Form 2210 2022

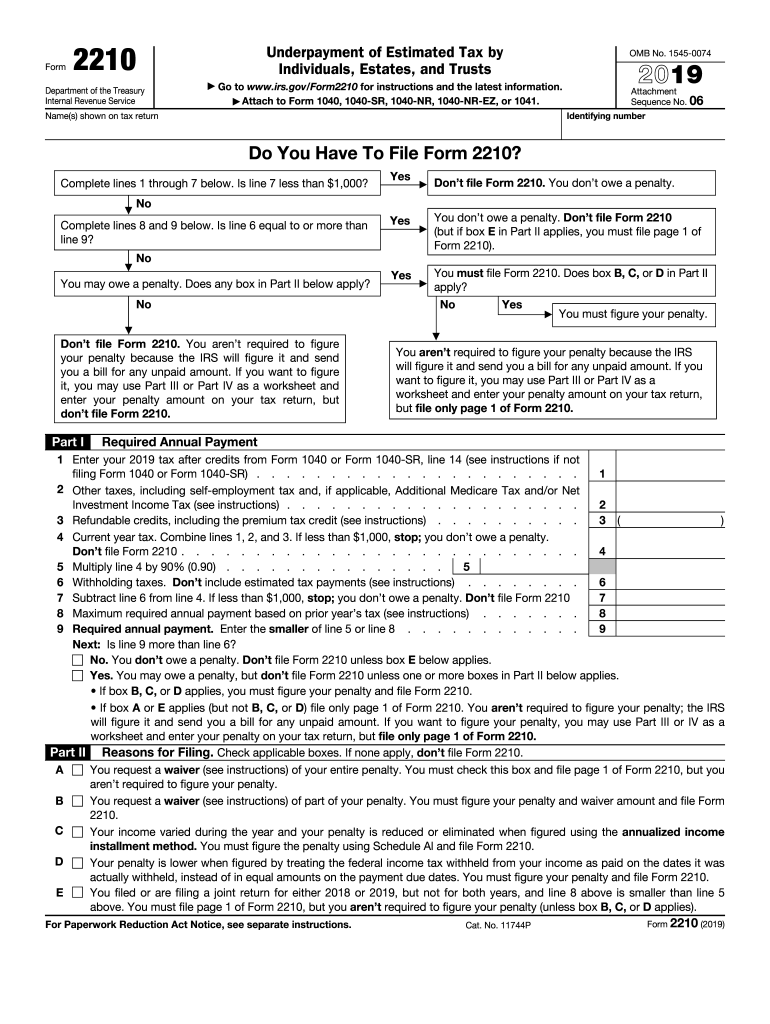

Form 2210 2022 - Web the interest rate for underpayments, which is updated by the irs each quarter. You may use the short method if: All withholding and estimated tax payments were made equally throughout the year. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. Underpayment of estimated tax by individuals, estates, and trusts. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Department of the treasury internal revenue service. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability.

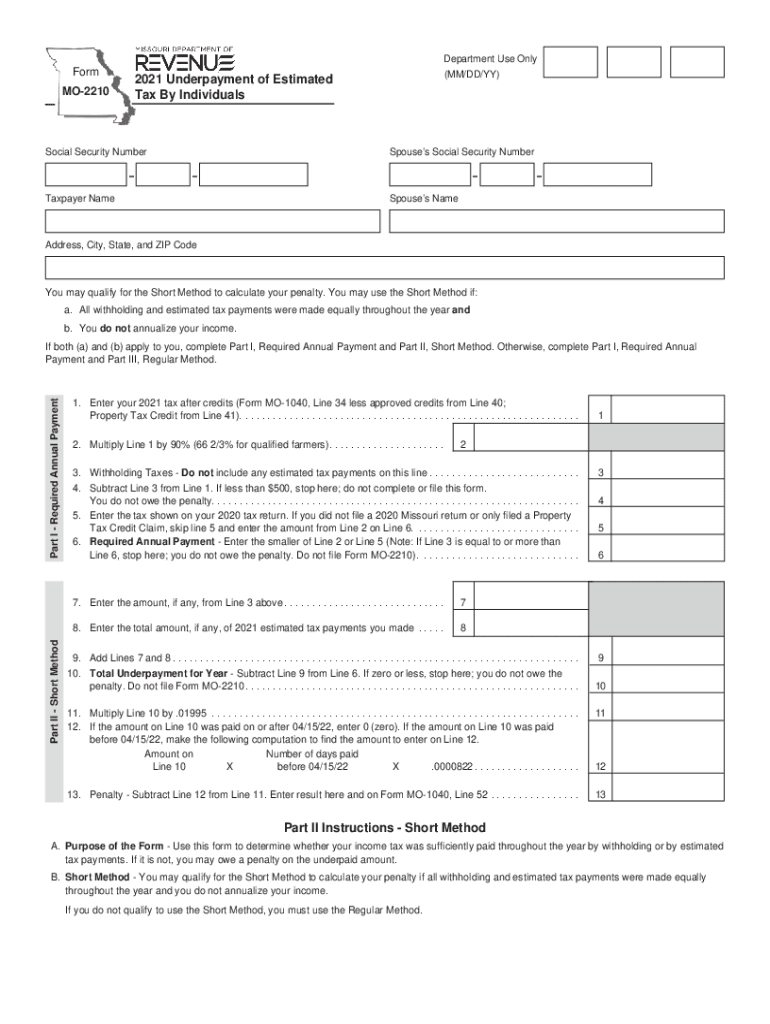

For instructions and the latest information. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). You may qualify for the short method to calculate your penalty. Name(s) shown on tax return. Web 2022 underpayment of estimated. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022.

You may qualify for the short method to calculate your penalty. Web if your adjusted gross income (line 11 of your 2022 form 1040) is greater than $150,000 (or $75,000 if you're married and file a separate return from your spouse), you can avoid a penalty by paying at least 110% of your total. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. Web 2022 underpayment of estimated. You may use the short method if: Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. All withholding and estimated tax payments were made equally throughout the year. Name(s) shown on tax return. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service.

