Form 4506-B Instructions

Form 4506-B Instructions - Web you can apply for a disaster loan online. Designate (on line 5) a third party to receive the tax massachusetts, return. Attach payment and mail form 4506 to the address. Enter only one tax form number. *special note there are many versions of. Please see attachments below to download corresponding forms. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Enter the tax form number here (1 040, 1065, 1120, etc.) and check the appropriate box below. Web in an effort to minimize the impact of the irs suspension and to ensure that loan proceeds are disbursed to small businesses as soon as possible, sba is providing temporary. Web execute form 4506 on behalf of the taxpayer.

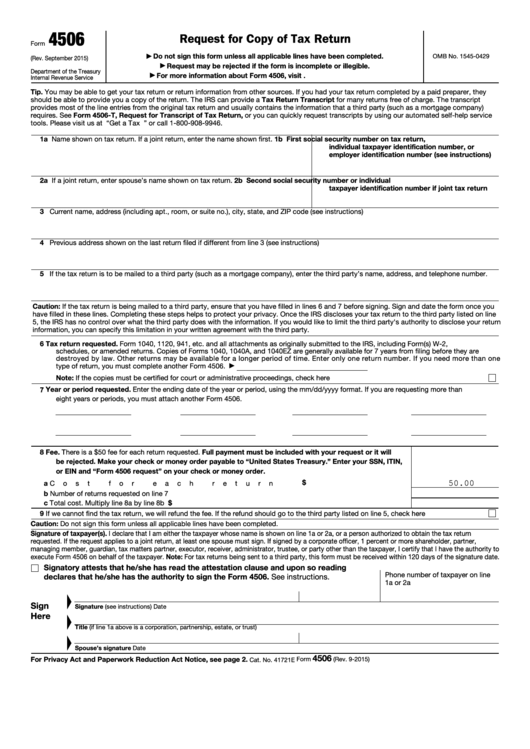

Request for copy of tax return. Web you can apply for a disaster loan online. A copy of an exempt organization’s exemption application or letter. Web form 4506 is filed by taxpayers to request exact copies of previously filed tax returns and tax information. How long will it take? Web execute form 4506 on behalf of the taxpayer. The form authorizes the irs to provide federal income tax. *special note there are many versions of. Designate (on line 5) a third party to receive the tax massachusetts, return. Request a copy of your tax return, or designate a third.

This form must be received by irs within 120 days of the signature date. Enter only one tax form number. Use form 4506 to request a copy of your tax return. Download, print loan application and. You can request a range of different types of previously filed. A copy of an exempt organization’s exemption application or letter. You can also designate (on line 5) a third party to receive the tax return. Do not sign this form unless all applicable lines. Use form 4506 to request a copy of your tax return. Web in an effort to minimize the impact of the irs suspension and to ensure that loan proceeds are disbursed to small businesses as soon as possible, sba is providing temporary.

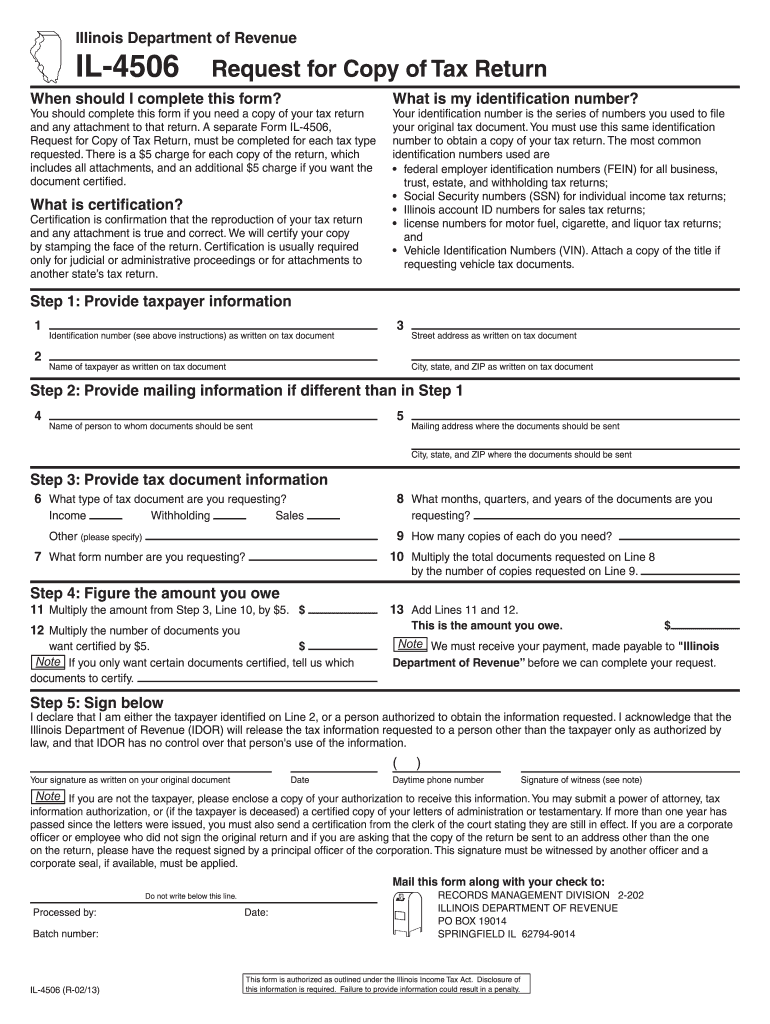

Il 4506 Fill Online, Printable, Fillable, Blank pdfFiller

The form authorizes the irs to provide federal income tax. You can request a range of different types of previously filed. Web you can apply for a disaster loan online. Use form 4506 to request a copy of your tax return. Please see attachments below to download corresponding forms.

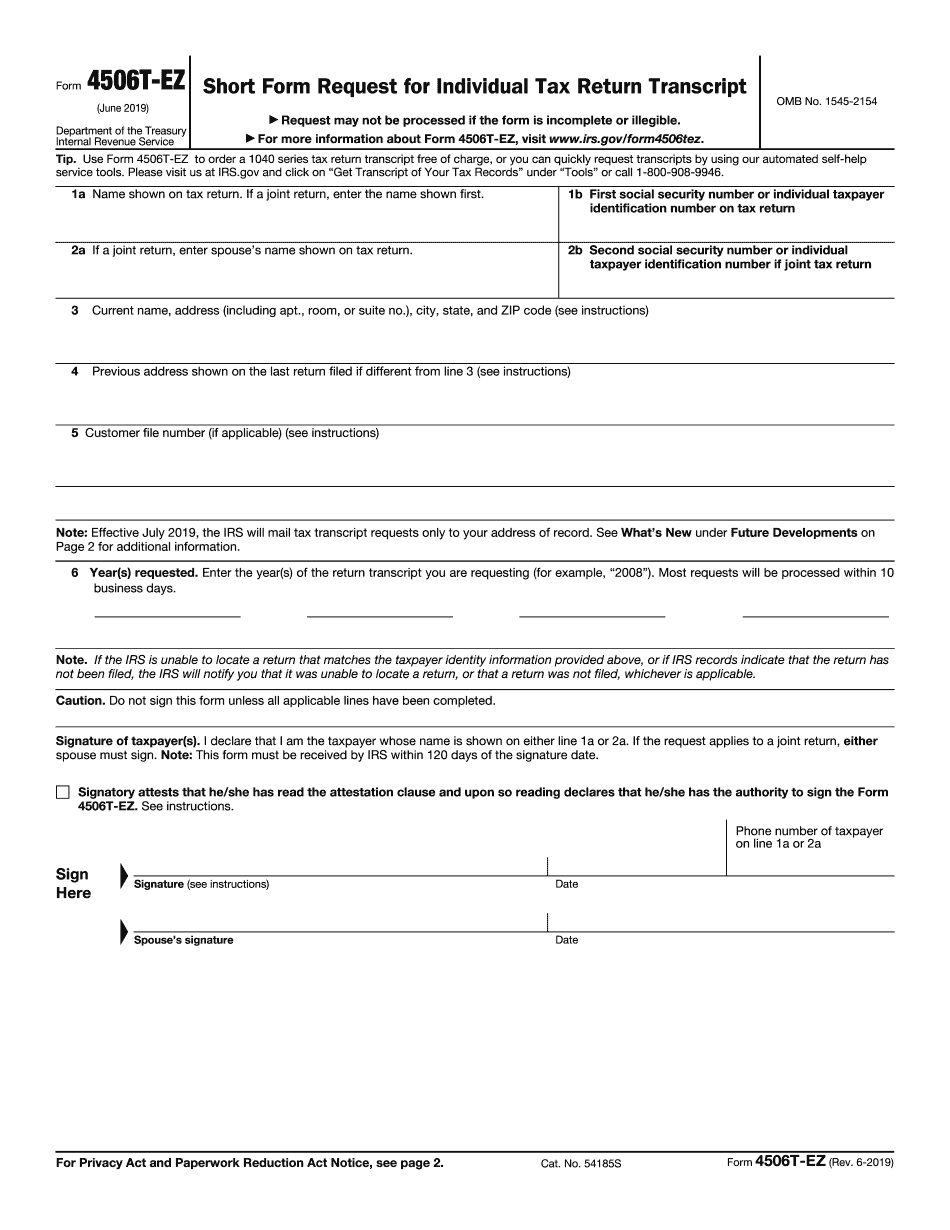

Form 4506T Instructions & Information about IRS Tax Form 4506T

Web have a copy of your 2019 federal tax return available for reference when completing the 4506t. You can also designate (on line 5) a third party to receive the tax return. Attach payment and mail form 4506 to the address. Designate (on line 5) a third party to receive the tax massachusetts, return. The form authorizes the irs to.

Form 4506T Instructions for SBA EIDL Loan, Covid19 EIDL Grant, or SBA

You can request a range of different types of previously filed. Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is. Signatory attests that he/she has read the. How long will it take? Download, print loan application and.

IRS Form 4506 and 4506T How mortgage lenders verify a prospective

Enter the tax form number here (1 040, 1065, 1120, etc.) and check the appropriate box below. Web have a copy of your 2019 federal tax return available for reference when completing the 4506t. This form must be received by irs within 120 days of the signature date. Web you can apply for a disaster loan online. Web form 4506.

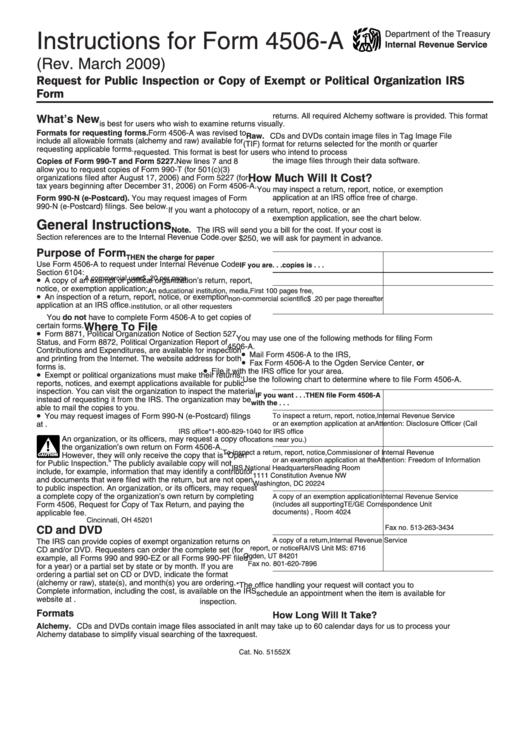

Irs Form 4506a Fillable and Editable PDF Template

Web in an effort to minimize the impact of the irs suspension and to ensure that loan proceeds are disbursed to small businesses as soon as possible, sba is providing temporary. A copy of an exempt organization’s exemption application or letter. Download, print loan application and. Web execute form 4506 on behalf of the taxpayer. Do not sign this form.

How To Fill Out 4506 T Form Create A Digital Sample in PDF

Do not sign this form unless all applicable lines. Signatory attests that he/she has read the. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Use form 4506 to request a copy of your tax return. A copy of an exempt organization’s exemption application or letter.

Form 4506T YouTube

Enter only one tax form number. Web these where to file addresses are to be used by taxpayers and tax professionals filing form 4506. Designate (on line 5) a third party to receive the tax massachusetts, return. Enter the tax form number here (1 040, 1065, 1120, etc.) and check the appropriate box below. You can also designate (on line.

Instructions For Form 4506A Request For Public Inspection Or Copy Of

A copy of an exempt organization’s exemption application or letter. The form authorizes the irs to provide federal income tax. This form must be received by irs within 120 days of the signature date. Enter the tax form number here (1 040, 1065, 1120, etc.) and check the appropriate box below. Web form 4506 (novmeber 2021) department of the treasury.

Fillable Form 4506 Request For Copy Of Tax Return printable pdf download

Attach payment and mail form 4506 to the address. Enter only one tax form number. Signatory attests that he/she has read the. How long will it take? This form must be received by irs within 120 days of the signature date.

Form 1120 schedule b instructions 2022 Fill online, Printable

Web you can apply for a disaster loan online. Signatory attests that he/she has read the. Please see attachments below to download corresponding forms. Download, print loan application and. Use form 4506 to request a copy of your tax return.

Web Form 4506 Is Filed By Taxpayers To Request Exact Copies Of Previously Filed Tax Returns And Tax Information.

Web execute form 4506 on behalf of the taxpayer. Signatory attests that he/she has read the. Use form 4506 to request a copy of your tax return. Web in an effort to minimize the impact of the irs suspension and to ensure that loan proceeds are disbursed to small businesses as soon as possible, sba is providing temporary.

Web Form 4506 Is Used By Taxpayers To Request Copies Of Their Tax Returns For A Fee.

Use form 4506 to request a copy of your tax return. You can also all others. Request a copy of your tax return, or designate a third. How long will it take?

This Form Must Be Received By Irs Within 120 Days Of The Signature Date.

Attach payment and mail form 4506 to the address. Please see attachments below to download corresponding forms. Confirm you are using the march 2019 version available on the sba.gov. *special note there are many versions of.

Web Have A Copy Of Your 2019 Federal Tax Return Available For Reference When Completing The 4506T.

You can also designate (on line 5) a third party to receive the tax return. The form authorizes the irs to provide federal income tax. A copy of an exempt organization’s exemption application or letter. Enter only one tax form number.