Form 593 Instructions 2022

Form 593 Instructions 2022 - 2 months and 15 days past the start of the tax year in which the election is to be effective. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Form 593, real estate withholding. The new form is a combination of the prior: Verify form 593 is signed if the seller. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Web $100,000 or less in foreclosure seller is a bank acting as a trustee see form 593, part iii for a complete list of full exemptions, and part iv for full or partial exemptions. When you reach take a. 593 real estate withholding tax statement report withholding on real estate sales or transfers. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of.

Web california real estate withholding. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web on january 1, 2020, our new form 593, real estate withholding statement went live. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: 593 real estate withholding tax statement report withholding on real estate sales or transfers. Form 593, real estate withholding. Confirm only california income tax withheld is claimed. First, complete your state return. Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. Sign it in a few clicks draw your signature, type it,.

File your california and federal tax returns online with turbotax in minutes. Web your california real estate withholding has to be entered on both the state and the federal return. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Sign it in a few clicks draw your signature, type it,. Web california real estate withholding. Confirm only california income tax withheld is claimed. Verify form 593 is signed if the seller. When you reach take a. See instructions for form 593, part iv. The new form is a combination of the prior:

Form 593 C 2020 slidesharetrick

Web $100,000 or less in foreclosure seller is a bank acting as a trustee see form 593, part iii for a complete list of full exemptions, and part iv for full or partial exemptions. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. If the organization adheres to. If you.

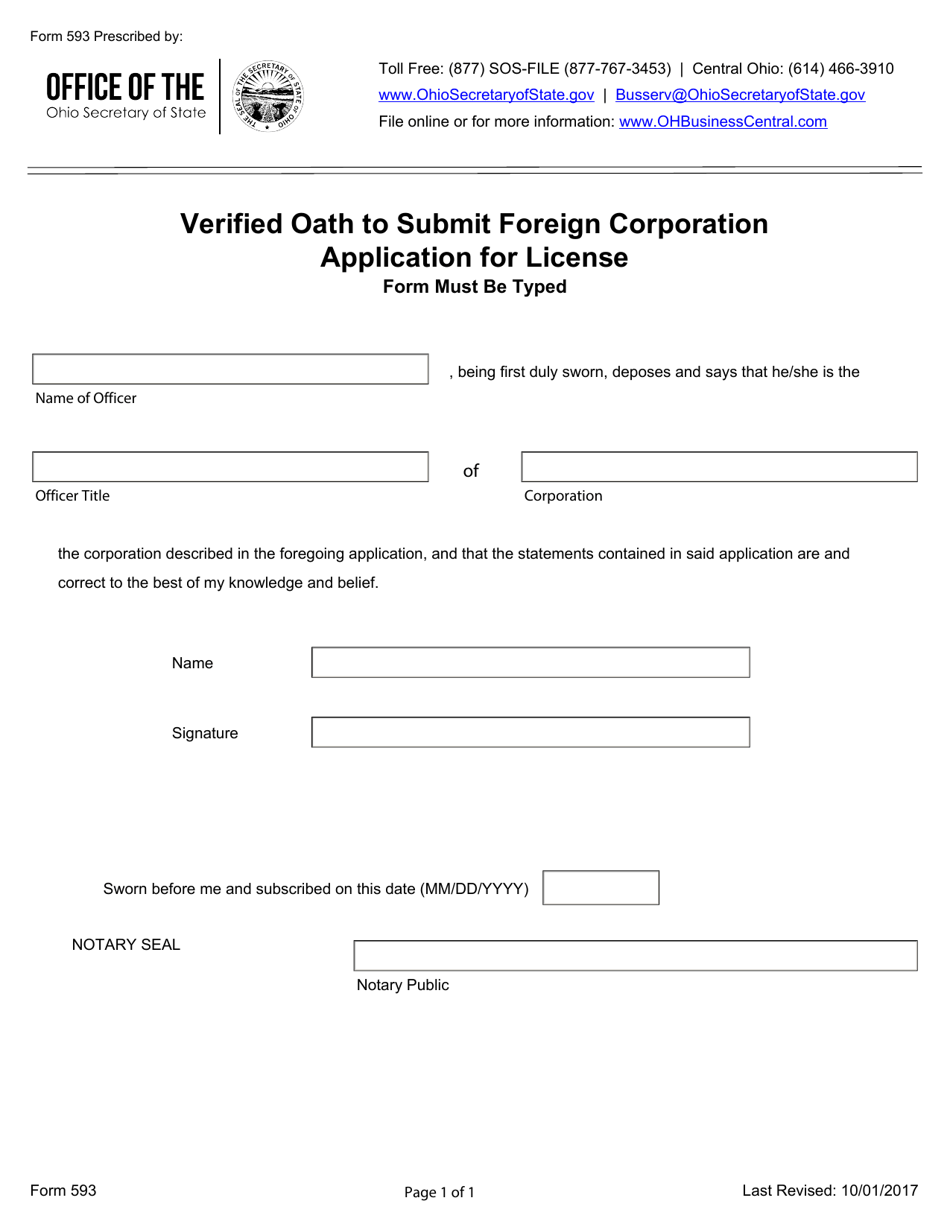

Form 593 Download Fillable PDF or Fill Online Verified Oath to Submit

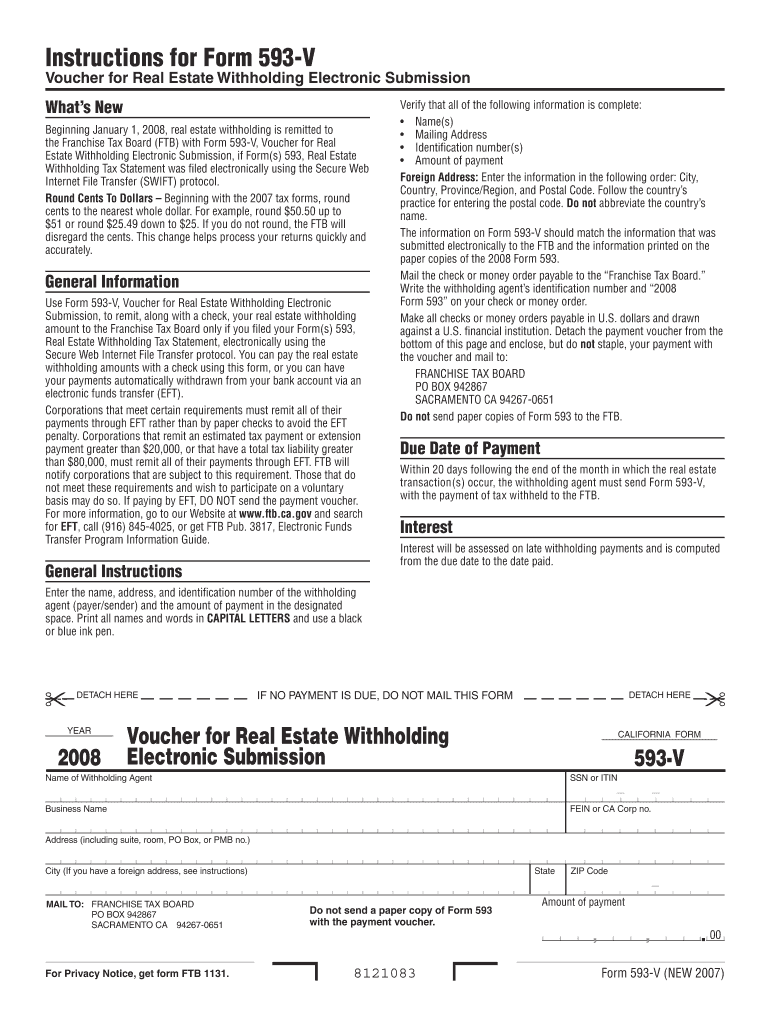

2 months and 15 days past the start of the tax year in which the election is to be effective. Sign it in a few clicks draw your signature, type it,. Payment voucher for real estate withholding. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the.

Form 593 C slidesharetrick

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. If the organization adheres to. Form 593, real estate withholding. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale.

Form 593V Franchise Tax Board Edit, Fill, Sign Online Handypdf

Verify form 593 is signed if the seller. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. Web your california real estate.

