Form 3893 California

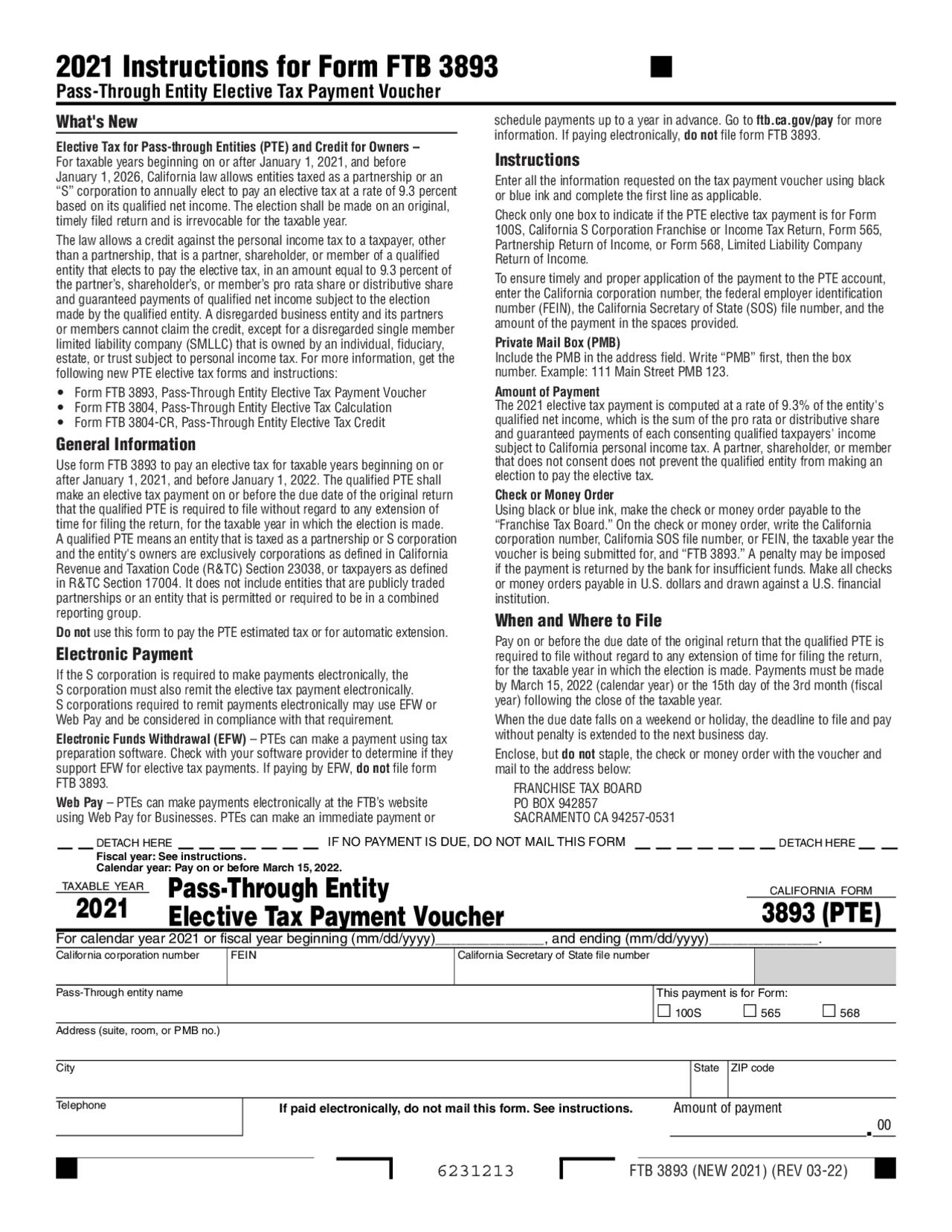

Form 3893 California - 2) calendar year ptes must make payments by march 15, 2022; Web tax year 2022 ftb form 3893 automatically activates when 3893 (2021) is present. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. Manually include / override specific shareholder Printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Automatically include all shareholders go to california > other information worksheet. The due date of this voucher is june 15th, 2022. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web march 31, 2023.

Telephone if paid electronically, do not mail this form. 2) calendar year ptes must make payments by march 15, 2022; Web the instructions include: We anticipate the revised form 3893 will be available march 7, 2022. The due date of this voucher is june 15th, 2022. Web march 31, 2023. Printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Manually include / override specific shareholder “ptes must make all elective tax payments either by using the free.

“ptes must make all elective tax payments either by using the free. 3893 (2022) prepayment is simply half of the calculated 2021 amount. Web the instructions include: Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. The due date of this voucher is june 15th, 2022. Manually include / override specific shareholder However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. If the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb. 2) calendar year ptes must make payments by march 15, 2022; Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022.

3893 California St UNIT 9 Rancho Photos

Web tax year 2022 ftb form 3893 automatically activates when 3893 (2021) is present. Web the instructions include: The due date of this voucher is june 15th, 2022. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Telephone if paid electronically, do not mail this form.

California Form 3893 Passthrough Entity Tax Problems Windes

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web march 31, 2023. Printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. 1) ptes electing to pay the tax must use form 3893 to make.

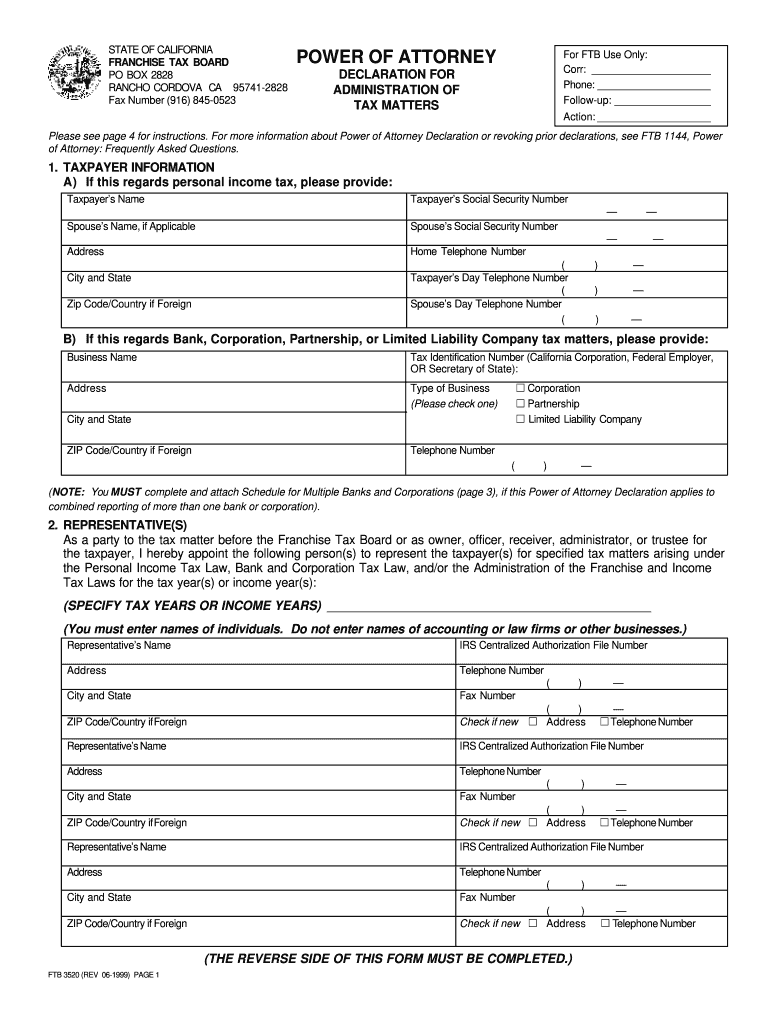

Ftb fax number Fill out & sign online DocHub

We anticipate the revised form 3893 will be available march 7, 2022. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Web march 31, 2023. Telephone if paid electronically, do not mail this form. The due date of this voucher is june 15th, 2022.

3893 California St UNIT 11 Rancho Photos

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). If the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb. Printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form.

3893 California St UNIT 11 Rancho Photos

Web the instructions include: Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. 2) calendar year ptes must make payments by march 15,.

3893 California St UNIT 9 Rancho Photos

Automatically include all shareholders go to california > other information worksheet. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. “ptes must make all elective tax payments either by using.

2021 Instructions for Form 3893, PassThrough Entity Elective

Telephone if paid electronically, do not mail this form. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. The due date of this voucher is june 15th, 2022. 1) ptes electing to.

3893 California St UNIT 11 Rancho Photos

If the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. 2) calendar year ptes must make payments by march 15, 2022; Web california form 3893 (pte) for.

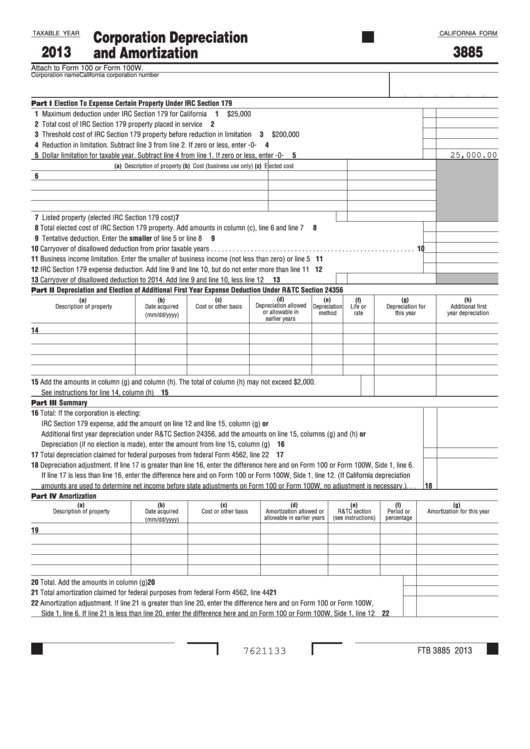

Fillable California Form 3885 Corporation Depreciation And

Web tax year 2022 ftb form 3893 automatically activates when 3893 (2021) is present. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Manually include / override specific shareholder 3893 (2022) prepayment.

California Corner Revised Instructions for 2022, 2023 PassThrough

3893 (2022) prepayment is simply half of the calculated 2021 amount. The due date of this voucher is june 15th, 2022. Automatically include all shareholders go to california > other information worksheet. 2) calendar year ptes must make payments by march 15, 2022; Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment.

However, The Instructions To For Ftb 3893 Indicate That The Qualified Entity Can Make A Payment Through Electronic Funds Withdrawal.

Automatically include all shareholders go to california > other information worksheet. “ptes must make all elective tax payments either by using the free. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. 1) ptes electing to pay the tax must use form 3893 to make payment for taxable years beginning on or after jan.

Web The Instructions Include:

A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. 3893 (2022) prepayment is simply half of the calculated 2021 amount. 2) calendar year ptes must make payments by march 15, 2022;

Web Tax Year 2022 Ftb Form 3893 Automatically Activates When 3893 (2021) Is Present.

Web march 31, 2023. Printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. Telephone if paid electronically, do not mail this form. We anticipate the revised form 3893 will be available march 7, 2022.

If The Qualified Entity Makes A Payment Through Electronic Funds Withdrawal, It Will Not File A Form Ftb.

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Manually include / override specific shareholder The due date of this voucher is june 15th, 2022.