Form 1099-Nec Due Date 2023

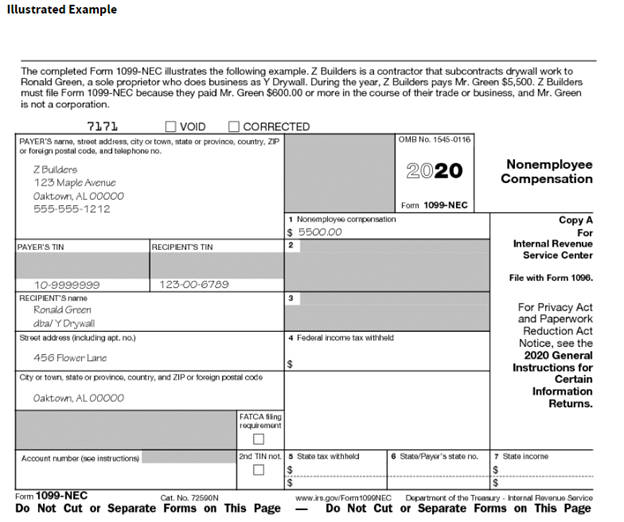

Form 1099-Nec Due Date 2023 - Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Do not miss the deadline. Tax payers submit payments in box eight or box 10 of the tax form; But, with the right preparation and understanding, you can keep your business compliant and off of. Simply answer a few question to instantly download, print & share your form. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. Takes 5 minutes or less to complete.

Web 1099 due dates for 2022: Takes 5 minutes or less to complete. Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Tax payers submit payments in box eight or box 10 of the tax form;

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Tax payers submit payments in box eight or box 10 of the tax form; Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Web 4th quarter 2022 estimated tax payment due: Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Simply answer a few question to instantly download, print & share your form. Takes 5 minutes or less to complete. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Do not miss the deadline. Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer.

How to File Your Taxes if You Received a Form 1099NEC

The deadline to send the. But, with the right preparation and understanding, you can keep your business compliant and off of. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the due date for the 1099 tax form’s electronic filing.

