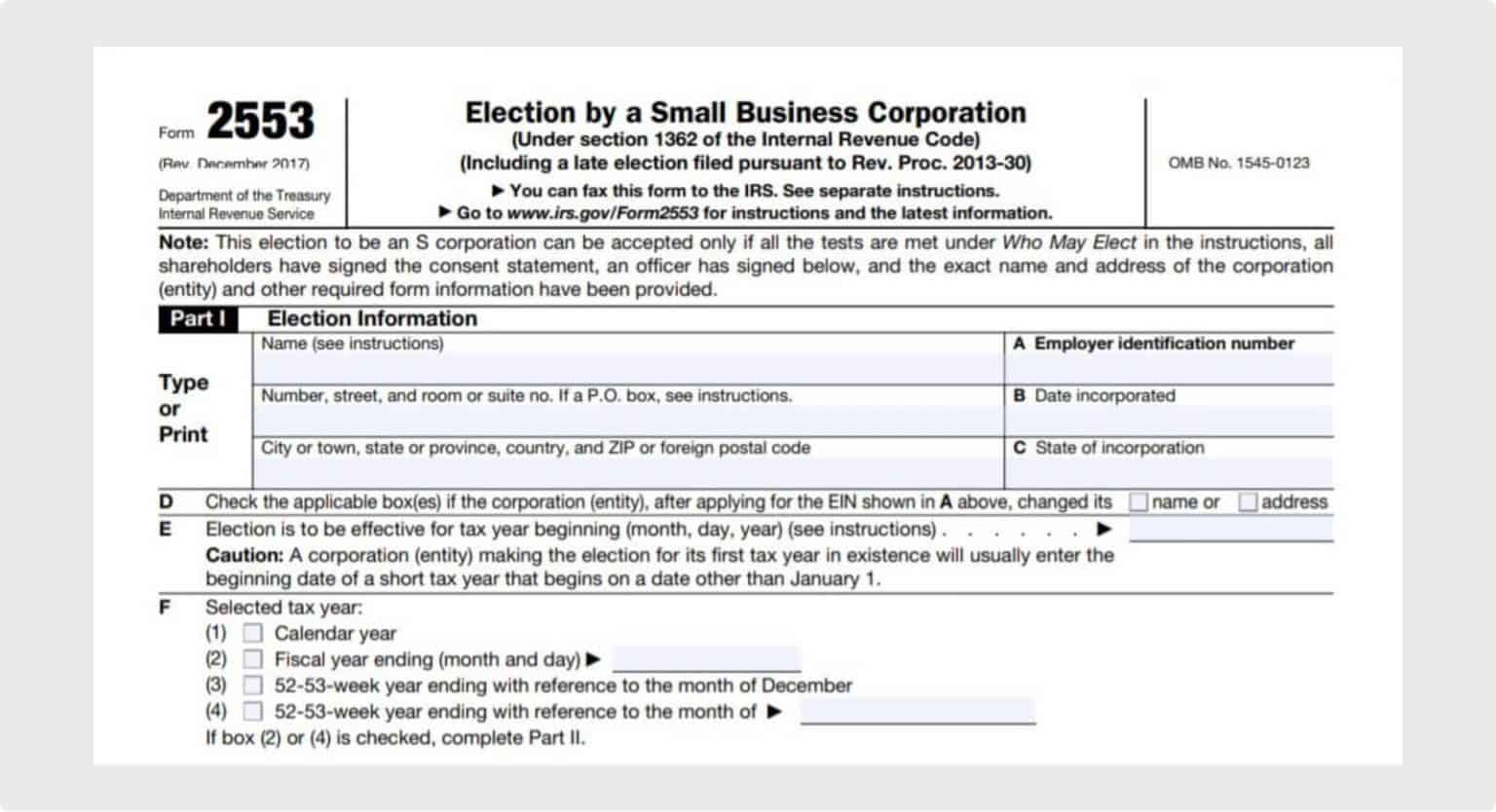

File Form 2553 S Corp - Complete, edit or print tax forms instantly. Web requirements for a form 2553 late filing s corporation election you can file for a late s corp election up to 3 years and 75 days after its proposed effective date!. Our business specialists help you incorporate your business. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. We have unmatched experience in forming businesses online. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Web up to 40% cash back irs form 2553 is used for gaining recognition under subcahpter s of the federal tax code. The irs will tax you under the default classification rules if you set up an. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather. This election occurs when a business.

