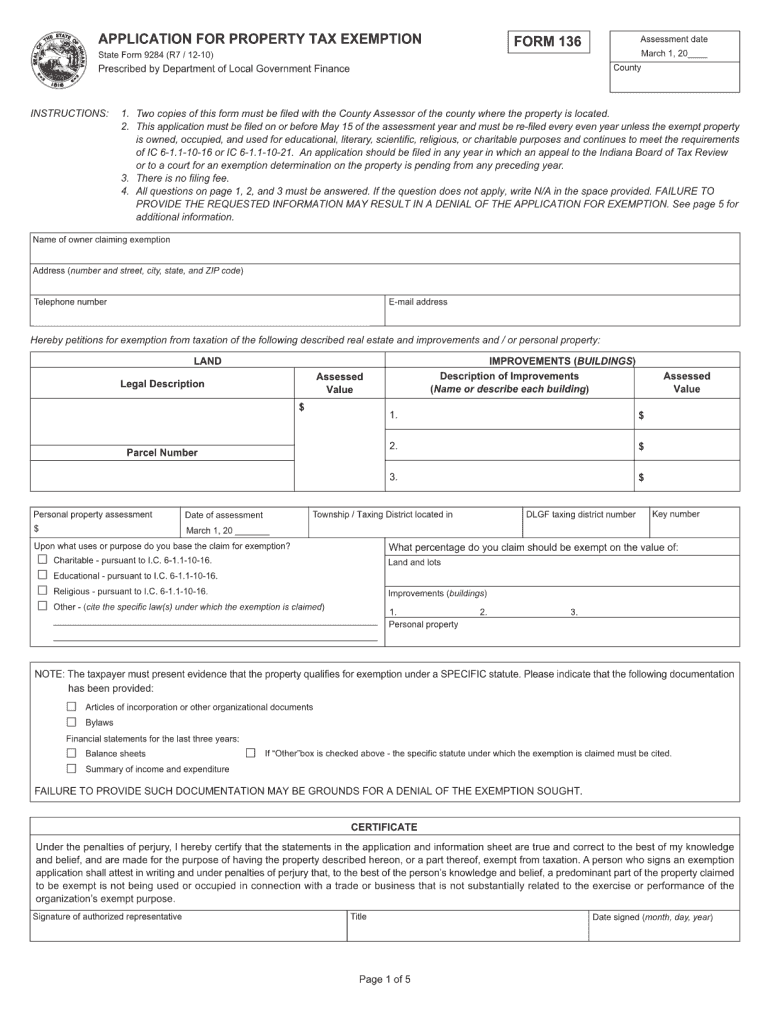

Form 136 Indiana

Form 136 Indiana - Claim for homestead property tax standard/supplemental: Form 136 must be filed to. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana. Once approved, the form 136 does. Web organizations such as charitable, educational, religious may be eligible for tax exemption. Web you may now file the application for property tax exemption (form 136) online by visiting our beacon website. You can also download it, export it or print it out. Type text, add images, blackout confidential. Application for property tax exemption, 136, indiana statewide, department of local government finance application for property tax exemption form. Web send form 136 indiana exemption via email, link, or fax.

Web indiana code exempts tangible personal property and real property from property tax for charitable, educational, and religious purposes. Web file form 136, application for property tax exemption, with the county assessor where the property is located in every year. Claim for homestead property tax standard/supplemental: Once approved, the form 136 does. Web the deadline for filing a form 136, the application for property tax exemption, is april 1, 2023. Web send form 136 indiana exemption via email, link, or fax. Know when i will receive my tax refund. You can also download it, export it or print it out. Sign online button or tick the. 2006 is a filing year for every owner.

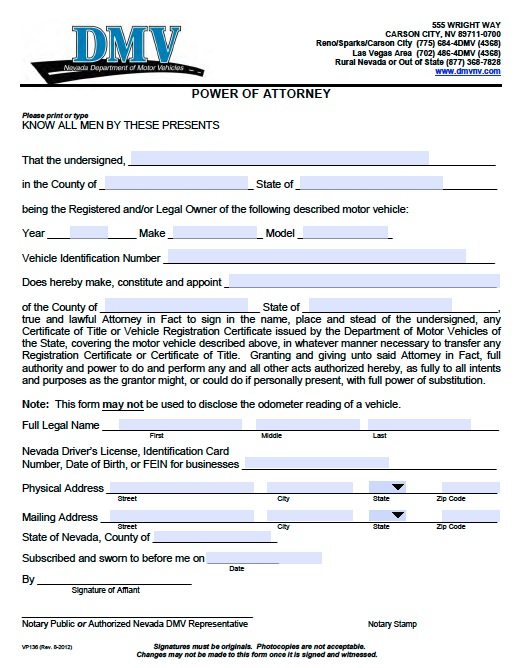

Web you may now file the application for property tax exemption (form 136) online by visiting our beacon website. Web indiana code exempts from tax real property and business tangible personal property used for educational, religious or charitable purposes. You can also download it, export it or print it out. Application for property tax exemption. Web pike county's commitment to universal access. Terrell, adjutant general, indiana, 1867. Web dor forms.in.gov find indiana tax forms. Include this completed form with your application for title, and keep a copy for your records. Web file form 136, application for property tax exemption, with the county assessor where the property is located in every year. Web the 136th indiana infantry regiment served in the union army between may 21 and september 2, 1864, during the american civil war.

Indiana Property Tax Exemption Form 136 propertyvb

Web the 136th indiana infantry regiment served in the union army between may 21 and september 2, 1864, during the american civil war. Once approved, the form 136 does. Web the deadline for filing a form 136, the application for property tax exemption, is april 1, 2023. Web to obtain exemption, indiana form 136 must be filed with the county.

Form 136 Download Fillable PDF or Fill Online Application for

Web indiana code exempts tangible personal property and real property from property tax for charitable, educational, and religious purposes. Type text, add images, blackout confidential. Know when i will receive my tax refund. Web organizations such as charitable, educational, religious may be eligible for tax exemption. Once approved, the form 136 does.

Catalog, 1958, Purple, Form 136, Wayne Street building.