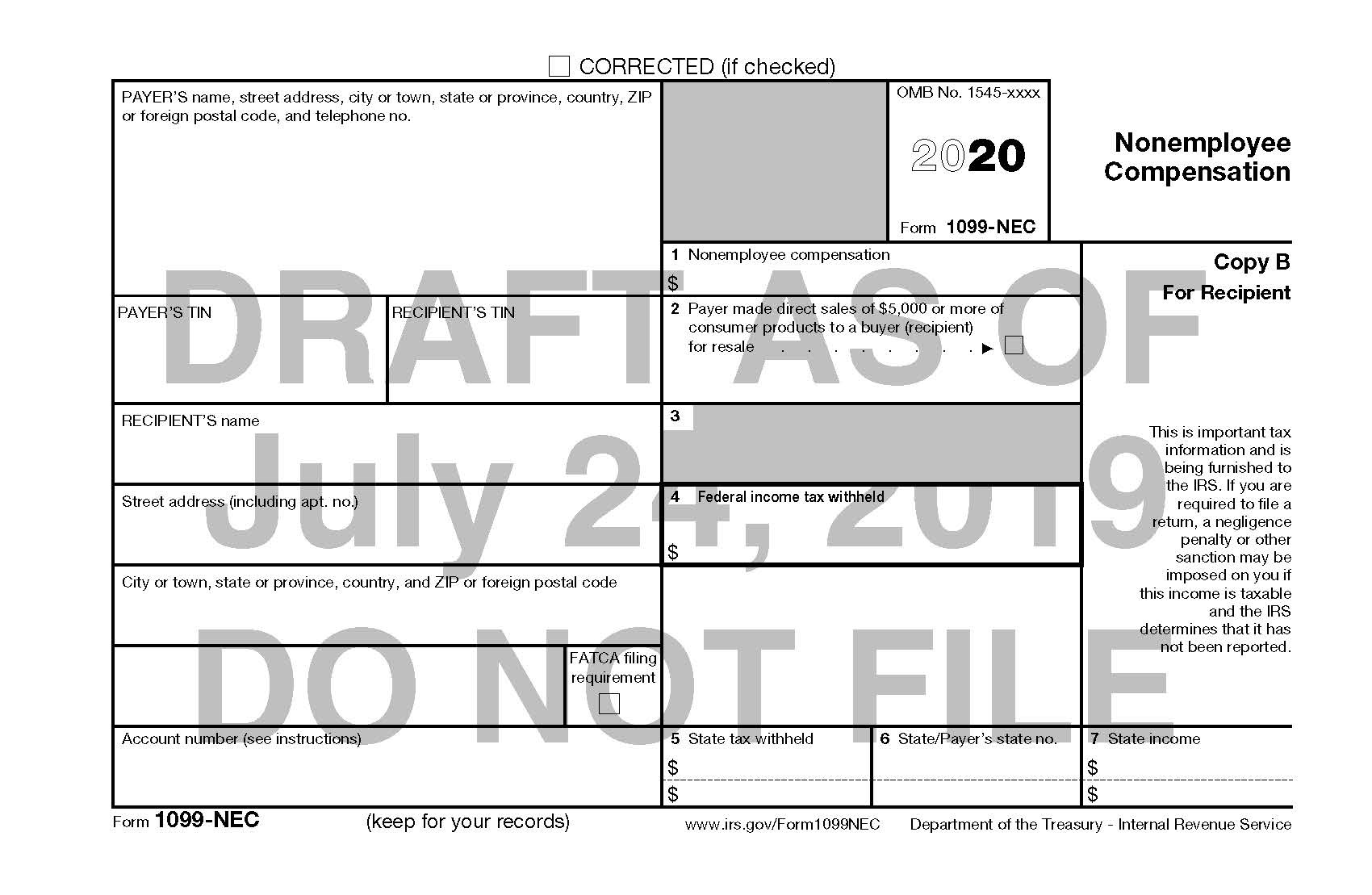

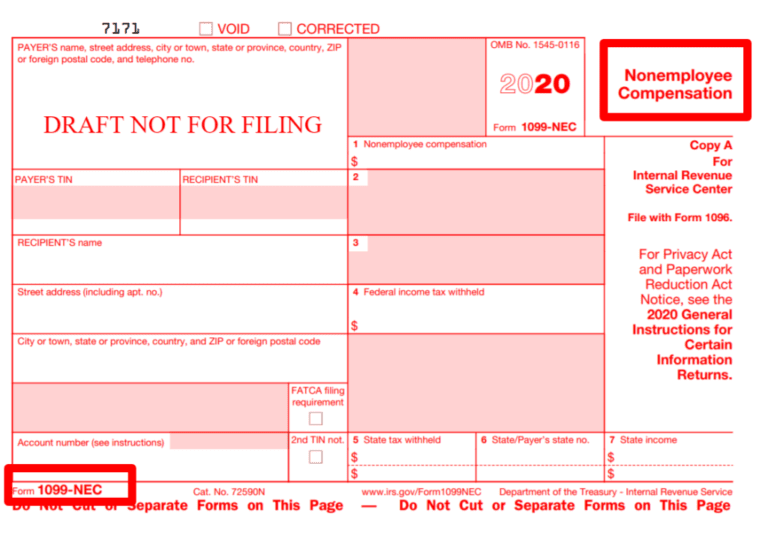

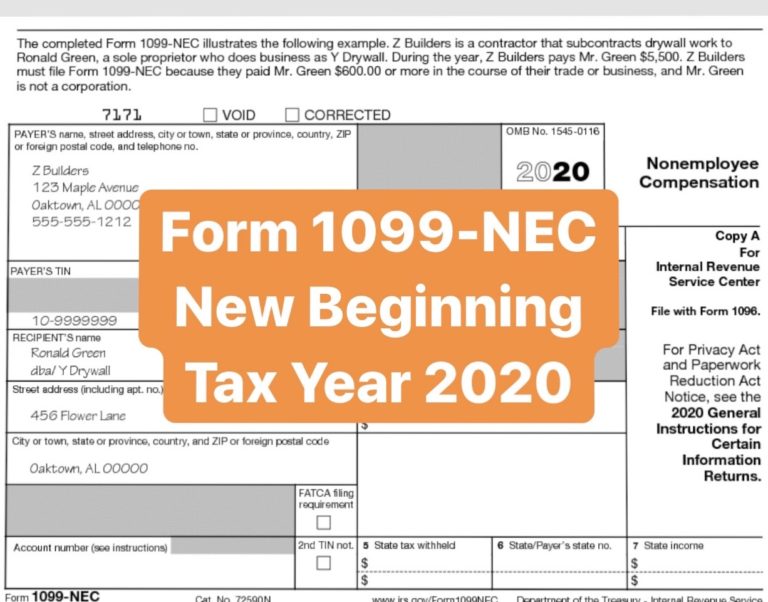

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Copy a & copy b should be filed by january 31. Do not miss the deadline. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web with the.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Simply answer a few question to instantly download, print & share your form. Takes 5 minutes or less to complete. Web 4th quarter 2022 estimated tax payment due: Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Copy a & copy b should be filed by january 31.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Takes 5 minutes or less to complete. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Web 1099 due dates for 2022: Do not miss the deadline.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Web 1099 due dates for 2022: Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Simply answer a few question to instantly download, print & share your form. Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Web form 1099 rules for employers in.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web 1099 due dates for 2022: Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Copy a & copy b should be filed by january 31. Furnishing due date for information returns payers must.

1099NEC or 1099MISC? What has changed and why it matters! IssueWire

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing)..

Beware The 1099NEC Due Date How To Avoid Late Fees

Tax payers submit payments in box eight or box 10 of the tax form; Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? But, with the.

What is Form 1099NEC for Nonemployee Compensation

Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. Get ready for tax season deadlines by completing any required tax forms today. Do not miss the deadline. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Furnishing.

Should An Llc Get A 1099 Nec Armando Friend's Template

Tax payers submit payments in box eight or box 10 of the tax form; Takes 5 minutes or less to complete. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Do not miss the deadline. Furnishing due date for information returns payers must.

Ad Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Irs Regulations.

Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Tax payers submit payments in box eight or box 10 of the tax form; Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms.

Web The Irs Filing Season 2023 Deadlines For Tax Year 2022 Are As Follows:

The deadline to send the. Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Takes 5 minutes or less to complete.

Web Form 1099 Rules For Employers In 2023 Hat Is A 1099 Form, And How Is It Used?

Simply answer a few question to instantly download, print & share your form. Furnishing due date for information returns payers must. Get ready for tax season deadlines by completing any required tax forms today. Copy a & copy b should be filed by january 31.

Do Not Miss The Deadline.

Web 4th quarter 2022 estimated tax payment due: Web 1099 due dates for 2022: But, with the right preparation and understanding, you can keep your business compliant and off of. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)