Form 1099 Rental Income

Form 1099 Rental Income - Security deposits do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. Web there are three types of 1099 rental income related forms. That's not the end of the story, though. Web updated march 7, 2023 reviewed by daisy does taxes if you're a rental property owner, you'll get a 1099 form if you have at least one commercial tenant who paid you at least $600 during the year. Web rental income includes: The new 1099 form requirements have been delayed until 2024 meaning the original threshold of $20,000 in transactions will persist through 2023. Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Of course, if you have been operating your business by the book before 2022, you’ll see little change in the way you file your taxes. We’ll outline them by situation: Written by ben luxon published on 6 jan 2023 update:

Here are the steps you’ll take for claiming rental income on taxes: We’ll outline them by situation: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. You must include $10,000 in your income in the first year. Web there are three types of 1099 rental income related forms. Security deposits do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. That's not the end of the story, though. Reporting rental income on your tax return typically, the rental income tax forms you’ll use to report your rental income include: Written by ben luxon published on 6 jan 2023 update:

Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Here are the steps you’ll take for claiming rental income on taxes: We’ll outline them by situation: You must include $10,000 in your income in the first year. Security deposits do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. That's not the end of the story, though. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Of course, if you have been operating your business by the book before 2022, you’ll see little change in the way you file your taxes. Web rental income includes:

Will I Receive a Form 1099 for Rent?

We’ll outline them by situation: Web rental income includes: Reporting rental income on your tax return typically, the rental income tax forms you’ll use to report your rental income include: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Web in the real estate industry, these documents.

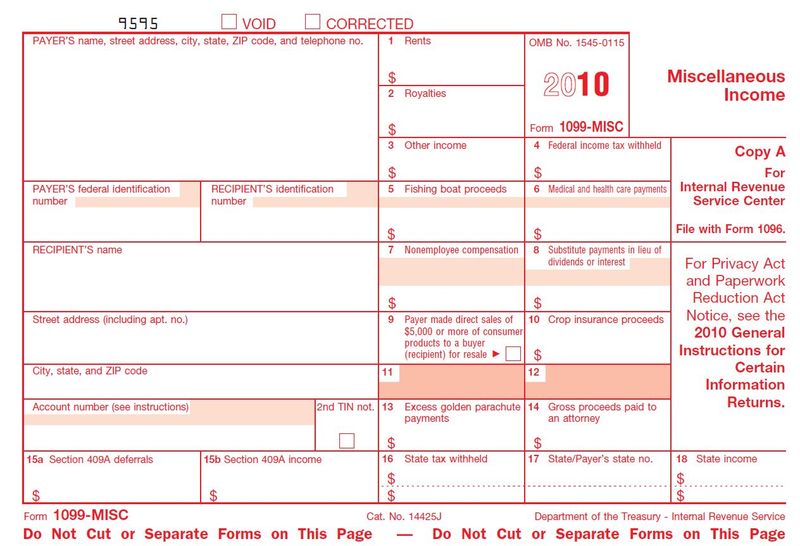

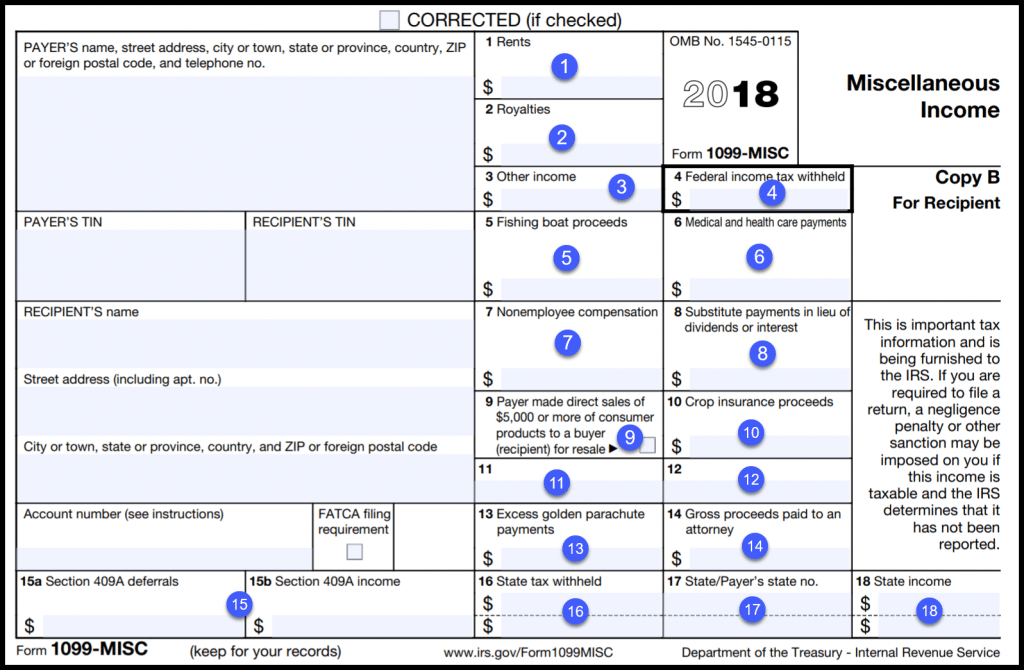

Form 1099MISC Requirements, Deadlines, and Penalties eFile360

Web updated march 7, 2023 reviewed by daisy does taxes if you're a rental property owner, you'll get a 1099 form if you have at least one commercial tenant who paid you at least $600 during the year. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Here.

What is a 1099 & 5498? uDirect IRA Services, LLC

That's not the end of the story, though. Medical and health care payments. Of course, if you have been operating your business by the book before 2022, you’ll see little change in the way you file your taxes. Web there are three types of 1099 rental income related forms. Reporting rental income on your tax return typically, the rental income.

» 1099 Good Buddy! New Reporting Requirements for Landlords

Medical and health care payments. Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. Web in the first year, you receive $5,000 for the first year's rent.

Prepare for the Extended Tax Season With Your Rental Property These

That's not the end of the story, though. Here are the steps you’ll take for claiming rental income on taxes: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status.

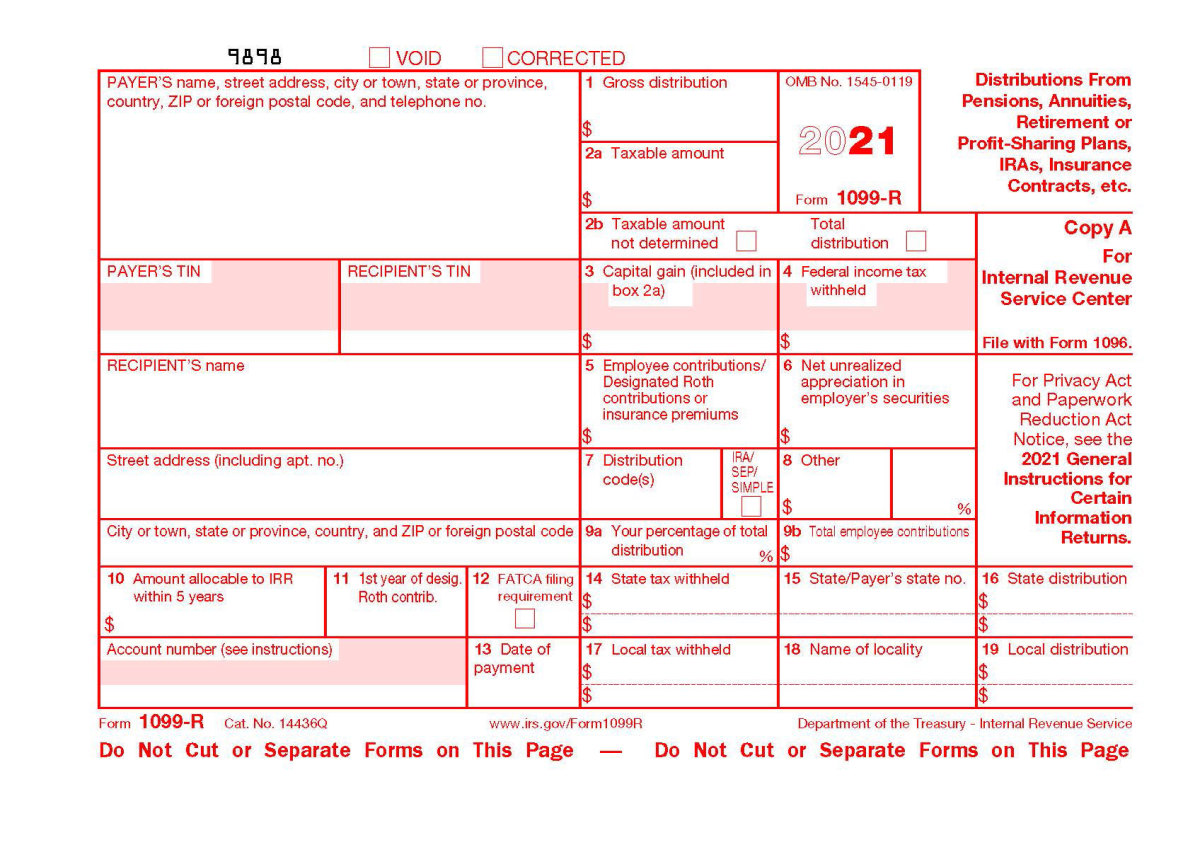

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. You must include $10,000 in your income in the first year. Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Of course, if you have been.

Form 1099 Overview and FAQ Buildium Help Center

Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Web rental income includes: Security deposits do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. We’ll outline them by.

1099MISC Software to Create, Print and EFile Form 1099MISC Irs

Web rental income includes: Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Here are the steps you’ll take for claiming rental income on taxes: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income.

IRS Form 1099 Reporting for Small Business Owners

Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. We’ll outline them by situation: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Medical and health care payments. Web in the real estate industry, these.

Form 1099 Misc Fillable Universal Network

Medical and health care payments. Web updated march 7, 2023 reviewed by daisy does taxes if you're a rental property owner, you'll get a 1099 form if you have at least one commercial tenant who paid you at least $600 during the year. Here are the steps you’ll take for claiming rental income on taxes: Reporting rental income on your.

Tenants In Commercial Leases May Need To Include Additional Information When Filing Taxes, Depending On The Tax Status Of The Landlord.

Written by ben luxon published on 6 jan 2023 update: Medical and health care payments. That's not the end of the story, though. The new 1099 form requirements have been delayed until 2024 meaning the original threshold of $20,000 in transactions will persist through 2023.

We’ll Outline Them By Situation:

Of course, if you have been operating your business by the book before 2022, you’ll see little change in the way you file your taxes. You must include $10,000 in your income in the first year. Web updated march 7, 2023 reviewed by daisy does taxes if you're a rental property owner, you'll get a 1099 form if you have at least one commercial tenant who paid you at least $600 during the year. Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease.

Web In The Real Estate Industry, These Documents Become Necessary When A Landlord Receives More Than $600 In Rent Annually.

Web there are three types of 1099 rental income related forms. Web rental income includes: Web according to the new regulations, landlords and property managers must now ensure they file form 1099 for rental income over $600. Reporting rental income on your tax return typically, the rental income tax forms you’ll use to report your rental income include:

Here Are The Steps You’ll Take For Claiming Rental Income On Taxes:

Security deposits do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease.