Form 433 A Oic

Form 433 A Oic - In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. If you are an individual who owes income tax on form 1040, For an oic based on doubt as to liability, download the following forms: This form is also about eight pages long. Answer all questions or write n/a if the question is not. Individual income tax return an individual with a personal liability for excise tax We will go through it step by step, section by section. Web form 656, offer in compromise; Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Individual income tax return an individual with a personal liability for excise tax

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Individual income tax return an individual with a personal liability for excise tax Web form 656, offer in compromise; This form is also about eight pages long. Answer all questions or write n/a if the question is not. In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. We will go through it step by step, section by section. For an oic based on doubt as to liability, download the following forms: If you are an individual who owes income tax on form 1040, Individual income tax return an individual with a personal liability for excise tax

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. This form is also about eight pages long. For an oic based on doubt as to liability, download the following forms: Answer all questions or write n/a if the question is not. We will go through it step by step, section by section. In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. Web form 656, offer in compromise; Individual income tax return an individual with a personal liability for excise tax Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040,

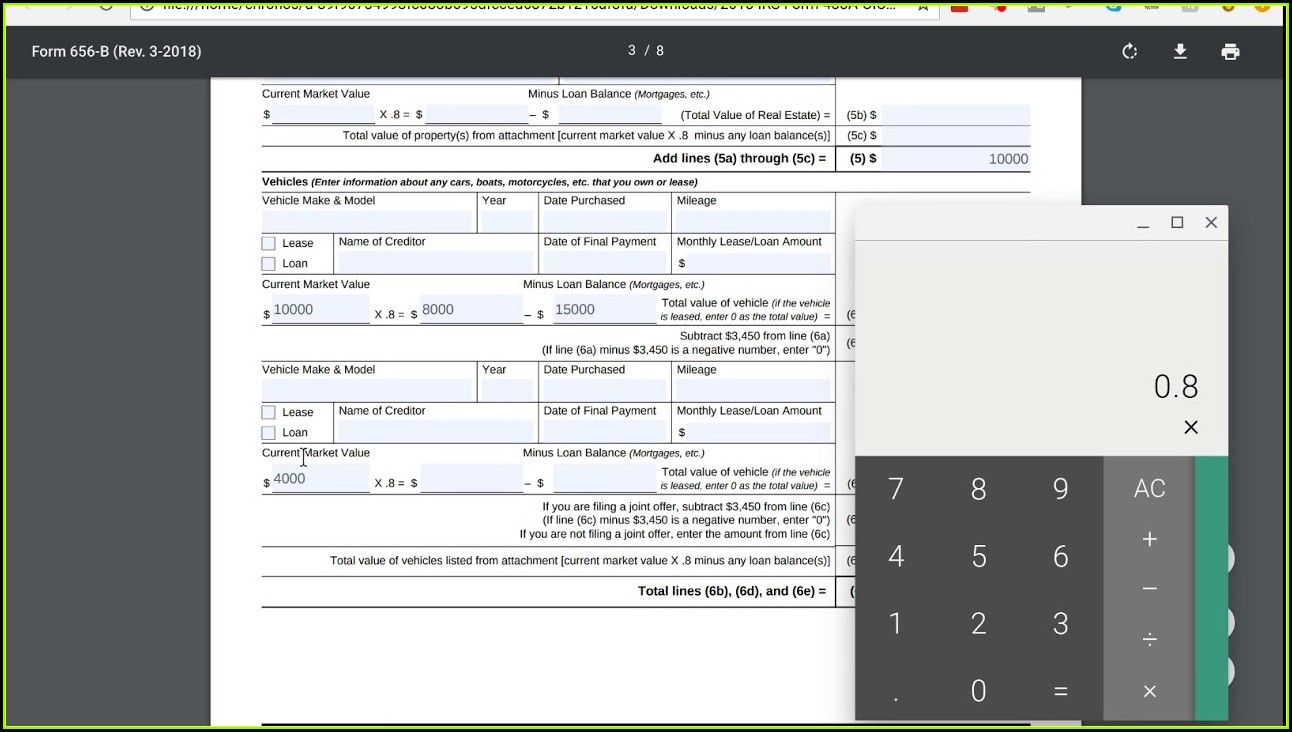

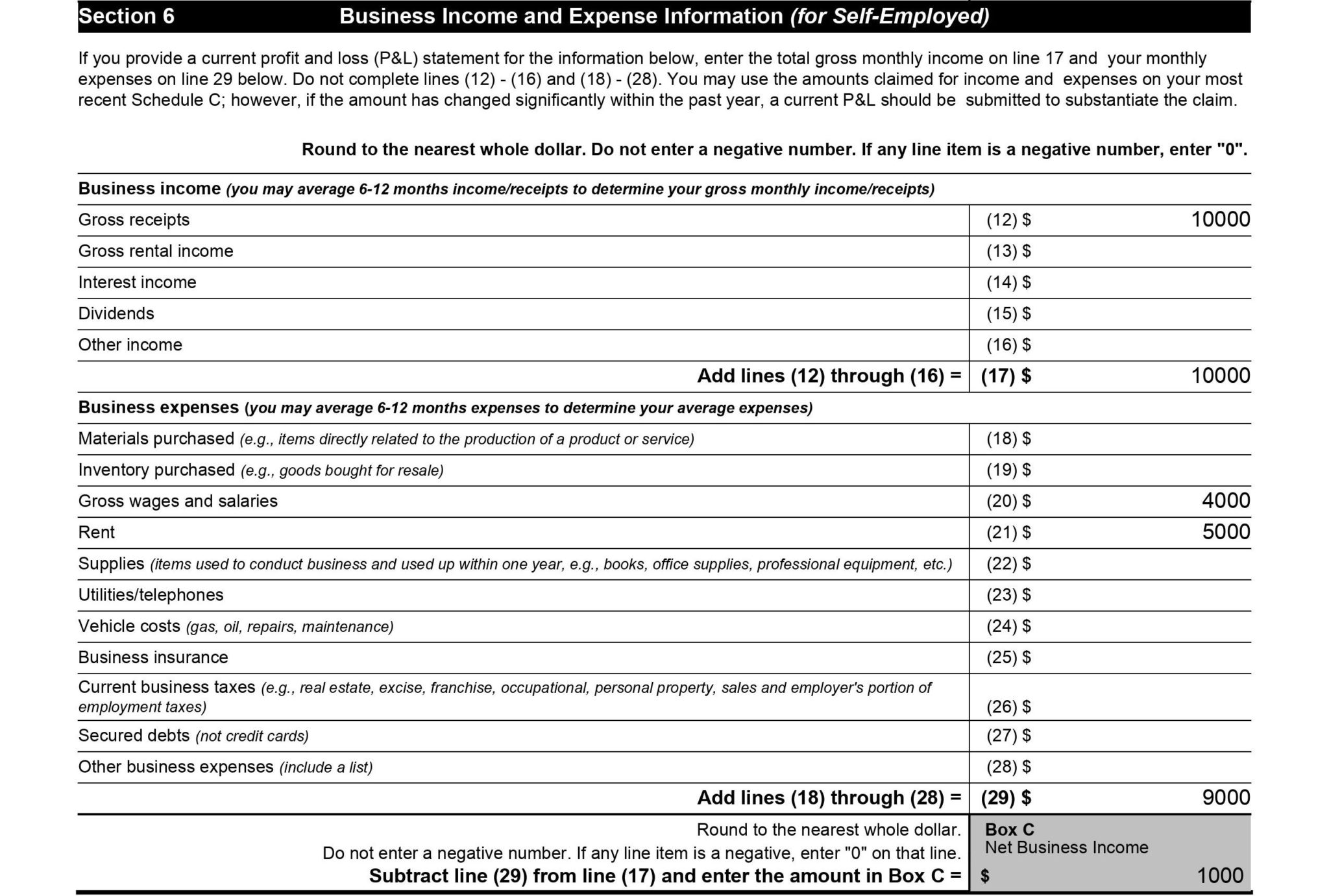

IRS Form 433A (OIC) Offer in Compromise Example numbers used that

Answer all questions or write n/a if the question is not. Individual income tax return an individual with a personal liability for excise tax If you are an individual who owes income tax on form 1040, Individual income tax return an individual with a personal liability for excise tax Web form 656, offer in compromise;

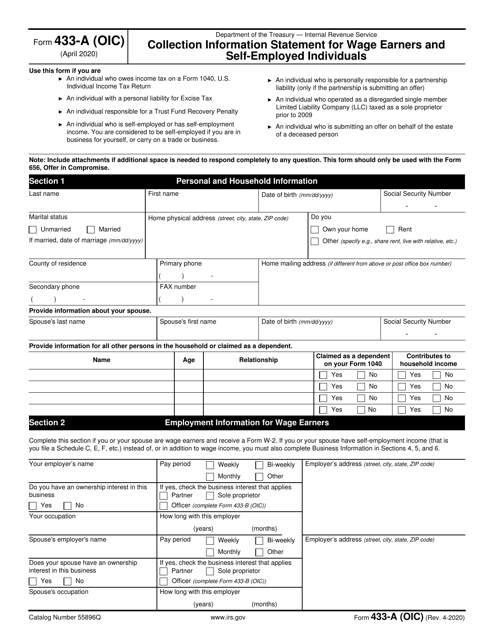

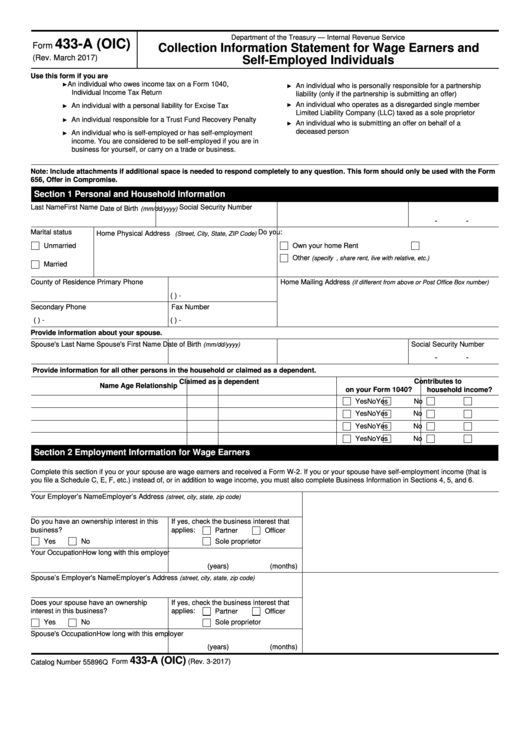

Form 433A (OIC) Collection Information Statement for Wage Earners

This form is also about eight pages long. Individual income tax return an individual with a personal liability for excise tax Individual income tax return an individual with a personal liability for excise tax In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through.

Form 433A (OIC) Download Fillable PDF or Fill Online Collection

Web form 656, offer in compromise; If you are an individual who owes income tax on form 1040, We will go through it step by step, section by section. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. In an effort to keep this video short for your viewing, we have gone ahead and.

Irs Form 433 A Oic Form Resume Examples X42Mwa1YkG

For an oic based on doubt as to liability, download the following forms: If you are an individual who owes income tax on form 1040, We will go through it step by step, section by section. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write n/a if the question.

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

This form is also about eight pages long. We will go through it step by step, section by section. Web form 656, offer in compromise; For an oic based on doubt as to liability, download the following forms: Individual income tax return an individual with a personal liability for excise tax

Form 433A (Oic) Collection Information Statement For Wage Earners

In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. We will go through it step by step, section by section. Individual income tax return an individual with a personal liability for excise tax Web form 656, offer in compromise; For an.

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

We will go through it step by step, section by section. For an oic based on doubt as to liability, download the following forms: In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. Web form 656, offer in compromise; Individual income.

IRS Form 433A (OIC) 2018 2019 Fill out and Edit Online PDF Template

If you are an individual who owes income tax on form 1040, This form is also about eight pages long. We will go through it step by step, section by section. In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that. Answer.

Irs Form 433 A Oic Instructions Form Resume Examples N8VZ8K09we

This form is also about eight pages long. If you are an individual who owes income tax on form 1040, Individual income tax return an individual with a personal liability for excise tax Answer all questions or write n/a if the question is not. Web form 656, offer in compromise;

Form 433A (OIC) Collection Information Statement for Wage Earners

Individual income tax return an individual with a personal liability for excise tax Answer all questions or write n/a if the question is not. We will go through it step by step, section by section. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. This form is also about eight pages long.

Answer All Questions Or Write N/A If The Question Is Not.

Web form 656, offer in compromise; Individual income tax return an individual with a personal liability for excise tax We will go through it step by step, section by section. Individual income tax return an individual with a personal liability for excise tax

For An Oic Based On Doubt As To Liability, Download The Following Forms:

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. This form is also about eight pages long. If you are an individual who owes income tax on form 1040, In an effort to keep this video short for your viewing, we have gone ahead and prefilled the form, and we're just going to go through what that.