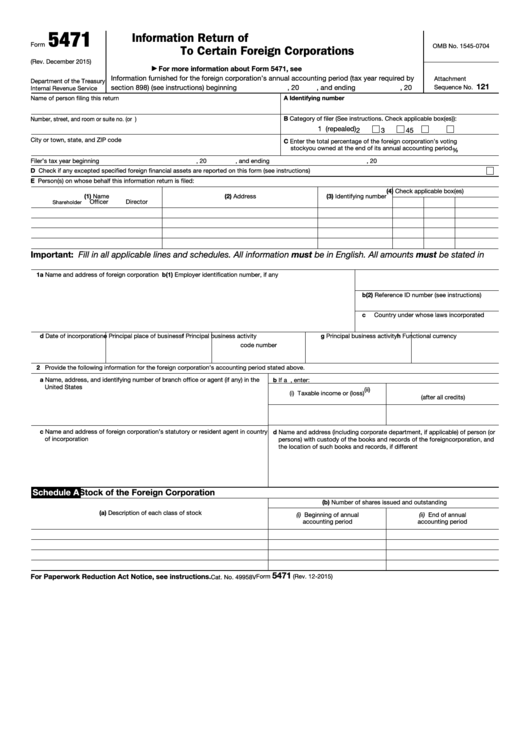

Form 5471 Requirements

Form 5471 Requirements - Web not filing form 5471 at all, filing it inaccurately, or filing it late will lead to certain penalties. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Taxpayer who has partial or total ownership of a foreign corporation. If you aren’t sure if you. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company. The form and schedules are used to satisfy. Web all information must be in english. Persons who are officers, directors, or shareholders in. Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038.

The form and schedules are used to satisfy. Web to adhere to the reporting requirements of secs. Web form 5471 is an informational tax form that must be filled out each year by any u.s. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Persons who are officers, directors, or shareholders in certain foreign corporations. 2 provide the following information for the foreign corporation’s. Form 5471 is what is known in the trade as an informational filing,. The penalty under irc section 6038 (b) (1) is $10,000 for each late or. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. During this course you will learn how to identify form 5471.

Citizen and resident alien individuals, u.s. Web to adhere to the reporting requirements of secs. Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Web form 5471 & instructions. Web all information must be in english. Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038. During this course you will learn how to identify form 5471. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. First, let’s clarify what a foreign corporation is. All amounts must be stated in u.s.

IRS Issues Updated New Form 5471 What's New?

The form and schedules are used to satisfy. Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Web all information must be in english. Taxpayer who has partial or total ownership of a foreign corporation. Web to adhere to the reporting requirements of secs.

Form 5471 Information Return of U.S. Persons with Respect to Certain

All amounts must be stated in u.s. Form 5471 is used by u.s. Web a filing obligation is an irs requirement to file a particular form or schedule with your tax returns. Form 5471 is what is known in the trade as an informational filing,. Web all information must be in english.

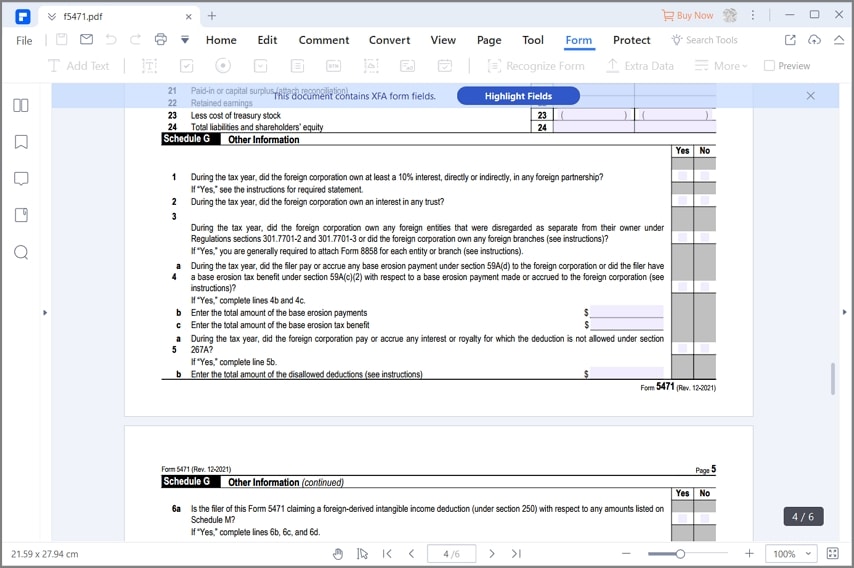

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Persons who are officers, directors, or shareholders in certain foreign corporations. Web what is form 5471? Web must be removed before printing. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. 2 provide the following information for the foreign corporation’s.

Form 5471 Your US Expat Taxes and Reporting Requirements

2 provide the following information for the foreign corporation’s. Web form 5471 & instructions. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for.

FORM 5471 TOP 6 REPORTING CHALLENGES Expat Tax Professionals

Taxpayer who has partial or total ownership of a foreign corporation. If you aren’t sure if you. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Form 5471 is used by u.s. Web certain taxpayers related to foreign corporations must file form 5471.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

2 provide the following information for the foreign corporation’s. Persons who are officers, directors, or shareholders in certain foreign corporations. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. First, let’s clarify what a foreign.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

If you aren’t sure if you. Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038. The form and schedules are used to satisfy. Form 5471 is used by certain u.s. Web to adhere to the reporting requirements of secs.

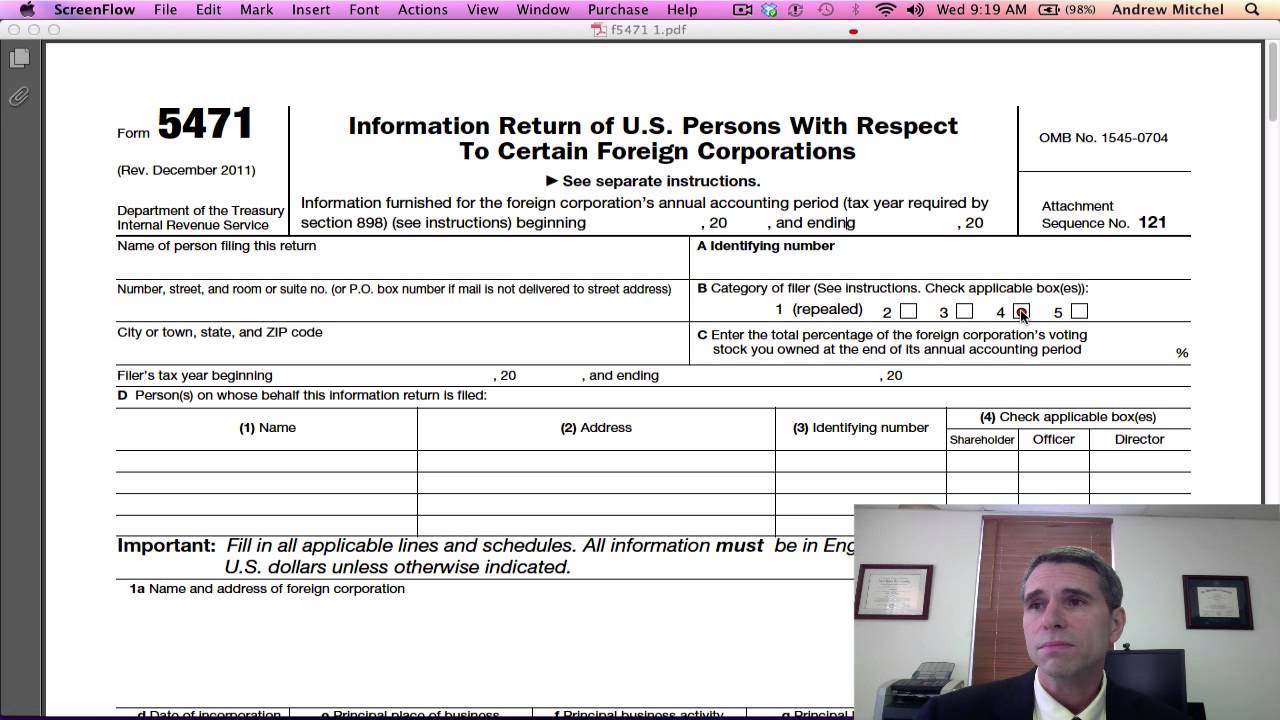

IRS Form 5471, Page1 YouTube

Web all information must be in english. 2 provide the following information for the foreign corporation’s. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Web not filing form 5471 at all, filing it inaccurately, or filing it late will lead to certain penalties. During this course you.

How to Fill out IRS Form 5471 (2020 Tax Season)

Persons who are officers, directors, or shareholders in. Taxpayer who has partial or total ownership of a foreign corporation. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Citizen and resident alien individuals, u.s. Web these changes add clarity but also increase the compliance burden and complexity.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

During this course you will learn how to identify form 5471. 6038 and 6046, form 5471 is required to be filed by certain u.s. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. For most individuals, that would be april 15th or, if you are an expat, june 15th. If you aren’t sure if you.

The Penalty Under Irc Section 6038 (B) (1) Is $10,000 For Each Late Or.

Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Form 5471 is used by u.s. Web a filing obligation is an irs requirement to file a particular form or schedule with your tax returns. Web unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income, expenses, and balance sheets for the company.

Web Form 5471 Requires Information And Details About The Corporation's Ownership, Stock Transactions, Shareholder And Company Transactions, Foreign Taxes, Foreign Bank And.

Persons involved in foreign corporations to satisfy federal reporting requirements under internal revenue code (irc) sections 6038. Web certain taxpayers related to foreign corporations must file form 5471. Taxpayer who has partial or total ownership of a foreign corporation. Form 5471 is used by certain u.s.

Web What Is Form 5471?

Citizen and resident alien individuals, u.s. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Web form 5471 is an informational tax form that must be filled out each year by any u.s. The form and schedules are used to satisfy.

2 Provide The Following Information For The Foreign Corporation’s.

Web these changes add clarity but also increase the compliance burden and complexity of completing the form 5471. Web must be removed before printing. All amounts must be stated in u.s. Web all information must be in english.