Form 5500 Health Insurance

Form 5500 Health Insurance - Web on the first day of their employee retirement income security act ( erisa) plan year (which is different than the policy year), if a company had 100 or more. Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year. The section what to file summarizes what information must be reported for different types of plans and. Web form 5500 will vary according to the type of plan or arrangement. Web find missouri health insurance options at many price points. Web who is considered a participant when determining if a form 5500 is required? Filings for plan years prior to 2009 are not. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web form 5500 consists of the main form, in addition to various schedules and attachments that supplement the comprehensiveness of the main form. Web additionally, the form 5500 is the primary public disclosure document for participating employers, plan participants and beneficiaries, and the public to monitor the.

Web part i information concerning insurance contract coverage, fees, and commissions provide information for each contract on a separate schedule a. Plans protected by erisa and. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web form 5500 consists of the main form, in addition to various schedules and attachments that supplement the comprehensiveness of the main form. Web the form 5500 series was created under the internal revenue code and titles i and iv of the employee retirement income security act (erisa) to collect. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). Web find common forms you need for insurance claims, online account setup, beneficiary changes and more, ready to download and print for your convenience. Information reporting under sections 6055 and 6056 (forms 1094 & 1095). Web form 5500 will vary according to the type of plan or arrangement. Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year.

Web who is considered a participant when determining if a form 5500 is required? The section what to file summarizes what information must be reported for different types of plans and. Web part i information concerning insurance contract coverage, fees, and commissions provide information for each contract on a separate schedule a. Web form 5500 consists of the main form, in addition to various schedules and attachments that supplement the comprehensiveness of the main form. Plans protected by erisa and. Web the form 5500 series was created under the internal revenue code and titles i and iv of the employee retirement income security act (erisa) to collect. Filings for plan years prior to 2009 are not. Web axcet’s benefits options typically include health, dental, vision, disability and life insurance, as well as an employee assistance plan, health savings accounts (hsa) and flexible. Web find missouri health insurance options at many price points. Web health insurance exchanges (marketplaces) individual mandates;

irs form 5500 instructions 2014 Fill out & sign online DocHub

Web who is considered a participant when determining if a form 5500 is required? Web find common forms you need for insurance claims, online account setup, beneficiary changes and more, ready to download and print for your convenience. Filings for plan years prior to 2009 are not. Web this form is required to be filed for employee benefit plans under.

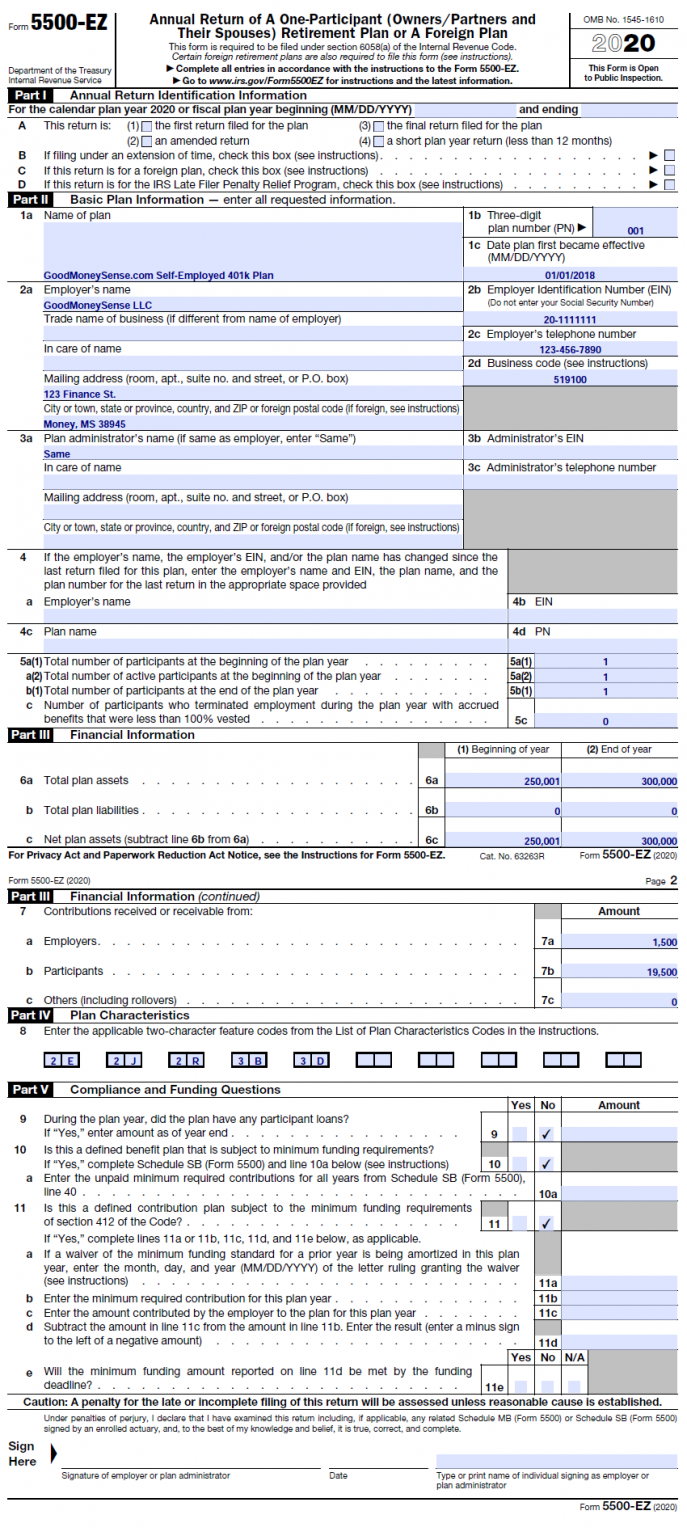

Solo 401k Reporting Requirements Solo 401k

Web additionally, the form 5500 is the primary public disclosure document for participating employers, plan participants and beneficiaries, and the public to monitor the. Web form 5500 consists of the main form, in addition to various schedules and attachments that supplement the comprehensiveness of the main form. Web find missouri health insurance options at many price points. Web find common.

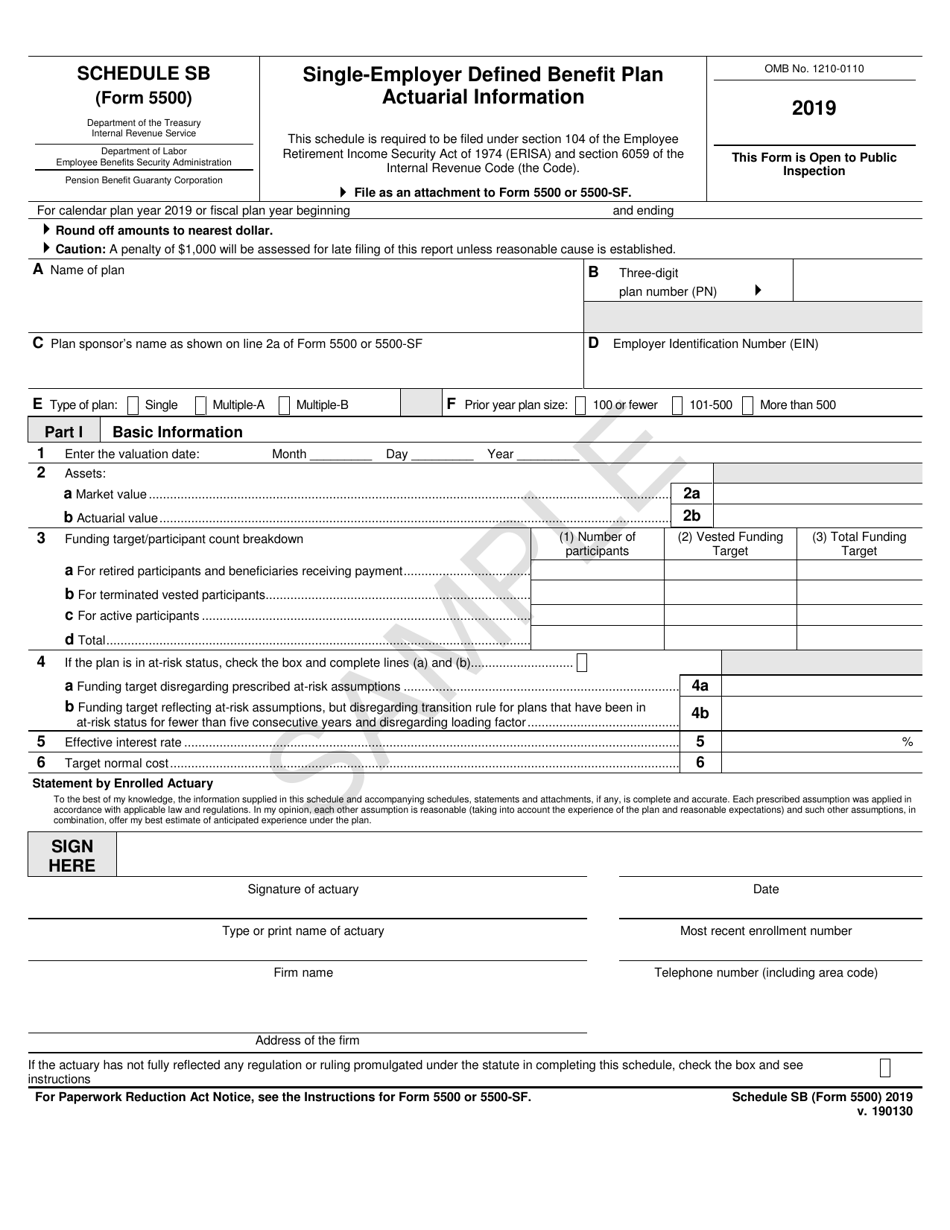

IRS Form 5500 Schedule SB Download Fillable PDF or Fill Online Single

Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year. Plans protected by erisa and. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa).

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Filings for plan years prior to 2009 are not. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). Web on the first day of their employee retirement income security act ( erisa) plan year (which is different than the.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web form 5500 will vary according to the type of plan or arrangement. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b)..

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

The section what to file summarizes what information must be reported for different types of plans and. Web on the first day of their employee retirement income security act ( erisa) plan year (which is different than the policy year), if a company had 100 or more. Web form 5500 consists of the main form, in addition to various schedules.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web on the first day of their employee retirement income security act ( erisa) plan year (which is different than the policy year), if a company had 100 or more. Web health insurance exchanges (marketplaces) individual mandates; Web find missouri health insurance options at many price points. Web part i information concerning insurance contract coverage, fees, and commissions provide information.

Form 5500 Search What You Need To Know Form 5500

Posting on the web does not constitute acceptance of the filing by. Web find missouri health insurance options at many price points. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b). Plans protected by erisa and. Web form 5500.

form 5500 filing requirements for health plans Fill Online, Printable

The section what to file summarizes what information must be reported for different types of plans and. Web additionally, the form 5500 is the primary public disclosure document for participating employers, plan participants and beneficiaries, and the public to monitor the. Information reporting under sections 6055 and 6056 (forms 1094 & 1095). Web most health and welfare plans with more.

Slide Deck Advanced Prospecting with the Form 5500 Judy Diamond

Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year. Web part i information concerning insurance contract coverage, fees, and commissions provide information for each contract on a separate schedule a. Information reporting under sections 6055 and 6056 (forms 1094 & 1095)..

Web Find Missouri Health Insurance Options At Many Price Points.

Web who is considered a participant when determining if a form 5500 is required? Information reporting under sections 6055 and 6056 (forms 1094 & 1095). This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web this form is required to be filed for employee benefit plans under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and sections 6057(b).

Web Form 5500 Consists Of The Main Form, In Addition To Various Schedules And Attachments That Supplement The Comprehensiveness Of The Main Form.

The section what to file summarizes what information must be reported for different types of plans and. Web on the first day of their employee retirement income security act ( erisa) plan year (which is different than the policy year), if a company had 100 or more. Plans protected by erisa and. Web find common forms you need for insurance claims, online account setup, beneficiary changes and more, ready to download and print for your convenience.

Web Additionally, The Form 5500 Is The Primary Public Disclosure Document For Participating Employers, Plan Participants And Beneficiaries, And The Public To Monitor The.

Filings for plan years prior to 2009 are not. Web part i information concerning insurance contract coverage, fees, and commissions provide information for each contract on a separate schedule a. Web health insurance exchanges (marketplaces) individual mandates; Web the form 5500 series was created under the internal revenue code and titles i and iv of the employee retirement income security act (erisa) to collect.

Posting On The Web Does Not Constitute Acceptance Of The Filing By.

Web form 5500 will vary according to the type of plan or arrangement. Web axcet’s benefits options typically include health, dental, vision, disability and life insurance, as well as an employee assistance plan, health savings accounts (hsa) and flexible. Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)