Form 1065 Line 20 Other Deductions Worksheet

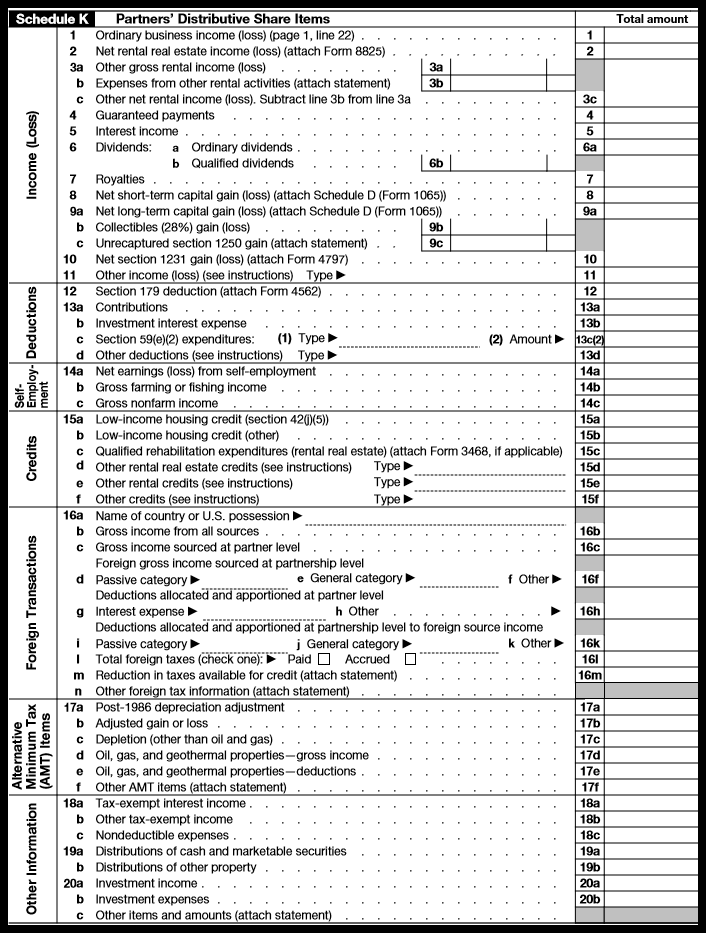

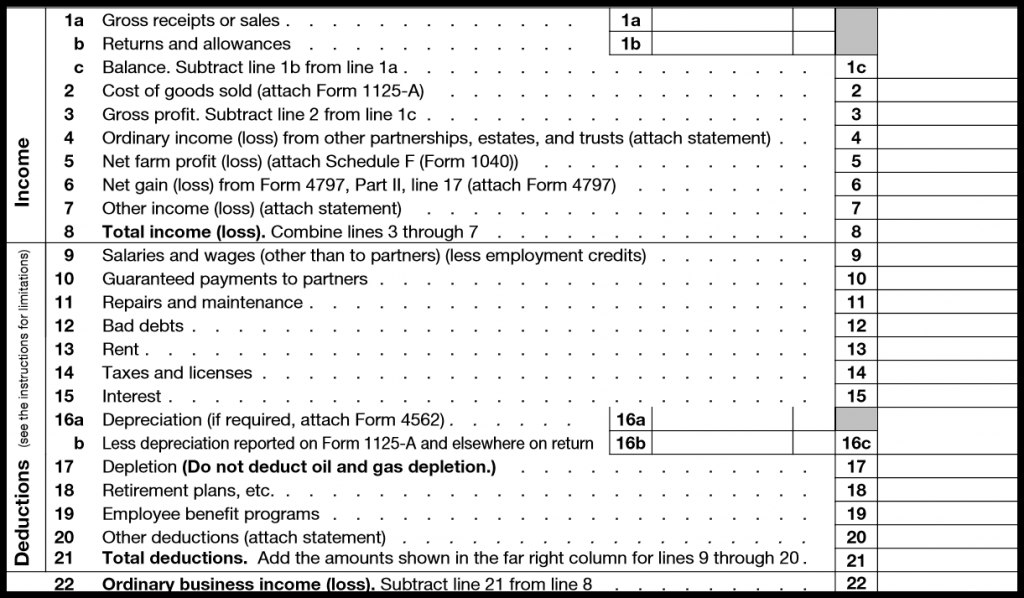

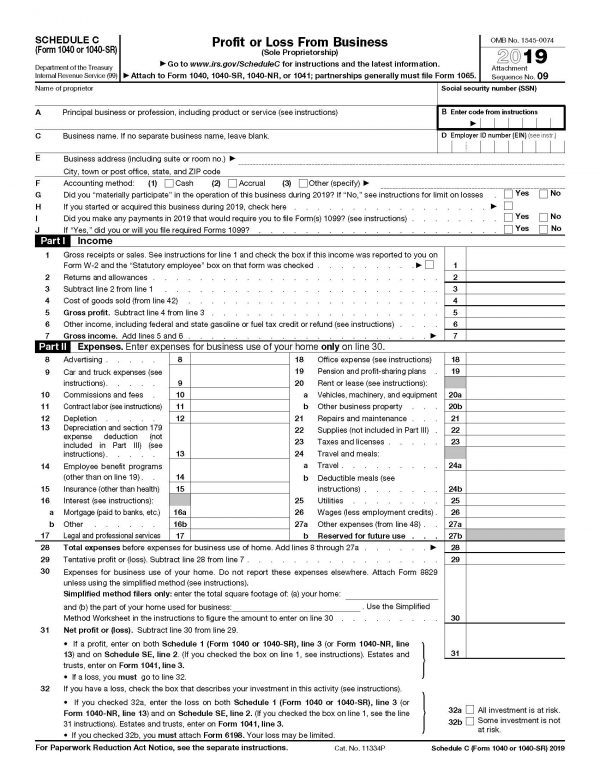

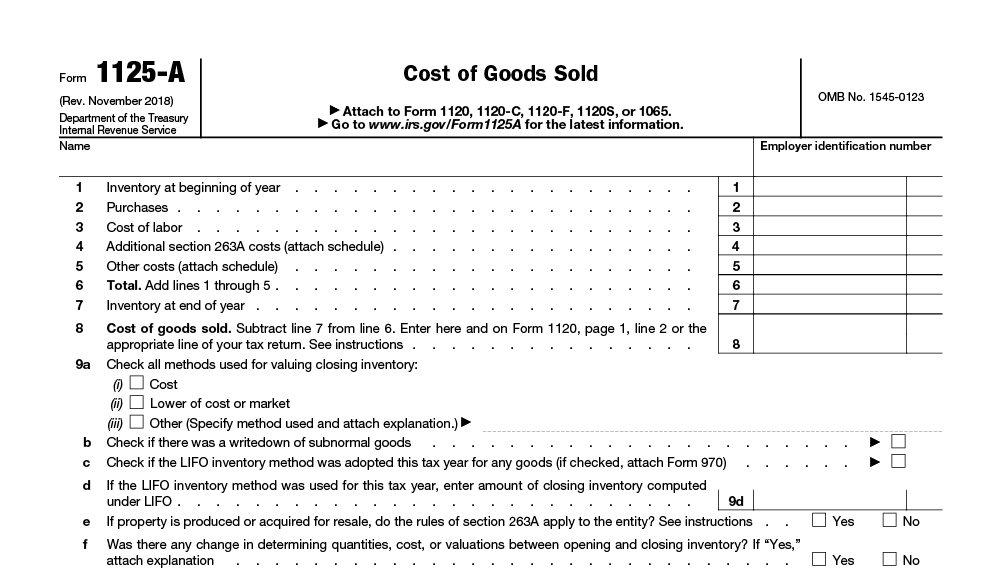

Form 1065 Line 20 Other Deductions Worksheet - Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Enter payments made to a qualified plan, sep, or simple ira plan on schedule 1 (form 1040), line 16. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Return of partnership income are reported on line 20. City or town, state or province, country, and zip or foreign postal code a Line 13(d) schedule k other. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Form form name/dependency xml document name reference. Attach a statement listing by type and amount each deduction included on this line. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065.

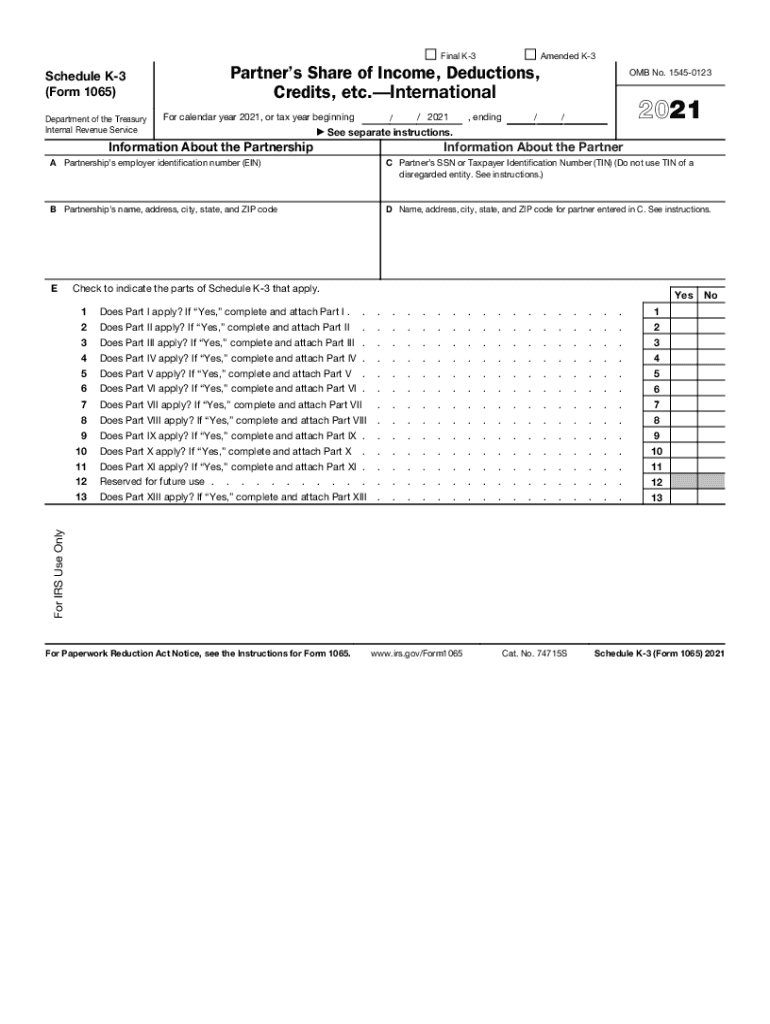

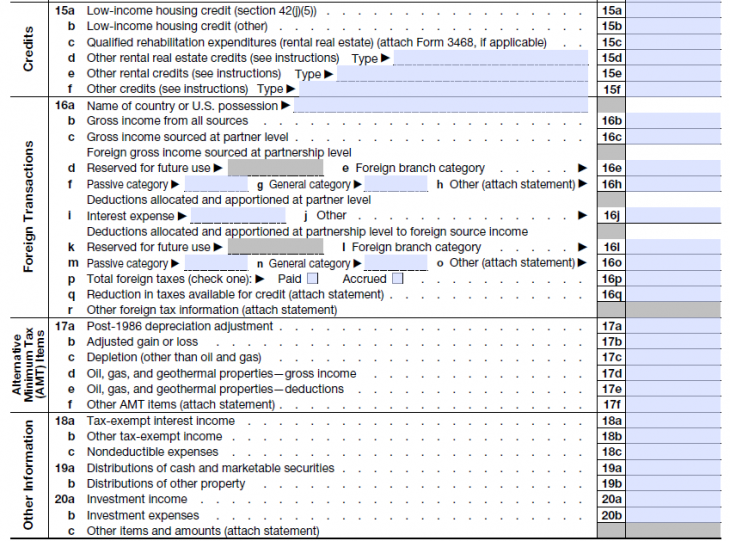

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web go to www.irs.gov/form1065 for instructions and the latest information. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Enter payments made to a qualified plan, sep, or simple ira plan on schedule 1 (form 1040), line 16. City or town, state or province, country, and zip or foreign postal code a Line 15(f) irs form 4562 irs4562 line 16a yes irs form 4562 irs4562 line 20 yes yes irs form 4562 irs4562 schedule k line 12. Examples of other deductions include the following. Attach a statement listing by type and amount each deduction included on this line. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065.

Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. City or town, state or province, country, and zip or foreign postal code a Form form name/dependency xml document name reference. To enter this information in the partnership q&a: Web go to www.irs.gov/form1065 for instructions and the latest information. Attach a statement listing by type and amount each deduction included on this line. Line 15(f) irs form 4562 irs4562 line 16a yes irs form 4562 irs4562 line 20 yes yes irs form 4562 irs4562 schedule k line 12. See the schedule 1 (form 1040) instructions for line 20 to figure your ira deduction. Enter payments made to a qualified plan, sep, or simple ira plan on schedule 1 (form 1040), line 16.

