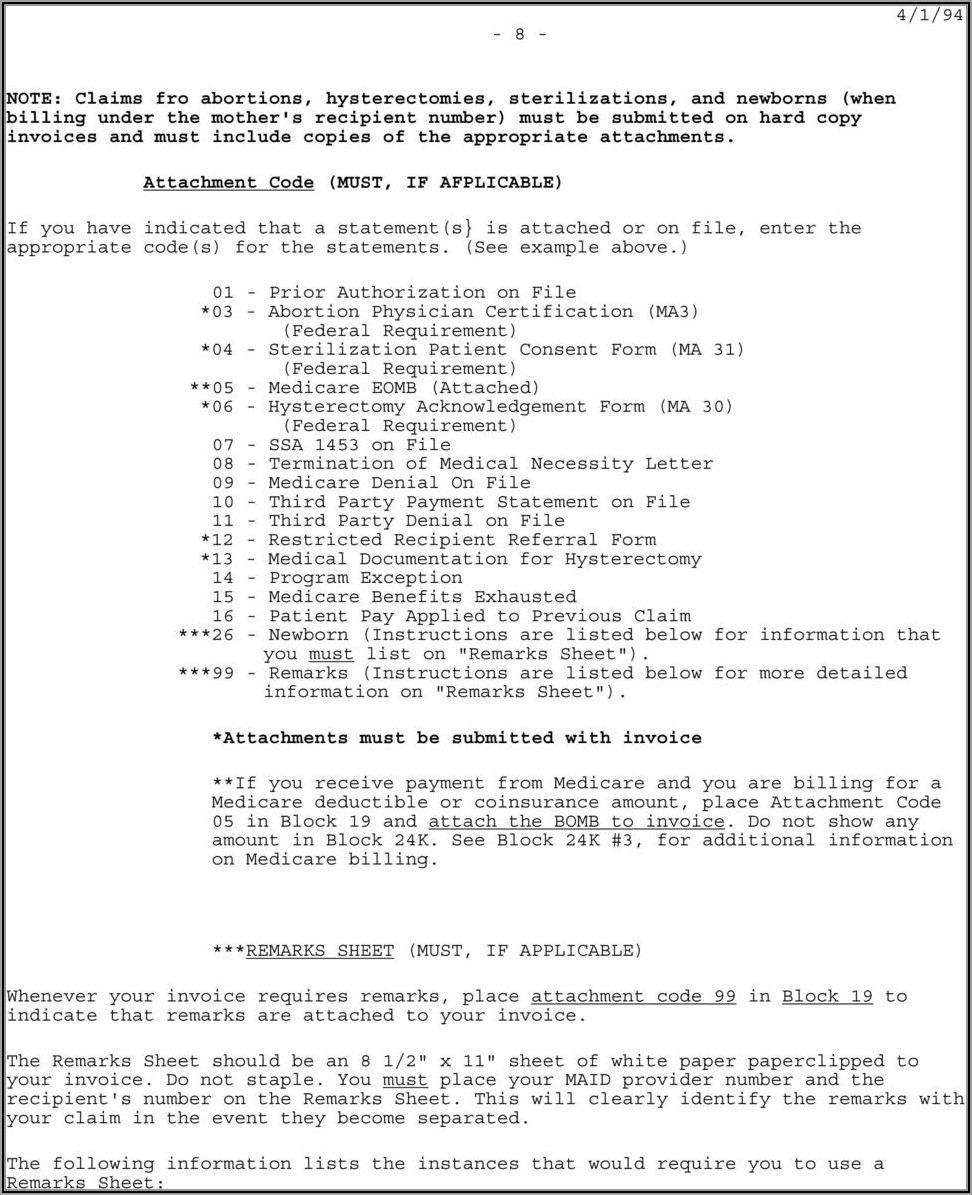

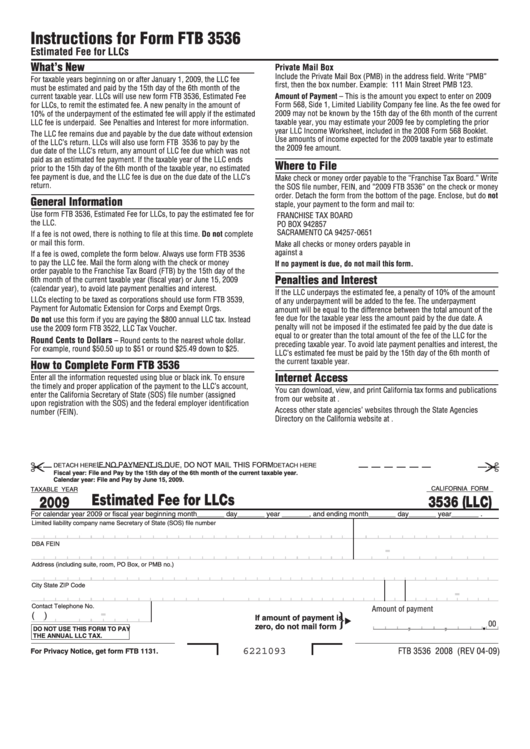

Form 3536 California

Form 3536 California - The limited liability company (llc) must estimate the fee it will owe for the taxable year and must. Complete, edit or print tax forms instantly. Unlike ftb 3522, ftb 3536 is not a flat fee, but is based off the california income of the llc. Save or instantly send your ready documents. To revoke a tia, you must use one of the following methods: Web file form ftb 3536. Web file form ftb 3536. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web 2021 instructions for form ftb 3536 estimated fee for llcs general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and. Easily fill out pdf blank, edit, and sign them.

Web the following tips will help you complete ca ftb 3536 quickly and easily: Ftb 3536, estimated fee for llcs. Web ftb 3536 represents the llc fee. Use form ftb 3536 if you are paying the 2020 $800 annual llc tax. Complete, edit or print tax forms instantly. Web file form ftb 3536. Unlike ftb 3522, ftb 3536 is not a flat fee, but is based off the california income of the llc. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. To revoke a tia, you must use one of the following methods:

Web file form ftb 3536. To revoke a tia, you must use one of the following methods: This form is used to estimate and pay the annual. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; You can download or print current or past. Web 2021 instructions for form ftb 3536 estimated fee for llcs general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and. This form is for income earned in tax year 2022, with. Instead use the 2019 form ftb 3522, llc tax voucher. Web do not file form ftb 3536. The limited liability company (llc) must estimate the fee it will owe for the taxable year and must.

1500 Hcfa Form Form Resume Examples N8VZvlMVwe

Instead use the 2020 form ftb 3522, llc tax voucher. Do not use form ftb 3536 if you are paying the 2019 $800 annual llc tax. Web file form ftb 3536. Get ready for tax season deadlines by completing any required tax forms today. Ftb 3536, estimated fee for llcs.

Fillable California Form Ftb 3536 (Llc) Estimated Fee For Llcs 2009

2023 instructions 2022 instructions how did we do? Web file now with turbotax we last updated california form 3536 in april 2023 from the california franchise tax board. Web the following tips will help you complete ca ftb 3536 quickly and easily: Instead use the 2020 form ftb 3522, llc tax voucher. The limited liability company (llc) must estimate the.

2021 Jeep Grand Cherokee Trackhawk 4x4 3536 Miles Gray Suv 8 Cylinder

For example, round $50.50 up to $51 or round $25.49 down to $25. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web ftb 3536 represents the llc fee. Web file form ftb 3536. Instead use the 2017 form ftb 3522, llc tax voucher.

California Form 3536

Easily fill out pdf blank, edit, and sign them. For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by. Unlike ftb 3522, ftb 3536 is not a flat fee, but is based off the california income of the llc. Web general information the limited liability company (llc) must estimate the.

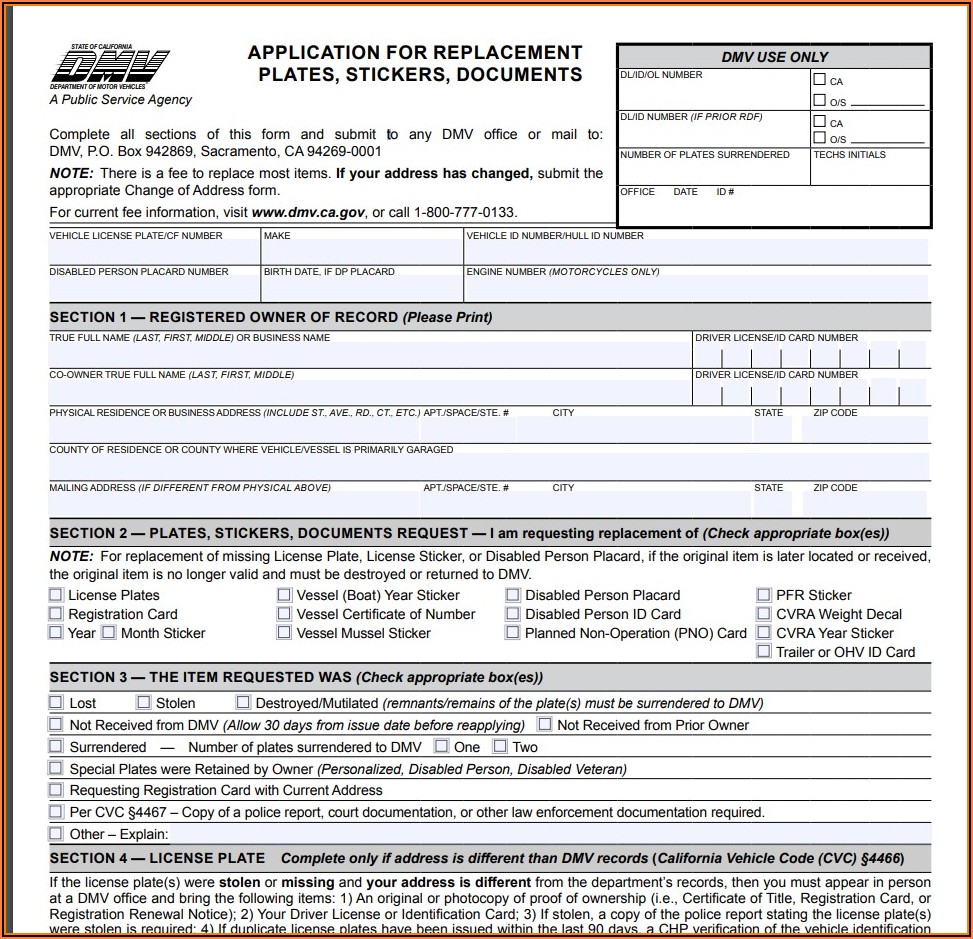

California Dmv Registration Form 156 Form Resume Examples 4x2vB7Q25l

Web file form ftb 3536. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. For example, round $50.50 up to $51 or round $25.49 down to $25. Web do not file form ftb 3536. Web ftb 3536 represents the llc fee.

1096 Fillable Fill Online, Printable, Fillable, Blank PDFfiller

Web ftb 3536 represents the llc fee. Web file form ftb 3536. The fee amount varies from $0 to $11,790,. You can download or print current or past. Do not use form ftb 3536 if you are paying the 2019 $800 annual llc tax.

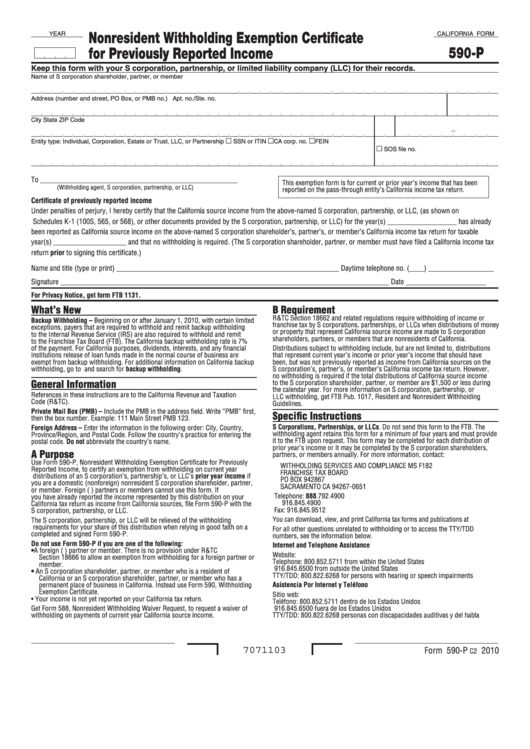

Fillable California Form 590P Nonresident Withholding Exemption

This form is used to estimate and pay the annual. Form 3536 only needs to be filed if your income is $250,000. Web the 2010 form ftb 3522, llc tax voucher. Ftb 3536, estimated fee for llcs. The limited liability company (llc) must estimate the fee it will owe for the taxable year and must.

California Dmv Registration Form 262 Form Resume Examples e79QBBkYkQ

Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web 2021 instructions for form ftb 3536 estimated fee for llcs general information the limited liability company (llc) must estimate the fee it will owe for the.

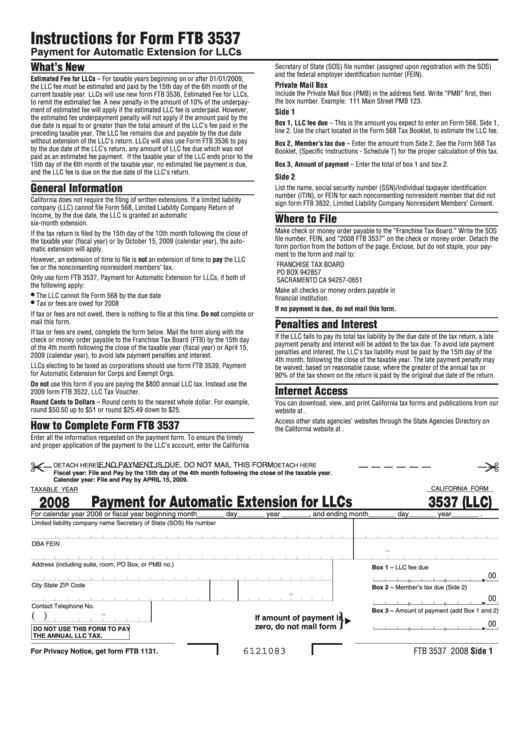

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Form 3536 only needs to be filed if your income is $250,000. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Unlike ftb 3522, ftb 3536 is not a flat fee, but is based off the california income of the llc. Easily fill out pdf blank, edit, and sign them. Use form ftb.

2022 Form CA FTB 3536 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with. Instead use the 2020 form ftb 3522, llc tax voucher. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax..

For Tax Years That Begin On Or After January 1, 2009, Llcs Must Estimate And Pay Their Applicable Fee By.

Web the 2010 form ftb 3522, llc tax voucher. Download or email ftb 3536 & more fillable forms, register and subscribe now! Do not use form ftb 3536 if you are paying the 2019 $800 annual llc tax. Save or instantly send your ready documents.

Ftb 3536, Estimated Fee For Llcs.

Complete, edit or print tax forms instantly. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. You can download or print current or past. Do not use form ftb 3536 if you are paying the 2017 $800 annual llc tax.

For Example, Round $50.50 Up To $51 Or Round $25.49 Down To $25.

Get ready for tax season deadlines by completing any required tax forms today. Web 2021 instructions for form ftb 3536 estimated fee for llcs general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and. Form 3536 only needs to be filed if your income is $250,000. 2022 form 3536 (llc extension payment);

Complete, Edit Or Print Tax Forms Instantly.

Instead use the 2020 form ftb 3522, llc tax voucher. 2023 instructions 2022 instructions how did we do? The limited liability company (llc) must estimate the fee it will owe for the taxable year and must. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts.