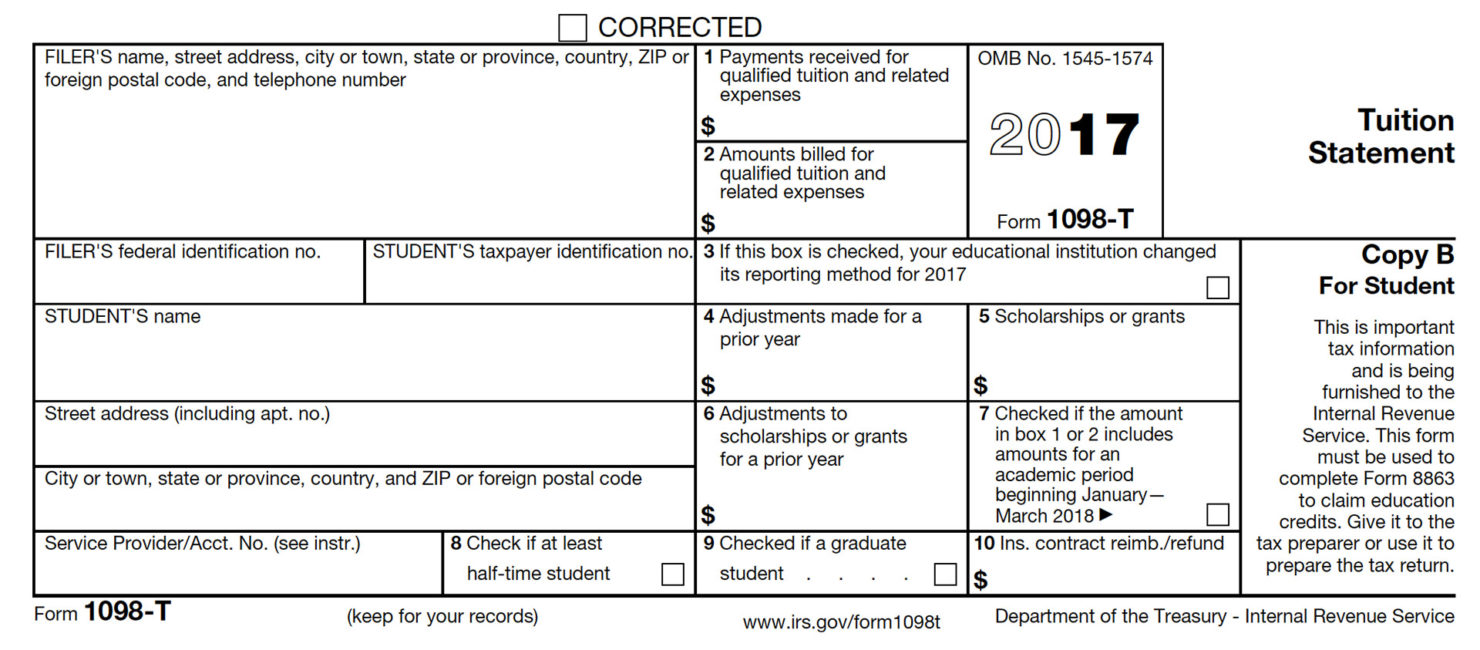

Form 1098 T International Students

Form 1098 T International Students - International students who are non. This box reports the total amount. Jun 29, 2021 most international student are not eligible to claim education tax credit on their u.s. See information on establishing a presence in the usa to be. No, it does not apply to nonresident students. Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. 31 of the year following the. International students who may be. If you do not have a u.s. Web is 1098t applicable for an international student?

Web international students who have a u.s. If year of 2016 is within the five year periods from the first year. This box reports the total amount. If you do not have a u.s. Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Tin # on file at aic, please contact student accounts to request the. Payments received for qualified tuition and related expenses. Jun 29, 2021 most international student are not eligible to claim education tax credit on their u.s. No, it does not apply to nonresident students. Most international students are not eligible to claim education tax credits with the u.s.

Payments received for qualified tuition and related expenses. Most international students are not eligible to claim education tax credits with the u.s. Go to www.irs.gov/freefile to see if. Web note for international students: This box reports the total amount. No, it does not apply to nonresident students. Tin # on file at aic, please contact student accounts to request the. Web international students who have a u.s. If year of 2016 is within the five year periods from the first year. International students who are non.

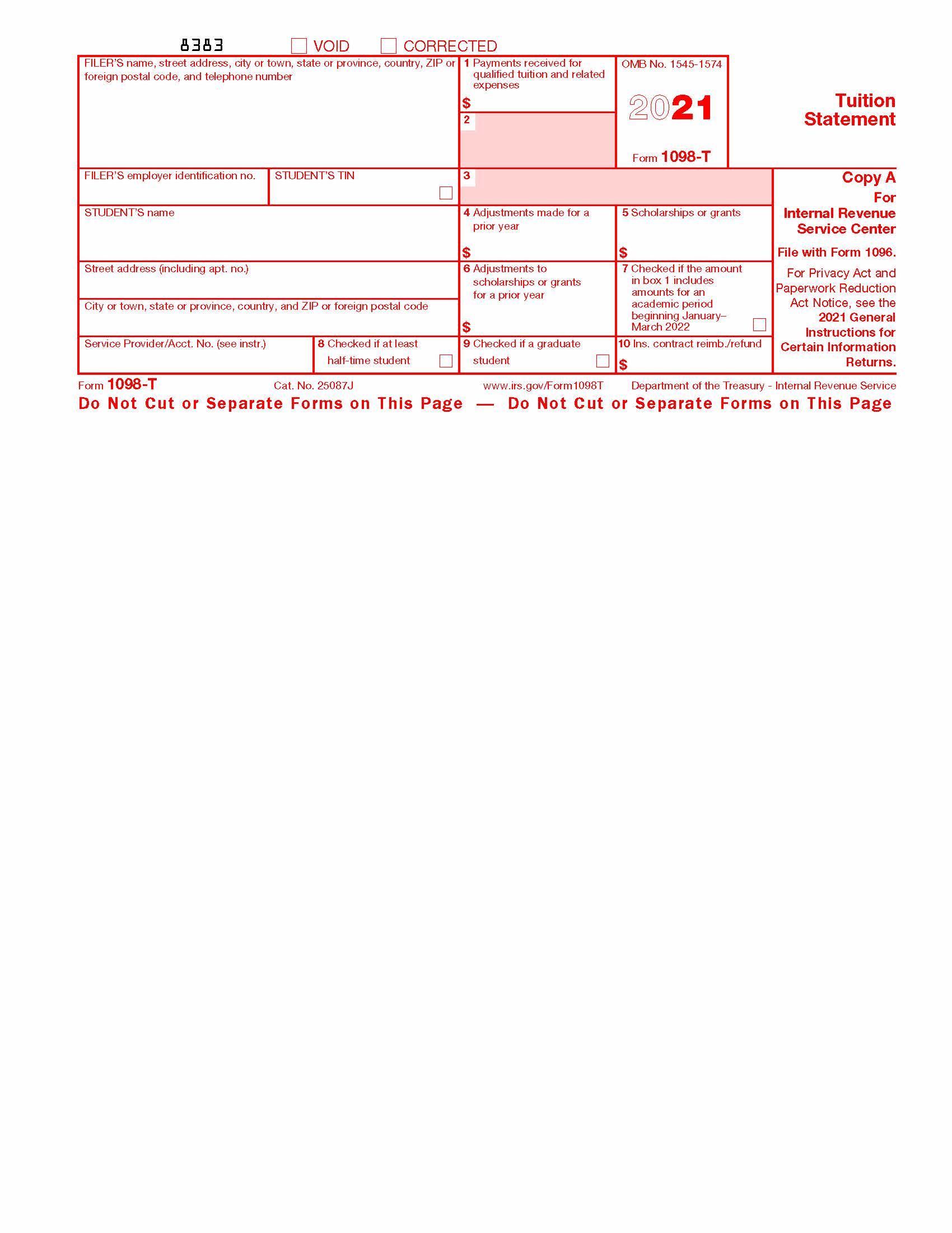

Form 1098T Everything you need to know Go TJC

If you do not have a u.s. Go to www.irs.gov/freefile to see if. Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Web is 1098t applicable for an international student? You must file for each student you enroll and.

Form 1098T Still Causing Trouble for Funded Graduate Students

Web international students who have a u.s. Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. > > to student enrollment page. If you do not have a u.s. Most international students are not eligible to claim education tax.

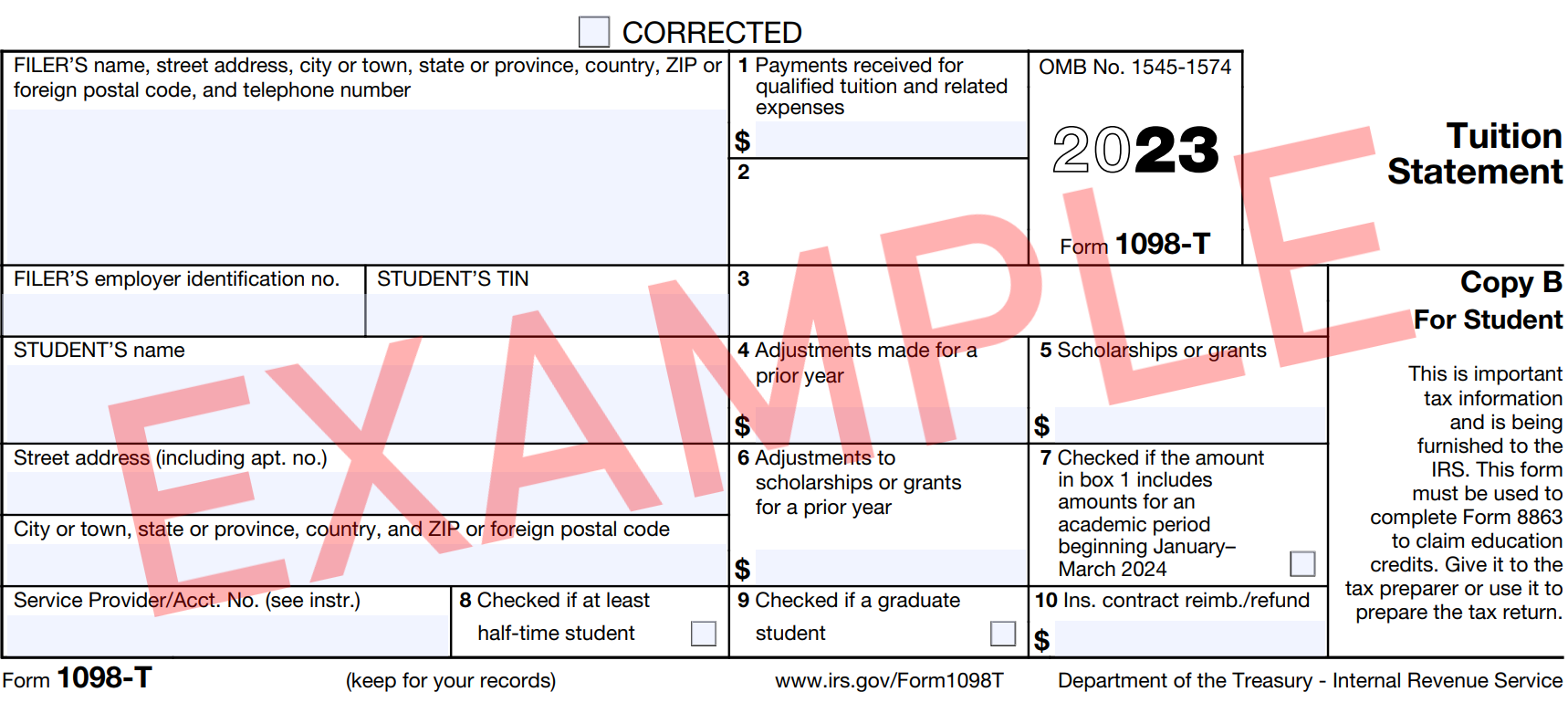

Irs Form 1098 T Box 4 Universal Network

If year of 2016 is within the five year periods from the first year. Web note for international students: Go to www.irs.gov/freefile to see if. > > to student enrollment page. Jun 29, 2021 most international student are not eligible to claim education tax credit on their u.s.

Form 1098T, Tuition Statement, Student Copy B

Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Go to www.irs.gov/freefile to see if. 31 of the year following the. Web international students who have a u.s. You must file for each student you enroll and for whom.

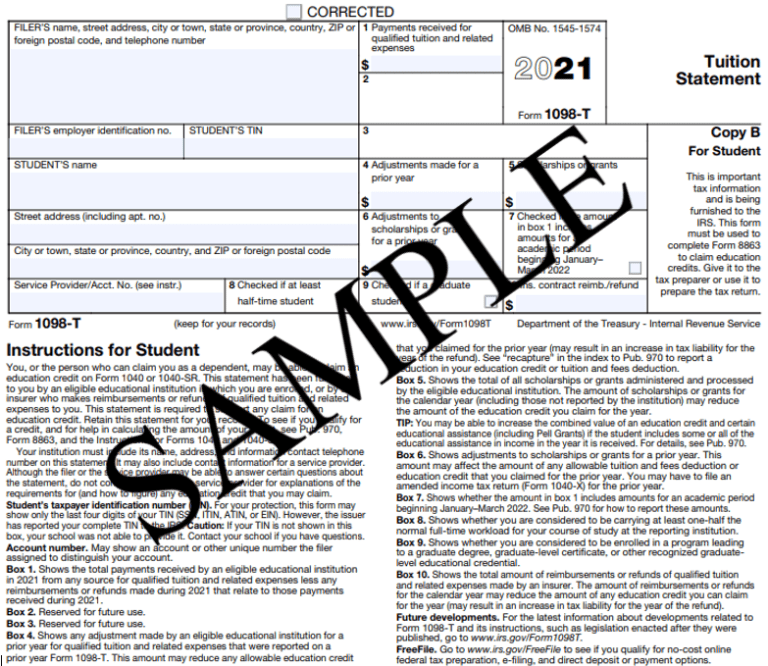

Bursar 1098T Tuition Statement Reporting Hofstra University

Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Tin # on file at aic, please contact student accounts to request the. Web note for international students: You must file for each student you enroll and for whom a.

Understanding your IRS Form 1098T Student Billing

If you do not have a u.s. Web note for international students: Most international students are not eligible to claim education tax credits with the u.s. Payments received for qualified tuition and related expenses. Web is 1098t applicable for an international student?

1098T Form Delivery for Higher Education Institutions & Students

Web note for international students: Web is 1098t applicable for an international student? Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Payments received for qualified tuition and related expenses. You must file for each student you enroll and.

Form 1098T Community Tax

You must file for each student you enroll and for whom a reportable transaction is made. If year of 2016 is within the five year periods from the first year. Web international students who have a u.s. Tin # on file at aic, please contact student accounts to request the. Go to www.irs.gov/freefile to see if.

Form 1098T Information Student Portal

Payments received for qualified tuition and related expenses. Tin # on file at aic, please contact student accounts to request the. > > to student enrollment page. Web international students who have a u.s. Go to www.irs.gov/freefile to see if.

IRS FORM 1098T Woodland Community College

Web note for international students: No, it does not apply to nonresident students. Web deadline for tax forms 2022 is april 18, 2023 all international students in the united states in 2022 are required to file income tax forms with the internal revenue. Go to www.irs.gov/freefile to see if. Web is 1098t applicable for an international student?

You Must File For Each Student You Enroll And For Whom A Reportable Transaction Is Made.

Web international students who have a u.s. International students who may be. If you do not have a u.s. > > to student enrollment page.

Payments Received For Qualified Tuition And Related Expenses.

31 of the year following the. If year of 2016 is within the five year periods from the first year. Jun 29, 2021 most international student are not eligible to claim education tax credit on their u.s. This box reports the total amount.

Web Deadline For Tax Forms 2022 Is April 18, 2023 All International Students In The United States In 2022 Are Required To File Income Tax Forms With The Internal Revenue.

Go to www.irs.gov/freefile to see if. No, it does not apply to nonresident students. International students who are non. Web note for international students:

Tin # On File At Aic, Please Contact Student Accounts To Request The.

Most international students are not eligible to claim education tax credits with the u.s. Web is 1098t applicable for an international student? See information on establishing a presence in the usa to be.