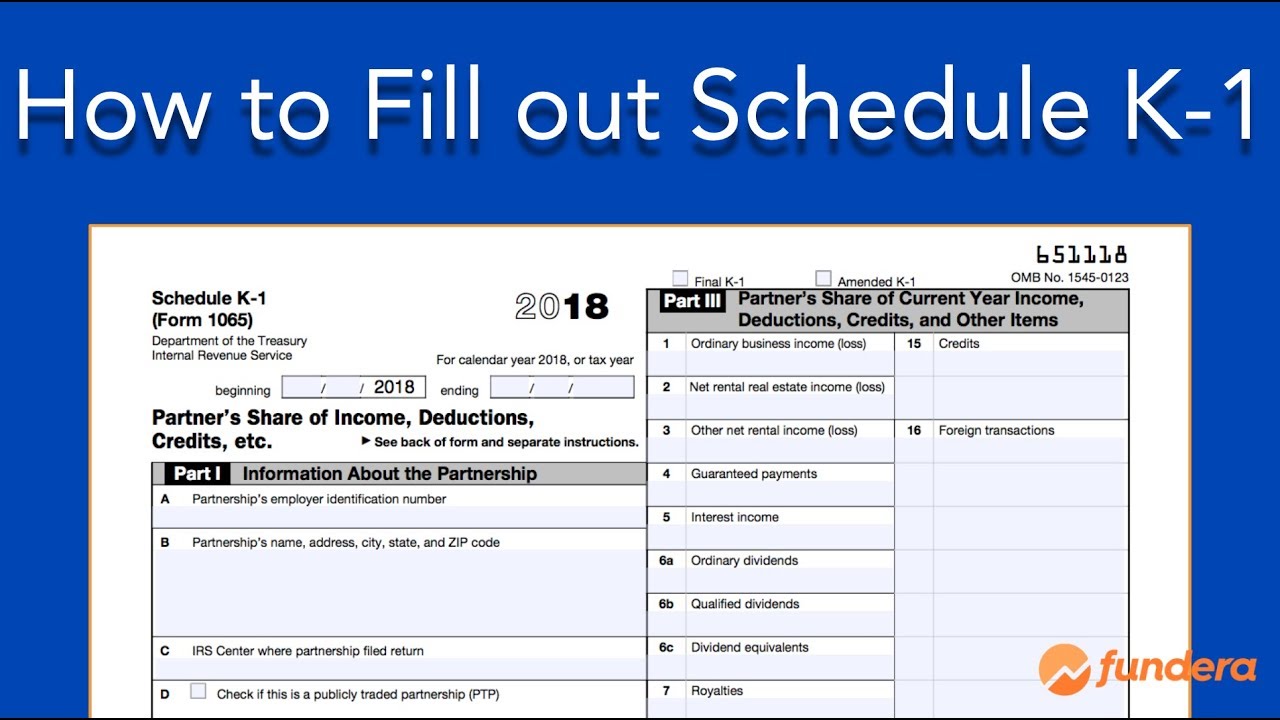

How To Complete Form 1065 US Return of Partnership

See the schedule 1 (form 1040) instructions for line 20 to figure your ira deduction. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Line 13(d) schedule k other. City or town, state or province, country, and zip or foreign postal code a Return of partnership income are reported on line.

Other deductions worksheet (ode) PS Help Tax Australia 2020 MYOB

Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Examples of other deductions include the following. Return of partnership income are reported on line 20. Line 13(d) schedule k other. Attach a statement listing by type and amount each deduction included on this line.

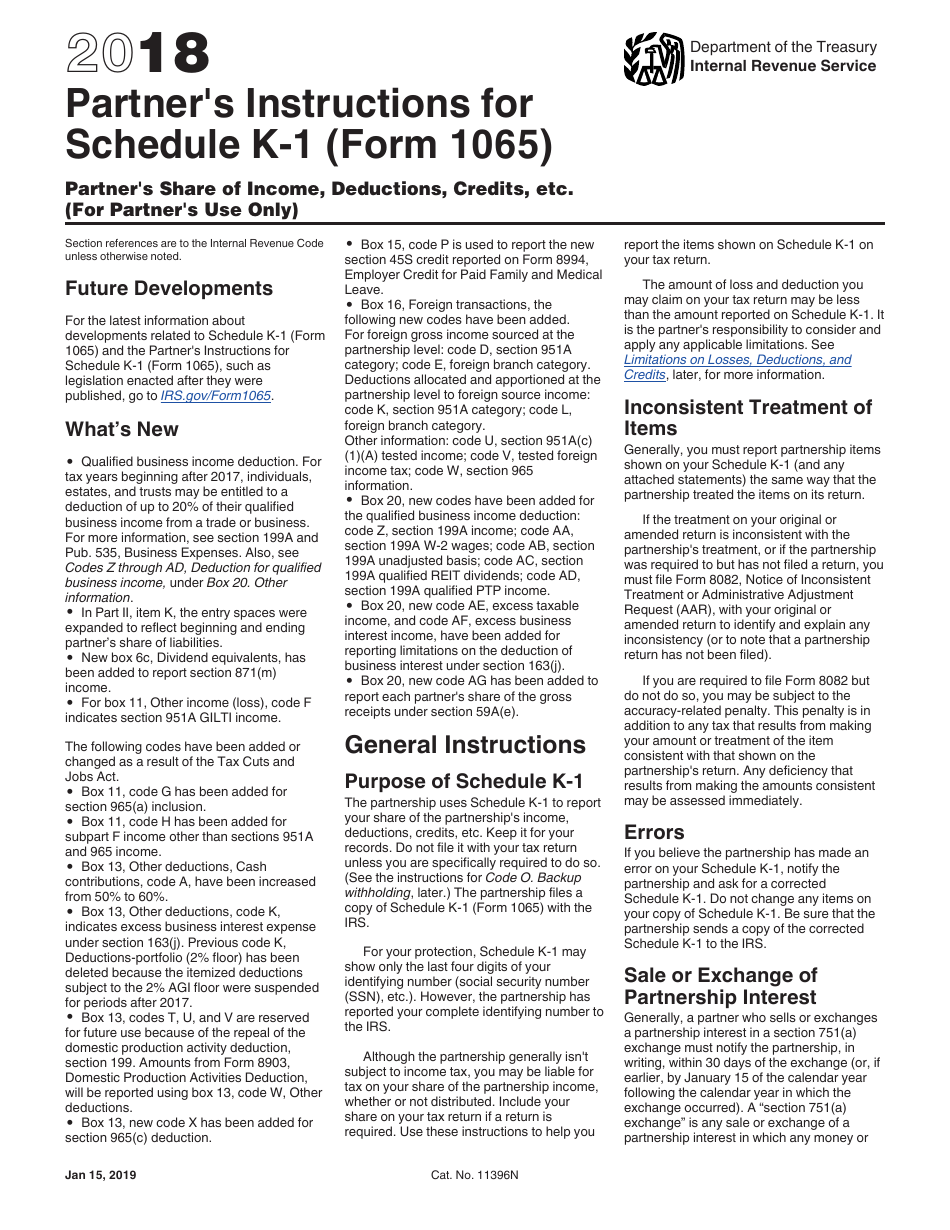

Download Instructions for IRS Form 1065 Schedule K1 Partner's Share of

Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Form form name/dependency xml document name reference. Attach a statement listing by type and amount each deduction included on this line. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. See the schedule 1 (form 1040) instructions for line 20 to figure your ira deduction. City or town, state or province, country,.

Form 8 Who Must Sign The Biggest Contribution Of Form 8 Who Must Sign

City or town, state or province, country, and zip or foreign postal code a Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Enter payments made to a qualified plan, sep, or.

Form 1065 Line 20 Other Deductions Worksheet

Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Examples of other deductions include the following. Form form name/dependency xml document name reference. See the schedule.

Form 1065 Line 20 Other Deductions Worksheet

To enter this information in the partnership q&a: Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. City or town, state or province, country, and zip or foreign postal code a Form form name/dependency xml document name reference. See the schedule 1 (form 1040) instructions for line.

Form 1065 Instructions U.S. Return of Partnership

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. See the schedule 1 (form 1040) instructions for line 20 to figure your ira deduction. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. To.

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

Examples of other deductions include the following. Line 13(d) schedule k other. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Web go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income are reported on line 20.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

To enter this information in the partnership q&a: Return of partnership income are reported on line 20. Attach a statement listing by type and amount each deduction included on this line. Line 13(d) schedule k other. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information.

Enter The Total Allowable Trade Or Business Deductions That Aren't Deductible Elsewhere On Page 1 Of Form 1065.

City or town, state or province, country, and zip or foreign postal code a Return of partnership income are reported on line 20. Enter payments made to a qualified plan, sep, or simple ira plan on schedule 1 (form 1040), line 16. Form form name/dependency xml document name reference.

Generally, A Partnership Doesn't Pay Tax On Its Income But Passes Through Any Profits Or Losses To Its Partners.

To enter this information in the partnership q&a: Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Line 13(d) schedule k other.

Attach A Statement Listing By Type And Amount Each Deduction Included On This Line.

Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Line 15(f) irs form 4562 irs4562 line 16a yes irs form 4562 irs4562 line 20 yes yes irs form 4562 irs4562 schedule k line 12. Web go to www.irs.gov/form1065 for instructions and the latest information. Examples of other deductions include the following.