Form 1065 2022 Instructions

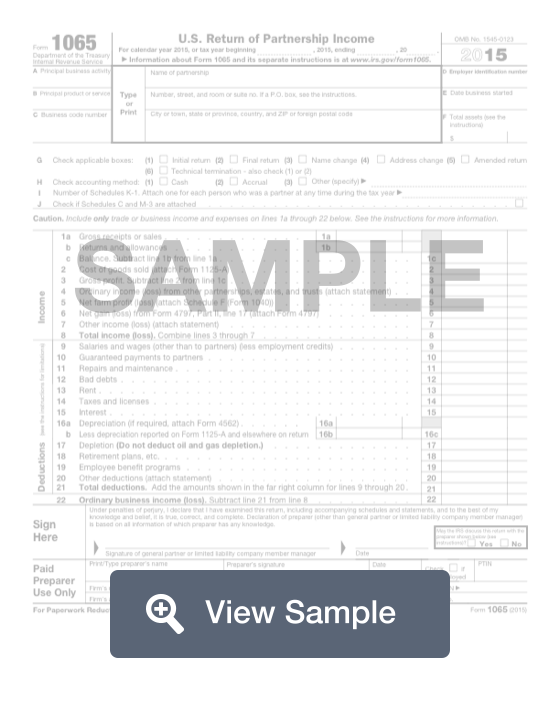

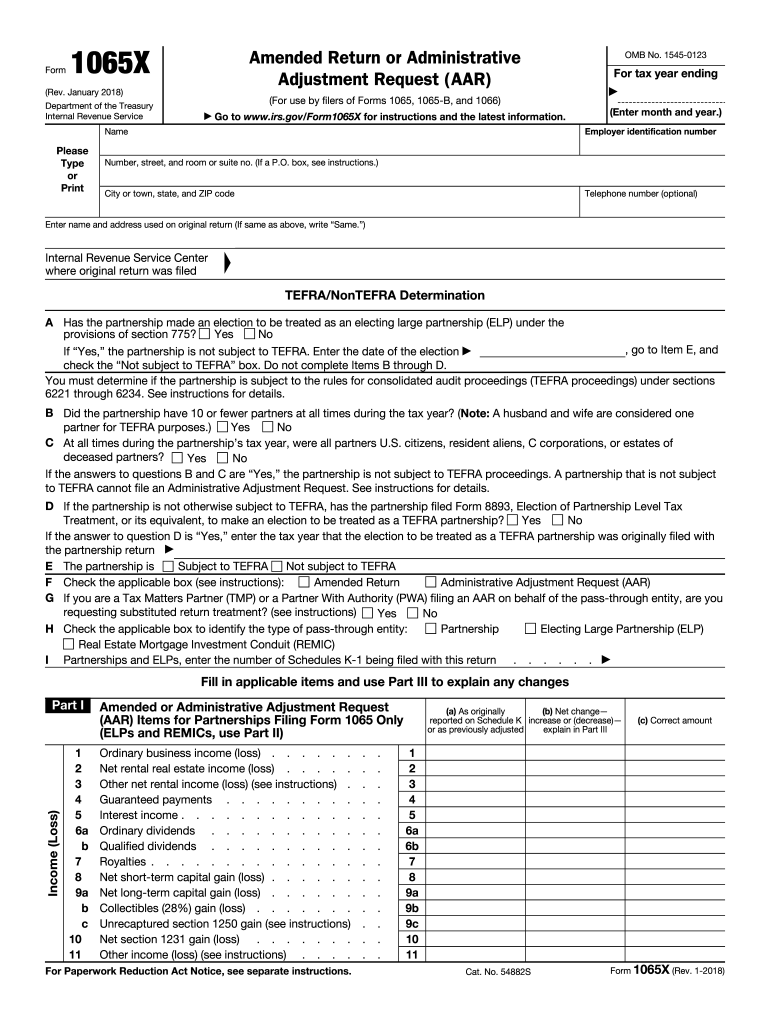

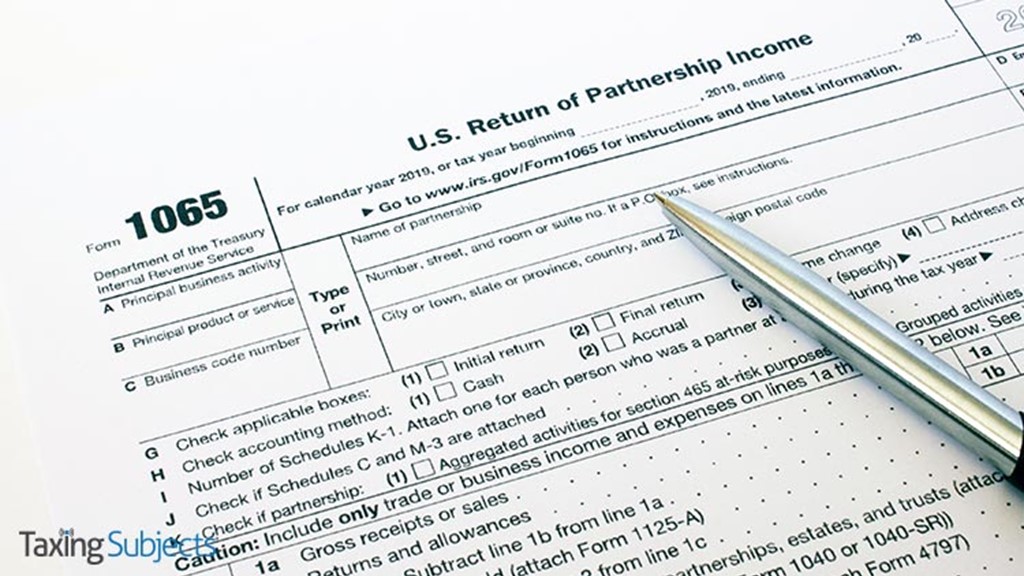

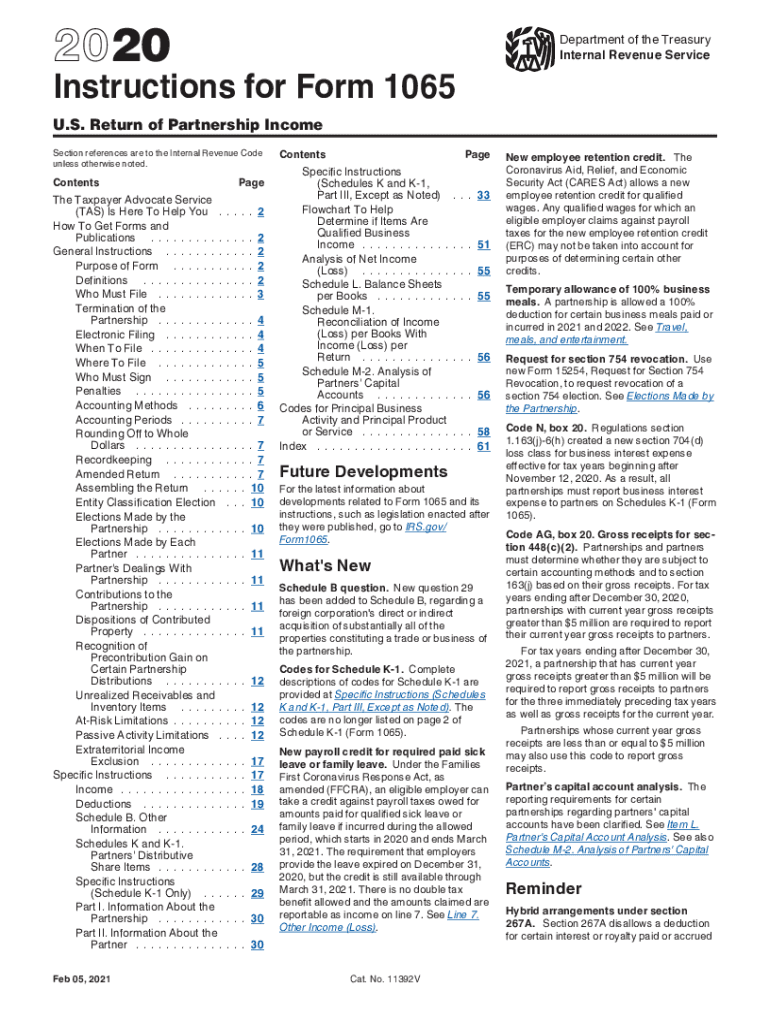

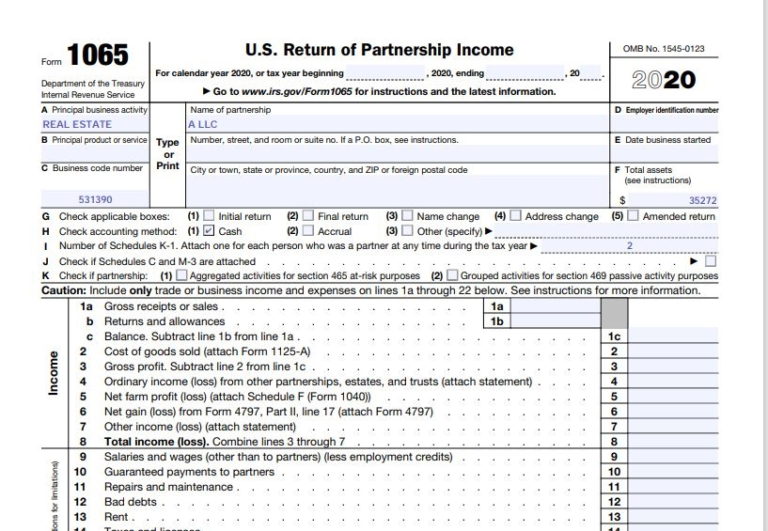

Form 1065 2022 Instructions - Possession, including for regulated investment companies. Web what is form 1065? Web information about form 1065, u.s. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. Web go to www.irs.gov/form1065 for instructions and the latest information. Or getting income from u.s. See the instructions for form 1065 for a list of forms that may be required. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

Web form 1065 instructions. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. International transactions new notice requirement. Or getting income from u.s. Possession, including for regulated investment companies. For tax year 2022, please see the 2022 instructions. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. See the instructions for form 1065 for a list of forms that may be required. City or town, state or province, country, and zip or foreign postal code a

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. Return of partnership income, including recent updates, related forms and instructions on how to file. Possession, including for regulated investment companies. Or getting income from u.s. Web what is form 1065? Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. City or town, state or province, country, and zip or foreign postal code a Web information about form 1065, u.s. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. See the instructions for form 1065 for a list of forms that may be required.

Form 1065 Partnership Tax Return Fill Out Onlne PDF FormSwift

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Possession, including for regulated investment companies. See the instructions for form 1065 for a list of forms that may be required. The form includes information related to a partnership’s income and deductions, gains and losses, taxes.

Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From

Web go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income, including recent updates, related forms and instructions on how to file. For tax year 2022, please see the 2022 instructions. City or town, state or province, country, and zip or foreign postal code a Web the 2022 form 1065 is an information return for calendar year.

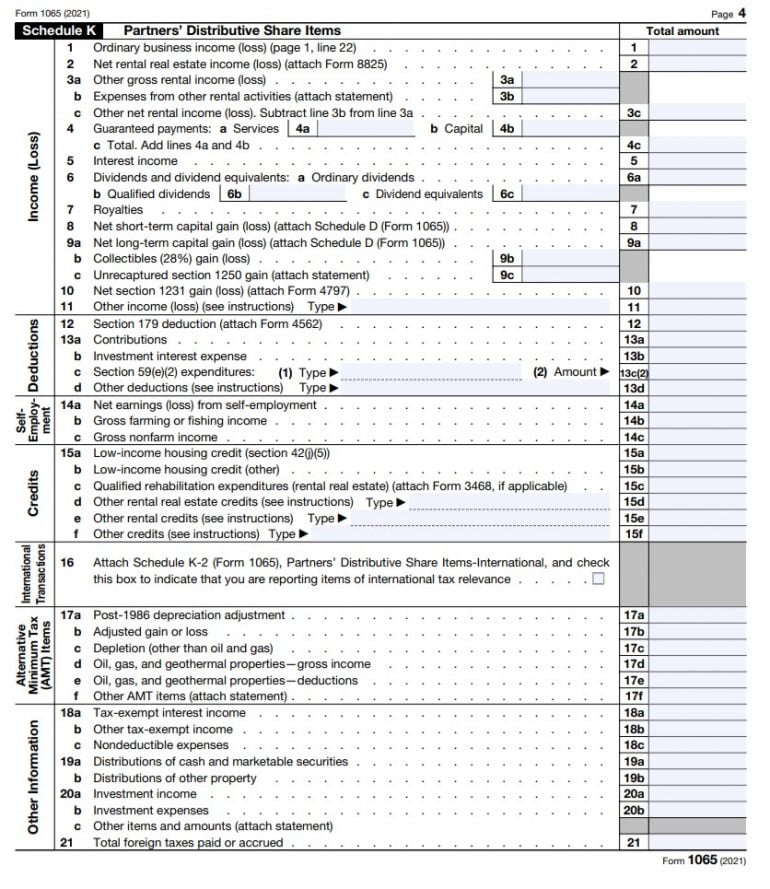

schedule k1 Taxing Subjects

Web information about form 1065, u.s. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. For tax year 2022, please see the 2022 instructions. International transactions new notice requirement. Or getting income from u.s.

Form 1065 Instructions 2022 2023 IRS Forms Zrivo

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Possession, including for regulated investment companies. City or town, state or province, country, and zip or foreign postal code a Web form 1065 instructions. Or getting income from u.s.

Form 1065 K 1 Instructions 2020 Fill Out and Sign Printable PDF

The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Return of partnership income, including recent updates, related forms and instructions on how to file. For tax year 2022, please see the 2022 instructions. See the instructions for form 1065 for a list of forms that may be required..

IRS Form 1065 Instructions StepbyStep Guide NerdWallet (2022)

Or getting income from u.s. For tax year 2022, please see the 2022 instructions. International transactions new notice requirement. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Return of partnership income, including recent updates, related forms and instructions on how to file.

How to Complete 2020 Form 1065 Nina's Soap

For tax year 2022, please see the 2022 instructions. Web form 1065 instructions. Web information about form 1065, u.s. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web go to www.irs.gov/form1065 for instructions and the latest information.

Schedule K1 Form 1065 Instructions 2016 Amy Rhyne's Template

International transactions new notice requirement. Web information about form 1065, u.s. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. City or.

20222023 Form 1065 Schedule D instructions Fill online, Printable

Web information about form 1065, u.s. Return of partnership income, including recent updates, related forms and instructions on how to file. Web form 1065 instructions. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. Possession, including for regulated investment companies.

Schedule K1 Beneficiary's Share of Deductions, Credits, etc

International transactions new notice requirement. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Web what is form 1065? For tax year 2022, please.

See The Instructions For Form 1065 For A List Of Forms That May Be Required.

Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web form 1065 instructions. Possession, including for regulated investment companies. For tax year 2022, please see the 2022 instructions.

Return Of Partnership Income, Is A Tax Form Used By Partnerships To Provide A Statement Of Financial Performance And Position To The Irs Each Tax Year.

Return of partnership income, including recent updates, related forms and instructions on how to file. Web information about form 1065, u.s. City or town, state or province, country, and zip or foreign postal code a Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

Or Getting Income From U.s.

Web what is form 1065? Web go to www.irs.gov/form1065 for instructions and the latest information. International transactions new notice requirement. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)