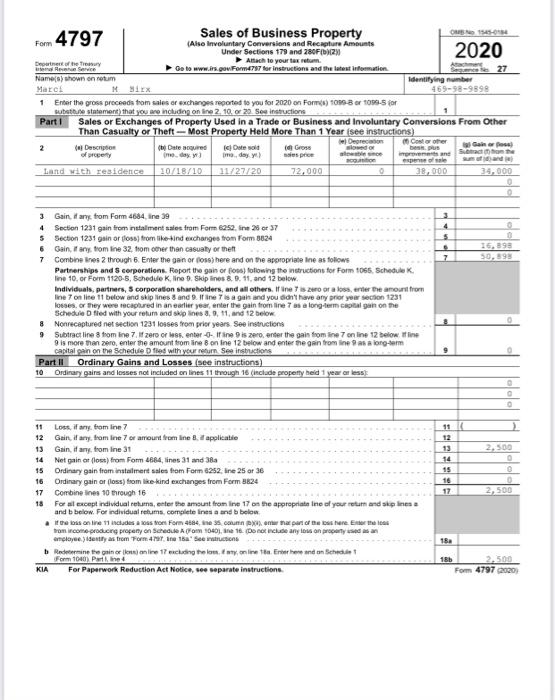

Form 4797 Part Ii

Form 4797 Part Ii - From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Single family home built in 1925 that was last sold on 05/10/2022. Ad download or email irs 4797 & more fillable forms, register and subscribe now! This might include any property used to generate rental income or even a. Single family home built in 2019 that was last sold on 06/14/2022. Or form 8824, parts i and ii. The zestimate for this multiple occupancy is $1,653,700, which has. Generally, assets held for more than a year carry to part i and items held for 1. 47797 w 2nd st, oakridge, or is a single family home that contains 2,356 sq ft and was built in 1956.

The zestimate for this multiple occupancy is $1,653,700, which has. An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. Web complete form 4797, line 10, columns (a), (b), and (c); To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. Web 952 47th st, brooklyn ny, is a multiple occupancy home that contains 3116 sq ft and was built in 1931. Generally, assets held for more than a year carry to part i and items held for 1. Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •.

Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Or form 8824, parts i and ii. The zestimate for this multiple occupancy is $1,653,700, which has. This might include any property used to generate rental income or even a. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. Web view 27 photos for 22447 n 97th ln, peoria, az 85383, a 4 bed, 3 bath, 2,485 sq. 47797 w 2nd st, oakridge, or is a single family home that contains 2,356 sq ft and was built in 1956. Web a sale of a partnership interest requires two transactions: Form 6252, lines 1 through 4; Single family home built in 1925 that was last sold on 05/10/2022.

Mona Inc. makes and distributes bicycle accessories. To streamline its

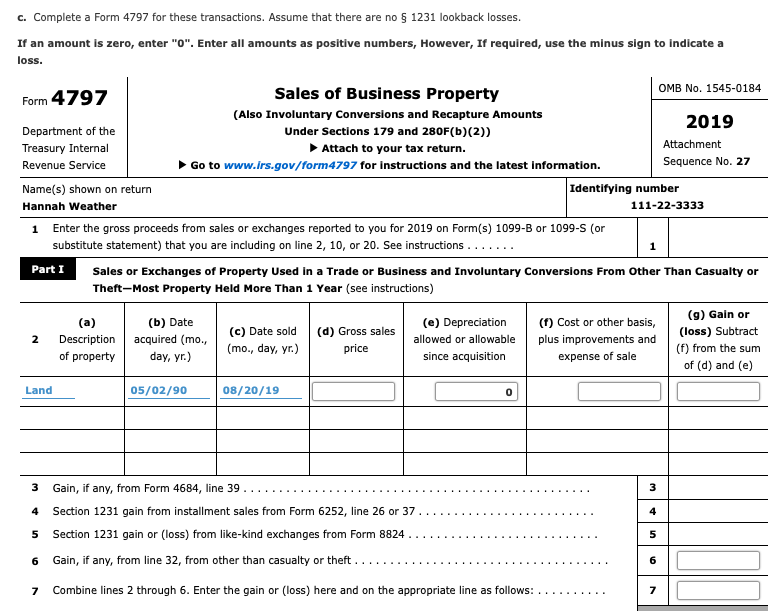

Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Ad download or email irs.

