Form 2555 Ez 2021

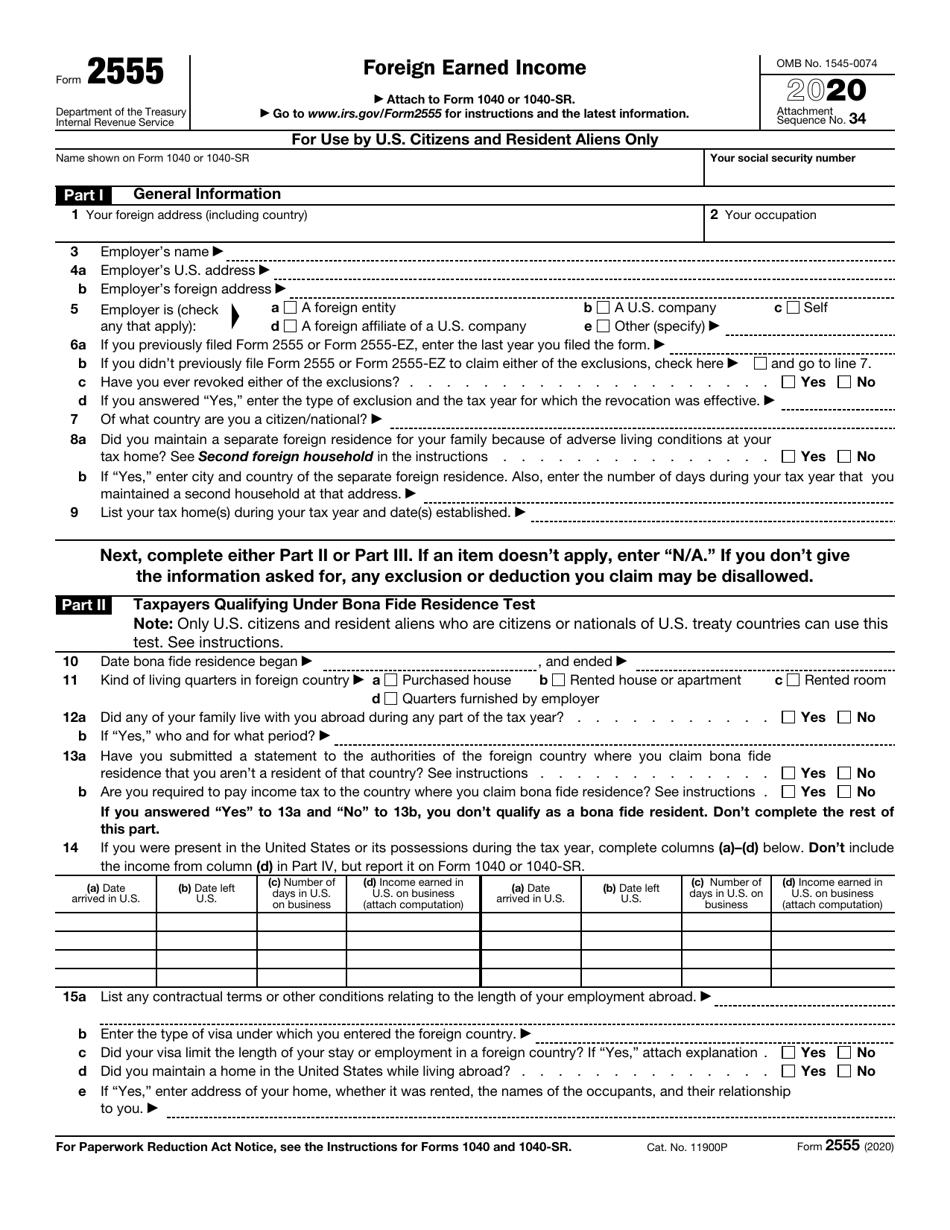

Form 2555 Ez 2021 - The form must be attached to a timely filed. Upload, modify or create forms. Web about form 2555, foreign earned income. Ad signnow allows users to edit, sign, fill and share all type of documents online. The housing deduction is not being. Fill all required lines in your document making use of our powerful pdf. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Go to www.irs.gov/form2555 for instructions and the. It is used to claim the foreign earned income exclusion and/or.

Enter the amount from your (and your spouse's, if filing jointly). Click on the button get form to open it and start editing. Web 235 rows purpose of form. The exclusion is an election. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. Get ready for this year's tax season quickly and safely with pdffiller! Citizen or a resident alien. Web about form 2555, foreign earned income. Ad access irs tax forms. Web if form 1040, line 10, is zero, don’t complete this worksheet.

Try it for free now! This form is for income earned in tax year 2022, with tax returns due. It is used to claim the foreign earned income exclusion and/or. Click on the button get form to open it and start editing. Get ready for this year's tax season quickly and safely with pdffiller! Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Enter the amount from your (and your spouse's, if filing jointly). Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign. The exclusion is an election.

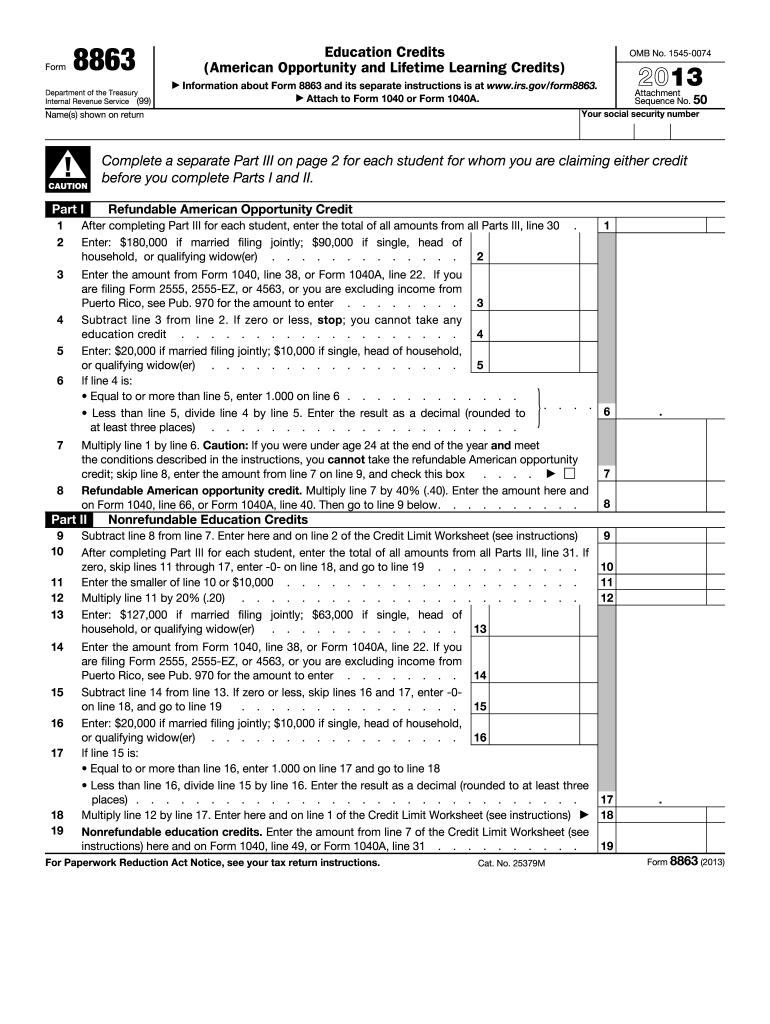

Form 8863 Fill Out and Sign Printable PDF Template signNow

Get ready for this year's tax season quickly and safely with pdffiller! Ad signnow allows users to edit, sign, fill and share all type of documents online. Web 235 rows purpose of form. Fill all required lines in your document making use of our powerful pdf. Earned wages/salaries in a foreign country.

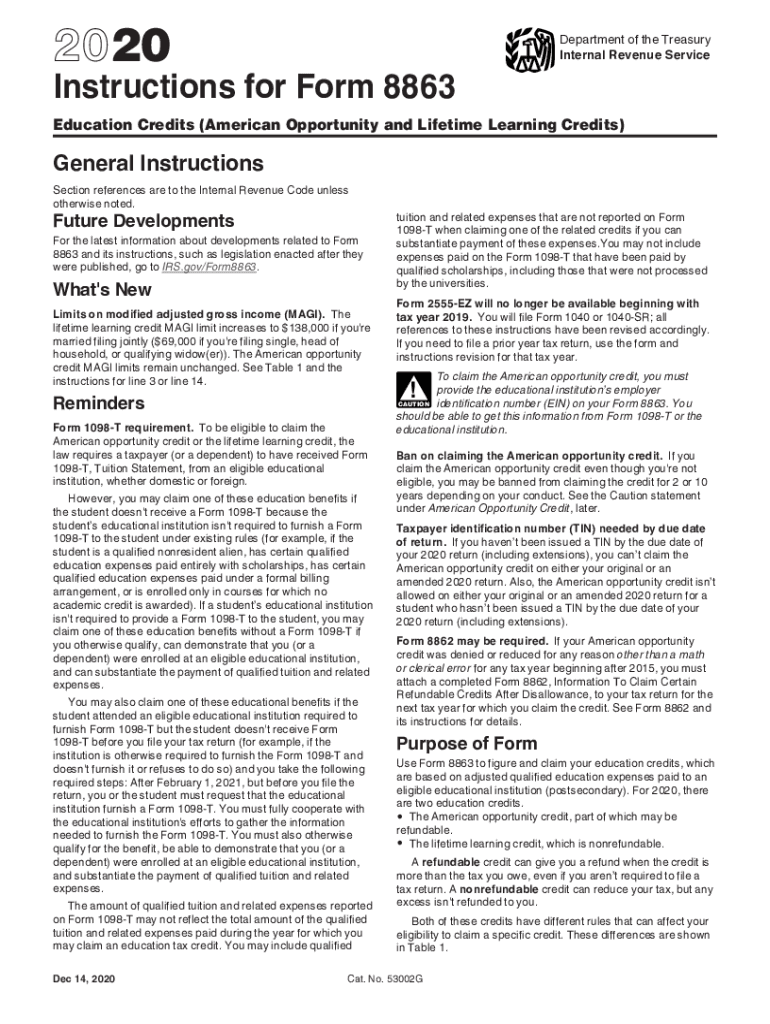

IRS Instruction 8863 20202022 Fill out Tax Template Online US

Create legally binding electronic signatures on any device. Only form 2555 will be produced in future qualifying returns. Enter the amount from form 1040, line 10.1. Click on the button get form to open it and start editing. Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is.

Irs Fillable Form 1040 / 1040 2020 Internal Revenue Service Robert

Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Ad access irs tax forms. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Complete, edit or print tax forms instantly. Enter the amount from your (and your.

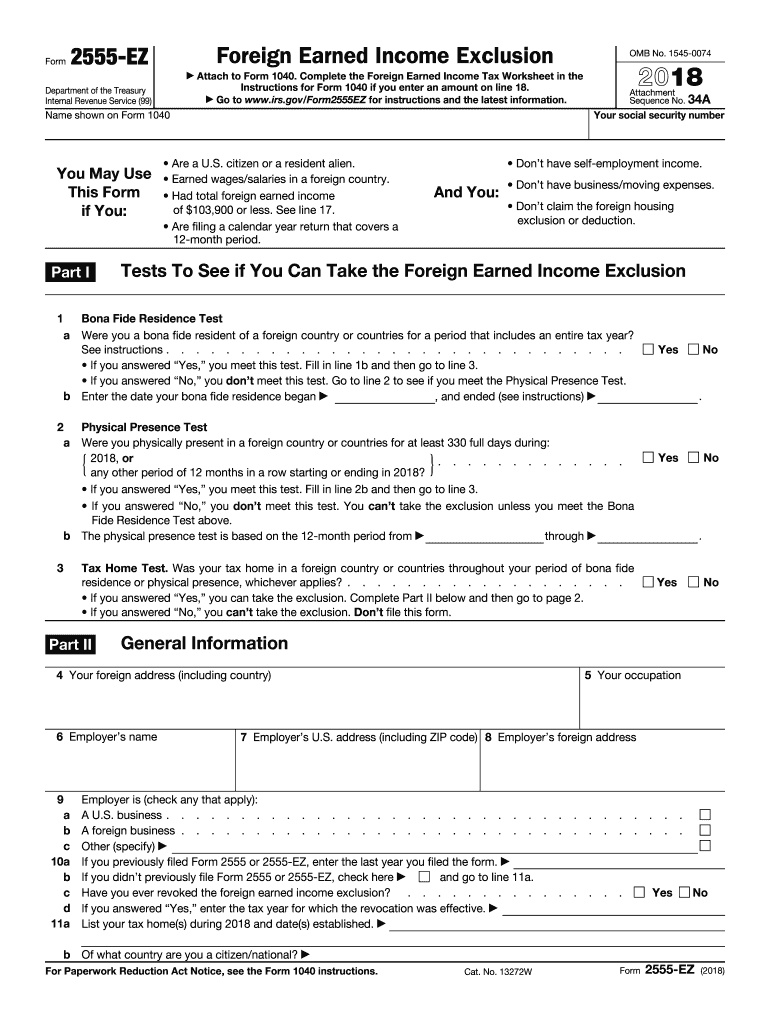

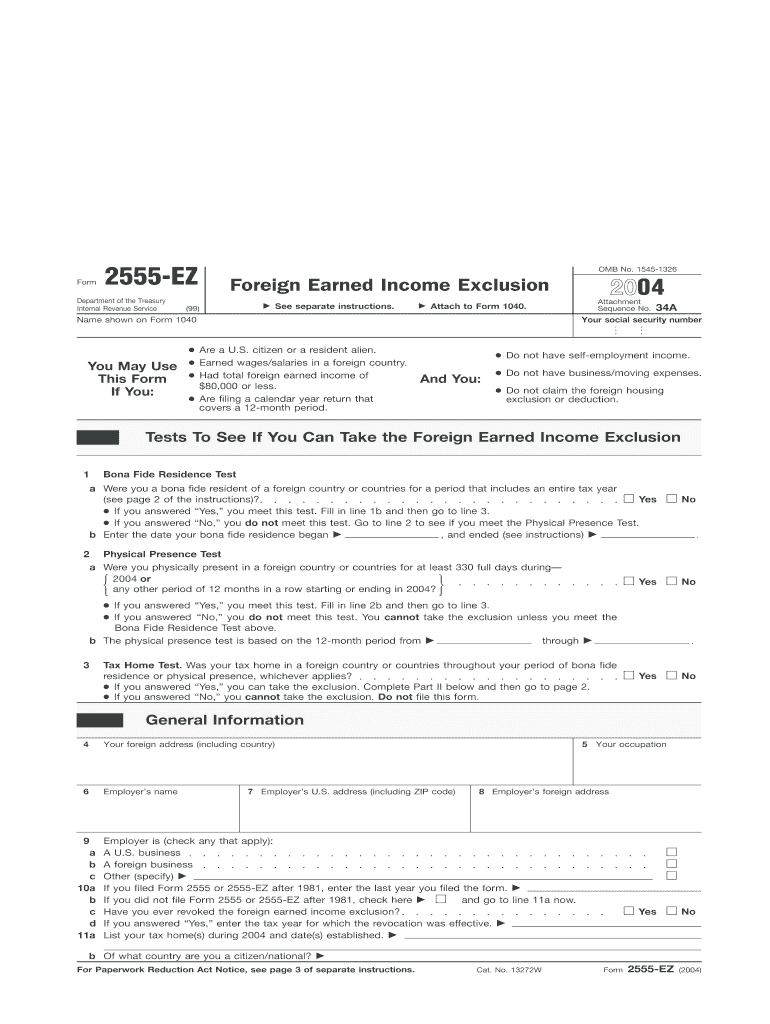

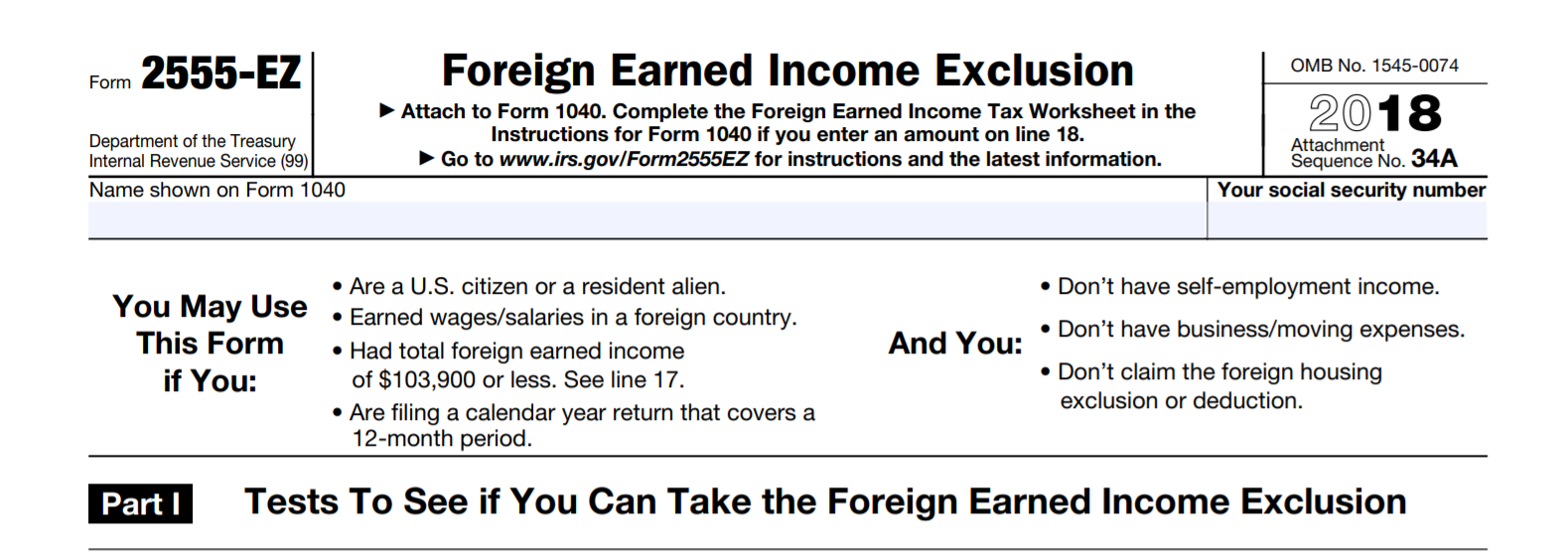

Ssurvivor Form 2555 Ez Instructions 2018

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Try it for free now! Irs tax forms and instructions do i have to file a us tax return irs form 2555 what is. It is used to claim the foreign earned income exclusion and/or. Only form 2555.

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

Fill all required lines in your document making use of our powerful pdf. The form must be attached to a timely filed. Web if form 1040, line 10, is zero, don’t complete this worksheet. Get ready for this year's tax season quickly and safely with pdffiller! Only form 2555 will be produced in future qualifying returns.

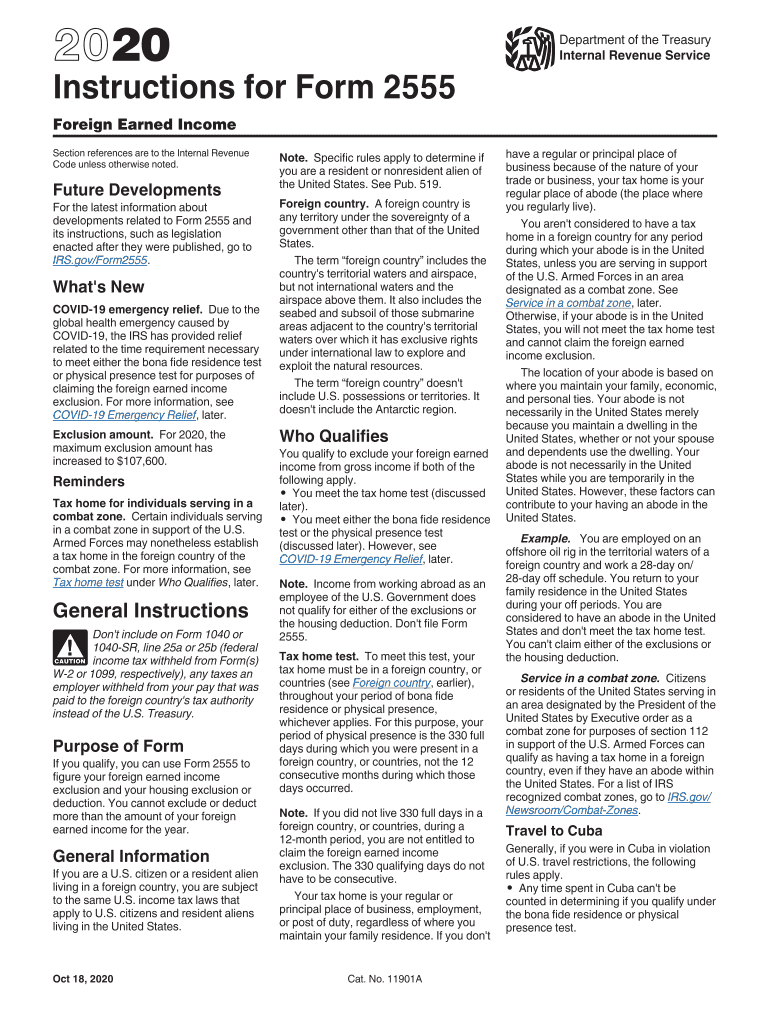

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Complete, edit or print tax forms instantly. Go to www.irs.gov/form2555 for instructions and the. Web 235 rows purpose of form. Ad access irs tax forms. Upload, modify or create forms.

PDF Télécharger tax form f2555ez Gratuit PDF

The form must be attached to a timely filed. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign. Enter the amount from your (and your spouse's, if filing jointly). Form 2555 (foreign earned.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

Web 235 rows purpose of form. Try it for free now! Enter the amount from your (and your spouse's, if filing jointly). Web if form 1040, line 10, is zero, don’t complete this worksheet. Ad access irs tax forms.

Instructions for IRS Form 2555EZ Foreign Earned Exclusion

The housing deduction is not being. Enter the amount from form 1040, line 10.1. Complete, edit or print tax forms instantly. Ad access irs tax forms. Ad signnow allows users to edit, sign, fill and share all type of documents online.

Form 2555 EZ SDG Accountant

The housing deduction is not being. Earned wages/salaries in a foreign country. Fill all required lines in your document making use of our powerful pdf. Enter the amount from your (and your spouse's, if filing jointly). Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states.

Complete, Edit Or Print Tax Forms Instantly.

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Try it for free now! If you qualify, you can use form 2555 to figure your foreign. Upload, modify or create forms.

If You Qualify, You Can Use Form 2555 To Figure Your Foreign Earned Income Exclusion And Your Housing Exclusion Or.

Go to www.irs.gov/form2555 for instructions and the. Ad signnow allows users to edit, sign, fill and share all type of documents online. Get ready for this year's tax season quickly and safely with pdffiller! Ad access irs tax forms.

Enter The Amount From Your (And Your Spouse's, If Filing Jointly).

Web 235 rows purpose of form. Complete, edit or print tax forms instantly. Enter the amount from form 1040, line 10.1. Earned wages/salaries in a foreign country.

Fill All Required Lines In Your Document Making Use Of Our Powerful Pdf.

Try it for free now! The housing deduction is not being. The form must be attached to a timely filed. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in the foreign.