Form 2553 Fax Number

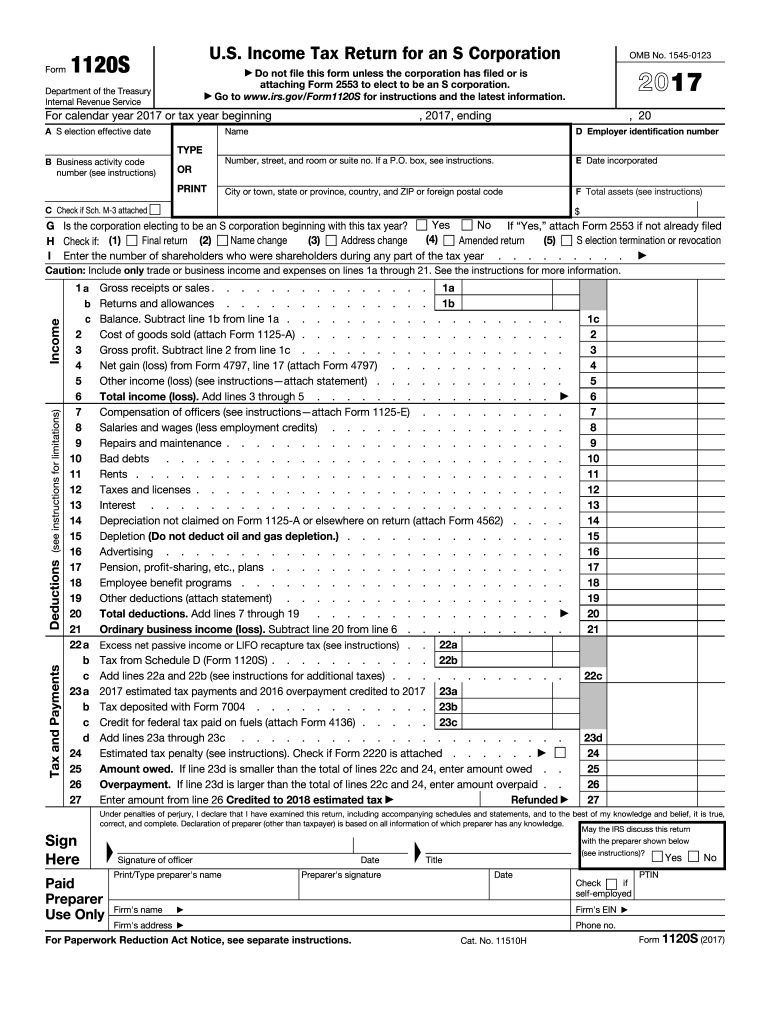

Form 2553 Fax Number - A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web department of the treasury you can fax this form to the irs. You can file the form either via fax or via mail. We have shared more information about s corp late election (below) that can help you apply for late election relief. Web use the following address or fax number: Let’s walk through filing form 2553 online with efax. Under item e, provide an effective date for an election, which is based on the date your corporation first had shareholders, assets, or began doing business. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Alternatively, the owners/shareholders of that business are taxed via their personal income tax return on the business’ profits and losses. Where to file the irs form 2553?

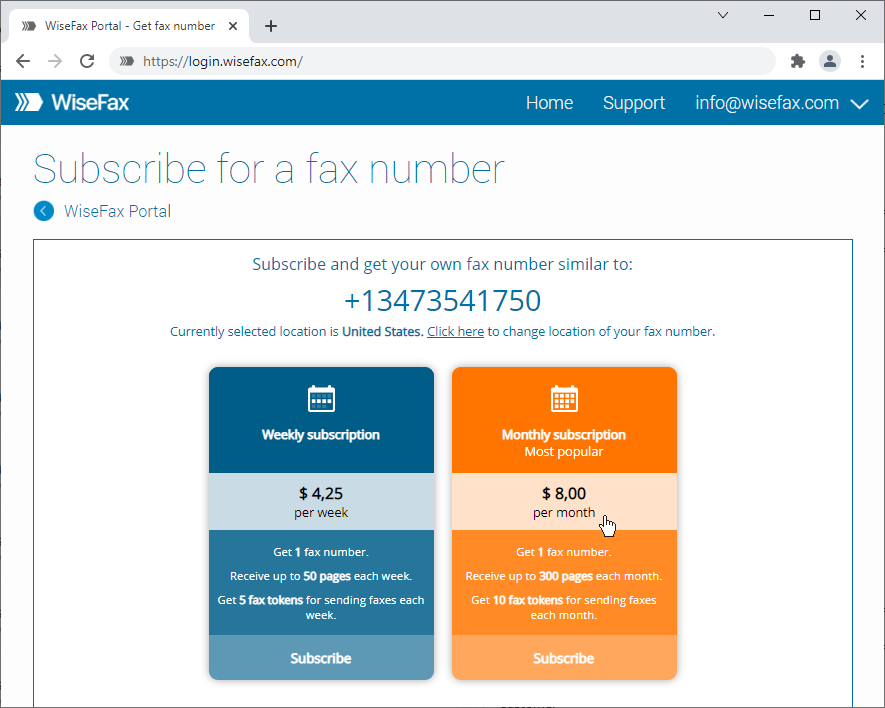

Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. If this form is not timely filed it can have serious tax consequences. You can file the form either via fax or via mail. Open the app and enter the fax number. Web use the following address or fax number: Web department of the treasury. Web fax form 2553 to irs from an online fax app. Web form 2553 fax number. Web department of the treasury you can fax this form to the irs. Where to file the irs form 2553?

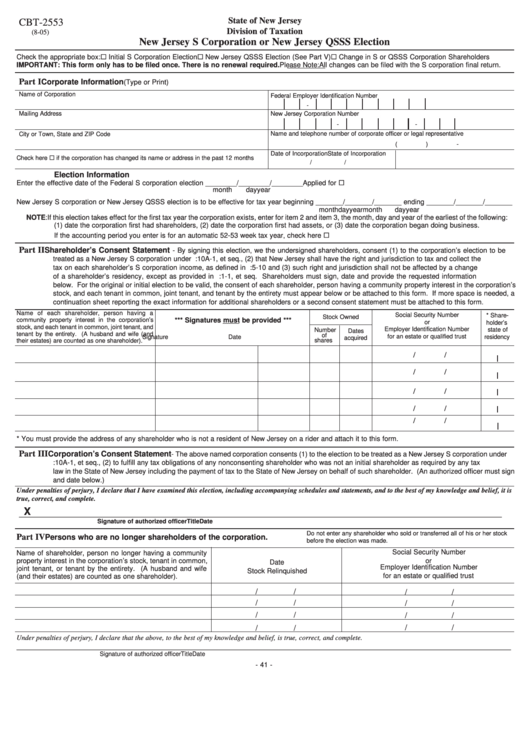

Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. We have shared more information about s corp late election (below) that can help you apply for late election relief. Download and install an online fax app on your device. If this form is not timely filed it can have serious tax consequences. Open the app and enter the fax number. Compose an email with the appropriate fax number A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web this form (2553) can be mailed via certified mail or faxed to the irs. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Web department of the treasury you can fax this form to the irs.

Fax Without a Fax Machine Receive Fax on WiseFax Fax Number

Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas, utah, washington, wyoming. How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Download and install an online fax app on your device..

Fillable Form Cbt2553 New Jersey S Corporation Or New Jersey Qsss

Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. You can.

Steps for Electing Sub S Status for Washington LLC or Corp Evergreen

Compose an email with the appropriate fax number Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. Web form 2553 fax number. Web this form (2553) can be mailed via certified mail or faxed to the irs. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by.

1120S Fill Out and Sign Printable PDF Template signNow

Web use the following address or fax number: Download and install an online fax app on your device. Web department of the treasury you can fax this form to the irs. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Open the app and enter the.

What is IRS Form 2553? Bench Accounting

Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. You can file the form either via fax or via mail. Under item e, provide an effective date for an election, which is based on the date your corporation first had shareholders, assets, or began doing business. How to fax.

Ssurvivor Form 2553 Irs Fax Number

Alternatively, the owners/shareholders of that business are taxed via their personal income tax return on the business’ profits and losses. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin: Open the app and enter the fax.

How to Get Fax Number From Computer or Email

Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Let’s.

Form 2553 Instructions How and Where to File mojafarma

How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas, utah, washington, wyoming. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine,.

Ssurvivor Form 2553 Irs Phone Number

If this form is not timely filed it can have serious tax consequences. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. Alternatively, the owners/shareholders of that business are taxed via their personal income tax return on the business’ profits and losses. We have shared more information about s corp late election (below) that can help you.

IRS Form 2553 Instructions How and Where to File This Tax Form

Web department of the treasury you can fax this form to the irs. Open the app and enter the fax number. We have shared more information about s corp late election (below) that can help you apply for late election relief. Where to file the irs form 2553? Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information.

Let’s Walk Through Filing Form 2553 Online With Efax.

Web fax form 2553 to irs from an online fax app. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web department of the treasury you can fax this form to the irs. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota, texas, utah, washington, wyoming.

Download And Install An Online Fax App On Your Device.

Internal revenue service go to www.irs.gov/form2553 for instructions and the latest information. How to fax form 2553 online with efax you can achieve s corp status without leaving your home or office. You can file the form either via fax or via mail. Web form 2553 fax number.

If This Form Is Not Timely Filed It Can Have Serious Tax Consequences.

Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. We have shared more information about s corp late election (below) that can help you apply for late election relief. Web this form (2553) can be mailed via certified mail or faxed to the irs.

A Corporation Or Other Entity Eligible To Be Treated As A Corporation Files This Form To Make An Election Under Section 1362(A) To.

Where to file the irs form 2553? Compose an email with the appropriate fax number Alternatively, the owners/shareholders of that business are taxed via their personal income tax return on the business’ profits and losses. Open the app and enter the fax number.