Form 1120-F Due Date

Form 1120-F Due Date - Web corporate income tax due dates. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; Due dates for declaration of estimated tax. If the due date falls on a saturday,. If the due date falls on a saturday, sunday, or legal holiday, the. Due to the fact that. For example, for a taxpayer with a tax year that ends. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Income tax liability of a foreign corporation. May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations.

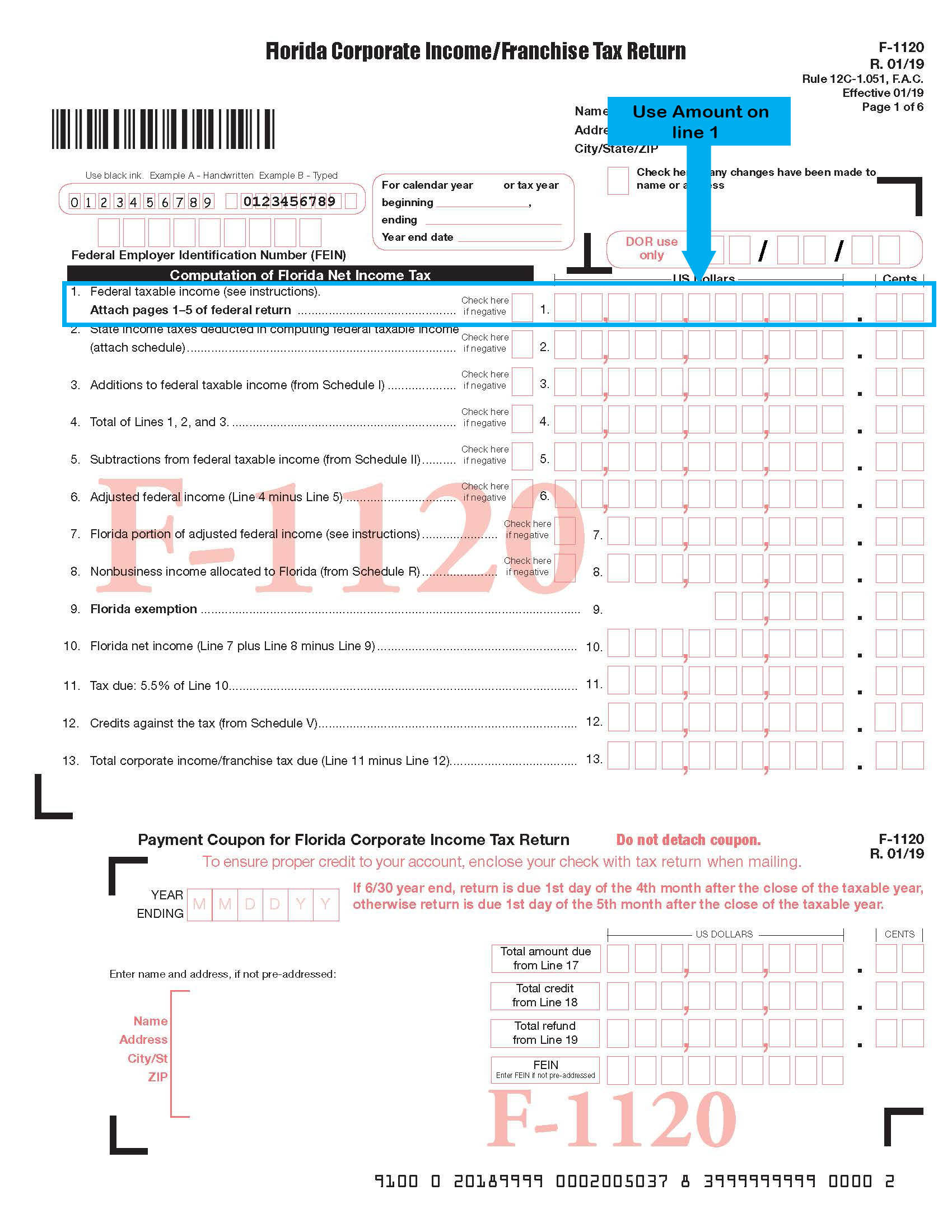

Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Web home forms and instructions about form 1120, u.s. Florida corporate income tax return filing dates. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. If the due date falls on a saturday, sunday, or legal holiday, the. How to create an electronic signature for putting it on the f 1120 in gmail. Due dates for declaration of estimated tax. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations.

Corporation income tax return domestic corporations use this form to: If a foreign corporation maintains a fixed. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. Report their income, gains, losses, deductions,. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. This form is to be used by a foreign corporation that has income that is. Who must use this form? How to create an electronic signature for putting it on the f 1120 in gmail. If the due date falls on a saturday, sunday, or legal holiday, the.

3.11.16 Corporate Tax Returns Internal Revenue Service

Web home forms and instructions about form 1120, u.s. If the due date falls on a saturday, sunday, or legal holiday, the. Florida corporate income tax return filing dates. Who must use this form? Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the.