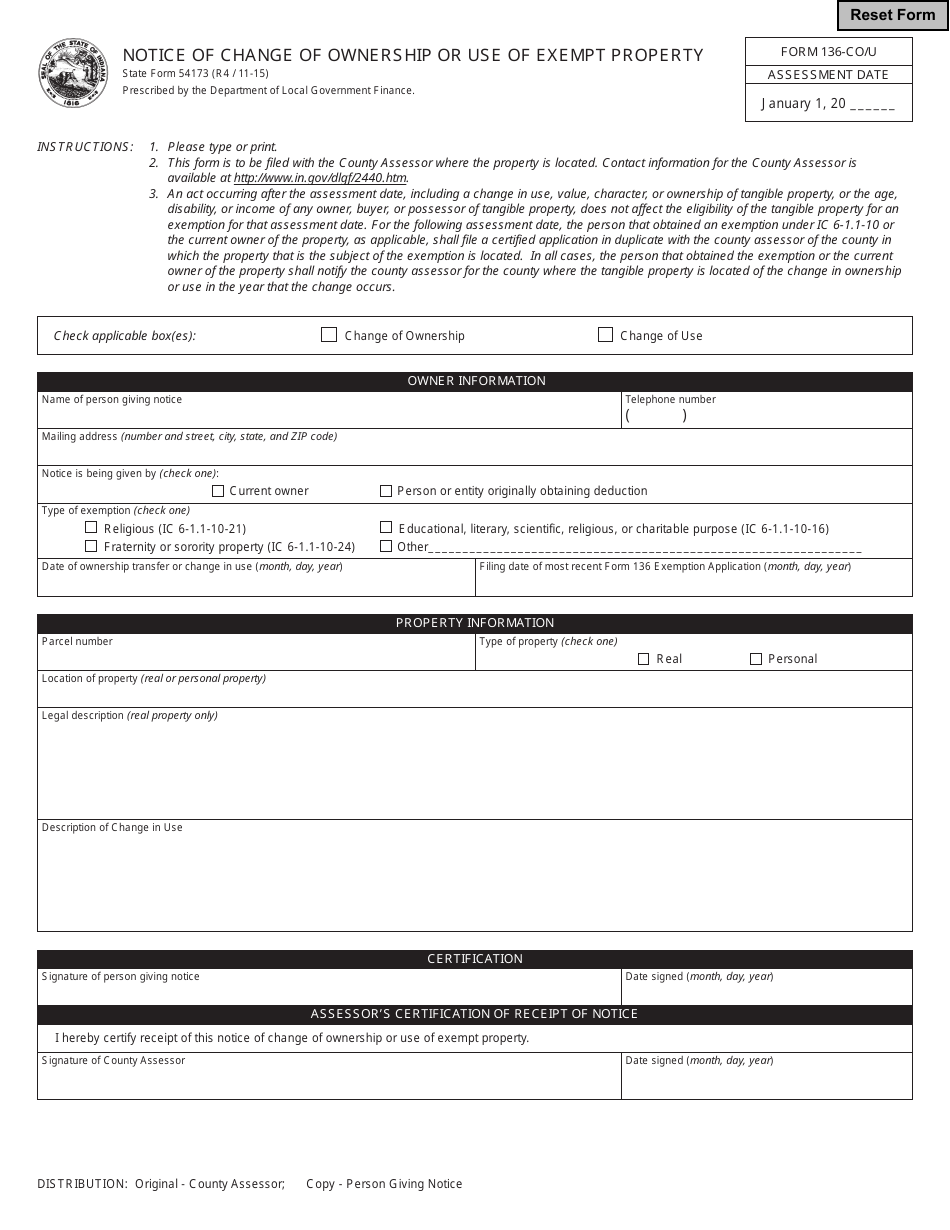

Web form title 09284 (form 136) real property exemptions application for property tax exemption 49585 (form 120) notice of action on exemption application 54173 (form. Form 136 must be filed to. Web indiana code exempts tangible personal property and real property from property tax for charitable, educational, and religious purposes. An exemption request must be filed timely, with the county.

136. 4th normal form YouTube

Provide this completed form to the county assessor (dmv). Web pike county's commitment to universal access. Application for property tax exemption, 136, indiana statewide, department of local government finance application for property tax exemption form. Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1, 2022 of the assessment year. To start the.

Js Form 136 Fill and Sign Printable Template Online US Legal Forms

Form 136 must be filed to. 2006 is a filing year for every owner. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana. Application for property tax exemption, 136, indiana statewide, department of local government finance application for property tax exemption form. Claim for homestead property tax standard/supplemental:

Form 136CO/U (State Form 54173) Download Fillable PDF or Fill Online

Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1, 2022 of the assessment year. Once approved, the form 136 does. Form 136 must be filed to. Web send form 136 indiana exemption via email, link, or fax. Sign online button or tick the.

Free Vehicle Power of Attorney Nevada Form 136 DMV Adobe PDF

Web pike county's commitment to universal access. Web organizations such as charitable, educational, religious may be eligible for tax exemption. Sign online button or tick the. Include this completed form with your application for title, and keep a copy for your records. 2006 is a filing year for every owner.

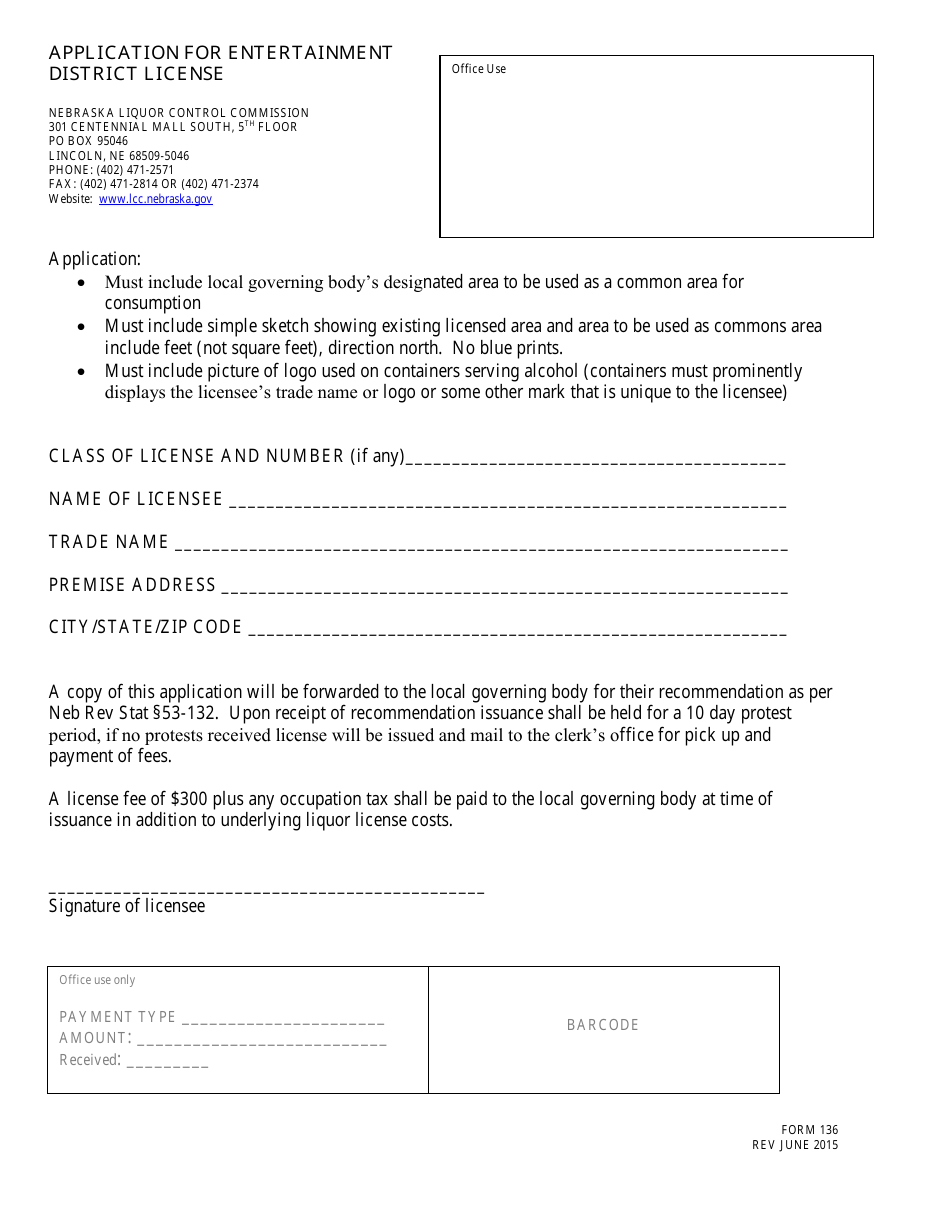

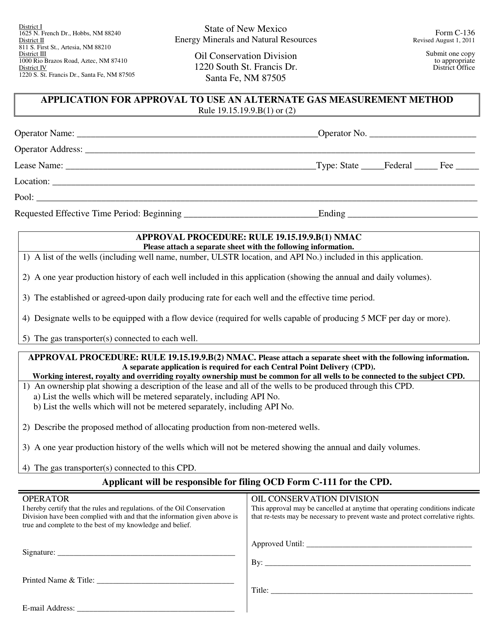

Form C136 Download Printable PDF or Fill Online Application for

Web send form 136 indiana exemption via email, link, or fax. Web to obtain exemption, indiana form 136 must be filed with the county assessor by april 1, 2022 of the assessment year. Terrell, adjutant general, indiana, 1867. Application for property tax exemption, 136, indiana statewide, department of local government finance application for property tax exemption form. Web form title.

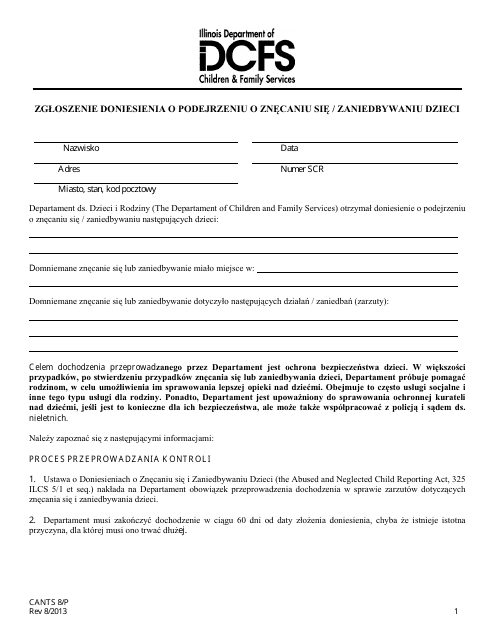

Dcf 136 Printable Form Printable Word Searches

Know when i will receive my tax refund. Web pike county's commitment to universal access. Web dor forms.in.gov find indiana tax forms. Web dlgf assessments exemptions exemptions exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. Terrell, adjutant general, indiana, 1867.

FEIN ECutSägeblatt Standard 65/50mm Form 136 (25 Stück)

Form 136 must be filed to. Web you may now file the application for property tax exemption (form 136) online by visiting our beacon website. Application for property tax exemption, 136, indiana statewide, department of local government finance application for property tax exemption form. You can also download it, export it or print it out. 2006 is a filing year.

Web You May Now File The Application For Property Tax Exemption (Form 136) Online By Visiting Our Beacon Website.

Know when i will receive my tax refund. Web file form 136, application for property tax exemption, with the county assessor where the property is located in every year. Web form title 09284 (form 136) real property exemptions application for property tax exemption 49585 (form 120) notice of action on exemption application 54173 (form. Web send form 136 indiana exemption via email, link, or fax.

Once Approved, The Form 136 Does.

Sign online button or tick the. Web the 136th indiana infantry regiment served in the union army between may 21 and september 2, 1864, during the american civil war. Edit your form 136 online. Web dlgf assessments exemptions exemptions exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable.

Web To Obtain Exemption, Indiana Form 136 Must Be Filed With The County Assessor By April 1, 2022 Of The Assessment Year.

Provide this completed form to the county assessor (dmv). Form 136 must be filed to. Claim for homestead property tax standard/supplemental: Web the deadline for filing a form 136, the application for property tax exemption, is april 1, 2023.

Web Indiana Code Exempts Tangible Personal Property And Real Property From Property Tax For Charitable, Educational, And Religious Purposes.

Web organizations such as charitable, educational, religious may be eligible for tax exemption. Type text, add images, blackout confidential. Web state form # description: An exemption request must be filed timely, with the county assessor by filing a form.