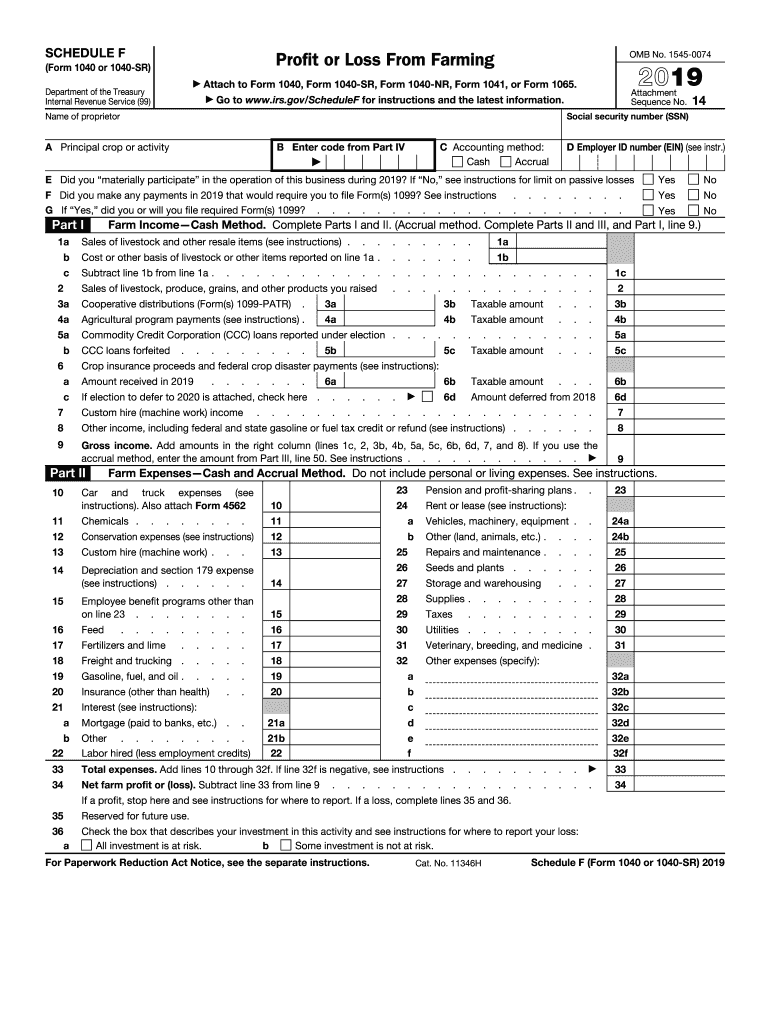

Form 1040 Schedule F

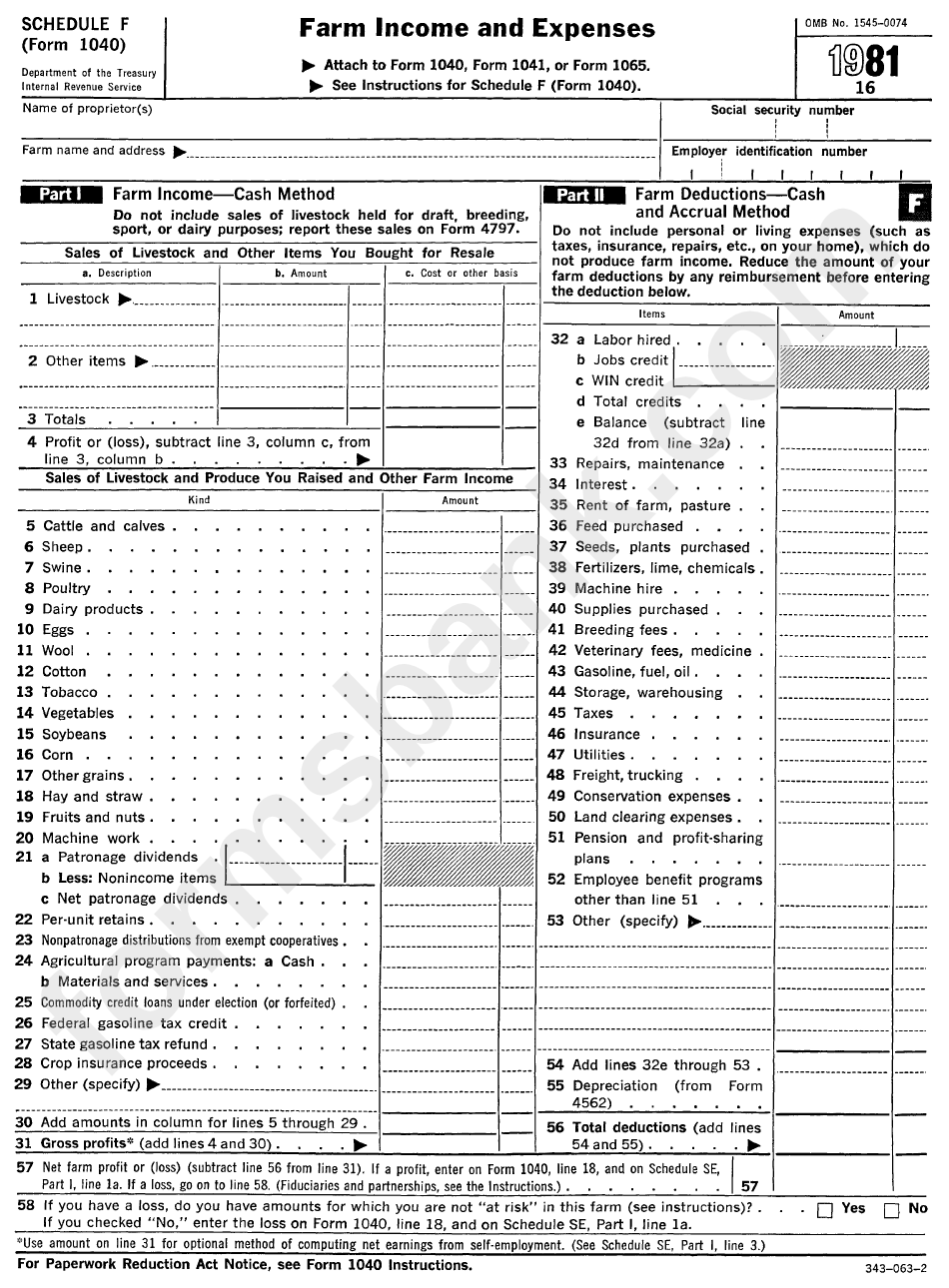

Form 1040 Schedule F - Web the irs has released a new tax filing form for people 65 and older. Net profits are subject to self. Your farming activity may subject you to state and. Web income received from farming is calculated on irs form 1040, schedule f, and transferred to irs form 1040. Other income on schedule f may represent. Profit or loss from farming. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. To view these forms, click the following links: • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. Web do not file schedule f (form 1040) to report the following.

You can download or print. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Web do not file schedule f (form 1040) to report the following. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. File your schedule f with the appropriate forms: Profit or loss from farming. Web the irs has released a new tax filing form for people 65 and older. 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line 34 of the worksheet to.

It has bigger print, less shading, and features. Web once the worksheet is completed, irs pub. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Your taxable income amount is then transferred to your. To view these forms, click the following links: Net profits are subject to self. Profit or loss from farming. File your schedule f with the appropriate forms: You can download or print. Web recorded on a form 1040 schedule f:

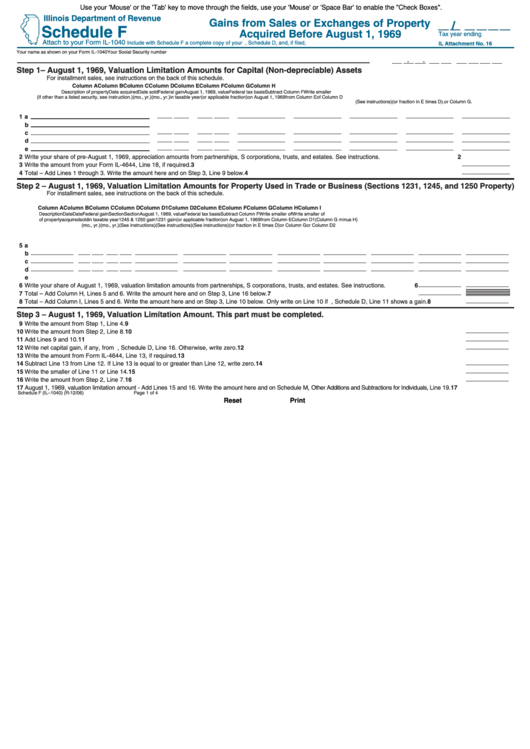

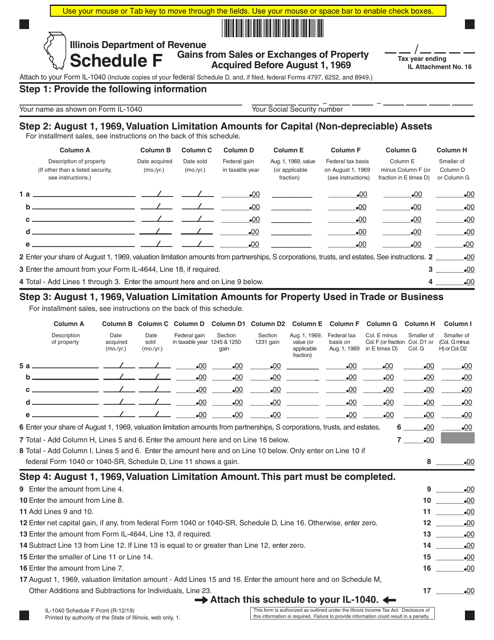

Fillable Form Il1040 Schedule F Gains From Sales Or Exchanges Of

Net profits are subject to self. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022. Your taxable income amount is then transferred to your. Web do not file schedule f (form 1040) to report the following. Web the irs has.

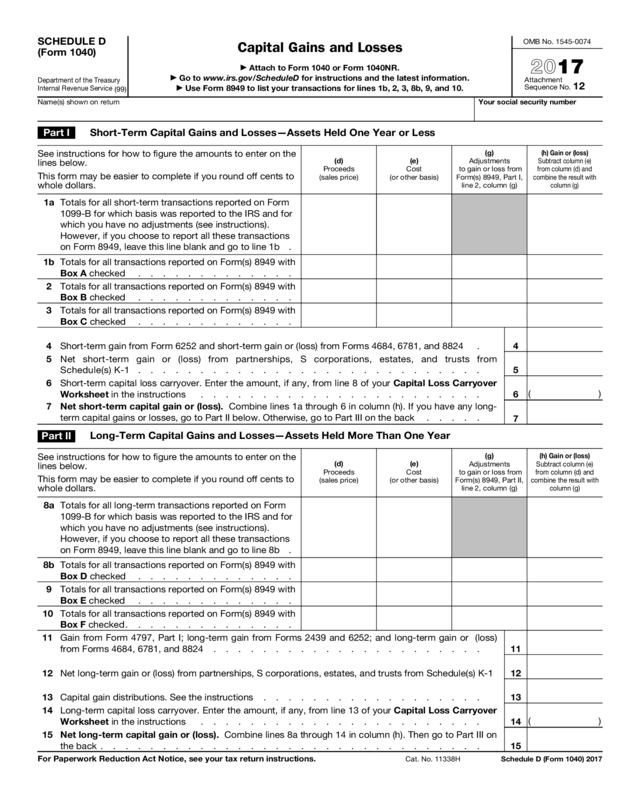

2016 Form 1040 (Schedule D) Edit, Fill, Sign Online Handypdf

Net profits are subject to self. To view these forms, click the following links: Web adding in a schedule f is necessary for tax purposes if you are claiming income from your farming operation, no matter how small.this article provides a general overview of. Someone may have a farm and someone may have a farm and produce farm income, but.

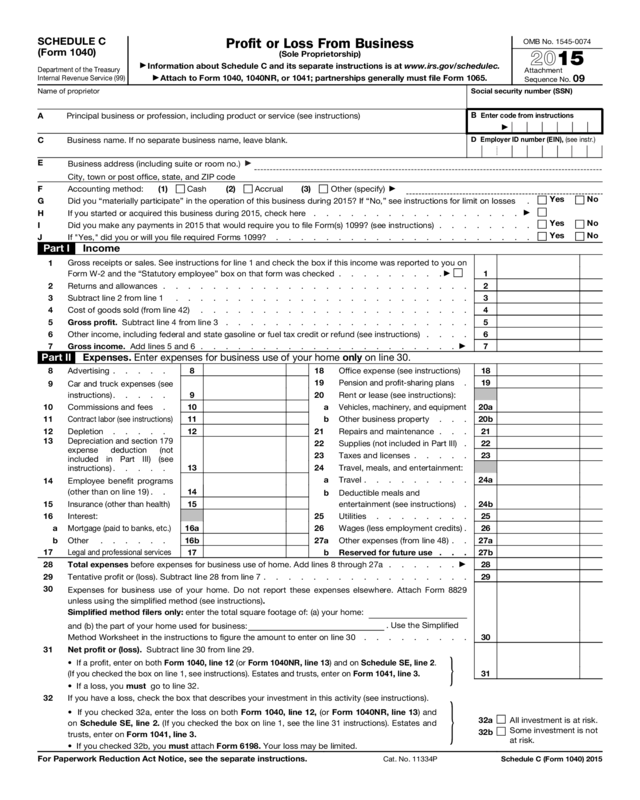

2015 Form 1040 (Schedule C) Edit, Fill, Sign Online Handypdf

Your taxable income amount is then transferred to your. Web do not file schedule f (form 1040) to report the following. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. 587 states if you file schedule f (form 1040), report your entire deduction for business use of the home (line.

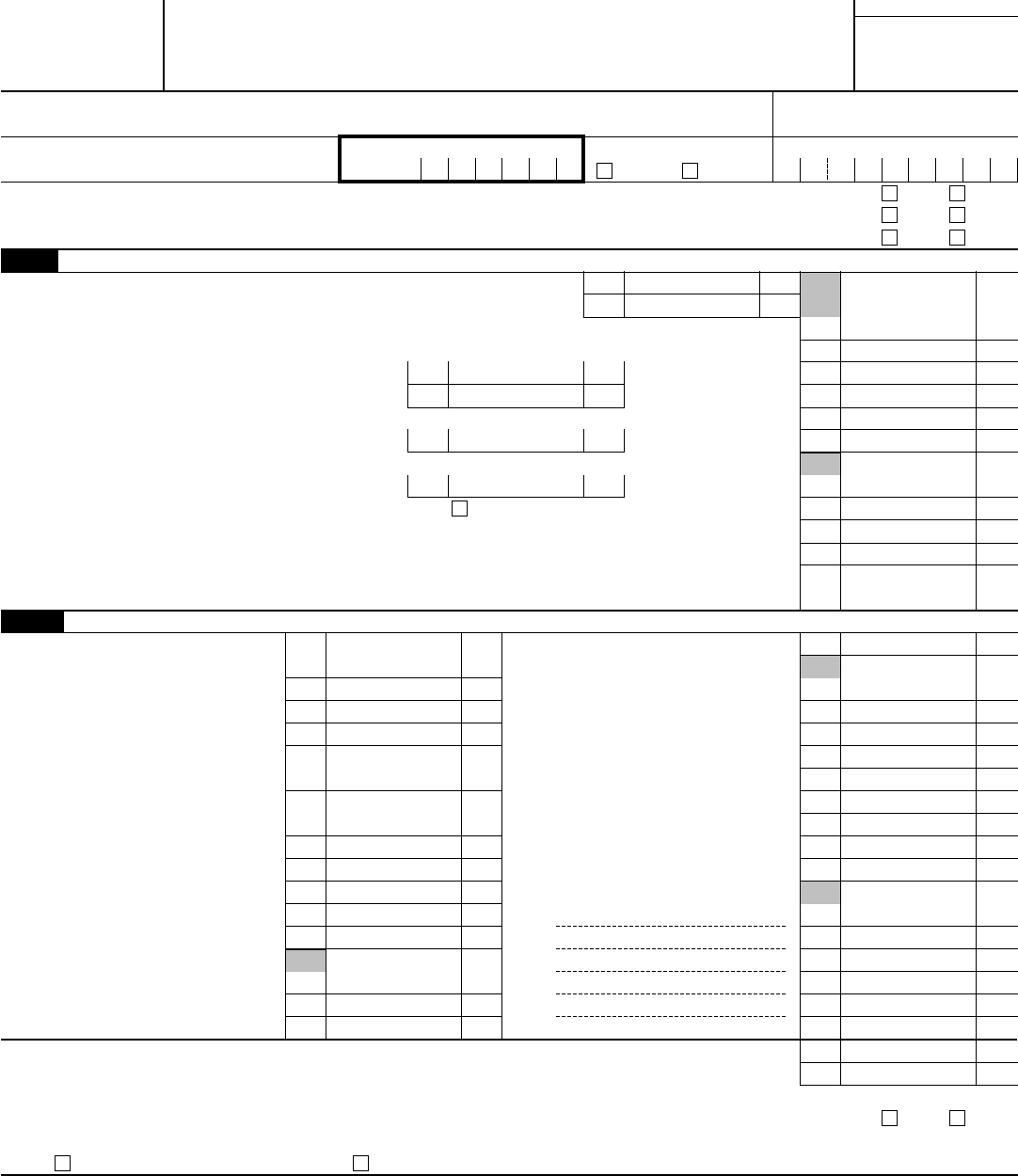

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Web once the worksheet is completed, irs pub. You can download or print. Web schedule f, profit or loss from.

Irs 1040 Form 2020 Printable What Is IRS Form 1040? How It Works in

Other income on schedule f may represent. Profit or loss from farming. • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Web once the worksheet is completed, irs pub.

Form IL1040 Schedule F Download Fillable PDF or Fill Online Gains From

Web use schedule f (profit or loss from farming) to report farm income and expenses. Web income received from farming is calculated on irs form 1040, schedule f, and transferred to irs form 1040. Your farming activity may subject you to state and. To view these forms, click the following links: Web adding in a schedule f is necessary for.

Schedule F (Form 1040) Farm Tax Expenses 1981 printable pdf

You can download or print. Web recorded on a form 1040 schedule f: Web once the worksheet is completed, irs pub. Web income received from farming is calculated on irs form 1040, schedule f, and transferred to irs form 1040. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and.

Irs Fillable Form 1040 Form 1040 Schedule F Fillable Profit Or Loss

Web schedule f, profit or loss from farming, helps farming businesses calculate profits or losses for the year. Web use schedule f (profit or loss from farming) to report farm income and expenses. Profit or loss from farming. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule.

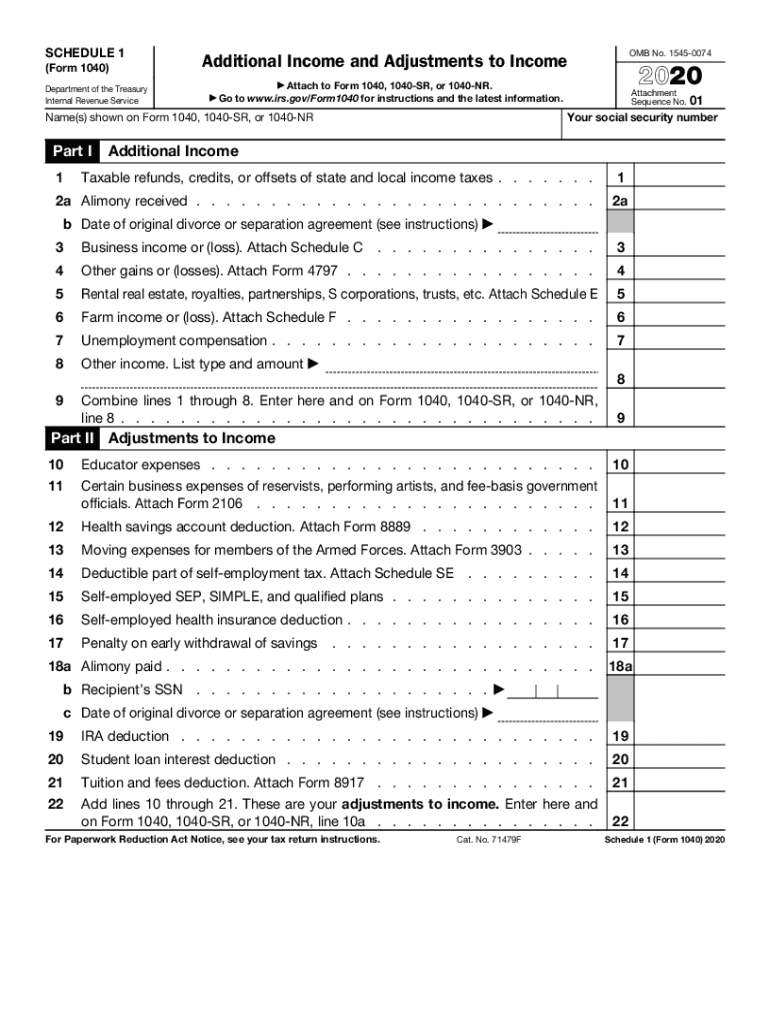

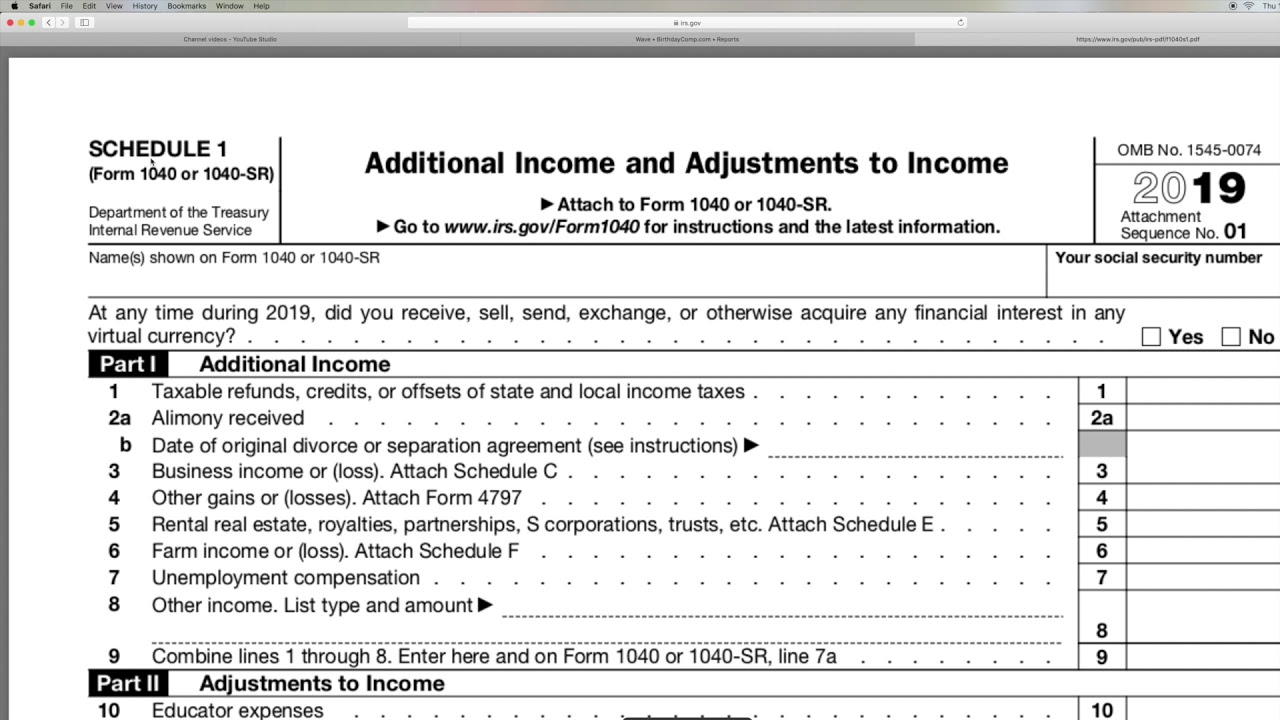

How to find Form 1040 Schedule 1 for Individual Tax Return Additional

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Web schedule f, profit or loss from farming, helps farming businesses calculate profits or losses for the year. Net profits are subject to self. File your schedule f with the appropriate forms: Web adding in a schedule.

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Your taxable income amount is then transferred to your. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. File your schedule f with the appropriate forms: Web the schedule f is a tax business schedule that allows you to calculate your taxable income from farming. Web use schedule.

Someone May Have A Farm And Someone May Have A Farm And Produce Farm Income, But Not Qualify As A.

To view these forms, click the following links: Web schedule f (form 1040) department of the treasury internal revenue service (99) profit or loss from farming. • income from providing agricultural services such as soil preparation, veterinary, farm labor, horticultural services. You can download or print.

File Your Schedule F With The Appropriate Forms:

Web adding in a schedule f is necessary for tax purposes if you are claiming income from your farming operation, no matter how small.this article provides a general overview of. Net profits are subject to self. Web schedule f, profit or loss from farming, helps farming businesses calculate profits or losses for the year. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses.

Web Use Schedule F (Form 1040) To Report Farm Income And Expenses.

Web income received from farming is calculated on irs form 1040, schedule f, and transferred to irs form 1040. Web use schedule f (profit or loss from farming) to report farm income and expenses. Your farming activity may subject you to state and. Other income on schedule f may represent.

Web The Schedule F Is A Tax Business Schedule That Allows You To Calculate Your Taxable Income From Farming.

Web recorded on a form 1040 schedule f: Web the irs has released a new tax filing form for people 65 and older. Profit or loss from farming. Web we last updated the profit or loss from farming in december 2022, so this is the latest version of 1040 (schedule f), fully updated for tax year 2022.