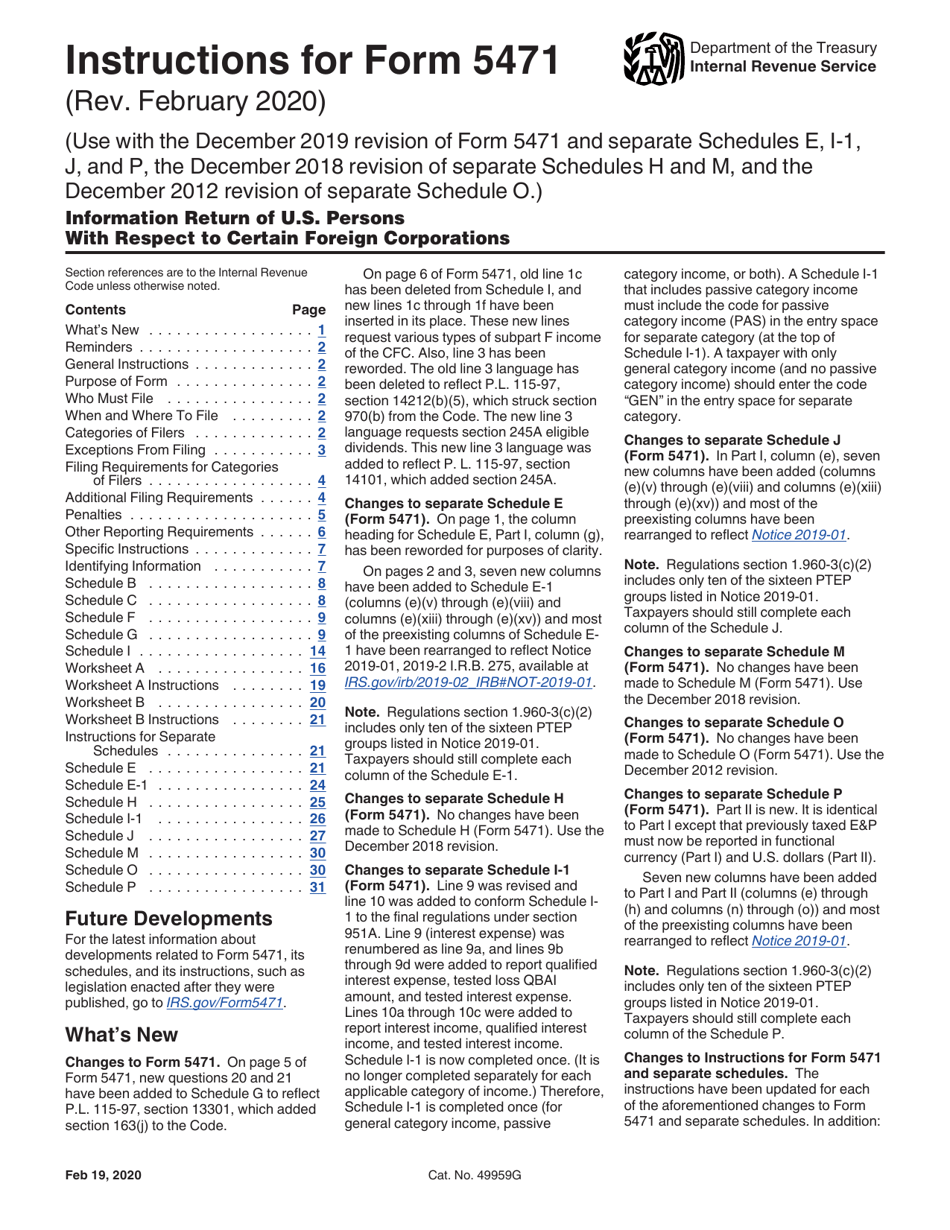

Form 5471 Sch E Instructions

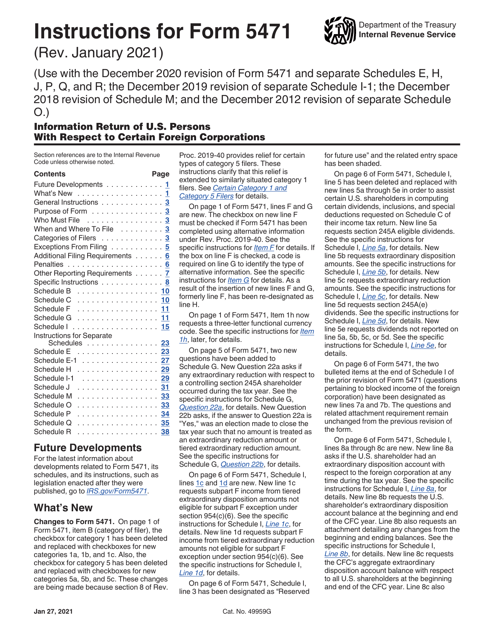

Form 5471 Sch E Instructions - As said, these are all u.s. Who must complete schedule h. Web this article will help you generate form 5471 and any required schedules. Shareholder of certain foreign corporations attach to form 5471. Web the form 5471 schedules are: Form 5471 filers generally use the same category of filer codes used on form 1118. Form 5471 schedule m is only required for filers from category four. Persons who had control of a foreign corporation. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Possession for the foreign corporation’s foreign tax year (s).

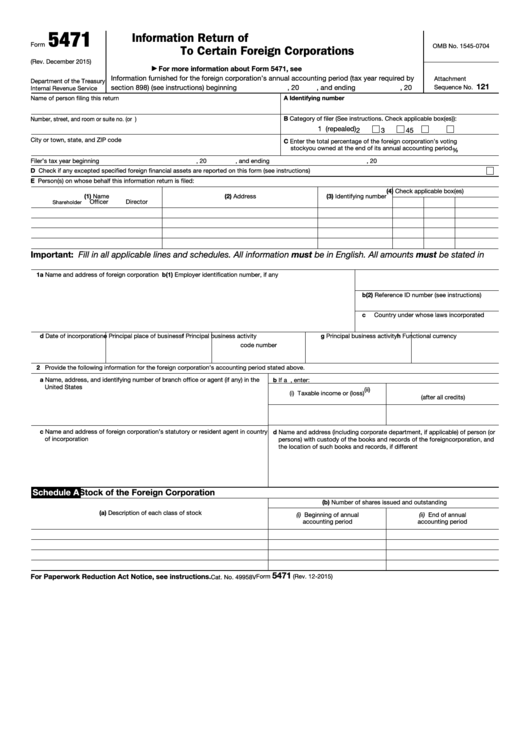

The category of filer checkboxes control which schedules on. Web how to prepare schedule p form 5471 ptep. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. And the december 2012 revision of separate schedule o.) Web follow these steps to generate and complete form 5471 in the program: The december 2020 revision of separate schedules j, p, and r; This schedule is not an income tax return to report foreign tax, but rather an information return of u.s. The purpose of the form 5471 schedule m is to report transactions between the cfc and its shareholders or related parties. Follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Web schedule p draft as of (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s.

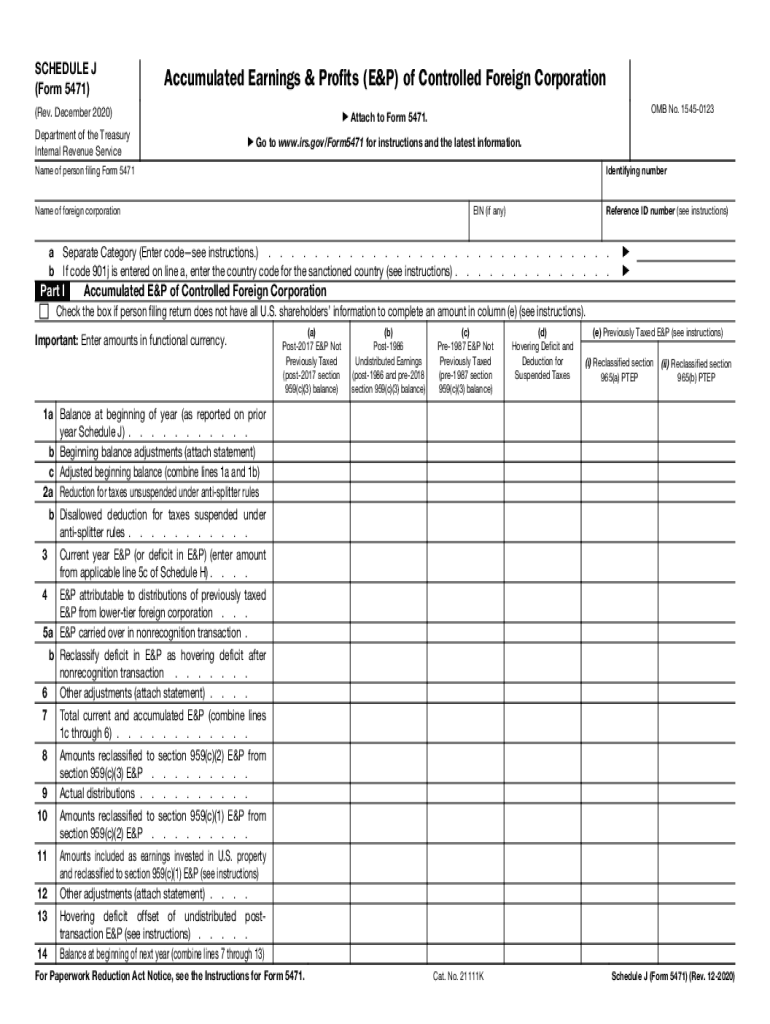

Exploring the (new) 2021 schedule j of form 5471: January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; This schedule is not an income tax return to report foreign tax, but rather an information return of u.s. The schedule j, the accumulated earnings and profits or e&p of a controlled foreign corporation. Web what is schedule m form 5471. Web how to prepare schedule p form 5471 ptep. 71397a schedule e (form 5471) (rev. This is especially true for a cfc (controlled foreign corporation). When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. The category of filer checkboxes control which schedules on.

Download Instructions for IRS Form 5471 Information Return of U.S

The december 2020 revision of separate schedules j, p, and r; This schedule is not an income tax return to report foreign tax, but rather an information return of u.s. Web follow these steps to generate and complete form 5471 in the program: Anyone preparing a form 5471 knows that the. Web the form 5471 schedules are:

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Citizen or resident described in category 2 must complete part i. Follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Web (new) 2021 schedule j of form 5471. Web.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

The category of filer checkboxes control which schedules on. Web instructions for form 5471(rev. Form 5471 filers generally use the same category of filer codes used on form 1118. Shareholder of certain foreign corporations attach to form 5471. Web schedule e (form 5471) (rev.

IRS Issues Updated New Form 5471 What's New?

Web this article will help you generate form 5471 and any required schedules. Recently, schedule h was revised. Web for paperwork reduction act notice, see instructions. E organization or reorganization of foreign corporation. Form 5471 filers generally use the same category of filer codes used on form 1118.

Download Instructions for IRS Form 5471 Information Return of U.S

Recently, schedule h was revised. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. The category of filer checkboxes control which schedules on. The december 2018 revision of schedule m; The schedule j, the accumulated earnings and profits or e&p of a controlled foreign corporation.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Persons designed to measure controlled foreign corporation (“cfc. Citizen or resident described in category 2 must complete part i. Who must complete schedule h.

IRS Form 5471 Carries Heavy Penalties and Consequences

Possession for the foreign corporation’s foreign tax year (s). On page 1, the column heading for schedule e, part i, column (g), has been reworded for purposes of clarity. This schedule is not an income tax return to report foreign tax, but rather an information return of u.s. Recently, schedule h was revised. Web schedule e (form 5471) (rev.

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

The december 2020 revision of separate schedules j, p, and r; Web how to prepare schedule p form 5471 ptep. Web schedule p draft as of (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s. Web (new) 2021 schedule j of form 5471. Persons with respect to certain foreign corporations

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Web (new) 2021 schedule j of form 5471. Go to www.irs.gov/form5471 for instructions and the latest information. Web schedule p draft as of (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s. Web follow these steps to generate and complete form 5471 in the program: Web schedule e (form 5471) (rev.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Form 5471 filers generally use the same category of filer codes used on form 1118. Web as provided for in the instructions for the form: Recently, schedule h was revised. The december 2018 revision of schedule m; Citizen or resident described in category 2 must complete part i.

Citizen Or Resident Described In Category 2 Must Complete Part I.

Web as provided for in the instructions for the form: Web schedule p draft as of (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

Web The Form 5471 Schedules Are:

And the december 2012 revision of separate schedule o.) January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; The december 2020 revision of separate schedules j, p, and r; File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

Exploring How To Prepare Schedule P Form 5471 Ptep:

Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Persons who had control of a foreign corporation. This article is designed to supplement the irs instructions to the form 5471. Recently, schedule h was revised.

Anyone Preparing A Form 5471 Knows That The.

Form 5471 filers generally use the same category of filer codes used on form 1118. As said, these are all u.s. Persons designed to measure controlled foreign corporation (“cfc. The schedule j, the accumulated earnings and profits or e&p of a controlled foreign corporation.