Form 2555 Instructions 2022

Form 2555 Instructions 2022 - You cannot exclude or deduct more than the. Web form 2555 department of the treasury internal revenue service. Web form 2555 instructions: Web solved•by intuit•3•updated august 25, 2022. Follow these steps to enter foreign wages on form 2555: Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. Enter form 2555 allocation information in the appropriate screen. Web here’s how to file form 2555 in three steps: For 2021, the maximum exclusion amount has increased to $108,700. You must have been physically present in a foreign country for at least 330 days in a 12.

Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. For paperwork reduction act notice, see the form 1040 instructions. Web form 2555 department of the treasury internal revenue service. Enter the feie as a negative amount on form 1040,. You cannot exclude or deduct more than the. Web enter the lesser of line 40 or line 41 on line 42, and you will have your final foreign earned income exclusion for the year. Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Web we estimate that it will take approximately 2.5 hours to prepare an application, including time to review instructions, gather and maintain data, and. Filing taxes can be daunting, especially if you’re an american living and working abroad. For 2021, the maximum exclusion amount has increased to $108,700.

In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Go to www.irs.gov/form2555 for instructions and the. You cannot exclude or deduct more than the. Web solved•by intuit•3•updated august 25, 2022. Web for 2022 and tax year 2021 i did return to good old paper for filing the foreign income exclusion as our situation was a little less straightforward to do online since we. Follow these steps to enter foreign wages on form 2555: Web 2022 11/01/2022 inst 2555: Instructions for form 2555, foreign earned income 2022 11/01/2022 « previous | 1 | next » get adobe ® reader. Web here’s how to file form 2555 in three steps: You must have been physically present in a foreign country for at least 330 days in a 12.

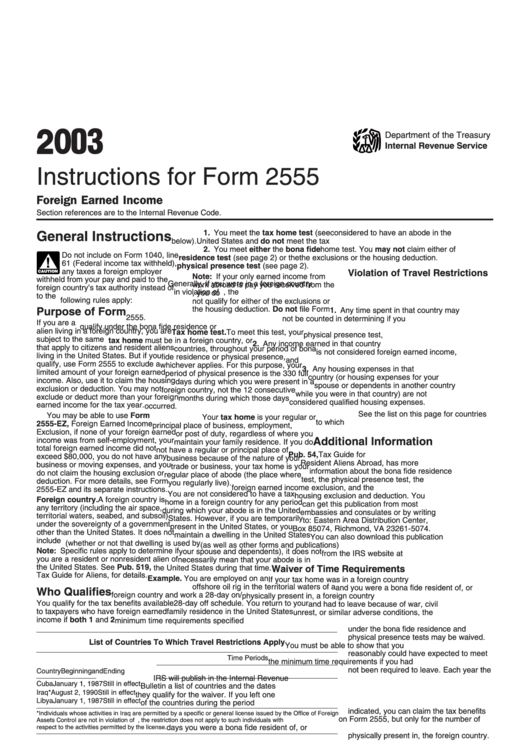

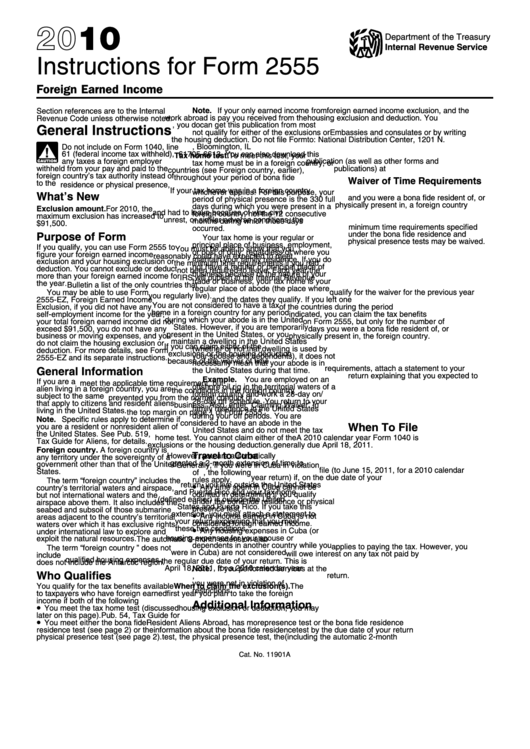

Instructions for IRS Form 2555 Foreign Earned Download

Go to www.irs.gov/form2555 for instructions and the. Filing taxes can be daunting, especially if you’re an american living and working abroad. Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in. Instructions for form 2555, foreign.

Tax Filing Guide for American Expats Abroad Foreigners in

Go to www.irs.gov/form2555 for instructions and the. Filing taxes can be daunting, especially if you’re an american living and working abroad. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Qualify for the foreign earned income exclusion (feie) as mentioned above, you have two options to qualify..

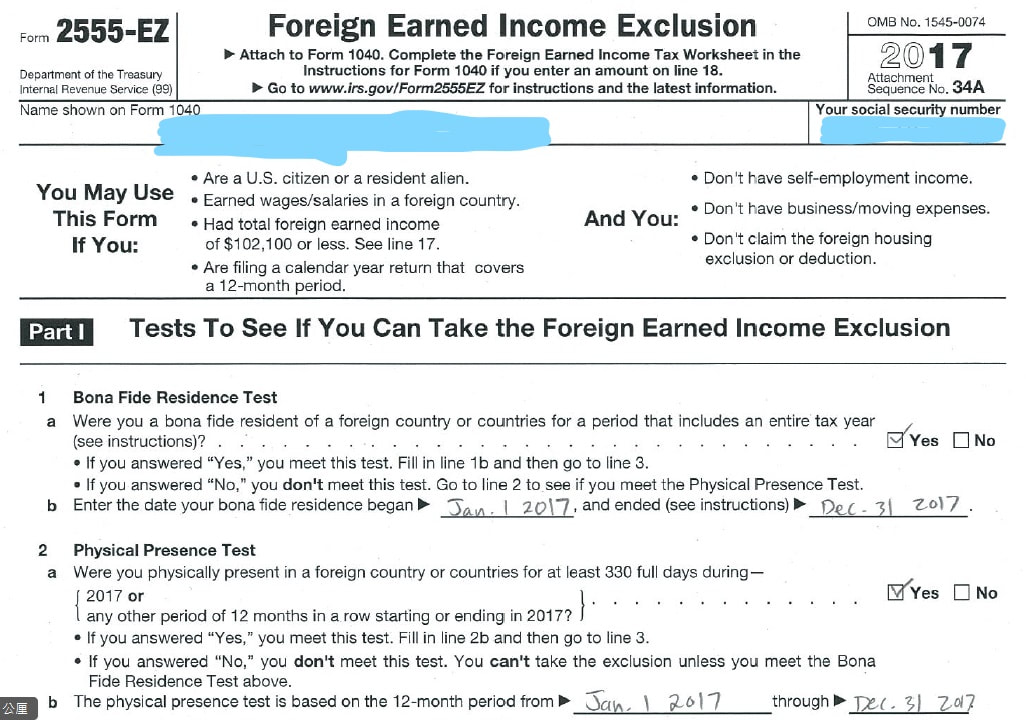

Ssurvivor Form 2555 Ez Instructions 2019

Go to www.irs.gov/form2555 for instructions and the. Refer to here for instructions on entering form 2555 general info. Web for 2022 and tax year 2021 i did return to good old paper for filing the foreign income exclusion as our situation was a little less straightforward to do online since we. Enter form 2555 allocation information in the appropriate screen..

Ssurvivor Form 2555 Ez Instructions 2019

Filing taxes can be daunting, especially if you’re an american living and working abroad. Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Web 2022 11/01/2022 inst 2555: Enter form 2555 allocation information in the appropriate screen. If you qualify, you can use.

Ssurvivor Form 2555 Instructions 2018 Pdf

Filing taxes can be daunting, especially if you’re an american living and working abroad. Web for 2022 and tax year 2021 i did return to good old paper for filing the foreign income exclusion as our situation was a little less straightforward to do online since we. Web we estimate that it will take approximately 2.5 hours to prepare an.

Business Tax Declaration Form In Ethiopia Paul Johnson's Templates

For paperwork reduction act notice, see the form 1040 instructions. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Web we estimate that it will take approximately 2.5 hours to prepare an application, including time to review instructions, gather.

Instructions For Form 2555 Foreign Earned Internal Revenue

If you qualify, you can use form. Web here’s how to file form 2555 in three steps: Go to www.irs.gov/form2555 for instructions and the. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Enter the feie as a negative amount on form 1040,.

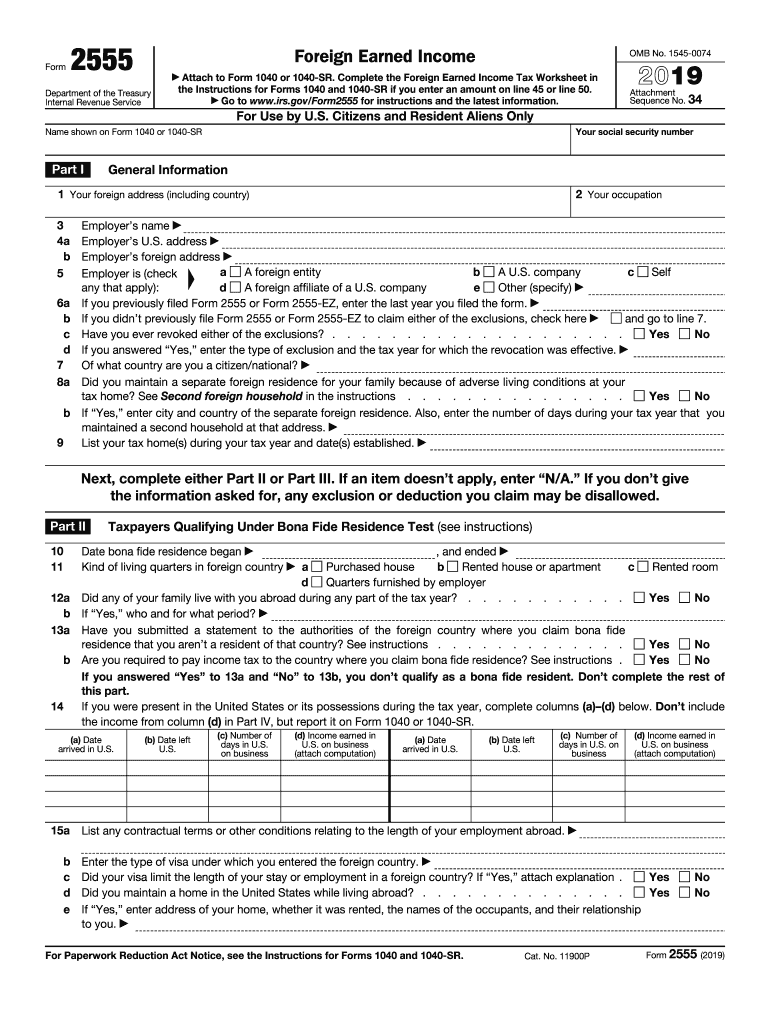

2019 Form 2555 Fill Out and Sign Printable PDF Template signNow

For 2021, the maximum exclusion amount has increased to $108,700. Refer to here for instructions on entering form 2555 general info. For paperwork reduction act notice, see the form 1040 instructions. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported.

Ssurvivor Form 2555 Instructions 2019

Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Web here’s how to.

Instructions For Form 2555 Foreign Earned Internal Revenue

Web to be eligible for this exclusion, a citizen of the united states or a resident alien must have a tax home in a foreign country and they must receive income for working in. Web solved•by intuit•3•updated august 25, 2022. You must have been physically present in a foreign country for at least 330 days in a 12. Qualify for.

Web Form 2555 Instructions:

In the blank space next to line 8, enter “form 2555.” on schedule 1 (form 1040), subtract this amount from your additional income to arrive at the amount reported on. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You cannot exclude or deduct more than the. Follow these steps to enter foreign wages on form 2555:

Refer To Here For Instructions On Entering Form 2555 General Info.

Enter form 2555 allocation information in the appropriate screen. You must have been physically present in a foreign country for at least 330 days in a 12. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web form 2555 department of the treasury internal revenue service.

Go To Www.irs.gov/Form2555 For Instructions And The.

Web future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to. Qualify for the foreign earned income exclusion (feie) as mentioned above, you have two options to qualify. Reminders tax home for individuals serving in a. Web here’s how to file form 2555 in three steps:

For 2021, The Maximum Exclusion Amount Has Increased To $108,700.

Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. For paperwork reduction act notice, see the form 1040 instructions. Web we estimate that it will take approximately 2.5 hours to prepare an application, including time to review instructions, gather and maintain data, and. Web enter the lesser of line 40 or line 41 on line 42, and you will have your final foreign earned income exclusion for the year.