Line 7 of Form 4797 is 50,898At what rate(s) is

Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. Web common questions for form 4797 in proseries below are.

U.S. TREAS Form treasirs1120a1995

Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Single family home built in 1925 that was last sold on 05/10/2022. This.

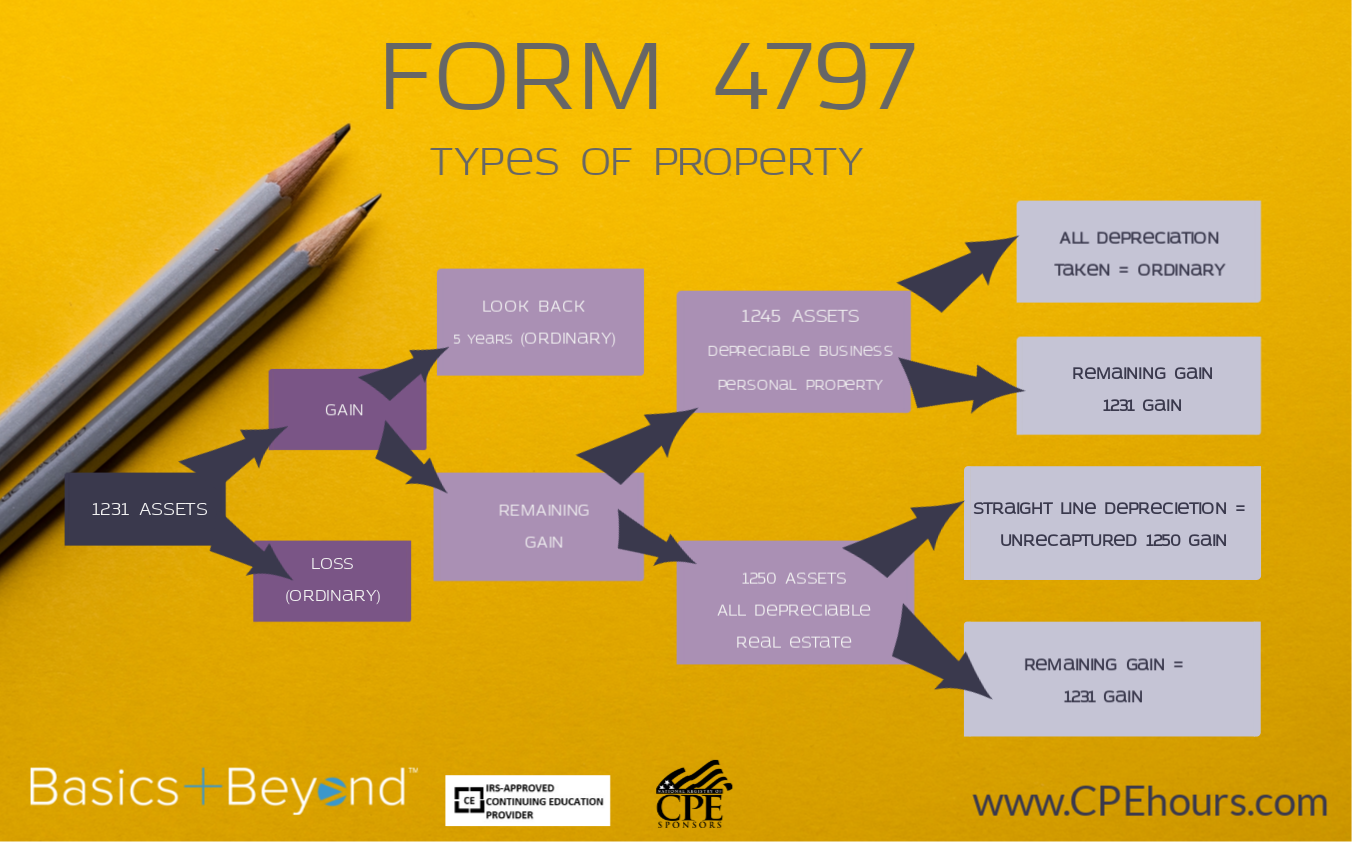

4797 Basics & Beyond

The zestimate for this multiple occupancy is $1,653,700, which has. It contains 3 bedrooms and 2 bathrooms. Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. To enter a loss for the sale of business property not entered.

TURBOTAX Logical Progression of Where Ordinary AND Capital Gains

Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. The zestimate for this multiple occupancy is $1,653,700, which has..

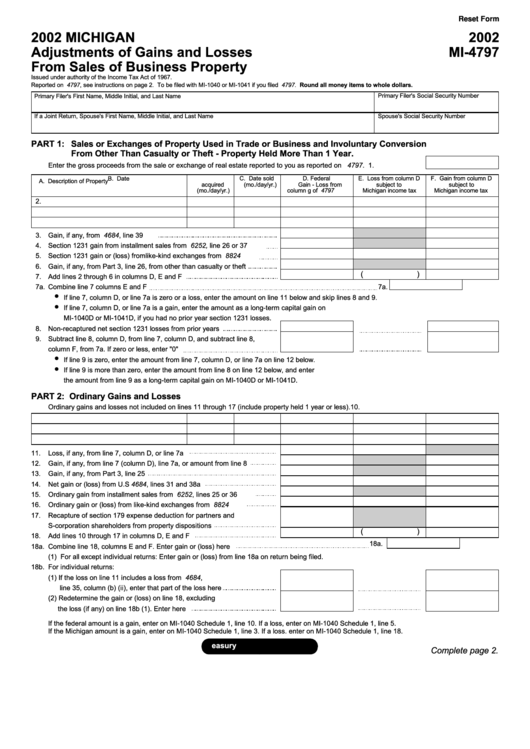

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web a sale of a partnership interest requires two transactions: This might include any property used to generate rental income or even a. To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the.

TURBOTAX InvestorVillage

Single family home built in 1925 that was last sold on 05/10/2022. Form 6252, lines 1 through 4; Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Ad download or email irs 4797 & more fillable forms, register and subscribe now!.

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) The zestimate for this multiple occupancy is $1,653,700, which has. From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. This might include any property used.

Form 4797 1996 Fill out & sign online DocHub

Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? From there as you scroll through the form you.

Form 4797 (2019) Page 2 Part III Gain From

This might include any property used to generate rental income or even a. Web a sale of a partnership interest requires two transactions: Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. From there as you scroll through the form you.

Web View 9 Photos For 752 Nw 47Th St, Miami, Fl 33127, A 2 Bed, 1 Bath, 1,164 Sq.

Web 952 47th st, brooklyn ny, is a multiple occupancy home that contains 3116 sq ft and was built in 1931. Single family home built in 2019 that was last sold on 06/14/2022. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a.

Or Form 8824, Parts I And Ii.

An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. Form 6252, lines 1 through 4; Ad download or email irs 4797 & more fillable forms, register and subscribe now! Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2))

Web Complete Form 4797, Line 10, Columns (A), (B), And (C);

Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web view 27 photos for 22447 n 97th ln, peoria, az 85383, a 4 bed, 3 bath, 2,485 sq. The zestimate for this multiple occupancy is $1,653,700, which has. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset.

This Might Include Any Property Used To Generate Rental Income Or Even A.

Single family home built in 1925 that was last sold on 05/10/2022. It contains 3 bedrooms and 2 bathrooms. Generally, assets held for more than a year carry to part i and items held for 1. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset.