Form 3520 Late Filing Penalty

Form 3520 Late Filing Penalty - Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. The maximum penalty is 25% of the amount of the gift. Form 3520 is due at the time of a. Taxpayers should work with their counsel to assess the different strategies and how to proceed on. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. The maximum penalty is 25% of the amount of the gift. Web penalties may be assessed in accordance with existing procedures. Web the form 3520 penalty may be abated (removed) based on the letter alone. Web to the extent a taxpayer fails to file a form 3520 where the taxpayer is otherwise required to do so, the taxpayer may receive cp15. When this type of abatement occurs, a 21c letter is issued.

Taxpayers should work with their counsel to assess the different strategies and how to proceed on. Web if you file form 3520 late, or if the information provided is incomplete or incorrect, the irs may determine the income tax consequences of the receipt of such foreign gift or bequest and you may be subject to penalties under section 6039f(c) if. Web to the extent a taxpayer fails to file a form 3520 where the taxpayer is otherwise required to do so, the taxpayer may receive cp15. When this type of abatement occurs, a 21c letter is issued. The maximum penalty is 25% of the amount of the gift. 35% of distributions received from a foreign trust (form 3520); Web a penalty applies if form 3520 is not timely filed or if the information is incomplete or incorrect (see below for an exception if there is reasonable cause). If the due date for filing the tax return is extended, the due date Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable).

Taxpayers should work with their counsel to assess the different strategies and how to proceed on. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Generally, the cp15 states that the taxpayer may submit a reasonable cause statement contesting. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. 35% of distributions received from a foreign trust (form 3520); Web the form 3520 penalty may be abated (removed) based on the letter alone. Web penalties may be assessed in accordance with existing procedures. 35% of contributions to a foreign trust (form 3520); Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report, among other things, transactions with foreign trusts — and limited the penalty to a.

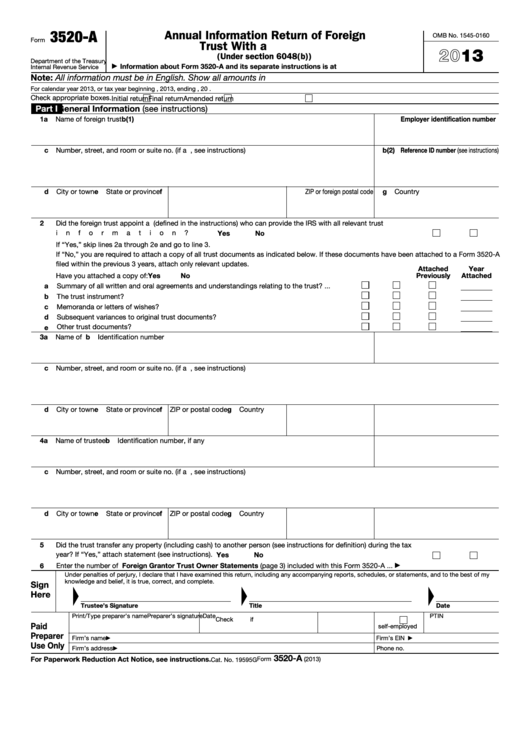

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Web to the extent a taxpayer fails to file a form 3520 where the taxpayer is otherwise required to do so, the taxpayer may receive cp15. Form 3520 is due at the time.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Taxpayers should work with their counsel to assess the different strategies and how to proceed on. The maximum penalty is 25% of the amount of the gift. Generally,.

Relief from Filing Forms 3520 and Form 3520A for Some SF Tax Counsel

Generally, the cp15 states that the taxpayer may submit a reasonable cause statement contesting. Web a penalty applies if form 3520 is not timely filed or if the information is incomplete or incorrect (see below for an exception if there is reasonable cause). Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable). Web.

A District Court Determines that a Sole Beneficiary of a Foreign Trust

Web if you file form 3520 late, or if the information provided is incomplete or incorrect, the irs may determine the income tax consequences of the receipt of such foreign gift or bequest and you may be subject to penalties under section 6039f(c) if. Web the penalty for filing a delinquent form 3520 is 5% of the value of the.

Are Distributions From Foreign Trust Reportable on Tax Return?

Web the form 3520 penalty may be abated (removed) based on the letter alone. The maximum penalty is 25% of the amount of the gift. 35% of contributions to a foreign trust (form 3520); Form 3520 is due at the time of a. Generally, the cp15 states that the taxpayer may submit a reasonable cause statement contesting.

Form 3520 Blank Sample to Fill out Online in PDF

35% of distributions received from a foreign trust (form 3520); Form 3520 is due at the time of a timely filing of the u.s. When this type of abatement occurs, a 21c letter is issued. 35% of contributions to a foreign trust (form 3520); Web if you file form 3520 late, or if the information provided is incomplete or incorrect,.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

35% of contributions to a foreign trust (form 3520); Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report, among other things, transactions with foreign trusts — and limited the penalty to a. Web the penalty for filing a delinquent.

The Tax Times IRS Sending SemiAutomated Penalties For Late Filed Form

If the due date for filing the tax return is extended, the due date Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable). Web if you file form 3520 late, or if the information provided is incomplete or incorrect, the irs may determine the income tax consequences of the receipt of such foreign.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Web the form 3520 penalty may be abated (removed) based on the letter alone. 35% of distributions received from a foreign trust (form 3520); The maximum penalty is 25% of the amount of the gift. When this type of abatement occurs, a 21c letter is issued. Generally, the cp15 states that the taxpayer may submit a reasonable cause statement contesting.

Has the IRS Assessed You a Penalty for a Late Filed Form 3520A? You

Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable). Form 3520 is due at the time of a timely filing of the u.s. If the due date for filing the tax return is extended, the due date Web the federal district court struck down the irs's imposition of a 35% civil penalty for.

When This Type Of Abatement Occurs, A 21C Letter Is Issued.

Taxpayers should work with their counsel to assess the different strategies and how to proceed on. Web to the extent a taxpayer fails to file a form 3520 where the taxpayer is otherwise required to do so, the taxpayer may receive cp15. Form 3520 is due at the time of a timely filing of the u.s. Web if you file form 3520 late, or if the information provided is incomplete or incorrect, the irs may determine the income tax consequences of the receipt of such foreign gift or bequest and you may be subject to penalties under section 6039f(c) if.

Web In Particular, Late Filers Of Form 3520, “Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts,” Have Found It Challenging To Persuade The Irs To Even.

Web the form 3520 penalty may be abated (removed) based on the letter alone. 35% of distributions received from a foreign trust (form 3520); The maximum penalty is 25% of the amount of the gift. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date.

Web Penalties May Be Assessed In Accordance With Existing Procedures.

Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Form 3520 is due at the time of a. The maximum penalty is 25% of the amount of the gift. Generally, the cp15 states that the taxpayer may submit a reasonable cause statement contesting.

35% Of Contributions To A Foreign Trust (Form 3520);

Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable). Web a penalty applies if form 3520 is not timely filed or if the information is incomplete or incorrect (see below for an exception if there is reasonable cause). Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report, among other things, transactions with foreign trusts — and limited the penalty to a. If the due date for filing the tax return is extended, the due date