Form 5500 Instructions

Form 5500 Instructions - Schedule b (form 5500) part 2 8 hr., 39 min. Other form 5500 data sets. Form 5500 raw data sets. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Form 5500 version selection tool. For more detailed information on how to file, see the efast2 faqs and other publications. Schedule c (form 5500) 5 hr., 16 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Web form 5500 is a report detailing a company’s employee benefits.

Other form 5500 data sets. Schedule b (form 5500) part 2 8 hr., 39 min. Web form 5500 annual return/report of employee benefit plan | instructions; Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. For more detailed information on how to file, see the efast2 faqs and other publications. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web schedule a (form 5500) 17 hr., 28 min. Form 5500 version selection tool.

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. For more detailed information on how to file, see the efast2 faqs and other publications. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Other form 5500 data sets. Form 5500 raw data sets. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web schedule a (form 5500) 17 hr., 28 min. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web form 5500 annual return/report of employee benefit plan | instructions; We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year.

Form 5500 Instructions 5 Steps to Filing Correctly

Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min. Form 5500 raw data sets. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Form 5500 version selection tool. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively.

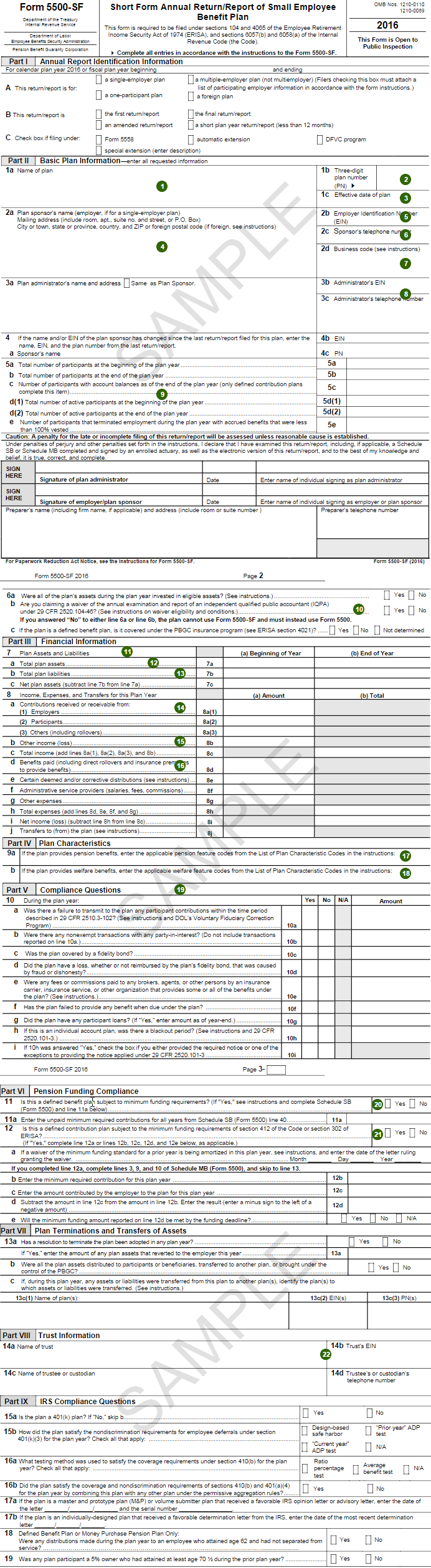

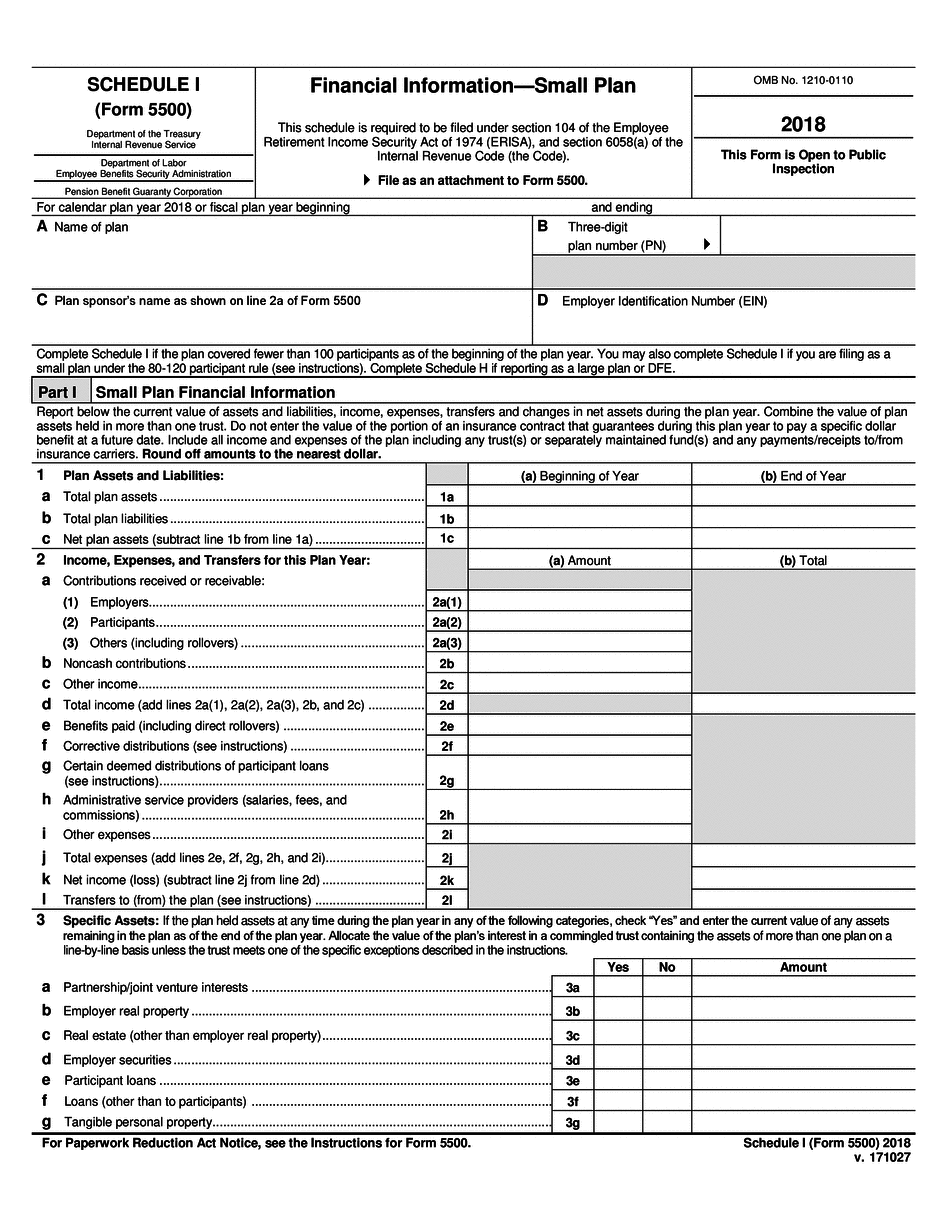

Understanding the Form 5500 for Defined Benefit Plans Fidelity

Form 5500 raw data sets. Schedule c (form 5500) 5 hr., 16 min. Web form 5500 annual return/report of employee benefit plan | instructions; Web schedule a (form 5500) 17 hr., 28 min. Other form 5500 data sets.

Understanding the Form 5500 for Defined Contribution Plans Fidelity

Form 5500 raw data sets. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web form 5500 is a report detailing a company’s employee benefits. Schedule c (form 5500) 5 hr., 16 min. Web form 5500 annual return/report of employee benefit plan | instructions;

Form 5500 Instructions 5 Steps to Filing Correctly

Web form 5500 annual return/report of employee benefit plan | instructions; Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Schedule b (form 5500) part 2 8 hr., 39 min. Other form 5500 data sets.

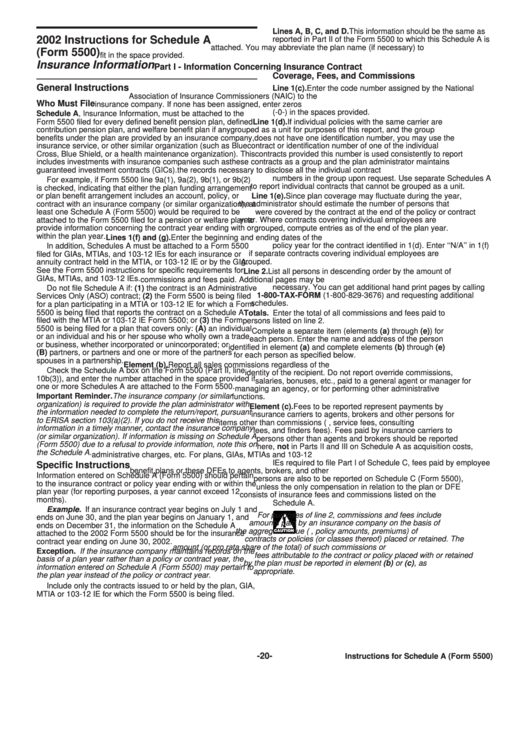

Form 5500 Schedule A Instructions Insurance Information 2002

Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Form 5500 version selection tool. Schedule c (form 5500) 5 hr., 16 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2 min.

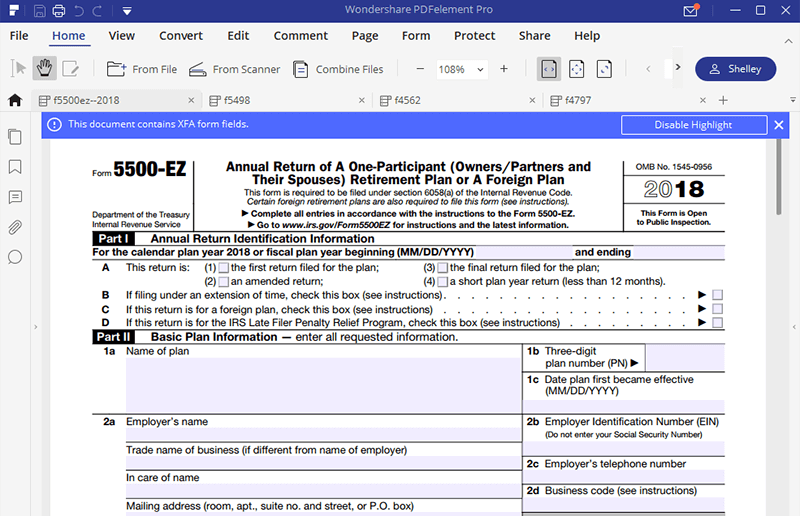

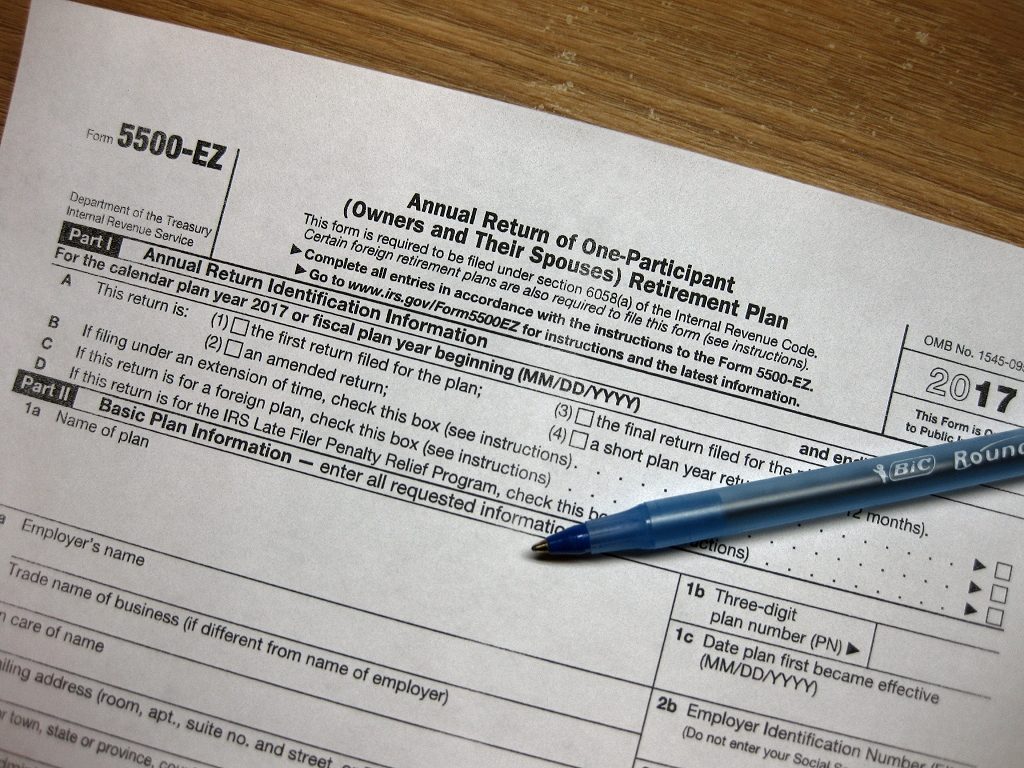

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web form 5500 is a report detailing a company’s employee benefits. Form 5500 version selection tool. Schedule c (form 5500) 5 hr., 16 min. Web schedule a (form 5500) 17 hr., 28 min.

Form 5500 Instructions 5 Steps to Filing Correctly

Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web form 5500 annual return/report of employee benefit plan | instructions; Schedule b (form 5500) part 2 8 hr., 39 min. Other form 5500 data sets. Schedule e (form 5500) (leveraged esop) 1 hr., 56 min.10 hr., 2.

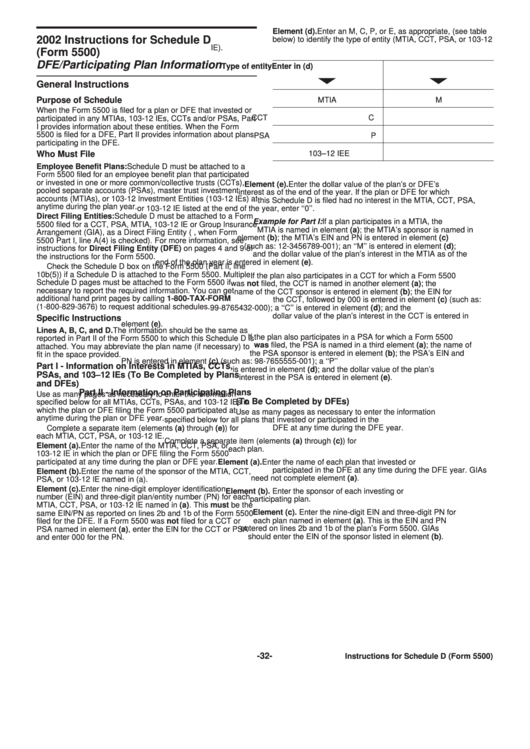

Instructions For Schedule D (Form 5500) Dfe/participating Plan

Web schedule a (form 5500) 17 hr., 28 min. Form 5500 raw data sets. For more detailed information on how to file, see the efast2 faqs and other publications. Web form 5500 is a report detailing a company’s employee benefits. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web form 5500 is a report detailing a company’s employee benefits. Web schedule a (form 5500) 17 hr., 28 min. Schedule b (form 5500) part 2 8 hr., 39 min. Schedule e (form 5500) (leveraged esop) 1 hr., 56.

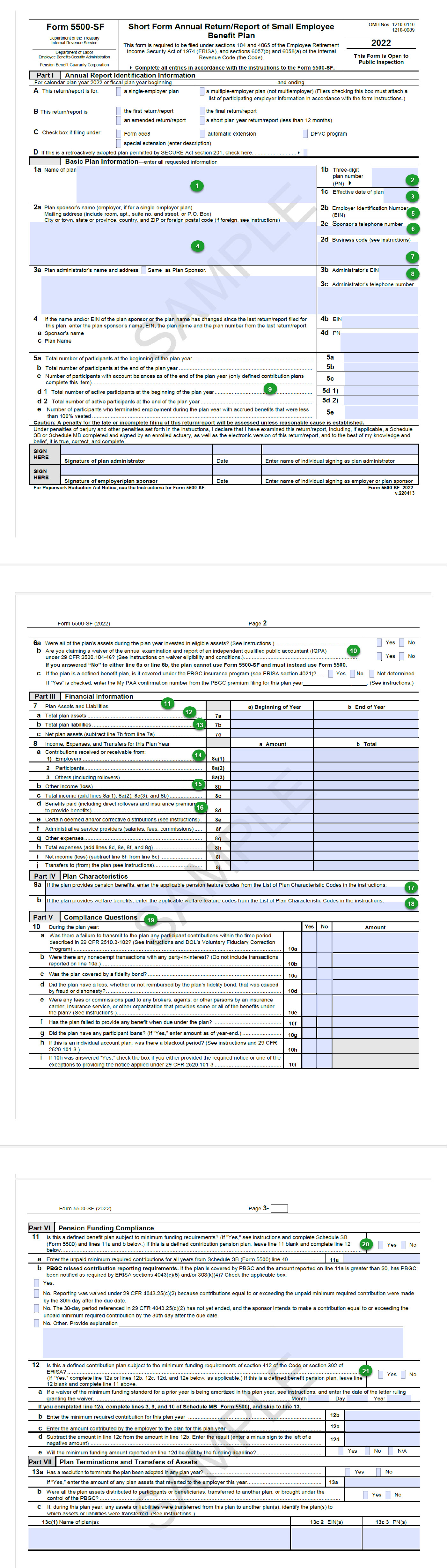

form 5500 instructions 2022 Fill Online, Printable, Fillable Blank

Schedule b (form 5500) part 2 8 hr., 39 min. Pension benefit plan all pension benefit plans covered by erisa must file an annual return/report except as provided in this section. Web schedule a (form 5500) 17 hr., 28 min. Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. Web form 5500 is a report detailing a company’s.

Schedule E (Form 5500) (Leveraged Esop) 1 Hr., 56 Min.10 Hr., 2 Min.

Web form 5500 annual return/report of employee benefit plan | instructions; Schedule b (form 5500) part 2 8 hr., 39 min. Schedule c (form 5500) 5 hr., 16 min. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets.

Pension Benefit Plan All Pension Benefit Plans Covered By Erisa Must File An Annual Return/Report Except As Provided In This Section.

Other form 5500 data sets. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. For more detailed information on how to file, see the efast2 faqs and other publications. Web schedule a (form 5500) 17 hr., 28 min.

Form 5500 Version Selection Tool.

Schedule e (form 5500) (nonleveraged esop) 13 min.1 hr., 12 min. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web form 5500 is a report detailing a company’s employee benefits. Form 5500 raw data sets.