Form 4720 Instructions 2021

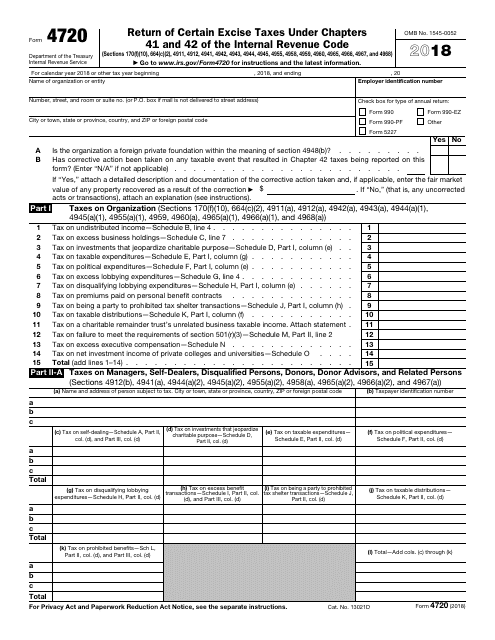

Form 4720 Instructions 2021 - Web electronic filing of form 4720 is expected to be available in march 2021, and the irs will announce the specific date of availability when the programming comes online. Web filer of form 4720 who is not required to file electronically also may use the electronic form. Document that may seem challenging to fill out. Web information about form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code, including recent updates, related forms and instructions on. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. Exempt organization business income tax return. Web form 4720 2021 return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943,. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2021 form 4720: Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2020 inst 4720: On the whole, the 2022 forms are very similar to the 2021 forms, though all include some relatively minor changes to formatting.

Web the irs expects to announce the availability of the electronic version of form 4720 and the requirement to electronically file form 4720 early in 2021. Web on june 16, 2021, the irs announced in an exempt organizations update that mandatory electronic filing of 2020 forms 4720, return of certain excise taxes. (public charities may still file paper forms 4720.). Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code pdf, is. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Document that may seem challenging to fill out. On the whole, the 2022 forms are very similar to the 2021 forms, though all include some relatively minor changes to formatting. Web form 4720 2021 return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943,. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. If “yes,” attach a list showing the name.

General instructions purpose of form use form 4720 to figure and pay the following. On the whole, the 2022 forms are very similar to the 2021 forms, though all include some relatively minor changes to formatting. Web form 4720, return of certain excise taxes. Web 1 gather your information, including your ein (for business) or ssn (for individual), pin, and tax form number. Web due to the limited changes to form 4720 and instructions from 2020 to 2021, this alert just summarizes those changes, rather than attaching an annotated version of the form. If “yes,” attach a list showing the name. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Web form 4720 2021 return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943,. (public charities may still file paper forms 4720.). Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2020 inst 4720:

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. General instructions purpose of form use form 4720 to figure and pay the following. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Exempt organization business income tax return. On the whole, the 2022 forms are.

IRS Form 4720 Reporting Updates OnDemand Course Lorman Education

If “yes,” attach a list showing the name. General instructions purpose of form use form 4720 to figure and pay the following. Web are you required to file form 4720 with respect to more than one organization in the current tax year? (public charities may still file paper forms 4720.). Web 1 gather your information, including your ein (for business).

Instructions For Form 4720 Return Of Certain Excise Taxes On

Document that may seem challenging to fill out. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Exempt organization business income tax return. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2021 form 4720: Web 1 gather your.

Instructions for IRS Form 4720 Return of Certain Excise Taxes Under

(public charities may still file paper forms 4720.). Web form 4720 2021 return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943,. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Web this article will give.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

Web form 4720 (2021) easily fill out and sign forms download blank or editable online send and share templates with pdfliner. If “yes,” attach a list showing the name. Web an irs updateposted on june 16, 2021 announced that any private foundation completing a form 4720, return of certain excise taxes under chapters 41 and 42 of the internal. Web.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

General instructions purpose of form use form 4720 to figure and pay the following. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2020 inst 4720: Web form 4720 (2021) easily fill out and sign forms download.

IRS Form 4720 Download Fillable PDF or Fill Online Return of Certain

General instructions purpose of form use form 4720 to figure and pay the following. Web an irs updateposted on june 16, 2021 announced that any private foundation completing a form 4720, return of certain excise taxes under chapters 41 and 42 of the internal. Web due to the limited changes to form 4720 and instructions from 2020 to 2021, this.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

(public charities may still file paper forms 4720.). On the whole, the 2022 forms are very similar to the 2021 forms, though all include some relatively minor changes to formatting. Document that may seem challenging to fill out. Web are you required to file form 4720 with respect to more than one organization in the current tax year? Web the.

Instructions For Form 4720 Return Of Certain Excise Taxes

If you aren't required to file any of. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. If “yes,” attach a list showing the name. Web filer of form 4720 who is not required to file electronically also may use the electronic form. Instructions for form 4720, return of certain excise taxes under chapters 41 and.

Instructions For Form 4720 2016 printable pdf download

Document that may seem challenging to fill out. Web the irs expects to announce the availability of the electronic version of form 4720 and the requirement to electronically file form 4720 early in 2021. Web on june 16, 2021, the irs announced in an exempt organizations update that mandatory electronic filing of 2020 forms 4720, return of certain excise taxes..

Exempt Organization Business Income Tax Return.

Web form 4720 2021 return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943,. Web 1 gather your information, including your ein (for business) or ssn (for individual), pin, and tax form number. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2020 inst 4720: Web due to the limited changes to form 4720 and instructions from 2020 to 2021, this alert just summarizes those changes, rather than attaching an annotated version of the form.

Web Information About Form 4720, Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code, Including Recent Updates, Related Forms And Instructions On.

Web the irs expects to announce the availability of the electronic version of form 4720 and the requirement to electronically file form 4720 early in 2021. Form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue code pdf, is. Web on june 16, 2021, the irs announced in an exempt organizations update that mandatory electronic filing of 2020 forms 4720, return of certain excise taxes. Web an irs updateposted on june 16, 2021 announced that any private foundation completing a form 4720, return of certain excise taxes under chapters 41 and 42 of the internal.

If “Yes,” Attach A List Showing The Name.

The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041),. General instructions purpose of form use form 4720 to figure and pay the following. Web this article will give the instructions for generating and filing form 4720. Web are you required to file form 4720 with respect to more than one organization in the current tax year?

Instructions For Form 4720, Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code 2021 Form 4720:

Web form 4720 (2021) easily fill out and sign forms download blank or editable online send and share templates with pdfliner. (public charities may still file paper forms 4720.). Document that may seem challenging to fill out. If you aren't required to file any of.