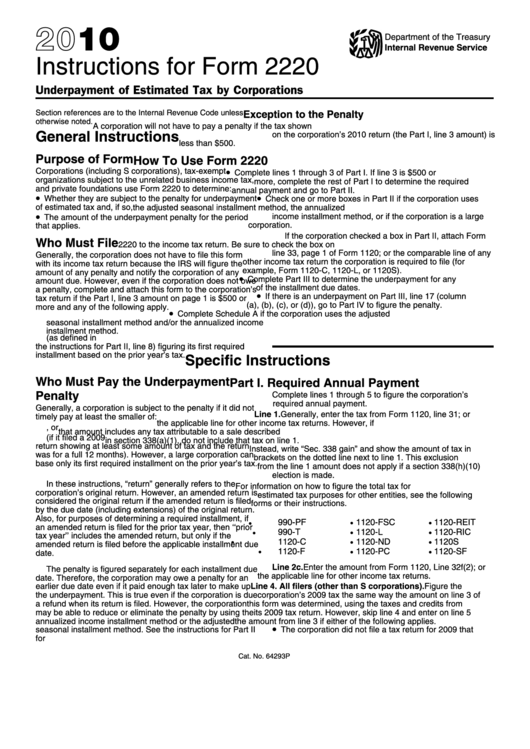

Form 2220 Instructions 2020

Form 2220 Instructions 2020 - Web instructions on the form. Web form 2220me underpayment of estimated tax maine revenue services, p.o. Transform an online template into an accurately completed 2020 2220 in a matter of. A corporation may reduce or eliminate the penalty by using the annualized income or adjusted seasonal installment method. Web form mo‑2220 (revised 12‑2020) instructions. Generally, the corporation is not required to file form 2220. Web video instructions and help with filling out and completing form 2220 instructions 2022. 2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of. Web for instructions and the latest information. The internal revenue service expects corporations to pay estimated taxes throughout the entire tax year.

A corporation may reduce or eliminate the penalty by using the annualized income or adjusted seasonal installment method. Web instructions for form 2220 underpayment of estimated tax by corporations section references are to the internal revenue code unless otherwise noted. Corporate income tax, estimated tax. Web instructions for form 2220 underpayment of estimated tax by corporations department of the treasury internal revenue service section references are to the internal revenue. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web form 2220me underpayment of estimated tax maine revenue services, p.o. The internal revenue service expects corporations to pay estimated taxes throughout the entire tax year. Whether they are subject to the penalty. Web instructions on the form. Web video instructions and help with filling out and completing form 2220 instructions 2022.

Corporate income tax, estimated tax. Web who must file generally, the corporation does not have to file this form with its income tax return because the irs will figure the amount of any penalty and notify the corporation of. Generally, the corporation is not required to file form 2220. A corporation may reduce or eliminate the penalty by using the annualized income or adjusted seasonal installment method. Web we last updated the underpayment of estimated tax by corporations in february 2023, so this is the latest version of form 2220, fully updated for tax year 2022. Form mo‑2220 is used by a corporation to determine whether it is. Web for instructions and the latest information. Web instructions for form 2220 underpayment of estimated tax by corporations section references are to the internal revenue code unless otherwise noted. Web video instructions and help with filling out and completing form 2220 instructions 2022. Web irs form 2220 instructions.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Transform an online template into an accurately completed 2020 2220 in a matter of. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Ad complete irs tax forms online or print government tax documents. Corporate income tax, estimated tax. Web.

How to avoid a penalty using Form 2220?

Corporate income tax, estimated tax. Subject to addition to tax for. Web form 2220me underpayment of estimated tax maine revenue services, p.o. Web instructions for form 2220 underpayment of estimated tax by corporations department of the treasury internal revenue service section references are to the internal revenue. Web video instructions and help with filling out and completing form 2220 instructions.

Fillable Form 2220 Underpayment Of Estimated Tax By Corporations

Ad complete irs tax forms online or print government tax documents. Web instructions on the form. Complete, edit or print tax forms instantly. Web who must file generally, the corporation does not have to file this form with its income tax return because the irs will figure the amount of any penalty and notify the corporation of. Form mo‑2220 is.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Complete, edit or print tax forms instantly. Web who must file generally, the corporation does not have to file this form with its income tax return because the irs will figure the amount of any penalty and notify the corporation of. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

The internal revenue service expects corporations to pay estimated taxes throughout the entire tax year. Whether they are subject to the penalty. Web irs form 2220 instructions. Generally, the corporation is not required to file form 2220. 2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax

Transform an online template into an accurately completed 2020 2220 in a matter of. A corporation may reduce or eliminate the penalty by using the annualized income or adjusted seasonal installment method. Subject to addition to tax for. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of. Corporate income tax, estimated tax. Web for instructions and the latest information. Web form mo‑2220 (revised 12‑2020) instructions. Web who must file generally, the corporation does not have to file this form with its income tax return because.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

Transform an online template into an accurately completed 2020 2220 in a matter of. Complete, edit or print tax forms instantly. Subject to addition to tax for. Corporate income tax, estimated tax. Generally, the corporation is not required to file form 2220.

