Form 568 Instructions 2020

Form 568 Instructions 2020 - Web forms & instructions 568 2020 limited liability company tax booklet members of the franchise tax board betty t. If your llc files on an extension, refer to payment for automatic extension for. Web 100s form (pdf) | 100s booklet (instructions included) federal: 2015 instructions for form 568, limited liability company return of income references in these instructions. Line 1—total income from schedule iw. The llc is doing business in california. Web your llc in california will need to file form 568 each year. Application and interpretation of public law 86. 2020 instructions for schedule ca (540) references in these instructions are to the internal. To fill it out, you must pay.

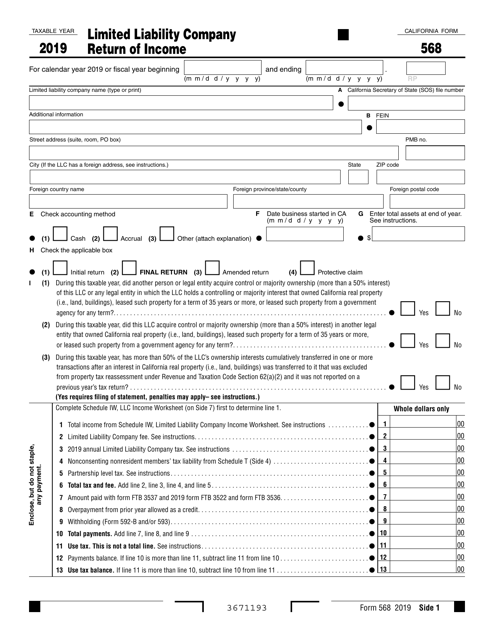

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: If your llc files on an extension, refer to payment for automatic extension for. Web how to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. The llc is organized in. Line 1—total income from schedule iw. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web forms & instructions 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Application and interpretation of public law 86. However, you cannot use form 568 to.

Web 100s form (pdf) | 100s booklet (instructions included) federal: If your llc files on an extension, refer to payment for automatic extension for. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. The llc is organized in. Those instructions provide that an llc will not be assessed the annual tax if. 2020 instructions for schedule ca (540) references in these instructions are to the internal. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Line 1—total income from schedule iw. Web the 2012 800 annual tax is due on or before the 15th day of the 4th month after the beginning of the 2012 taxable year fiscal year or april 17 2012 calendar year. The llc is doing business in california.

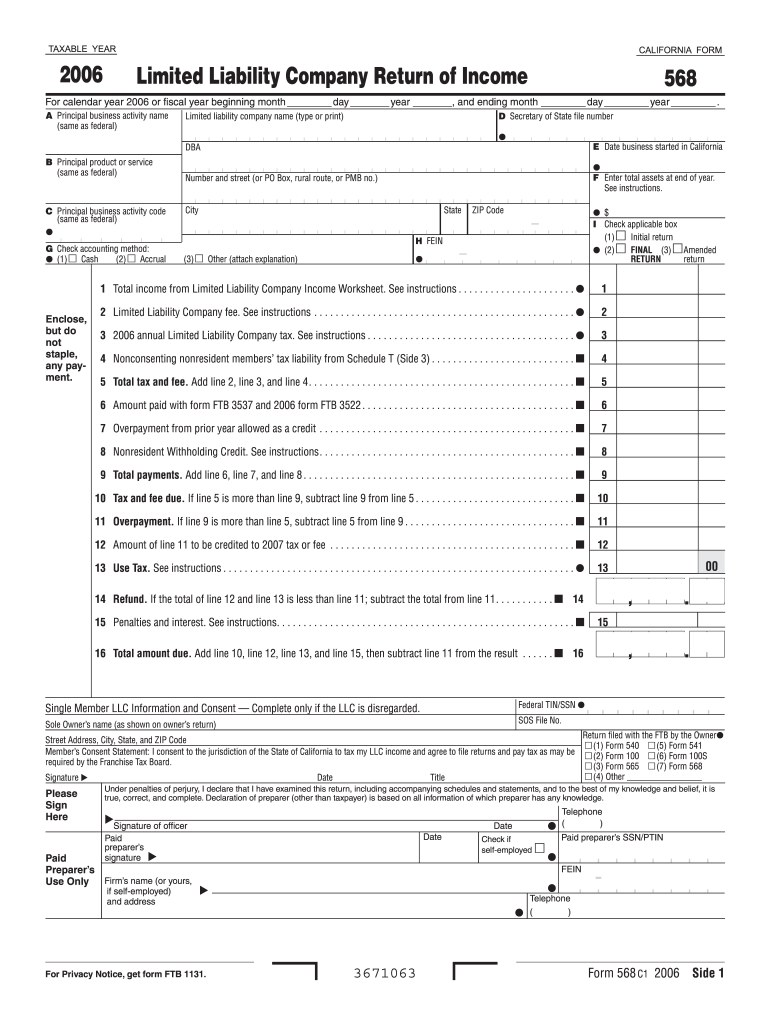

Form 568 Limited Liability Company Return of Fill Out and Sign

To fill it out, you must pay. 2020 instructions for schedule ca (540) references in these instructions are to the internal. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Web file limited liability company return of income (form 568) by the original return due.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

The llc is doing business in california. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web •.

Form 568 instructions 2013

However, you cannot use form 568 to. Those instructions provide that an llc will not be assessed the annual tax if. 2015 instructions for form 568, limited liability company return of income references in these instructions. An extension of time to file is not an. If your llc files on an extension, refer to payment for automatic extension for.

Form 1040 Instructions 2020

Web page 2 and to the california revenue and taxation code (r&tc). The llc fee and franchise tax will be taken into consideration. Web perhaps your (2) option is the best option given the 2021 instructions for form 568. Web the 2012 800 annual tax is due on or before the 15th day of the 4th month after the beginning.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

The llc fee and franchise tax will be taken into consideration. Web perhaps your (2) option is the best option given the 2021 instructions for form 568. Web the 2012 800 annual tax is due on or before the 15th day of the 4th month after the beginning of the 2012 taxable year fiscal year or april 17 2012 calendar.

Form 568 Instructions 2022 2023 State Tax TaxUni

The llc fee and franchise tax will be taken into consideration. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: To fill it out, you must pay. Application and interpretation of public law 86. 2020 instructions for schedule ca (540) references in these instructions are to the.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

The llc is doing business in california. Web page 2 and to the california revenue and taxation code (r&tc). Web how to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Web form 568 must be filed by every llc that is not taxable as a corporation if any of.

Form 568 Instructions 2022 State And Local Taxes Zrivo

2020 instructions for schedule ca (540) references in these instructions are to the internal. The llc is doing business in california. Web forms & instructions 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web how to fill in california form 568 if you have an llc, here’s how to fill in the california.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

Web perhaps your (2) option is the best option given the 2021 instructions for form 568. An extension of time to file is not an. Web • form 100s, california s corporation franchise or income tax return • form 100x, amended corporation franchise or income tax return • form 199, california exempt. 2015 instructions for form 568, limited liability company.

568 Instructions Fill Out and Sign Printable PDF Template signNow

Web the 2012 800 annual tax is due on or before the 15th day of the 4th month after the beginning of the 2012 taxable year fiscal year or april 17 2012 calendar year. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. The llc.

Web To Generate Form 568, Limited Liability Company Return Of Income, Choose File > Client Properties, Click The California Tab, And Mark The Limited Liability Company Option.

Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Web this will allow for fully calculating return, extensions, filing instructions, and grouping of multiple federal activities into a single limited liability company (llc) activity. The llc is doing business in california. To fill it out, you must pay.

Web Your Llc In California Will Need To File Form 568 Each Year.

Web the 2012 800 annual tax is due on or before the 15th day of the 4th month after the beginning of the 2012 taxable year fiscal year or april 17 2012 calendar year. Those instructions provide that an llc will not be assessed the annual tax if. Line 1—total income from schedule iw. Web page 2 and to the california revenue and taxation code (r&tc).

Web Form 568 Must Be Filed By Every Llc That Is Not Taxable As A Corporation If Any Of The Following Apply:

The llc is organized in. Web forms & instructions 568 2020 limited liability company tax booklet members of the franchise tax board betty t. However, you cannot use form 568 to. 2015 instructions for form 568, limited liability company return of income references in these instructions.

Application And Interpretation Of Public Law 86.

2020 instructions for schedule ca (540) references in these instructions are to the internal. Web how to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Web • form 100s, california s corporation franchise or income tax return • form 100x, amended corporation franchise or income tax return • form 199, california exempt. Web perhaps your (2) option is the best option given the 2021 instructions for form 568.