Form 1099 S Instructions

Form 1099 S Instructions - By the name itself, one can easily identify that the tax form used to report the sale or. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The sales price is the gross proceeds you received in. Web real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Proceeds from real estate transactions. Web the following are exceptions to the filing deadlines shown above. For internal revenue service center. Search yes continue yes sale of a second home, an inherited home, or land sale of a rental. Those preparing the form will need to include the date of closing and the gross proceeds from.

It is generally filed by the person responsible for closing the. Proceeds from real estate transactions. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Reportable real estate generally, you are required. Those preparing the form will need to include the date of closing and the gross proceeds from. Report the sale of your rental property on form 4797. For internal revenue service center. Learn more about how to simplify your businesses 1099 reporting. By the name itself, one can easily identify that the tax form used to report the sale or. This revised form and condensed instructions streamline the materials and.

For internal revenue service center. To determine if you have to report the sale or exchange of your main. It is generally filed by the person responsible for closing the. Proceeds from real estate transactions. By the name itself, one can easily identify that the tax form used to report the sale or. The sales price is the gross proceeds you received in. Learn more about how to simplify your businesses 1099 reporting. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Report the sale of your rental property on form 4797.

Form 1099 S Fill and Sign Printable Template Online US Legal Forms

The sales price is the gross proceeds you received in. Report the sale of your rental property on form 4797. Reportable real estate generally, you are required. Web irs form 1099 s also known as “proceeds from real estate transactions”. Web the following are exceptions to the filing deadlines shown above.

1099 S Form Fill Online, Printable, Fillable, Blank pdfFiller

Web the following are exceptions to the filing deadlines shown above. By the name itself, one can easily identify that the tax form used to report the sale or. To determine if you have to report the sale or exchange of your main. Reportable real estate generally, you are required. Learn more about how to simplify your businesses 1099 reporting.

EFile 1099S 2022 Form 1099S Online How to File 1099S

Reportable real estate generally, you are required. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Learn more about how to simplify your businesses 1099 reporting. The sales price is the gross proceeds you received in. Web for sales or exchanges of certain real estate, the person responsible for closing real estate transaction.

Social Security Administration (ssa) 1099 Form Form Resume Examples

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. By the name itself, one can easily identify that the tax form used to report the sale or. For internal revenue service center. The sales price is the gross proceeds you received in. This revised form and condensed instructions streamline the materials and.

Form 1099A Acquisition or Abandonment of Secured Property Definition

Those preparing the form will need to include the date of closing and the gross proceeds from. Web irs form 1099 s also known as “proceeds from real estate transactions”. Learn more about how to simplify your businesses 1099 reporting. Web for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the.

How Do I Give A 1099 Form

For internal revenue service center. By the name itself, one can easily identify that the tax form used to report the sale or. Reportable real estate generally, you are required. This revised form and condensed instructions streamline the materials and. Web the following are exceptions to the filing deadlines shown above.

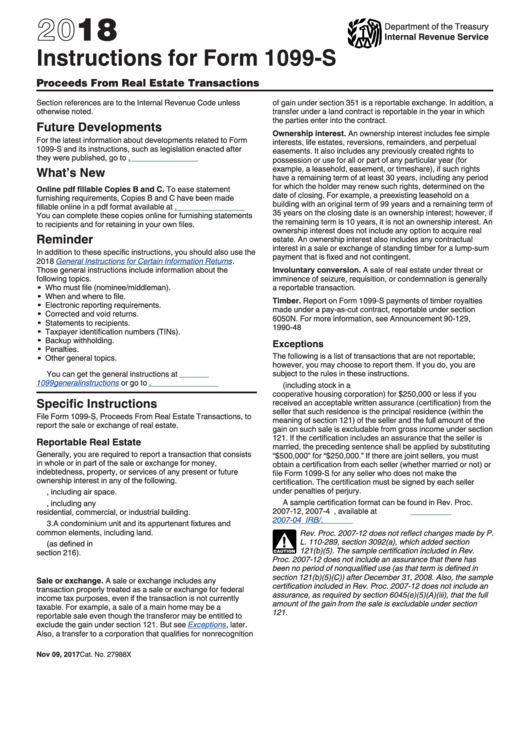

Instructions for Form 1099s Proceeds From Real Estate Transactions

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. It is generally filed by the person responsible for closing the. Learn more about how to simplify your businesses 1099 reporting. Web irs form 1099 s also known as “proceeds from real estate transactions”. Reportable real estate generally, you are required.

National Woodland Owners Association NEW REPORTING RULES FOR LUMPSUM

To determine if you have to report the sale or exchange of your main. The sales price is the gross proceeds you received in. Those preparing the form will need to include the date of closing and the gross proceeds from. Web real estate transaction must report the real estate proceeds to the irs and must furnish this statement to.

1099 S Fillable Form Form Resume Examples X42M5Ra2kG

It is generally filed by the person responsible for closing the. Those preparing the form will need to include the date of closing and the gross proceeds from. Learn more about how to simplify your businesses 1099 reporting. Web real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. For internal.

Instructions For Form 1099S Proceeds From Real Estate Transactions

The sales price is the gross proceeds you received in. To determine if you have to report the sale or exchange of your main. Proceeds from real estate transactions. Those preparing the form will need to include the date of closing and the gross proceeds from. Web irs form 1099 s also known as “proceeds from real estate transactions”.

Those Preparing The Form Will Need To Include The Date Of Closing And The Gross Proceeds From.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. To determine if you have to report the sale or exchange of your main. Web the following are exceptions to the filing deadlines shown above. Web for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the irs and must furnish this.

The Sales Price Is The Gross Proceeds You Received In.

This revised form and condensed instructions streamline the materials and. Web real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Proceeds from real estate transactions. Search yes continue yes sale of a second home, an inherited home, or land sale of a rental.

Web Irs Form 1099 S Also Known As “Proceeds From Real Estate Transactions”.

Learn more about how to simplify your businesses 1099 reporting. It is generally filed by the person responsible for closing the. Reportable real estate generally, you are required. By the name itself, one can easily identify that the tax form used to report the sale or.

Report The Sale Of Your Rental Property On Form 4797.

For internal revenue service center. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)