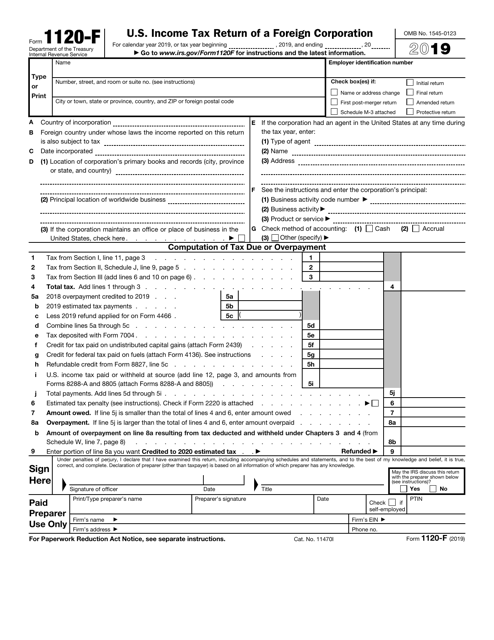

IRS Form 1120F Download Fillable PDF or Fill Online U.S. Tax

For example, for a taxpayer with a tax year that ends. Corporation income tax return domestic corporations use this form to: This form is to be used by a foreign corporation that has income that is. Florida corporate income tax return filing dates. How to create an electronic signature for putting it on the f 1120 in gmail.

F 1120 Due Date

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. If the due date falls on a saturday, sunday, or legal holiday, the. Corporation income tax return domestic corporations use this form to: How to create an electronic signature.

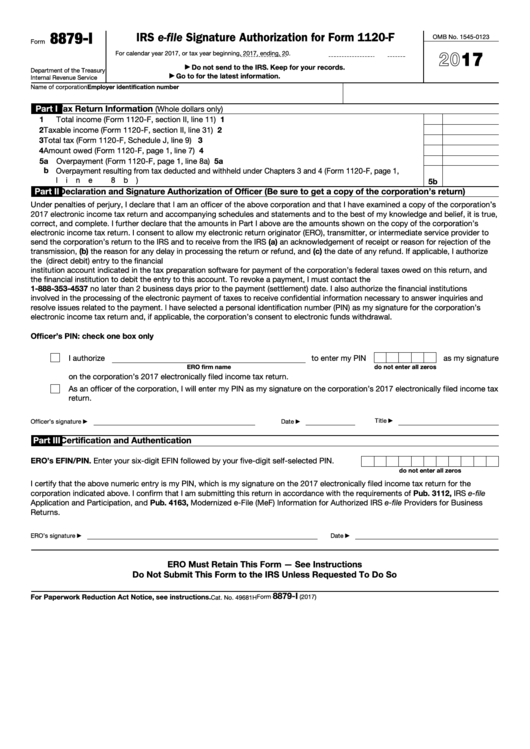

Fillable Form 8879I Irs EFile Signature Authorization For Form 1120

Who must use this form? May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Due dates for declaration of estimated tax..

Form 1120F (Schedule M3) Net Reconciliation for Foreign

If the due date falls on a saturday, sunday, or legal holiday, the. Corporation income tax return domestic corporations use this form to: Due dates for declaration of estimated tax. Web home forms and instructions about form 1120, u.s. For example, for a taxpayer with a tax year that ends.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Florida corporate income tax return filing dates. Corporation income tax return domestic corporations use this form to: If the corporation has premises in the us,. May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. How to create an electronic signature for putting it on the f 1120 in gmail.

Form 1120 Tax Templates Online to Fill in PDF

How to create an electronic signature for putting it on the f 1120 in gmail. Due to the fact that. Web corporate income tax due dates. Who must use this form? Due dates for declaration of estimated tax.

Form 1120F (Schedule S) Exclusion of from International

May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. How to create an electronic signature for putting it on the f 1120 in gmail. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to.

Fill Free fillable IRS efile Signature Authorization for Form 1120F

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. Income tax liability of a foreign corporation. Web corporate income tax due dates. Report their income, gains, losses, deductions,. This form is to be used by a foreign corporation.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

For example, for a taxpayer with a tax year that ends. If the corporation has premises in the us,. Income tax liability of a foreign corporation. Web home forms and instructions about form 1120, u.s. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to.

Web For All Other Tax Year Endings, The Due Date Is On Or Before The First Day Of The Fifth Month Following The Close Of The Tax Year.

Web corporate income tax due dates. Due to the fact that. Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved. How to create an electronic signature for putting it on the f 1120 in gmail.

Web Home Forms And Instructions About Form 1120, U.s.

Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; If the due date falls on a saturday,. Florida corporate income tax return filing dates. Report their income, gains, losses, deductions,.

Income Tax Liability Of A Foreign Corporation.

This form is to be used by a foreign corporation that has income that is. Who must use this form? For example, for a taxpayer with a tax year that ends. If a foreign corporation maintains a fixed.

You Must File A Return, Even If No Tax Is Due.

Corporation income tax return domestic corporations use this form to: Due dates for declaration of estimated tax. If the due date falls on a saturday, sunday, or legal holiday, the. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced.