Form 3520 Example

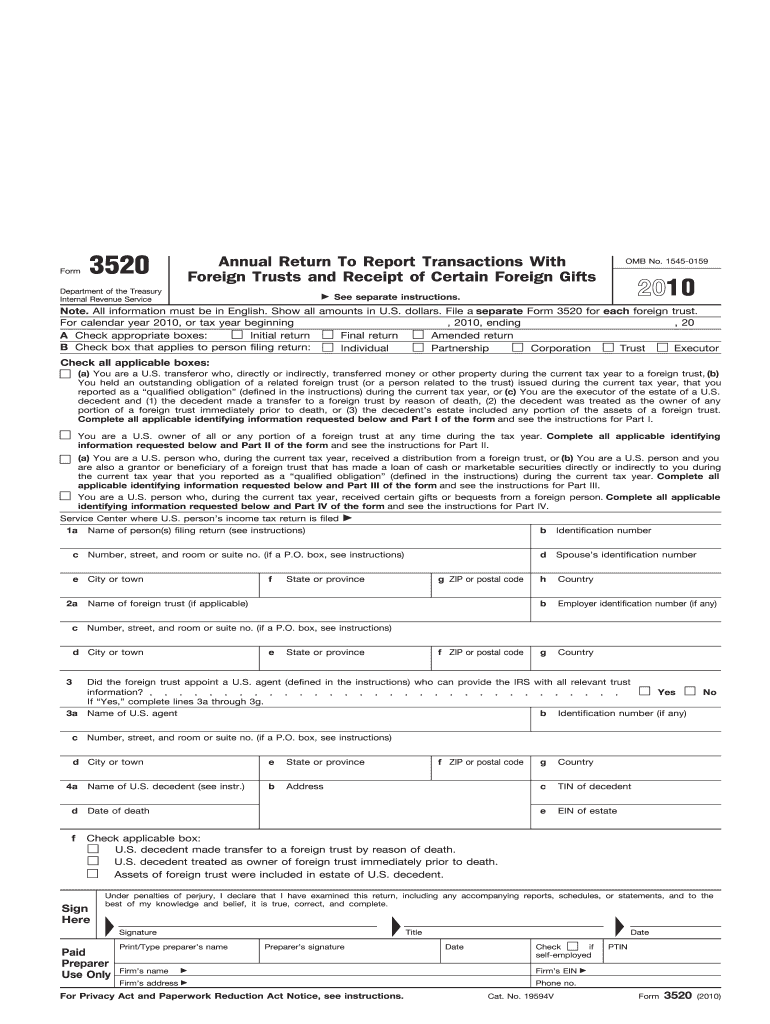

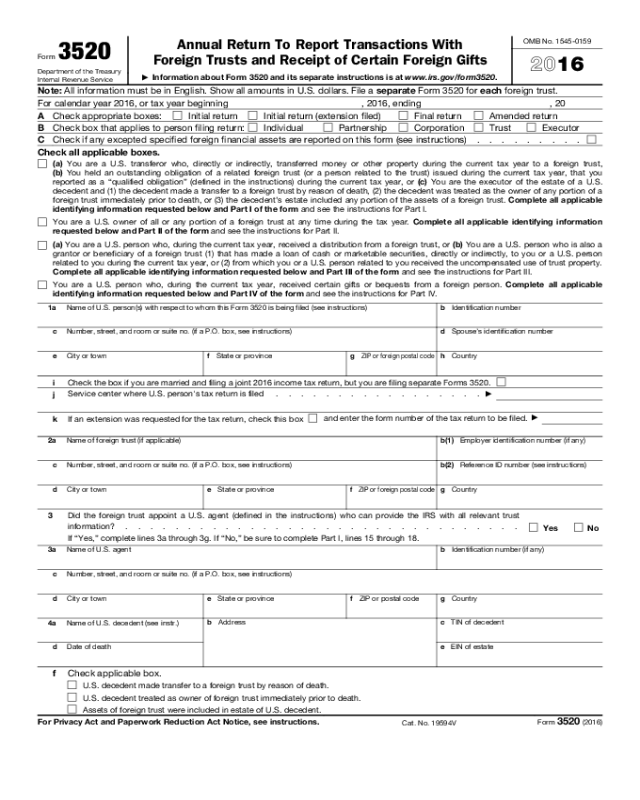

Form 3520 Example - Assume that john has an income tax filing requirement and a form 3520 filing requirement. About our international tax law firm form 3520 the irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section 6039f is a deceptive international information reporting form. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: File a separate form 3520 for each foreign trust. Persons (and executors of estates of u.s. Current revision form 3520 pdf Form 3520 is due the fourth month following the end of the person's tax year, typically april 15. Taxpayer transactions with a foreign trust. You receive direct or indirect distributions from a foreign trust. Citizen residing outside the united states.

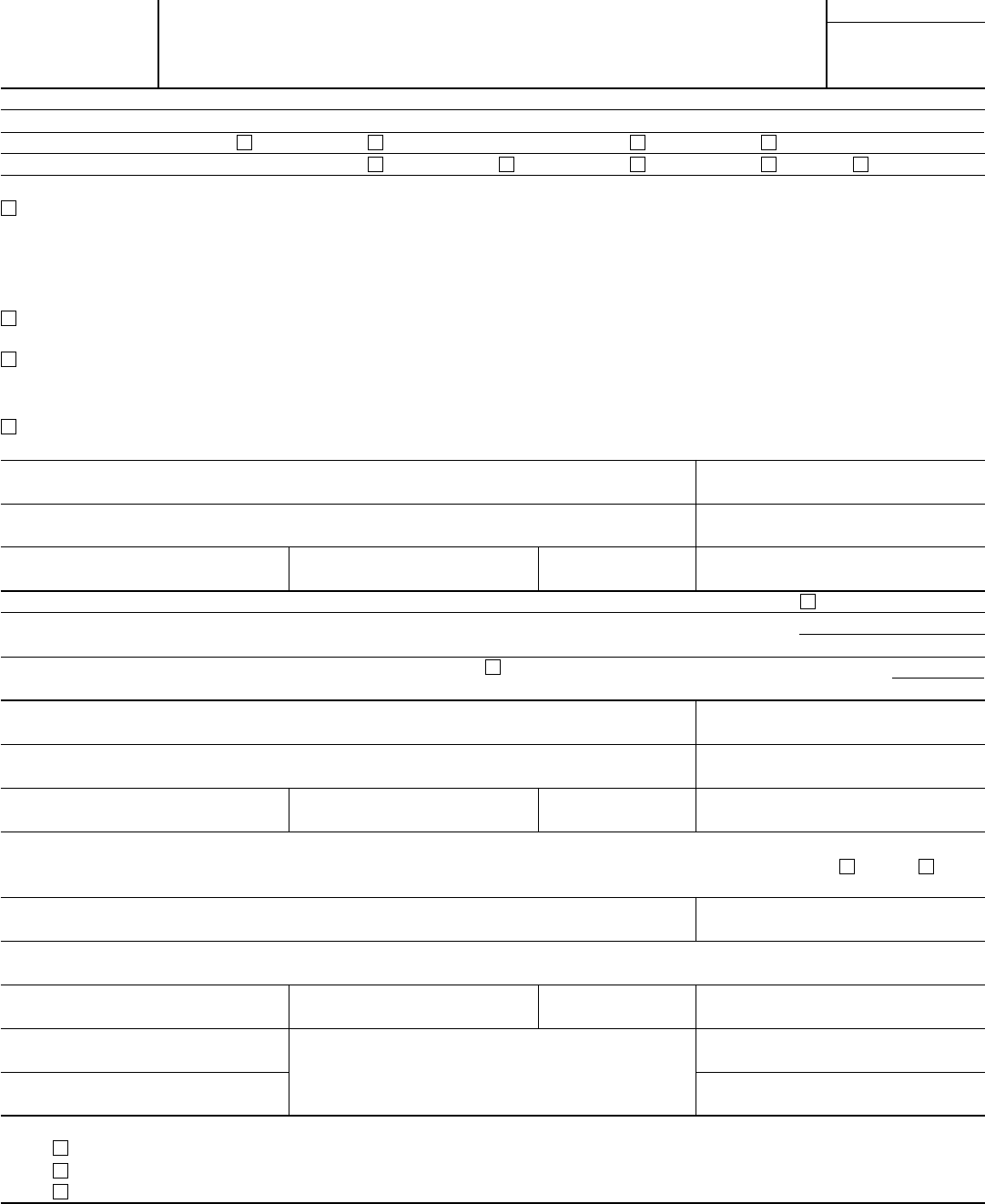

For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Certain transactions with foreign trusts. Alex, a us citizen, lives in kansas with his parents. Decedents) file form 3520 to report: Receipt of certain large gifts or bequests from certain foreign persons. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. File a separate form 3520 for each foreign trust. Show all amounts in u.s. If you filed form 3520 concerning transactions with a foreign trust and that trust terminated within the tax year, then the form 3520 for the year in which the trust terminated would be a final return. About our international tax law firm form 3520 the irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section 6039f is a deceptive international information reporting form.

Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. David is from taiwan and now resides in the u.s. His grandfather has a foreign grantor trust, and the trustee accordingly sends alex $15,000 from the trust. Assume that john has an income tax filing requirement and a form 3520 filing requirement. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: Transferor does not immediately recognize all of the gain on the property transferred, transfers involving a. Citizen residing outside the united states. Decedents) file form 3520 to report: For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: If you transfer any assets (money and property, for example) to a foreign trust.

Form 3520 Blank Sample to Fill out Online in PDF

Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Certain transactions with foreign trusts. All information must be in english. Decedents) file form 3520 to report:

2010 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Citizen residing outside the united states. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Show all amounts in u.s. All information must be in english.

3.21.19 Foreign Trust System Internal Revenue Service

Alex, a us citizen, lives in kansas with his parents. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Receipt of certain large gifts or bequests from certain foreign persons. Web form 3520 example #1. David is from taiwan and now resides in the u.s.

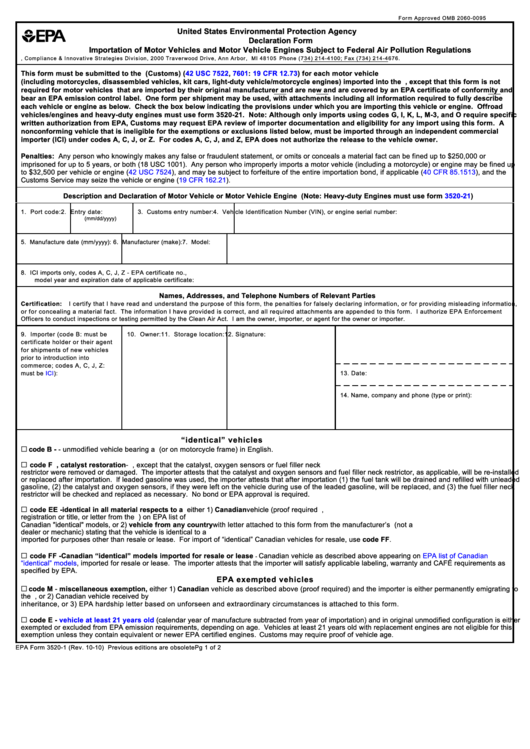

24 United States Environmental Protection Agency Forms And Templates

Receipt of certain large gifts or bequests from certain foreign persons. Transferor does not immediately recognize all of the gain on the property transferred, transfers involving a. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: Citizen residing outside the united states. Decedents) file form 3520 to report:

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Receipt of certain large gifts or bequests from certain foreign persons. If you filed form 3520 concerning transactions with a foreign trust and that trust terminated within the tax year, then the form 3520 for the year in which the trust terminated would be a final return. You receive direct or indirect distributions from a foreign trust. Transferor does not.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Taxpayer transactions with a foreign trust. Show all amounts in u.s. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: Alex, a us citizen, lives in kansas with his parents. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report transactions.

Understanding Form 3520 for Foreign Trusts and Gifts & Penalties YouTube

Persons (and executors of estates of u.s. All information must be in english. Web however, some fmv transfers must nevertheless be reported on form 3520 (for example, transfers in exchange for obligations that are treated as qualified obligations, transfers of appreciated property to a foreign trust for which the u.s. Web specifically, the receipt of a foreign gift of over.

IRS Form 3520Reporting Transactions With Foreign Trusts

Web form 3520 for u.s. Decedents) file form 3520 to report: Assume that john has an income tax filing requirement and a form 3520 filing requirement. Certain transactions with foreign trusts. He timely filed form 4868 to request an extension to file his income tax return to october 15.

Steuererklärung dienstreisen Form 3520

Certain transactions with foreign trusts. His grandfather (not a us citizen or resident) lives in spain and wants to give alex $15,000. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: Alex, a us citizen, lives in kansas with his parents. Decedents) file form 3520 to report:

3.21.19 Foreign Trust System Internal Revenue Service

Alex, a us citizen, lives in kansas with his parents. Foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Form 3520 is due the fourth month following the.

Web Form 3520 Example #1.

David is from taiwan and now resides in the u.s. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Show all amounts in u.s. Citizen residing outside the united states.

Initial Return Final Returnamended Return B Check Box That Applies To Person Filing Return:

He timely filed form 4868 to request an extension to file his income tax return to october 15. Foreign person gift of more than $100,000 (common form 3520 example) a gift from a foreign person is by far the most common form 3520 situation. You receive direct or indirect distributions from a foreign trust. His grandfather has a foreign grantor trust, and the trustee accordingly sends alex $15,000 from the trust.

About Our International Tax Law Firm Form 3520 The Irs Form Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts In Accordance With Internal Revenue Code Section 6039F Is A Deceptive International Information Reporting Form.

There are three main types of transactions with a foreign trust you need to report on: Assume that john has an income tax filing requirement and a form 3520 filing requirement. Taxpayer transactions with a foreign trust. Receipt of certain large gifts or bequests from certain foreign persons.

Transferor Does Not Immediately Recognize All Of The Gain On The Property Transferred, Transfers Involving A.

Web 8 golding & golding: Form 3520 is due the fourth month following the end of the person's tax year, typically april 15. File a separate form 3520 for each foreign trust. Here are some common form 3520 examples of individuals with a form 3520 reporting requirement: