Form 1065 Other Deductions Statement

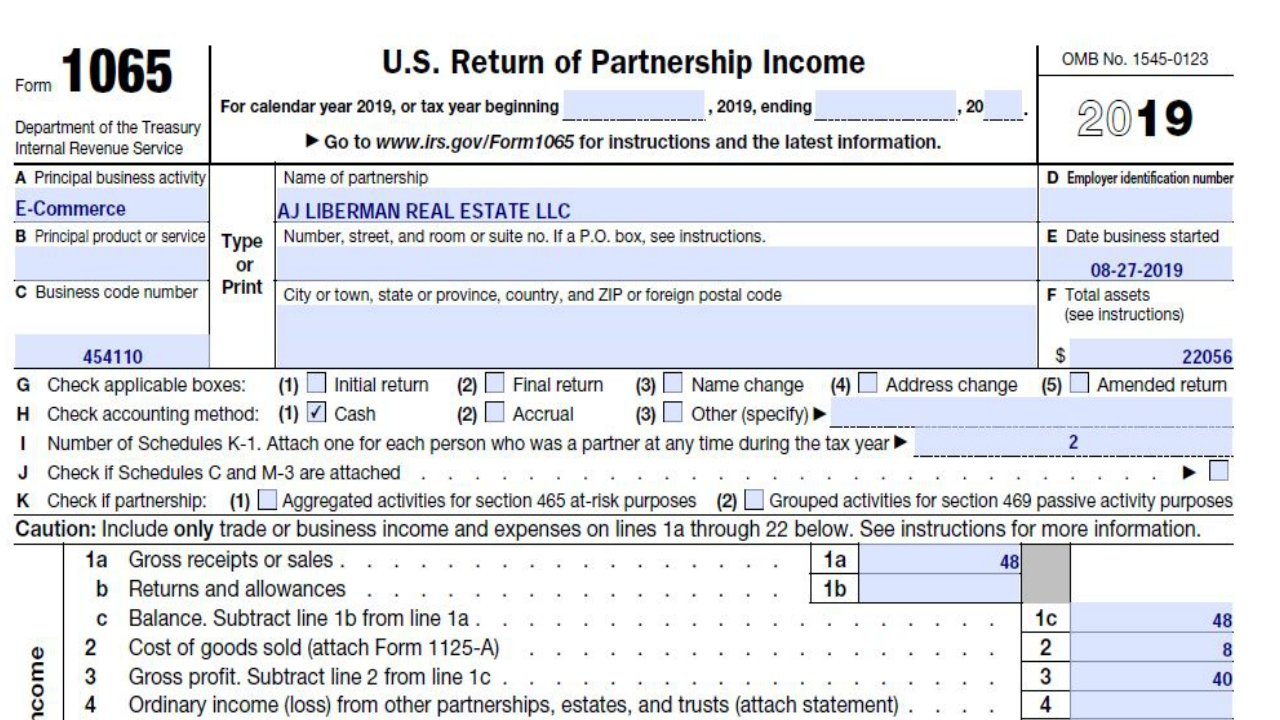

Form 1065 Other Deductions Statement - Web general instructions purpose of form who must file entities electing to be taxed as corporations. Web building your business form 1065 instructions: Click on the deductions folder to expand it. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. If the partnership's principal business, office, or agency is located in: Web there are two major steps involved in reporting taxes this way. Web purpose of form form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web where to file your taxes for form 1065. And the total assets at the end of the tax year. Web follow these steps if you selected 6=form 1065, schedule k:

Click on the deductions folder to expand it. Web form 1065, u.s. And the total assets at the end of the tax year. Web general instructions purpose of form who must file entities electing to be taxed as corporations. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. First, the partnership reports total net income and all other relevant financial information for the. Web building your business form 1065 instructions: Other deductions, for an individual return in intuit. Ad download or email irs 1065 & more fillable forms, register and subscribe now!

Web a 1065 form is the annual us tax return filed by partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Other deductions, for an individual return in intuit. Click on the deductions folder to expand it. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Web follow these steps if you selected 6=form 1065, schedule k: Web where to file your taxes for form 1065. Select the other deductions folder. Ad download or email irs 1065 & more fillable forms, register and subscribe now!

Form 1065 U.S. Return of Partnership (2014) Free Download

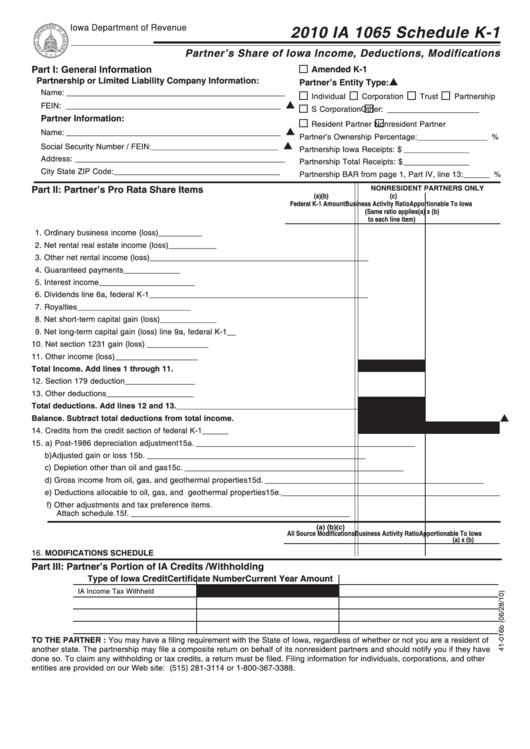

(for partner's use only) section references are to. If the partnership reports unrelated business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20,. First, the partnership reports total net income and all other relevant financial information for the. If the partnership's principal business, office, or agency is located.

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

This section of the program contains information for part iii of the schedule k. Web a 1065 form is the annual us tax return filed by partnerships. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. On smaller devices, click the menu icon in the upper..

Form 1065 (Schedule K1) Partner's Share of Deductions and

Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. On smaller devices, click the menu icon in the upper. Web there are two major steps involved in reporting taxes this way. Select the other deductions folder. First, the partnership reports total net income and all other.

Fill Free fillable Form 1065 Partner’s Share of Deductions

Web there are two major steps involved in reporting taxes this way. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Click on the deductions folder to expand it. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. And.

Form 1065 Line 20 Other Deductions Worksheet

Web form 1065, u.s. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. If the partnership's principal business, office, or agency is located in: Other deductions, for an individual return in intuit. On smaller devices, click the menu icon in the upper.

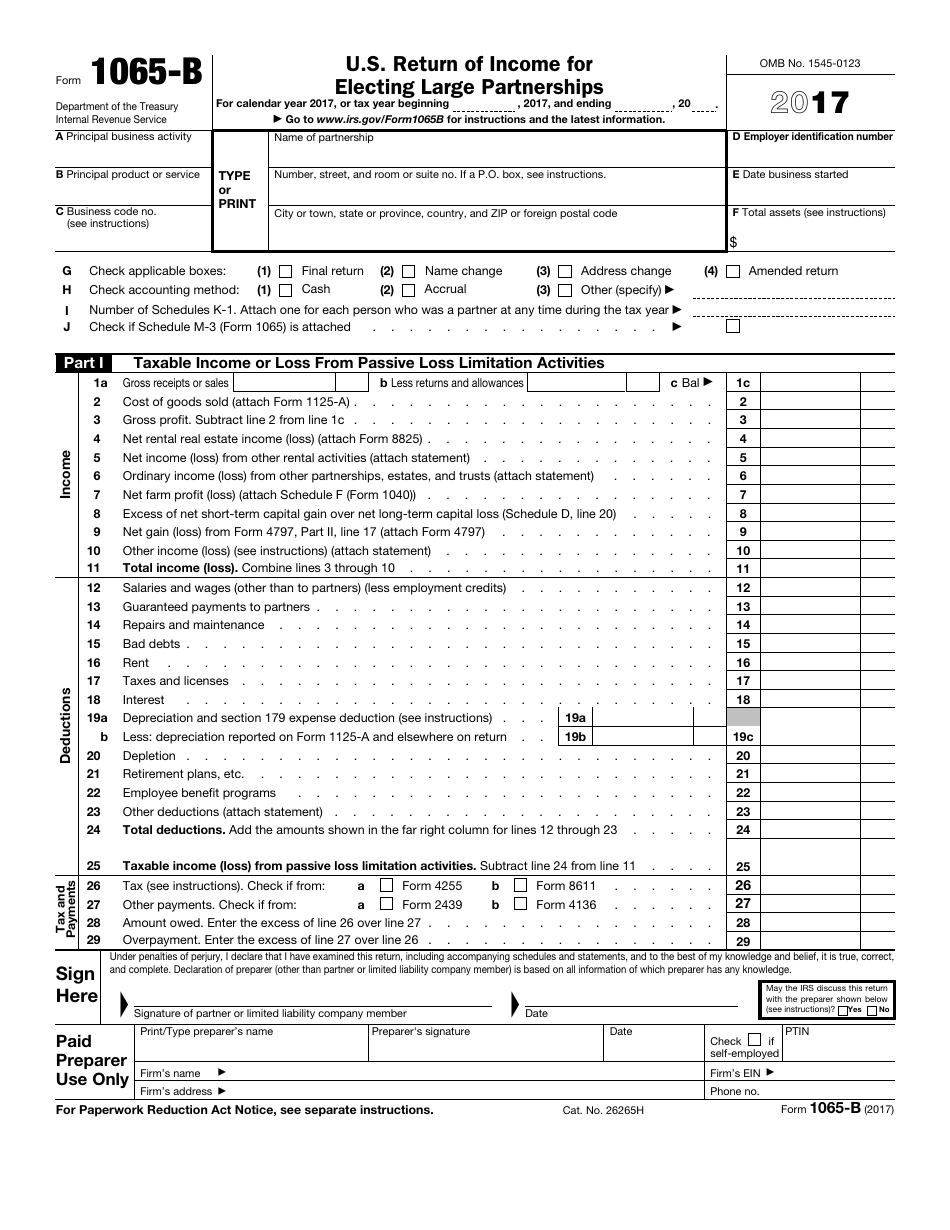

IRS Form 1065B Download Fillable PDF or Fill Online U.S. Return of

Web general instructions purpose of form who must file entities electing to be taxed as corporations. Web purpose of form form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web there are two major steps involved in reporting taxes this way. If the partnership reports.

How to Fill Out Form 1065 for a Trade or Business Carrying Inventory

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web there are two major steps involved in reporting taxes this way. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. Web purpose of form form 1065 is an information.

Form Ia 1065 Schedule K1 Partner'S Share Of Iowa Deductions

If the partnership's principal business, office, or agency is located in: Web follow these steps if you selected 6=form 1065, schedule k: Other deductions, for an individual return in intuit. Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web a 1065 form is the annual us tax return filed by partnerships.

How to fill out an LLC 1065 IRS Tax form

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. On smaller devices, click the menu icon in the upper. Web form 1065, u.s. Web purpose of form form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from.

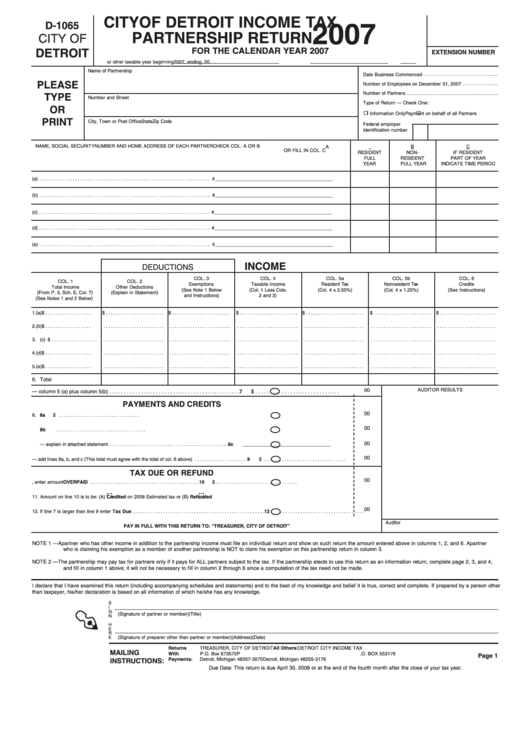

Form D1065 Tax Partnership Return 2007 printable pdf download

Web there are two major steps involved in reporting taxes this way. Web building your business form 1065 instructions: Web general instructions purpose of form who must file entities electing to be taxed as corporations. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web purpose of form form 1065 is an information return used.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

If the partnership's principal business, office, or agency is located in: (for partner's use only) section references are to. Web a 1065 form is the annual us tax return filed by partnerships. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership.

If The Partnership Reports Unrelated Business Taxable Income To An Ira Partner On Line 20, Code V, The Partnership Must Report The Ira's Ein On Line 20,.

Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Web where to file your taxes for form 1065. Web there are two major steps involved in reporting taxes this way. Other deductions, for an individual return in intuit.

And The Total Assets At The End Of The Tax Year.

Web building your business form 1065 instructions: Select the other deductions folder. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Click on the deductions folder to expand it.

First, The Partnership Reports Total Net Income And All Other Relevant Financial Information For The.

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs. This section of the program contains information for part iii of the schedule k. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web purpose of form form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/form-1065-income-and-expenses-section.png)