Form 1120 H Instructions

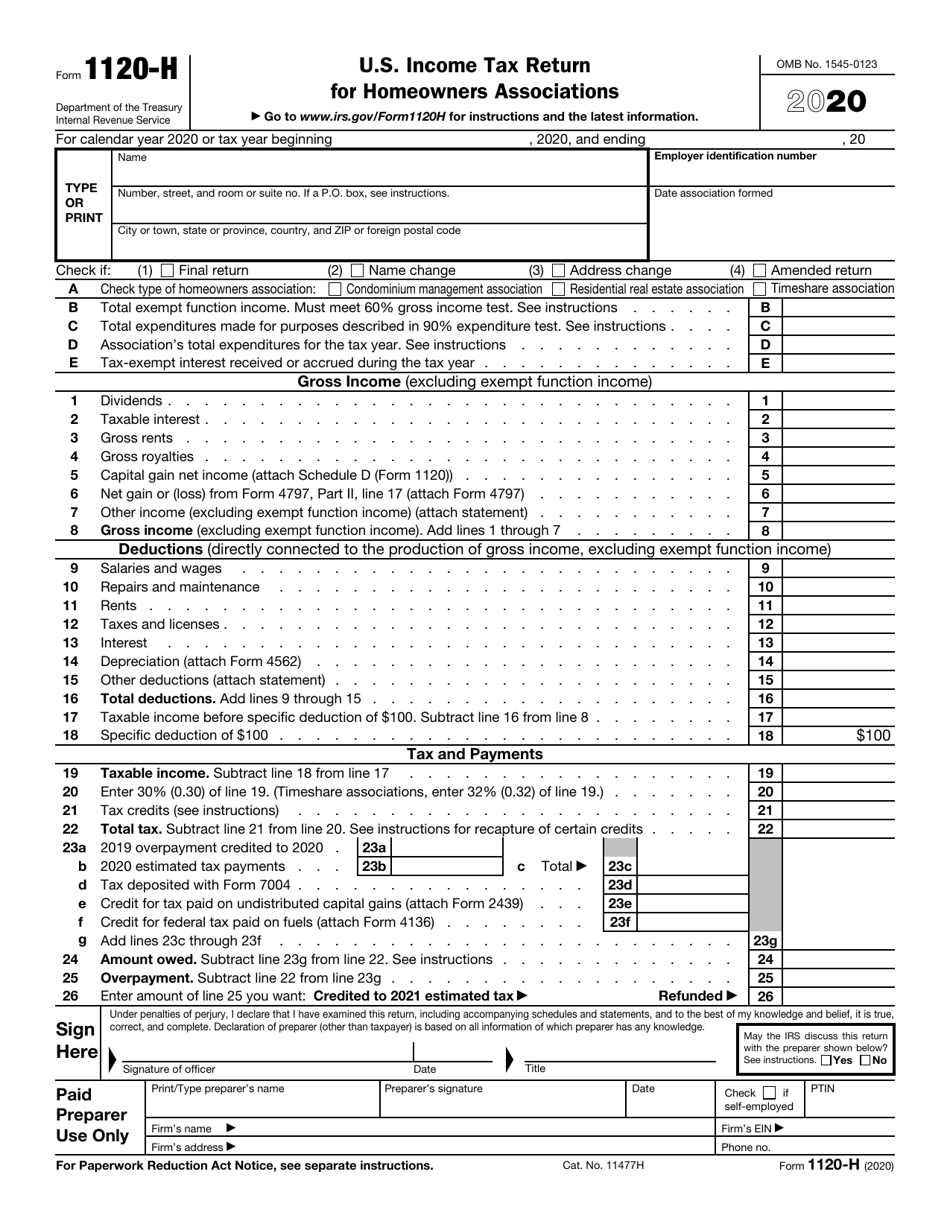

Form 1120 H Instructions - It will often provide a lower audit risk than the alternative form 1120. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles. Use the following irs center address. Hoa's are generally only subject to corporate inc. It's an important tax form because it provides several specific tax benefits. If the association's principal business or office is located in. For paperwork reduction act notice, see separate instructions. Domestic homeowners association to report its gross income and expenses. Income tax return for homeowners associations keywords:

For paperwork reduction act notice, see separate instructions. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an This form is specifically designated for “qualifying” homeowners’ associations. It's an important tax form because it provides several specific tax benefits. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Domestic homeowners association to report its gross income and expenses. Income tax return for homeowners associations keywords: Hoa's are generally only subject to corporate inc. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

For paperwork reduction act notice, see separate instructions. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an A homeowners association files this form as its income tax return to take advantage of certain tax benefits. If the association's principal business or office is located in. This form is specifically designated for “qualifying” homeowners’ associations. Income tax return for homeowners associations keywords: Hoa's are generally only subject to corporate inc. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

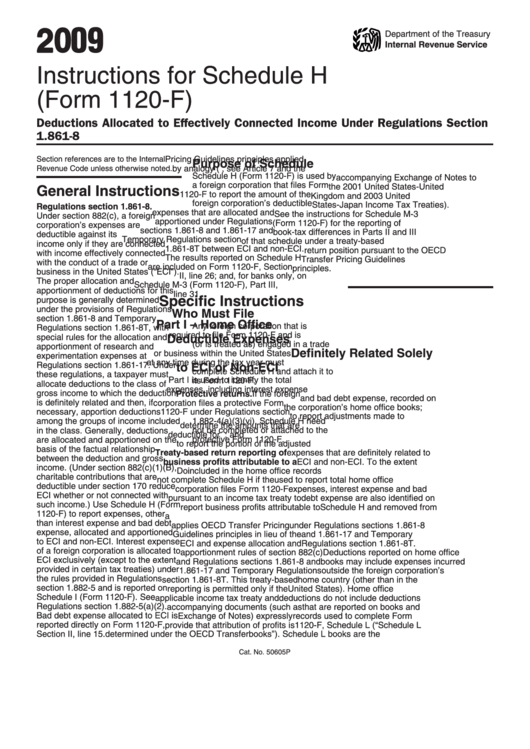

Form 1120F (Schedule H) Deductions Allocated to Effectively

Hoa's are generally only subject to corporate inc. It's an important tax form because it provides several specific tax benefits. It will often provide a lower audit risk than the alternative form 1120. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Corporation income tax return, to report the income, gains,.

Instructions For Form 1120Ric 2016 printable pdf download

It's an important tax form because it provides several specific tax benefits. If the association's principal business or office is located in. Hoa's are generally only subject to corporate inc. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. The election is made separately for each.

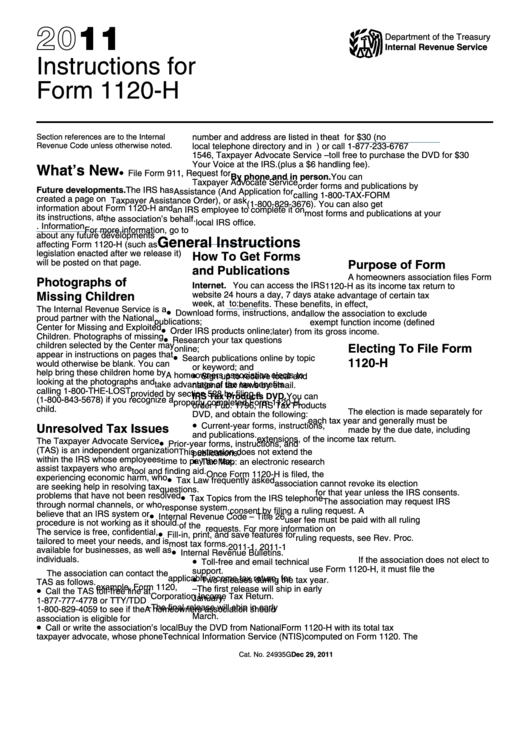

Instructions For Form 1120H 2004 printable pdf download

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Use the following irs center.

Instructions For Form 1120H 2008 printable pdf download

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Domestic homeowners association to report its gross income and expenses. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax return for homeowners associations, including recent updates, related.

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

It's an important tax form because it provides several specific tax benefits. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an A homeowners association files this form as its income tax return to take advantage of certain tax benefits. It will often provide a lower audit risk than the alternative form 1120. Income tax.

Instructions For Form 1120H 2016 printable pdf download

Income tax return for homeowners associations keywords: A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Use the following irs center address. It's an important tax form because it provides several specific tax benefits. The form requests information related to amount of money received and spent on rent, repairs, and other.

Instructions For Schedule H (Form 1120F) 2009 printable pdf download

This form is specifically designated for “qualifying” homeowners’ associations. Hoa's are generally only subject to corporate inc. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. If the association's principal business or office is located in. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the.

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles. This form is specifically designated for “qualifying” homeowners’ associations. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Hoa's are generally only subject to corporate inc. Income.

Instructions For Form 1120H U.s. Tax Return For Homeowners

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Income tax return for homeowners associations keywords: It will often provide a lower audit risk than the alternative form 1120. Hoa's are generally only subject to corporate inc. It's an important tax form because it.

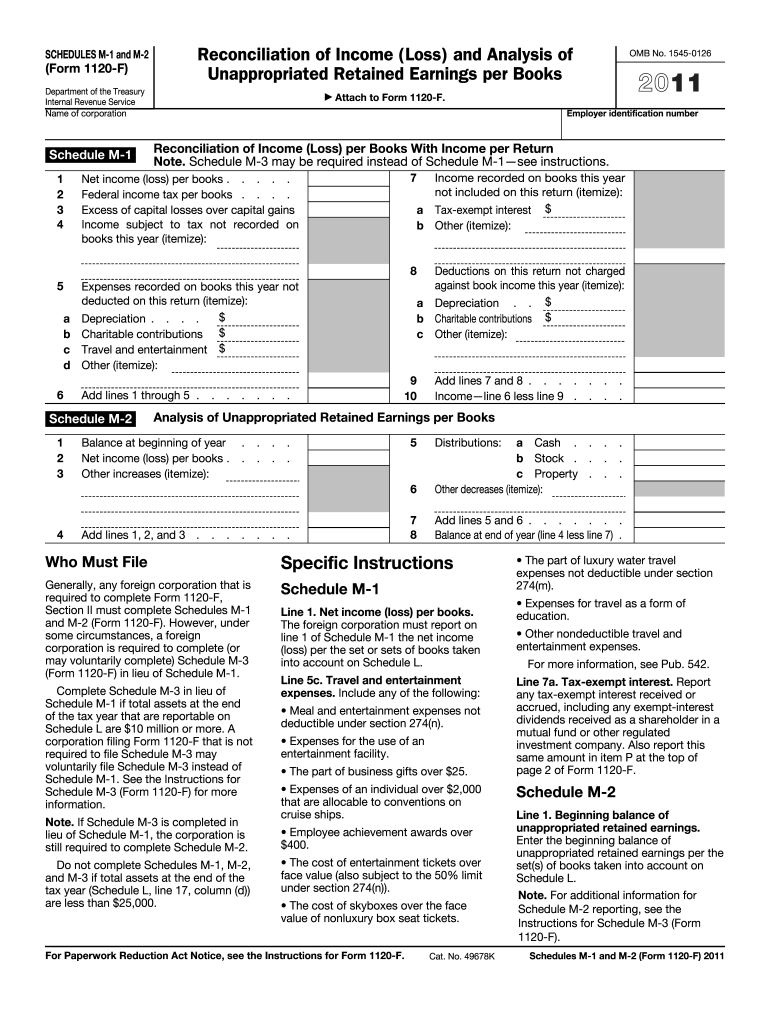

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

If the association's principal business or office is located in. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Domestic homeowners association to report its gross income and expenses. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Use the following.

Domestic Homeowners Association To Report Its Gross Income And Expenses.

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. For paperwork reduction act notice, see separate instructions. A homeowners association files this form as its income tax return to take advantage of certain tax benefits.

The Form Requests Information Related To Amount Of Money Received And Spent On Rent, Repairs, And Other Specific Deductibles.

Use the following irs center address. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an It will often provide a lower audit risk than the alternative form 1120. This form is specifically designated for “qualifying” homeowners’ associations.

Income Tax Return For Homeowners Associations Keywords:

If the association's principal business or office is located in. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Hoa's are generally only subject to corporate inc. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania.