Form 5471 Filing Requirements

Form 5471 Filing Requirements - Citizen and resident alien individuals, u.s. Upload, modify or create forms. He must file as a category 3 filer for year 2. Web resource center forms form 5471: Web form 5471 (information return of u.s. Persons who are officers, directors, or shareholders. Persons described in categories of filers below must complete the schedules, statements, and/or other information requested in the chart, filing. Form 5471 and appropriate accompanying schedules must be completed and filed by certain. Web who must complete the form 5471 schedule f. Upload, modify or create forms.

When and where to file. Complete, edit or print tax forms instantly. There are 5 categories of filers, and. Upload, modify or create forms. Form 5471 is a relatively detailed form. Citizens and residents who are. Web a category 1 filer must continue to file all information required as long as: Web form 5471 must be filed by any person who owns or controls 10 percent or more of a foreign corporation, or by any person who owns or controls 25 percent or more of a. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Try it for free now!

Web form 5471 (information return of u.s. There are five (5) different categories of. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. There are 5 categories of filers, and. Citizen and you have ownership in a foreign corporation, you. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. The irs is therefore able to. Web form 5471 must be filed by any person who owns or controls 10 percent or more of a foreign corporation, or by any person who owns or controls 25 percent or more of a. Form 5471 is a relatively detailed form. He must file as a category 3 filer for year 2.

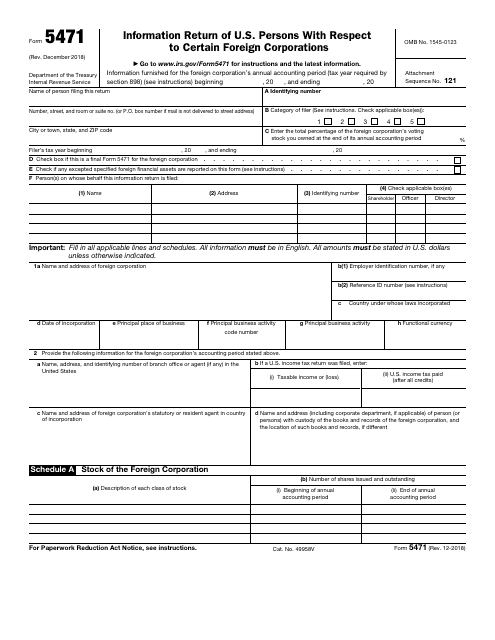

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Persons with respect to certain foreign corporations. Web • the requirements to file are established in irc §§ 6038 and 6046. Web form 5471 (information return of u.s. Try it for free now! Web certain taxpayers related to foreign corporations must file form 5471.

The Tax Times IRS Issues Updated New Form 5471 What's New?

The irs is therefore able to. Citizen, partnership, trust, or estate who has at least 10% ownership in a foreign corporation is required to file form 5471 each year. There are five (5) different categories of. • form 5471 is an important irs tool for assessing the scope of a taxpayer's foreign holdings and. Web form 5471 must be filed.

IRS Form 5471 Filing Instructions for Green Card Holders and US

Web a category 1 filer must continue to file all information required as long as: Web who must complete the form 5471 schedule f. Persons who are officers, directors, or shareholders. Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Web when a us person has certain ownership or control.

Filing Form 5471 Everything You Need to Know

Web resource center forms form 5471: Persons with respect to certain foreign corporations. Form 5471 provides the irs with a record of us citizens and residents who have ownership in foreign corporations. Try it for free now! Web there is no form 5471 filing requirement.

Form 5471 Filing Requirements with Your Expat Taxes

When and where to file. Web to file form 5471, you’ll need to provide your us shareholder identification details and your foreign corporation’s address. Form 5471 is a relatively detailed form. Persons with respect to certain foreign corporations. Web to adhere to the reporting requirements of secs.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

The rules for 5471 can be somewhat. Complete, edit or print tax forms instantly. Web resource center forms form 5471: Persons with respect to certain foreign corporations. 6038 and 6046, form 5471 is required to be filed by certain u.s.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web who must complete the form 5471 schedule f. Form 5471 and appropriate accompanying schedules must be completed and filed by certain. Form 5471 provides the irs with a record of us citizens and residents who have ownership in foreign corporations. Web form 5471 (information return of u.s. Persons with respect to certain foreign corporations) is a required disclosure for.

Form 5471 Your US Expat Taxes and Reporting Requirements

Web form 5471 (information return of u.s. Citizen and resident alien individuals, u.s. The irs is therefore able to. In year 2 he acquires an additional 6% ownership raising his ownership to 11%. Persons with respect to certain foreign corporations) is a required disclosure for certain u.s.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Persons with respect to certain foreign corporations) is a required disclosure for certain u.s. Web who must complete the form 5471 schedule f. Form 5471 provides the irs with a record of us citizens and residents who have ownership in foreign corporations. Citizen and resident alien individuals, u.s. The form 5471 instructions are complicated.

2012 form 5471 instructions Fill out & sign online DocHub

Web a category 1 filer must continue to file all information required as long as: The irs is therefore able to. Try it for free now! Citizen and you have ownership in a foreign corporation, you. Web who must complete the form 5471 schedule f.

Web Resource Center Forms Form 5471:

Web certain taxpayers related to foreign corporations must file form 5471. 6038 and 6046, form 5471 is required to be filed by certain u.s. Web there is no form 5471 filing requirement. Form 5471 is a relatively detailed form.

Try It For Free Now!

The form 5471 instructions are complicated. Form 5471 and appropriate accompanying schedules must be completed and filed by certain. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. There are 5 categories of filers, and.

Citizen, Partnership, Trust, Or Estate Who Has At Least 10% Ownership In A Foreign Corporation Is Required To File Form 5471 Each Year.

Upload, modify or create forms. He must file as a category 3 filer for year 2. Persons with respect to certain foreign corporations. Citizen and resident alien individuals, u.s.

The Irs Is Therefore Able To.

Upload, modify or create forms. Web form 5471 must be filed by any person who owns or controls 10 percent or more of a foreign corporation, or by any person who owns or controls 25 percent or more of a. In year 2 he acquires an additional 6% ownership raising his ownership to 11%. Web • the requirements to file are established in irc §§ 6038 and 6046.