Form 1039 Irs

Form 1039 Irs - A tax form distributed by the internal revenue service (irs) that notifies a shareholder. To alert the irs that your identity has been. The carryback of an nol; Irs form 8825 or step. The carryback of a net capital loss; Enter if fair rental days are not reported, the property is considered to be in service for 12. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Calculate monthly property cash flow using step 2a: The term—which gets its name from. Web get federal tax return forms and file by mail.

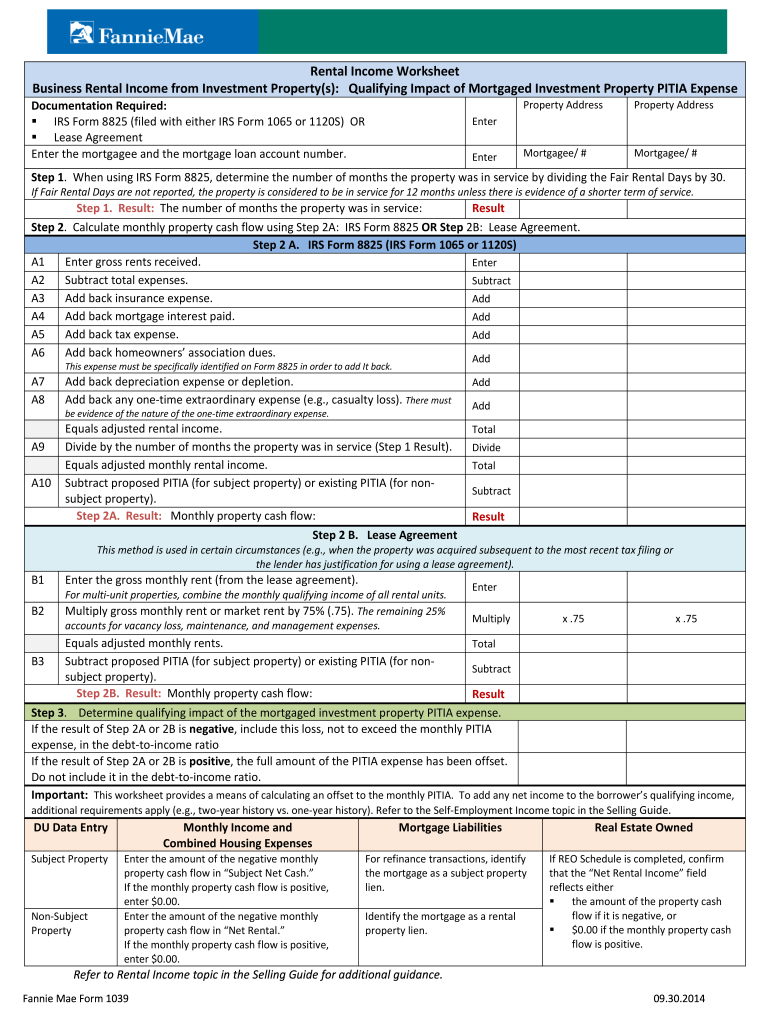

Web about form 1139, corporation application for tentative refund. The carryback of a net capital loss; Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Web 3301 gun club road west palm beach, fl 33406. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Enter if fair rental days are not reported, the property is considered to be in service for 12. Form 8825, result line1 step 2. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Irs form 8825 or step. Web fannie mae form 1039 02/23/16 rental income worksheet documentation required:

Calculate monthly property cash flow using step 2a: Irs form 8825 or step. Web simply fill in this brief application form and your local nria program specialist will respond to your inquiry within 24 to 48 hours to help you determine the types of home. A tax form distributed by the internal revenue service (irs) that notifies a shareholder. Web the irs thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments. The irs would typically expect a higher portion of. Web up to $40 cash back edit your income tax form form online. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web get federal tax return forms and file by mail. Web about form 1139, corporation application for tentative refund.

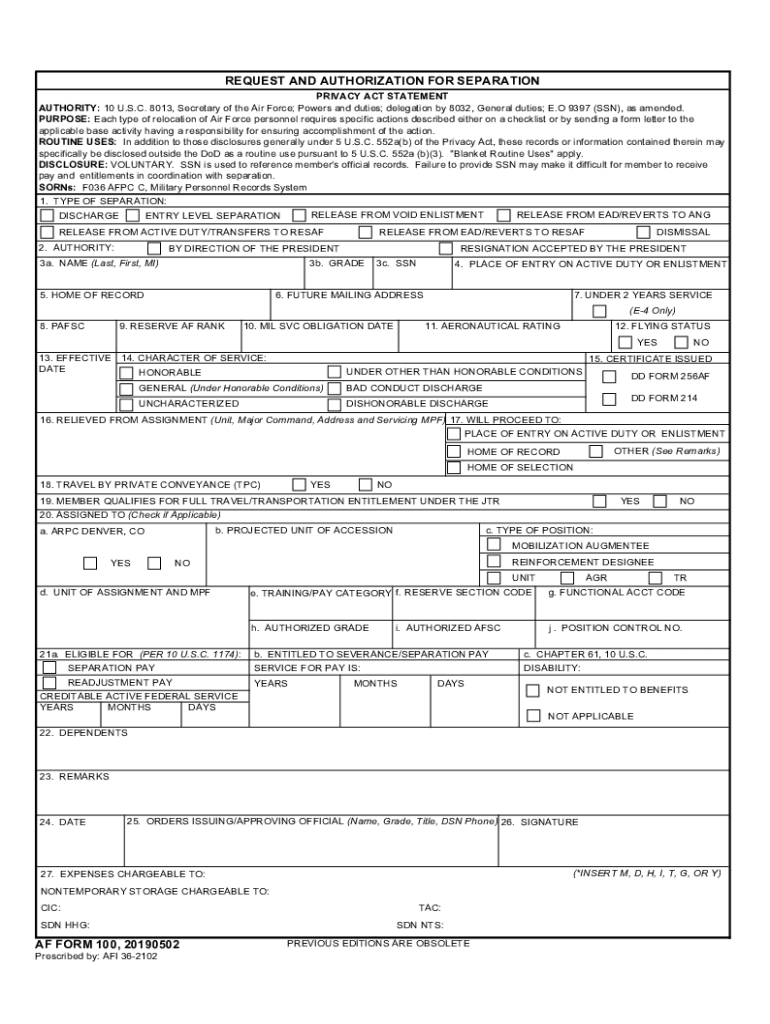

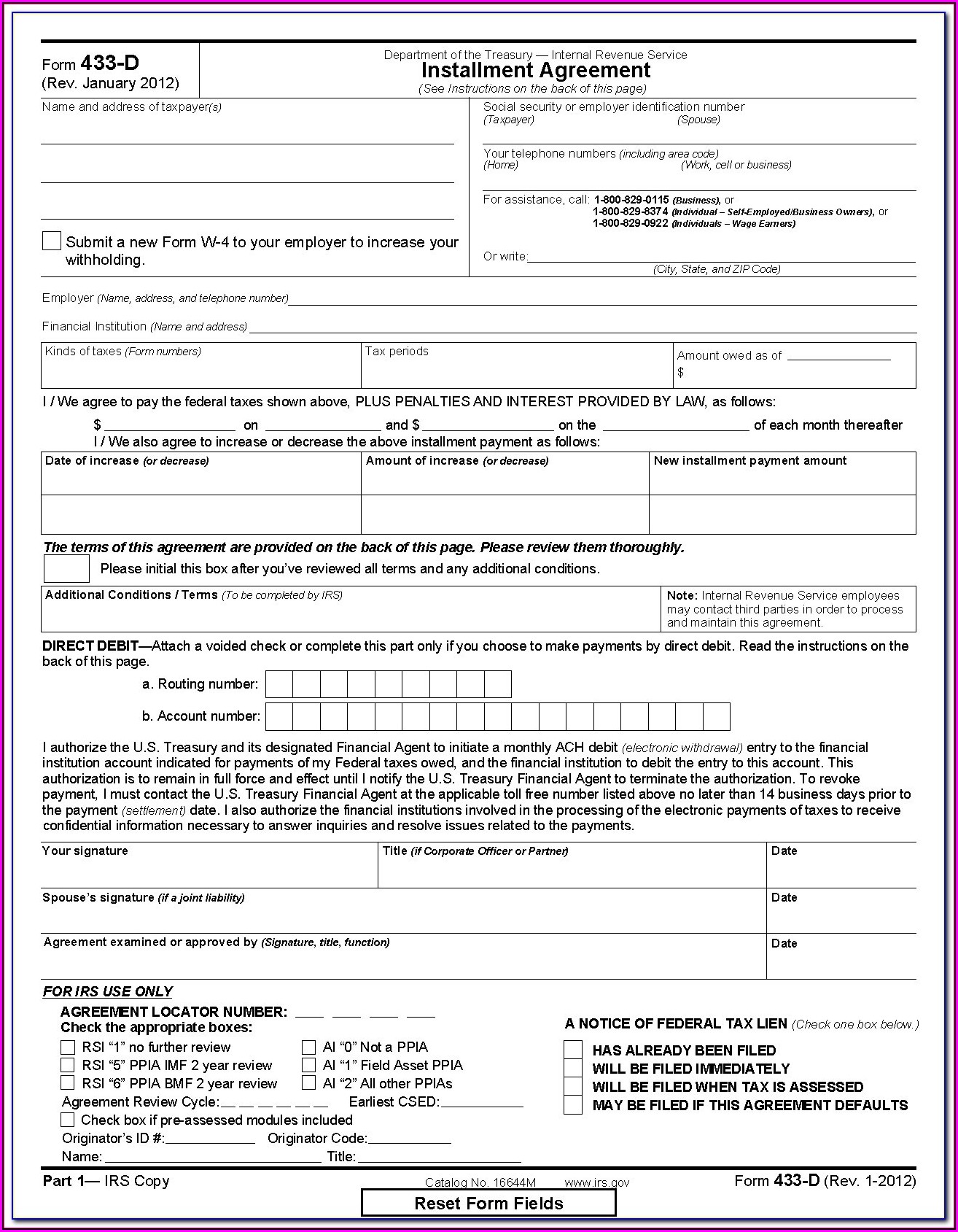

AF IMT 100 20192021 Fill and Sign Printable Template Online US

The irs would typically expect a higher portion of. A tax form distributed by the internal revenue service (irs) that notifies a shareholder. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. The carryback of a net capital loss; The term—which gets its name from.

()입소 신청서 샘플, 양식 다운로드

October 2018) department of the treasury internal revenue service. Web up to $40 cash back edit your income tax form form online. The number of months the property was in service: The irs would typically expect a higher portion of. The carryback of an nol;

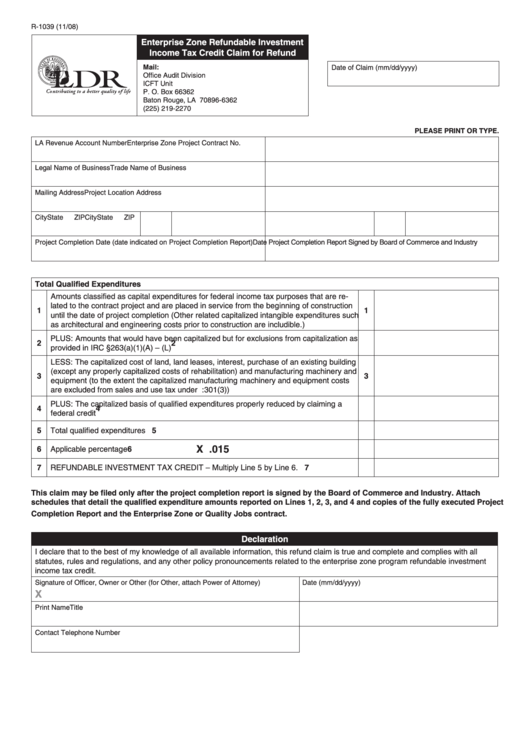

Fillable Form R1039 Enterprise Zone Refundable Investment Tax

Web general instructions purpose of form corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: The carryback of an nol; Corporation application for tentative refund. Are transactions ordinarily incident and necessary to the exportation.

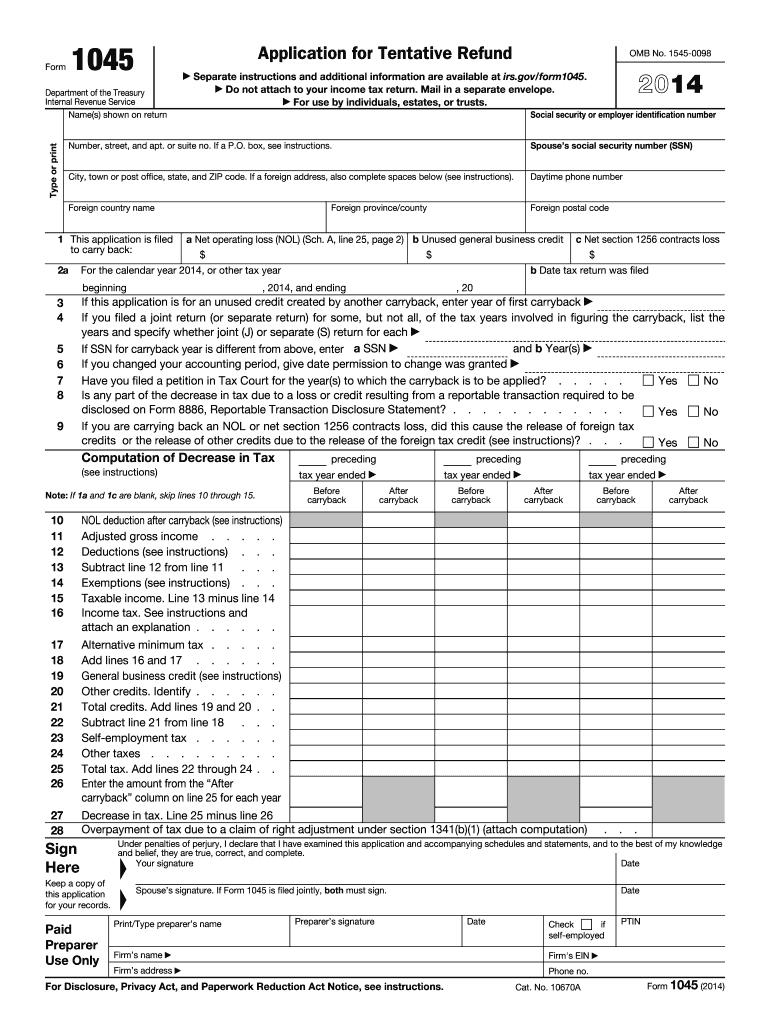

2014 Form IRS 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Calculate monthly property cash flow using step 2a: Web general instructions purpose of form corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: The carryback of an nol; Web a corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: Web up to.