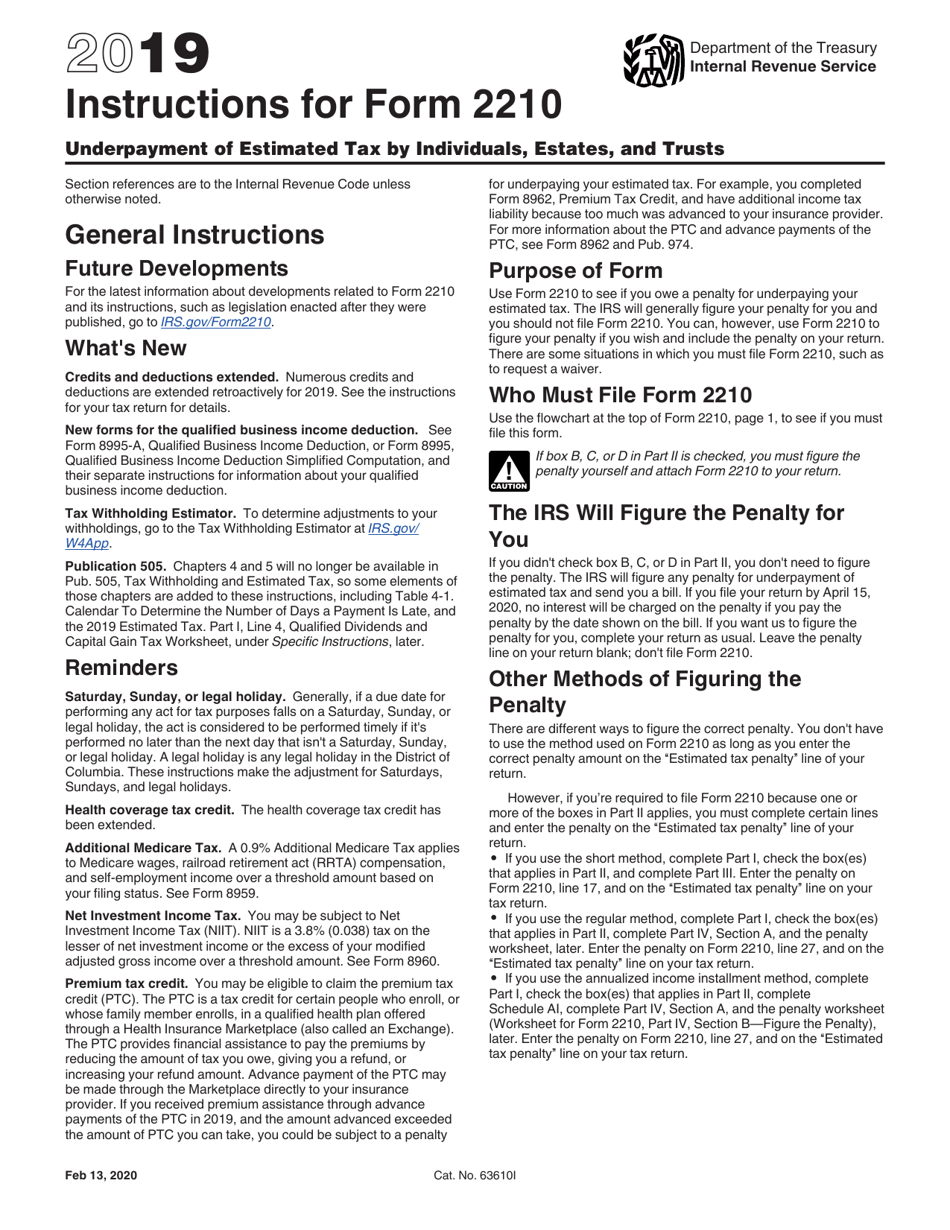

Instructions For Form 2210 Underpayment Of Estimated Tax By

You may use the short method if: Name(s) shown on tax return. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Sometimes the irs will calculate the tax penalty and the taxpayer will not be required to file form 2210. Underpayment of estimated tax by individuals, estates, and trusts. Go to www.irs.gov/form2210f for instructions and the latest information. You may qualify for the short method to calculate your penalty. For instructions and the latest information.

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

For instructions and the latest information. Web 2022 underpayment of estimated. You may qualify for the short method to calculate your penalty. Web the interest rate for underpayments, which is updated by the irs each quarter. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

Instructions for Federal Tax Form 2210 Sapling

Web the interest rate for underpayments, which is updated by the irs each quarter. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You can use form 2210, underpayment of estimated tax by individuals, estates, and.

2210 Form 2022 2023

Web the interest rate for underpayments, which is updated by the irs each quarter. You may qualify for the short method to calculate your penalty. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). All withholding and estimated tax payments were made equally throughout the year. You can use form 2210, underpayment of estimated.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Sometimes the irs will calculate the tax penalty and the taxpayer will not be required to file form 2210. Web if your adjusted gross income (line 11 of your 2022 form 1040) is greater than $150,000 (or $75,000 if you're married and file a separate return from your spouse), you can avoid a penalty by paying at least 110% of.

Ssurvivor Irs Form 2210 Instructions 2020

Underpayment of estimated tax by individuals, estates, and trusts. General instructions future developments for the latest information about developments related to form 2210 and Underpayment of estimated tax by individuals, estates, and trusts. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals.

Mo 2210 Fill Out and Sign Printable PDF Template signNow

Sometimes the irs will calculate the tax penalty and the taxpayer will not be required to file form 2210. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. For instructions and the latest information. Web 2022 instructions.

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

Underpayment of estimated tax by individuals, estates, and trusts. For instructions and the latest information. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Underpayment of estimated tax by individuals, estates, and trusts. Web 2022 underpayment of estimated.

About Form 2210, Underpayment of Estimated Tax by Fill Out and Sign

Web 2022 underpayment of estimated. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Go to www.irs.gov/form2210f for instructions and the latest information. For instructions and the latest information.

Web Complete Form 2210, Schedule Ai, Annualized Income Installment Method Pdf (Found Within The Form).

All withholding and estimated tax payments were made equally throughout the year. Name(s) shown on tax return. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service.

Dispute A Penalty If You Don’t Qualify For Penalty Removal Or Reduction Due To Retirement Or Disability, We Can't Adjust The Underpayment Of Estimated Tax By Individuals Penalty For Reasonable Cause.

Department of the treasury internal revenue service. For instructions and the latest information. Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web if your adjusted gross income (line 11 of your 2022 form 1040) is greater than $150,000 (or $75,000 if you're married and file a separate return from your spouse), you can avoid a penalty by paying at least 110% of your total.

Web Irs Form 2210, Underpayment Of Estimated Tax By Individuals, Estates, And Trusts, Is A Tax Document That Some Taxpayers Are Required To File To Determine If They Owe A Penalty For The Underpayment Of Their Estimated Tax Liability.

Web 2022 underpayment of estimated. General instructions future developments for the latest information about developments related to form 2210 and You may use the short method if: For instructions and the latest information.

Sometimes The Irs Will Calculate The Tax Penalty And The Taxpayer Will Not Be Required To File Form 2210.

Web the interest rate for underpayments, which is updated by the irs each quarter. You can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from. Go to www.irs.gov/form2210f for instructions and the latest information. You may qualify for the short method to calculate your penalty.