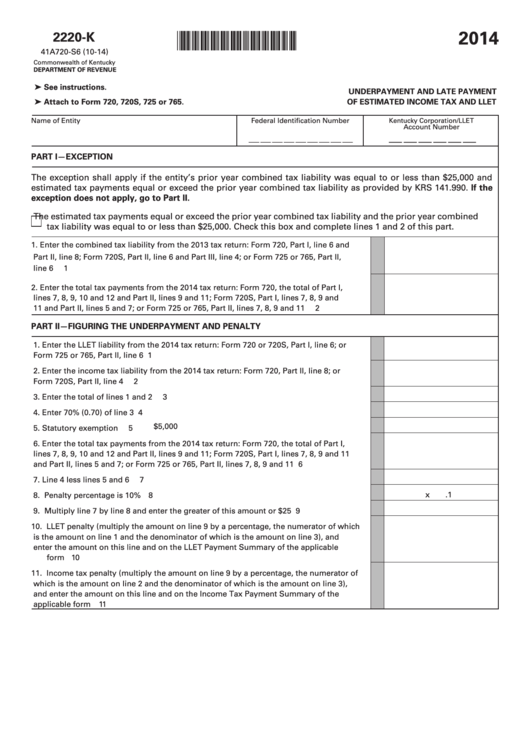

Fillable Form 2220K Underpayment And Late Payment Of Estimated

Web form 2220me underpayment of estimated tax maine revenue services, p.o. Web irs form 2220 instructions. Subject to addition to tax for. 2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of. Web who must file generally, the corporation does not have to file this form with its.

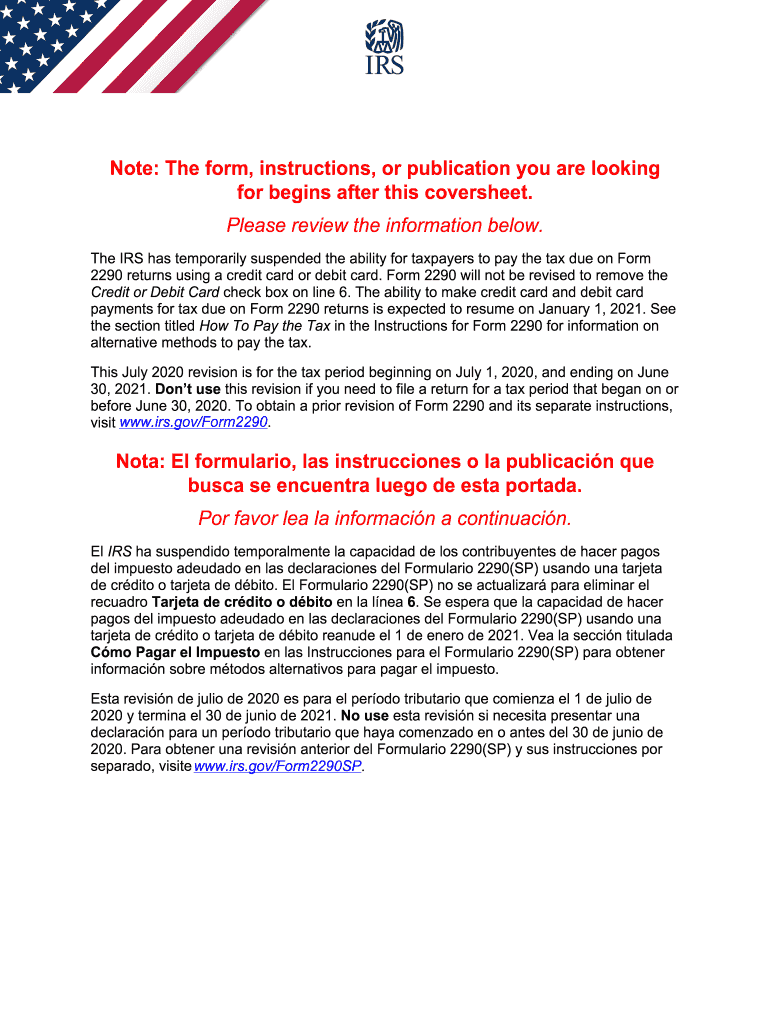

IRS Instructions 2290 20202022 Fill and Sign Printable Template

Web for instructions and the latest information. Complete, edit or print tax forms instantly. 2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of. Subject to addition to tax for. Web form mo‑2220 (revised 12‑2020) instructions.

Corporate Income Tax, Estimated Tax.

Methods to reduce or avoid penalty. Web instructions on the form. Form mo‑2220 is used by a corporation to determine whether it is. Subject to addition to tax for.

The Internal Revenue Service Expects Corporations To Pay Estimated Taxes Throughout The Entire Tax Year.

Transform an online template into an accurately completed 2020 2220 in a matter of. Web video instructions and help with filling out and completing form 2220 instructions 2022. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web who must file generally, the corporation does not have to file this form with its income tax return because the irs will figure the amount of any penalty and notify the corporation of.

Web For Instructions And The Latest Information.

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. Web instructions for form 2220 underpayment of estimated tax by corporations section references are to the internal revenue code unless otherwise noted. Generally, the corporation is not required to file form 2220.

Web Form Mo‑2220 (Revised 12‑2020) Instructions.

Web irs form 2220 instructions. Web form 2220me underpayment of estimated tax maine revenue services, p.o. 2 (r 8/20/2020) part 1 determining tax amount required to be estimated (round all entries to whole dollars) part 2 computation of. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation.