File Form 3921 Electronically

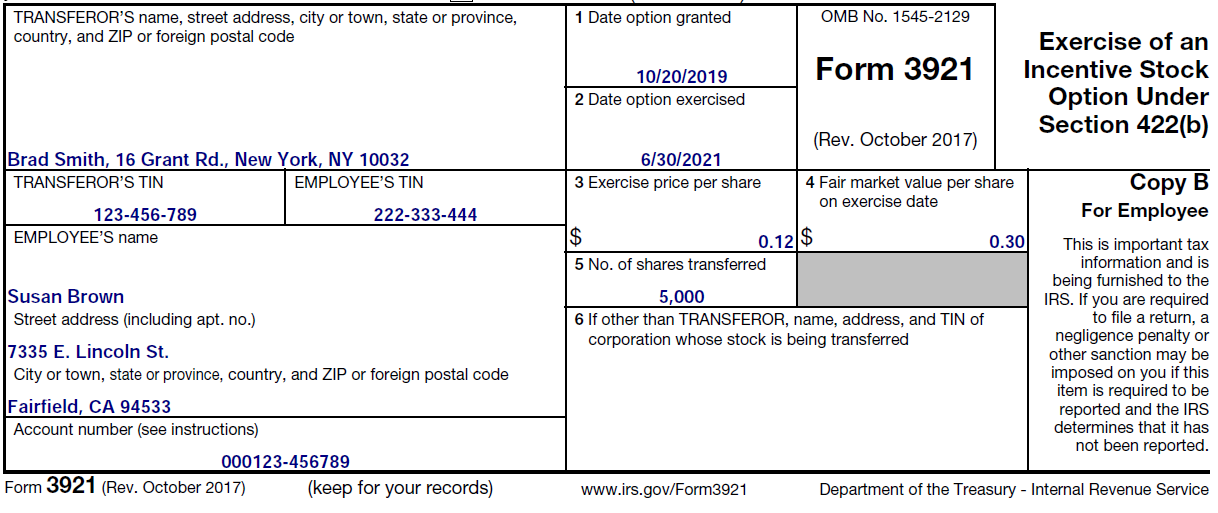

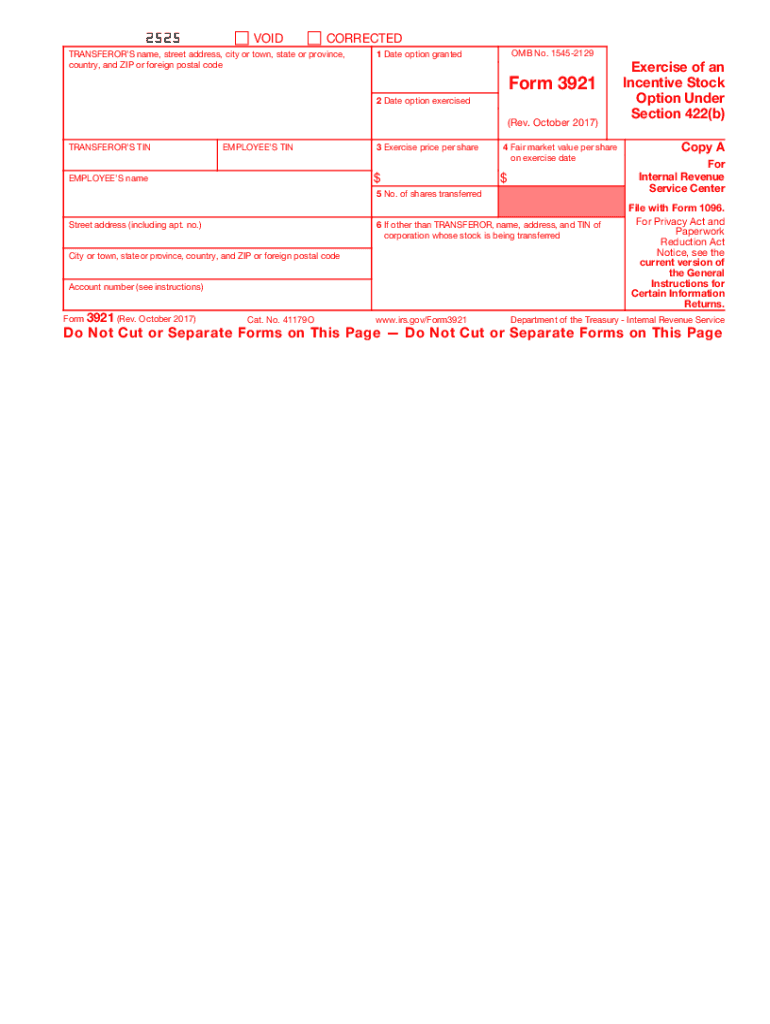

File Form 3921 Electronically - The number of shares transferred 5. After copy b is sent to the employees in the form of a consolidated. Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. Web how to file form 3921. Web if you file electronically, the due date is march 31 of the year following the year of exercise of the iso. File your 2290 tax now and receive schedule 1 in minutes. Our 3921 software creates files in the format required by the irs for electronic transmission. Copy a is sent to the irs; Copy b is the version you share with employees; Of shares transferred 6 if other than transferor, name, address, and ein of corporation whose stock is being transferred for internal revenue service center.