Web elect to be taxed as an s corporation in just a few clicks. Irs 2553 instr & more fillable forms, try for free now! So, if you plan to elect for s corp status in 2024, you can file form. We have unmatched experience in forming businesses online. Upload, modify or create forms. Our business specialists help you incorporate your business. Besides filing form 2553, you. Web june 5, 2022 the irs will tax it as a c corporation when you set up a corporation. Form 2553 llc refers to the irs form used by llcs to elect to be considered an s corporation for tax purposes. Ad kickstart your s corporation in minutes.

Web find mailing addresses by state and date for filing form 2553. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the. Web to be an s corporation beginning with its short tax year, the corporation must file form 2553 during the period that begins november 8 and ends january 22. Web requirements for a form 2553 late filing s corporation election you can file for a late s corp election up to 3 years and 75 days after its proposed effective date!. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. For example, if you want. Complete irs tax forms online or print government tax documents. Free website with formation to get you started. Ad protect your business from liabilities. If the corporation's principal business, office, or agency is located in.

LLC vs. SCorp (How to Choose) SimplifyLLC

Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Free website with formation to get you started. Web instructions for form 2553 department of the treasury internal revenue service (rev. So, if you plan to elect for s corp status.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Web in order for a business entity to qualify as an s corporation on its annual taxes, it must file form 2553 by the 15th day of the 3rd month after the start its tax year. This election occurs when a business. So, if you plan to elect for s corp status in 2024, you can file form. Ad kickstart.

Form "2553" Instructions What & Why's IRS Form 2553 Important?

Web form 2553 can be filed at any time in the tax year before the s corporation is to take effect. Upload, modify or create forms. Web requirements for a form 2553 late filing s corporation election you can file for a late s corp election up to 3 years and 75 days after its proposed effective date!. Web instructions.

IRS Form 2553 Instructions How and Where to File This Tax Form

So, if you plan to elect for s corp status in 2024, you can file form. Web find mailing addresses by state and date for filing form 2553. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. December 2020) (for.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Besides filing form 2553, you. Web to be an s corporation beginning with its short tax year, the corporation must file form 2553 during the period that begins november 8 and ends january 22. For example, if you want. Ad kickstart your s corporation in minutes. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the.

Form 2553 TRUiC

Form 2553 llc refers to the irs form used by llcs to elect to be considered an s corporation for tax purposes. Free website with formation to get you started. Web elect to be taxed as an s corporation in just a few clicks. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web june 5,.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the. Web what is form 2553 used for? Web up to 40% cash back irs form 2553 is used for gaining recognition under subcahpter s of the federal tax code. So,.

Form 2553 An Overview of Who, When, and Why

Ad access irs tax forms. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the. Web an llc or corporation must file form 2553 (election by a small business corporation) to request s corporation tax treatment. Web to be an.

Form 2553 Instructions How and Where to File mojafarma

The irs will tax you under the default classification rules if you set up an. Web an llc or corporation must file form 2553 (election by a small business corporation) to request s corporation tax treatment. Web what is form 2553 used for? Besides filing form 2553, you. Web in order for a business entity to qualify as an s.

2553 Vorwahl

Web up to 40% cash back irs form 2553 is used for gaining recognition under subcahpter s of the federal tax code. Ad kickstart your s corporation in minutes. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web requirements for a form 2553.

Web What Is Form 2553 Used For?

December 2020) (for use with the december 2017 revision of form 2553, election by a. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Free website with formation to get you started. Web up to 40% cash back irs form 2553 is used for gaining recognition under subcahpter s of the federal tax code.

Besides Filing Form 2553, You.

Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather. Try it for free now! Web june 5, 2022 the irs will tax it as a c corporation when you set up a corporation. Web elect to be taxed as an s corporation in just a few clicks.

For Example, If You Want.

Ad protect your business from liabilities. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Ad kickstart your s corporation in minutes. Web form 2553 can be filed at any time in the tax year before the s corporation is to take effect.

Form 2553 Llc Refers To The Irs Form Used By Llcs To Elect To Be Considered An S Corporation For Tax Purposes.

Ad access irs tax forms. Web instructions for form 2553 department of the treasury internal revenue service (rev. The irs will tax you under the default classification rules if you set up an. Our business specialists help you incorporate your business.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)