Form 5471 Filing Instructions

Form 5471 Filing Instructions - It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible penalties, and instructions for each section of the tax form. Shareholder who doesn't qualify as either a category 5b or 5c filer. Persons who are officers, directors, or shareholders in certain foreign corporations. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018. Follow the instructions below for an individual (1040) return, or. Persons with respect to certain foreign corporations • read the. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web information about form 5471, information return of u.s. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Web changes to form 5471.

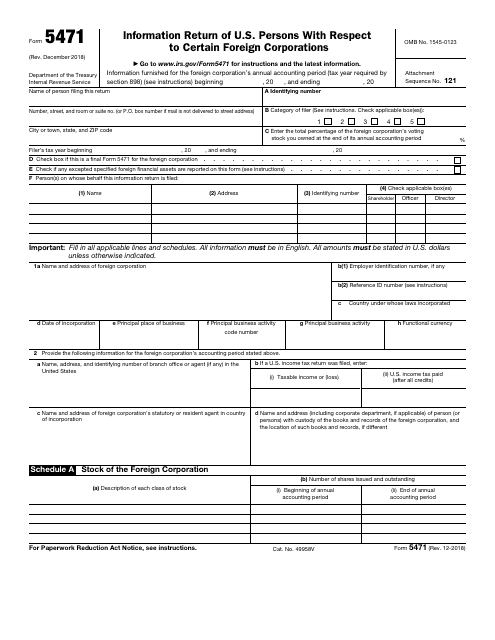

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. This article will help you generate form 5471 and any required schedules. All persons identified in item h must attach a statement to their income tax return that includes the information described in the instructions for item h. Web the instructions to form 5471 describes a category 5a filer as a u.s. Shareholder, while a 5c filer is a related constructive u.s. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Form 5471[pdf 218 kb], information return of u.s. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. So, a 5a filer is an unrelated section 958(a) u.s.

Persons with respect to certain foreign corporations • read the. Web the irs has provided a draft version of instructions for form 5471 for 2018. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web information about form 5471, information return of u.s. Follow the instructions below for an individual (1040) return, or. This article will help you generate form 5471 and any required schedules. The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. Persons who are officers, directors, or shareholders in certain foreign corporations. Shareholder who doesn't qualify as either a category 5b or 5c filer. Shareholder, while a 5c filer is a related constructive u.s.

Filing Form 5471 Everything You Need to Know

Persons with respect to certain foreign corporations • read the. The draft instructions reflect a “watermark” date of december 12. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018. Web changes to form 5471. It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible penalties, and instructions for each.

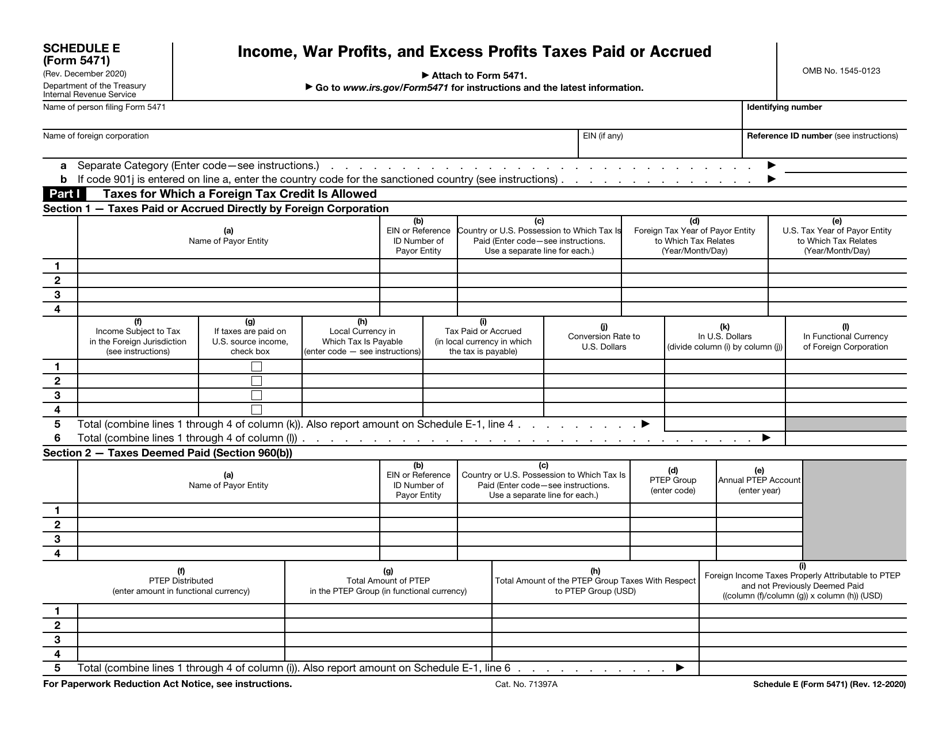

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web form 5471 is used by certain u.s. This article will help you generate form 5471 and any required schedules. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. The form and schedules are used to satisfy the filing requirements of sections.

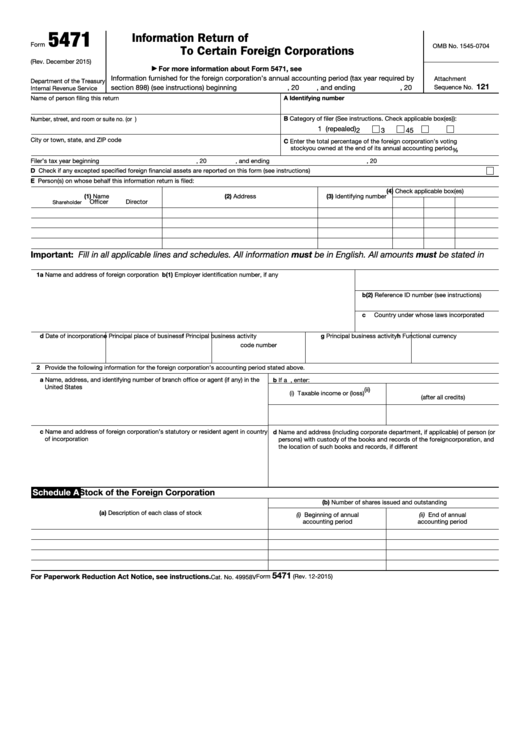

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c. Persons with respect to certain foreign corporations • read the. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web the form 5471 instructions as laid out by the irs defines the criteria for each.

IRS Form 5471 Carries Heavy Penalties and Consequences

When and where to file. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web changes to form 5471. Shareholder who doesn't qualify as either a category 5b or 5c filer. Shareholder, while a 5c filer is a related constructive u.s.

IRS Form 5471 Filing Instructions for Green Card Holders and US

Web form 5471 is used by certain u.s. Follow the instructions below for an individual (1040) return, or. When and where to file. Web changes to form 5471. Also, the checkbox for category 5 has been deleted and replaced with checkboxes for new categories 5a, 5b, and 5c.

2012 form 5471 instructions Fill out & sign online DocHub

Web changes to form 5471. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Persons with respect to certain foreign corporations • read the. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. It also describes the exceptions to filing, when to file, how to file,.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

So, a 5a filer is an unrelated section 958(a) u.s. Persons who are officers, directors, or shareholders in certain foreign corporations. Web the person that files form 5471 must complete form 5471 in the manner described in the instructions for item h. It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

All persons identified in item h must attach a statement to their income tax return that includes the information described in the instructions for item h. The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. Web changes to form.

IRS Issues Updated New Form 5471 What's New?

It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible penalties, and instructions for each section of the tax form. The draft instructions reflect a “watermark” date of december 12. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total).

Download Instructions for IRS Form 5471 Information Return of U.S

Shareholder, while a 5c filer is a related constructive u.s. Persons who are officers, directors, or shareholders in certain foreign corporations. Web the irs has provided a draft version of instructions for form 5471 for 2018. Web changes to form 5471. Draft version of the instructions[pdf 511 kb] for form 5471 for 2018.

Web The Person That Files Form 5471 Must Complete Form 5471 In The Manner Described In The Instructions For Item H.

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b, and 1c. Persons with respect to certain foreign corporations • read the. All persons identified in item h must attach a statement to their income tax return that includes the information described in the instructions for item h. It also describes the exceptions to filing, when to file, how to file, required form 5471 schedules, possible penalties, and instructions for each section of the tax form.

The Draft Instructions Reflect A “Watermark” Date Of December 12.

Follow the instructions below for an individual (1040) return, or. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. When and where to file. So, a 5a filer is an unrelated section 958(a) u.s.

Web Form 5471 Is Used By Certain U.s.

Form 5471[pdf 218 kb], information return of u.s. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. This article will help you generate form 5471 and any required schedules. Persons who are officers, directors, or shareholders in certain foreign corporations.

Web The Irs Has Provided A Draft Version Of Instructions For Form 5471 For 2018.

Web information about form 5471, information return of u.s. Shareholder who doesn't qualify as either a category 5b or 5c filer. The form and schedules are used to satisfy the filing requirements of sections 6038 and 6046, and the related regulations, as well as to report amounts related to section 965. Web changes to form 5471.