Fillable 941 Quarterly Form 2022

Fillable 941 Quarterly Form 2022 - Web below, you can get the online fillable pdf version of form 941 for the 2022 quarters. At this time, the irs. Take note that this is for those that are. Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. Upload, modify or create forms. This version of form 941 is an efficient way to file it on your computer, where you can print. The draft form 941 ,. Web follow the simple instructions below: Web report for this quarter of 2022 (check one.) 1: Web fill out 941 online.

Web the total tax reported on the “total liability for the quarter” line of the amended schedule b must match the corrected tax (form 941, line 12, combined with any correction reported. Form 941 is used by employers. Web street suite or room number return you’re correcting. Take note that this is for those that are. October, november, december go to. Ad get ready for tax season deadlines by completing any required tax forms today. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Upload, modify or create forms. Ad access irs tax forms. Employer’s quarterly federal tax return form (rev.

Ist april 30th , 2nd july 3l5t , 3rd october 3i5t and 4th january 31st. Ad access irs tax forms. Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. You might also be able to electronically file form 941, depending on your business and state. Complete, edit or print tax forms instantly. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. At this time, the irs expects the march. Web report for this quarter of 2022 (check one.) 1: March 2023) american samoa, guam, the commonwealth of the northern department of the. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Printable 941 Form 2021 Printable Form 2022

Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. Web the total tax reported on the “total liability for the quarter” line of the amended schedule b must match the corrected tax (form 941, line 12, combined with any correction reported. Web below, you can get the online.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

The draft form 941 ,. Web follow the simple instructions below: Form 941 is used by employers. Web below, you can get the online fillable pdf version of form 941 for the 2022 quarters. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

941 X Form Fill Out and Sign Printable PDF Template signNow

Web to find out where to mail form 941, check out the irs’s website. Ad get ready for tax season deadlines by completing any required tax forms today. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. At this time, the irs. Web the total tax reported on the.

Print Irs Form 941 Fill Online, Printable, Fillable, Blank pdfFiller

You might also be able to electronically file form 941, depending on your business and state. Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. 26 by the internal revenue service. Ist april 30th , 2nd july 3l5t , 3rd october 3i5t and 4th january 31st. Web the.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

March 2023) american samoa, guam, the commonwealth of the northern department of the. Get ready for tax season deadlines by completing any required tax forms today. Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. Web information about form 941, employer's quarterly federal tax return, including recent updates,.

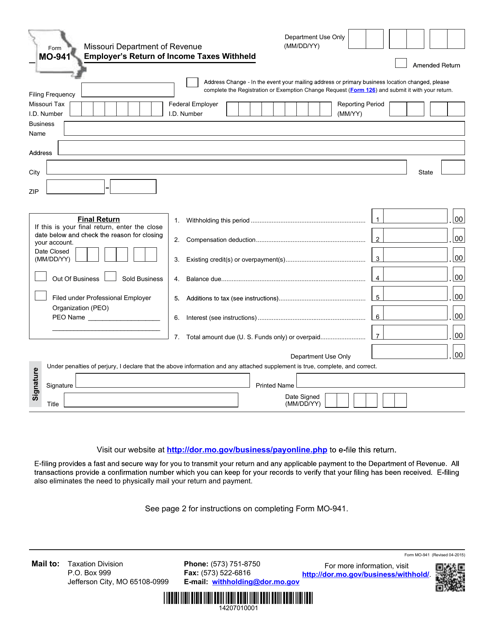

Form MO941 Download Fillable PDF or Fill Online Employer's Return of

October, november, december go to. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web report for this quarter of 2022 (check one.) 1: Check the type of return you’re correcting.