Copy b is the version you share with employees; Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. To file electronically, you must have software that generates a file. Maintain a copy c for your business records. Web within minutes, you will receive a code that you can use to file your form 3921 electronically. The form has to be filed in the. Either way, you’ll need a few things to get started: Web are you looking for where to file 3921 online? Irs form 3921 is used to report the. If you have more than 250 documents to file, then you are required to file online.

Web how to file form 3921. Web copy a $ $ 5 no. Web you can file form 3921 either by mail or online. Try it for free now! Ad download or email irs 3921 & more fillable forms, register and subscribe now! Don't miss this 50% discount. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. File online using an irs fire file option two: Irs form 3921 is used to report the.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

And copy c is for your own records. Web within minutes, you will receive a code that you can use to file your form 3921 electronically. Copy a is sent to the irs; After copy b is sent to the employees in the form of a consolidated. Of shares transferred 6 if other than transferor, name, address, and ein of.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web copy a $ $ 5 no. Either way, you’ll need a few things to get started: Copy a is sent to the irs; Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. Web companies can deliver this file electronically to the employee.

178 best W2 and 1099 Software images on Pinterest Consumer

If you have more than 250 documents to file, then you are required to file online. Upload, modify or create forms. Don't miss this 50% discount. Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. Web form 3921 is an internal revenue service.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Irs approved tax1099.com allows you to efile your 3921 with security and ease, all online. Maintain a copy c for your business records. File on paper faq getting started shoobx will begin by checking to see if any employees have exercised options in. If you have more than 250 documents to file, then you are required to file online. The.

Form 3921 Everything you need to know

Web if you file electronically, the due date is march 31 of the year following the year of exercise of the iso. Ad download or email irs 3921 & more fillable forms, register and subscribe now! Web companies can deliver this file electronically to the employee through carta platform. And copy c is for your own records. Web form 3921.

File Form 3921 Eqvista

Web form 3921 is an internal revenue service (irs) form that companies must file for tax years when their employees exercise any incentive stock options (isos). Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. If you are required to file 250 or.

How to file form 2290 Electronically For the Tax Year 20212022 by Form

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web how to file form 3921. Web are you looking for where to file 3921 online? Web companies can deliver this file electronically to the employee through carta platform. Information on the “transferor” if they are not the same corporation as the “payer”.

What is IRS Form 3921? When & How to File Carta

Irs form 3921 is used to report the. After copy b is sent to the employees in the form of a consolidated. The number of shares transferred 5. Form 3921 is completed in three parts. The form has to be filed in the.

IRS 3921 20172021 Fill out Tax Template Online US Legal Forms

Our 3921 software creates files in the format required by the irs for electronic transmission. To file electronically, you must have software that generates a file. Information on the “transferor” if they are not the same corporation as the “payer”. Web you can file form 3921 either by mail or online. Web electronic reporting requirements.

Requesting your TCC to file your 3921 through Mail/Fax Carta Help Center

The form has to be filed in the. Information on the “transferor” if they are not the same corporation as the “payer”. Web how to file form 3921. Form 3921 is completed in three parts. Web are you looking for where to file 3921 online?

Of Shares Transferred 6 If Other Than Transferor, Name, Address, And Ein Of Corporation Whose Stock Is Being Transferred For Internal Revenue Service Center.

Either way, you’ll need a few things to get started: Web file an unlimited number of 3921 forms electronically with the irs. You can file form 3921 either by mail or online. Don't miss this 50% discount.

File On Paper Faq Getting Started Shoobx Will Begin By Checking To See If Any Employees Have Exercised Options In.

Try it for free now! If you are required to file 250 or more 3921s, you must file online. Web form 3921, exercise of an incentive stock option under section 422 (b) form 3922, transfer of stock acquired through an employee stock purchase plan under. Complete, edit or print tax forms instantly.

Web How To File Form 3921.

Web if you file electronically, the due date is march 31 of the year following the year of exercise of the iso. File your 2290 tax now and receive schedule 1 in minutes. Web copy a should be sent to the irs either electronically or by mail. Copy a is sent to the irs;

File Online Using An Irs Fire File Option Two:

Web companies can deliver this file electronically to the employee through carta platform. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web form 3921 is an internal revenue service (irs) form that companies must file for tax years when their employees exercise any incentive stock options (isos). And copy c is for your own records.