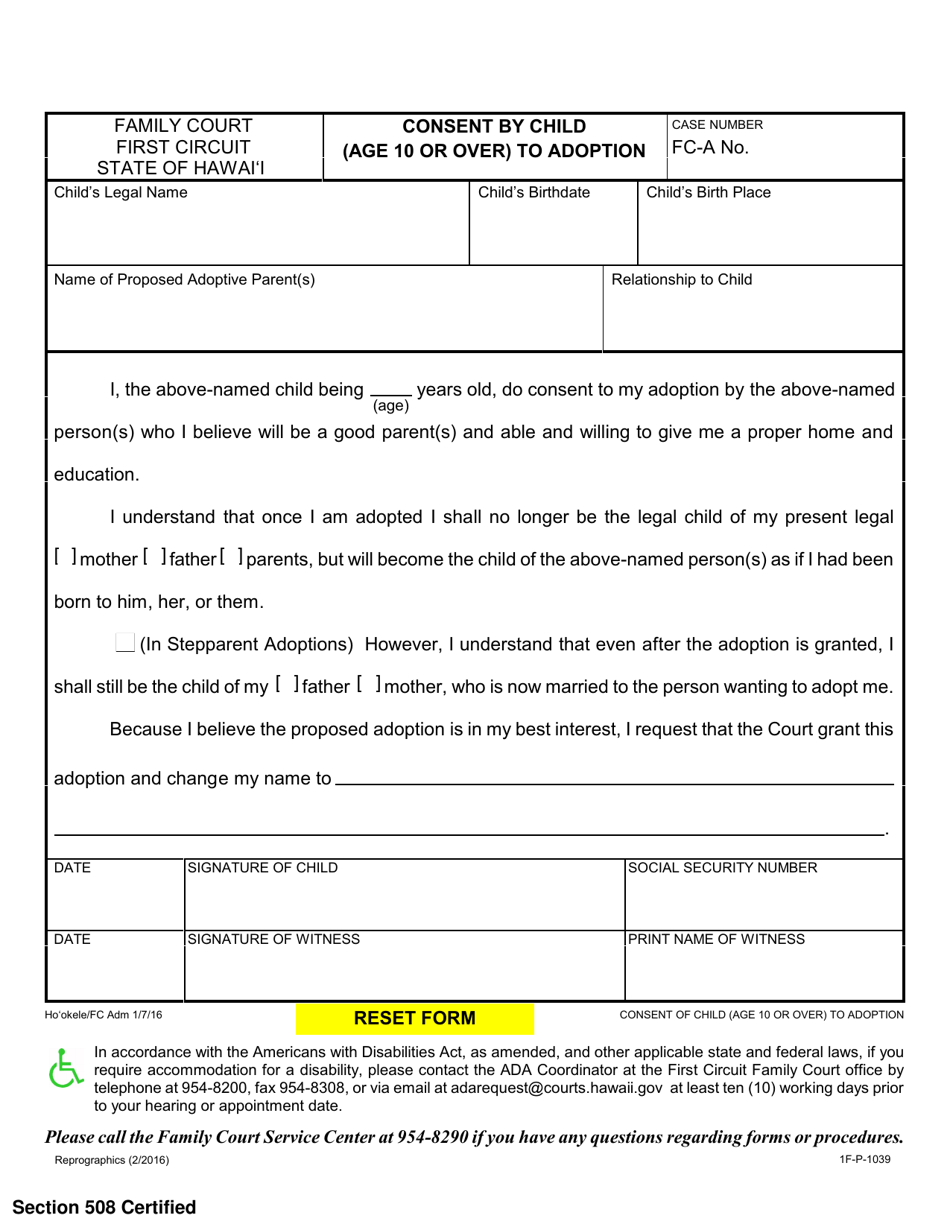

Form 1FP1039 Download Fillable PDF or Fill Online Consent by Child

Web general instructions purpose of form corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: A tax form distributed by the internal revenue service (irs) that notifies a shareholder. Web get federal tax return forms and file by mail. Are transactions ordinarily incident and necessary to the exportation or reexportation of.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Corporation application for tentative refund. The number of months the property was in service: The carryback of a net capital loss; The carryback of an nol;

Fill Free fillable IRS PDF forms

Corporation application for tentative refund. Web about form 1139, corporation application for tentative refund. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. The term—which gets its name from. A tax form distributed by the internal revenue service (irs) that notifies a shareholder.

Dd Form 149 Fill Online, Printable, Fillable, Blank pdfFiller

Enter if fair rental days are not reported, the property is considered to be in service for 12. The carryback of a net capital loss; Irs form 8825 or step. Web you can file irs form 14039, identity theft affidavit when someone else uses your social security number (ssn) to file a tax return. A tax form distributed by the.

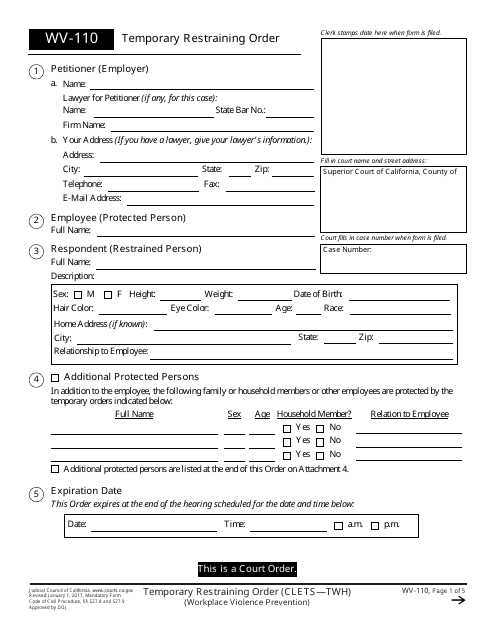

Form WV110 Download Fillable PDF or Fill Online Temporary Restraining

A tax form distributed by the internal revenue service (irs) that notifies a shareholder. The term—which gets its name from. Web fannie mae form 1039 02/23/16 rental income worksheet documentation required: Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. The number of months the property.

Tax Fill Online, Printable, Fillable, Blank pdfFiller

Web get federal tax return forms and file by mail. Web the irs thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments. Calculate monthly property cash flow using step 2a: Are transactions ordinarily incident and necessary to the exportation or reexportation of agricultural commodities to, from, or transiting the russian federation..

Corporation Application For Tentative Refund.

Web fannie mae form 1039 02/23/16 rental income worksheet documentation required: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. October 2018) department of the treasury internal revenue service. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from:

Web Up To $40 Cash Back Edit Your Income Tax Form Form Online.

To alert the irs that your identity has been. Web about form 1139, corporation application for tentative refund. The carryback of a net capital loss; Web general instructions purpose of form corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from:

Irs Form 8825 Or Step.

The number of months the property was in service: Web the irs thinks that your tax return shows an unusually high portion of gross receipts attributable to credit card payments. A tax form distributed by the internal revenue service (irs) that notifies a shareholder. The carryback of an nol;

Type Text, Complete Fillable Fields, Insert Images, Highlight Or Blackout Data For Discretion, Add Comments, And More.

Web get federal tax return forms and file by mail. Web a corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: Form 8825, result line1 step 2. Enter if fair rental days are not reported, the property is considered to be in service for 12.