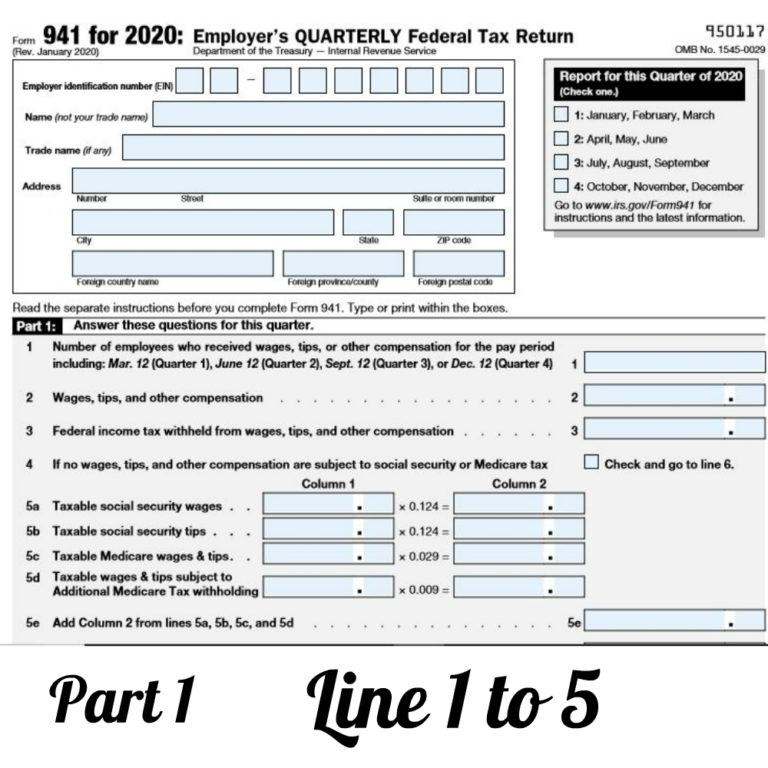

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Ist april 30th , 2nd july 3l5t , 3rd october 3i5t and 4th january 31st. March 2023) american samoa, guam, the commonwealth of the northern department of the. Ad get ready for tax season deadlines by completing any required tax forms today. At this time, the irs expects the march. Web form 941 for 2023:

Revised IRS Form 941 Schedule R 2nd quarter 2021

Report the payroll taxes you withheld from your employees’ wages during the 2022 tax year by filling out form 941 online. Complete, edit or print tax forms instantly. Ist april 30th , 2nd july 3l5t , 3rd october 3i5t and 4th january 31st. Web use the march 2023 revision of form 941 to report taxes for the first quarter of.

IRS Form 941X Complete & Print 941X for 2021

Web follow the simple instructions below: 26 by the internal revenue service. At this time, the irs. Web report for this quarter of 2022 (check one.) 1: At this time, the irs expects the march.

941 Schedule B Fill Out and Sign Printable PDF Template signNow

Web follow the simple instructions below: For paperwork reduction act notice, see separate. Get ready for tax season deadlines by completing any required tax forms today. At this time, the irs expects the march. March 2023) american samoa, guam, the commonwealth of the northern department of the.

Web Report For This Quarter Of 2022 (Check One.) 1:

Don't use an earlier revision to report taxes for 2023. For paperwork reduction act notice, see separate. Ist april 30th , 2nd july 3l5t , 3rd october 3i5t and 4th january 31st. Web the total tax reported on the “total liability for the quarter” line of the amended schedule b must match the corrected tax (form 941, line 12, combined with any correction reported.

Report The Payroll Taxes You Withheld From Your Employees’ Wages During The 2022 Tax Year By Filling Out Form 941 Online.

Check the type of return you’re correcting. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Ad access irs tax forms. Employer’s quarterly federal tax return form (rev.

Complete, Edit Or Print Tax Forms Instantly.

Web below, you can get the online fillable pdf version of form 941 for the 2022 quarters. 26 by the internal revenue service. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; March 2023) american samoa, guam, the commonwealth of the northern department of the.

Web Fill Out 941 Online.

At this time, the irs expects the march. Web report for this quarter of 2022 (check one.) 1: You might also be able to electronically file form 941, depending on your business and state. Web street suite or room number return you’re correcting.