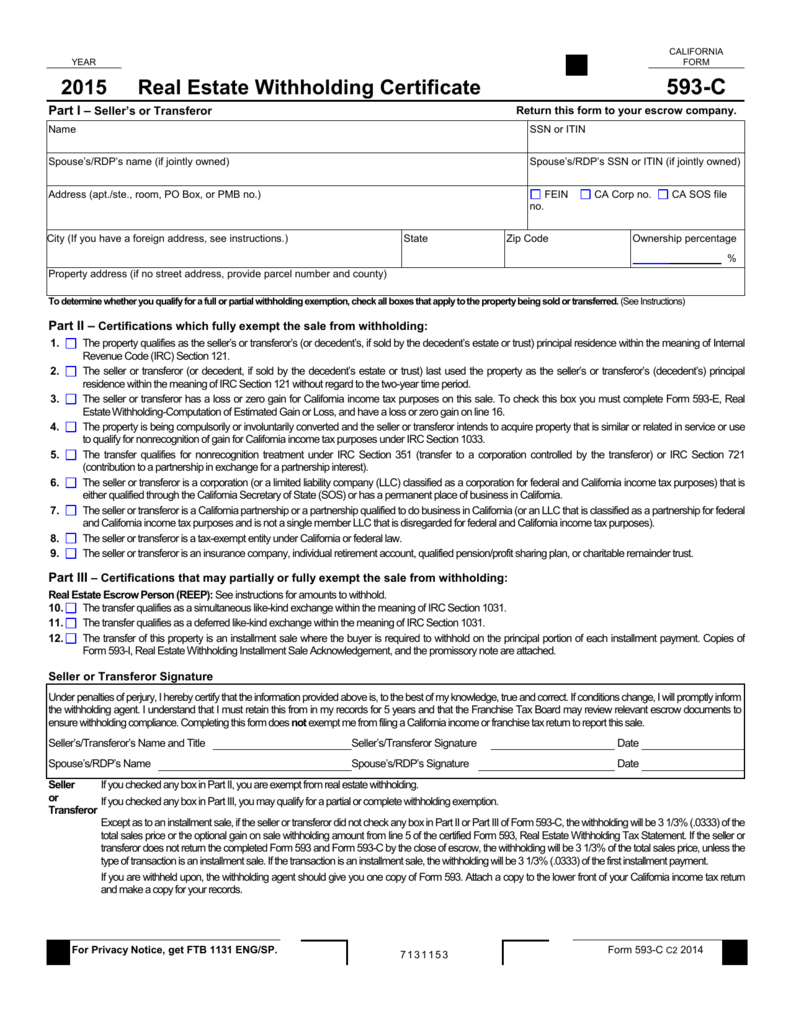

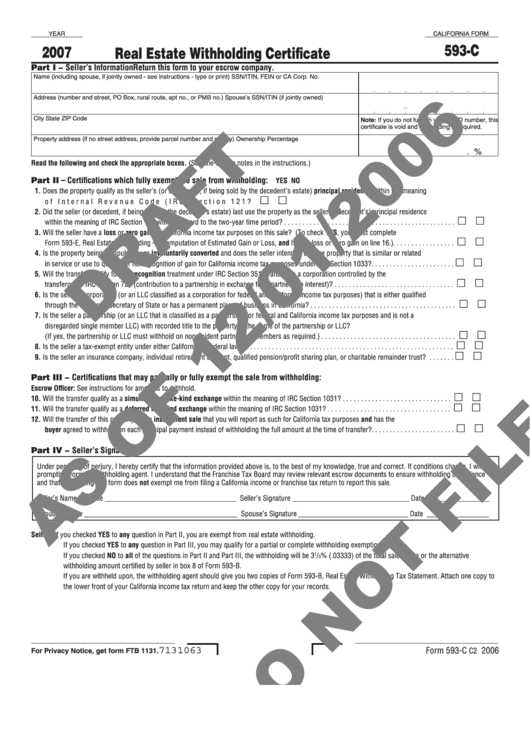

Fillable California Form 593C Real Estate Withholding Certificate

Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. If the organization adheres to. Inputs for ca form 593,. Web your california real estate withholding has to be entered on both the state and the federal return. File your california and federal.

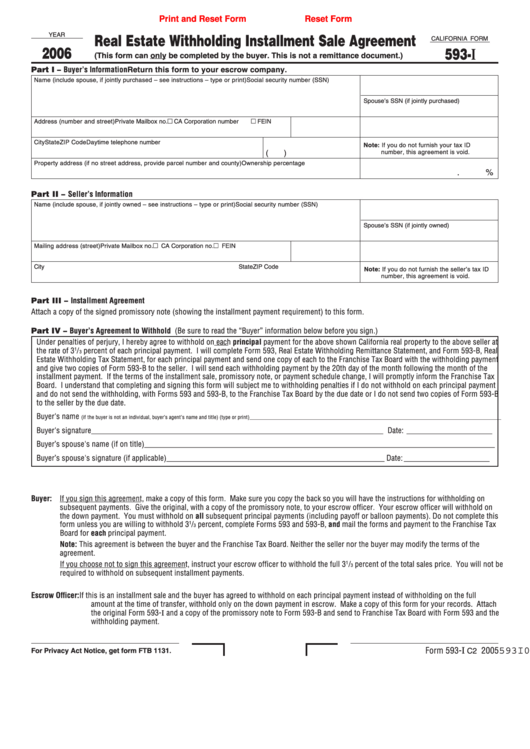

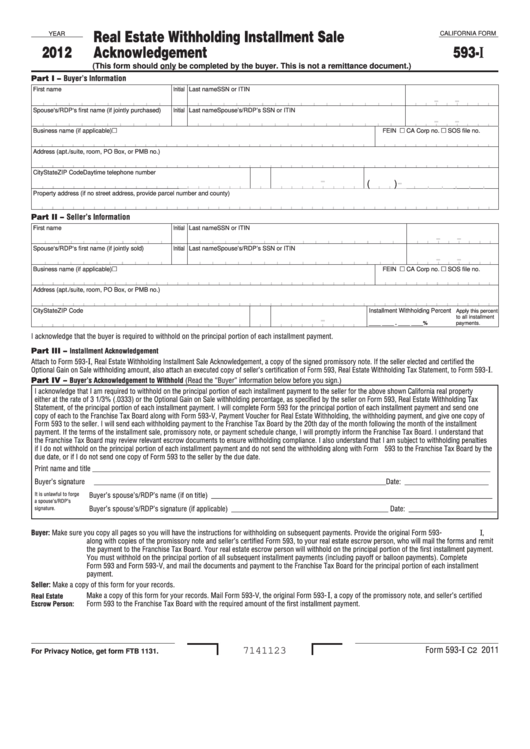

Fillable Form 593I Real Estate Withholding Installment Sale

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Form 593, real estate withholding. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. File your california and federal tax.

California Form 593C Draft Real Estate Withholding Certificate

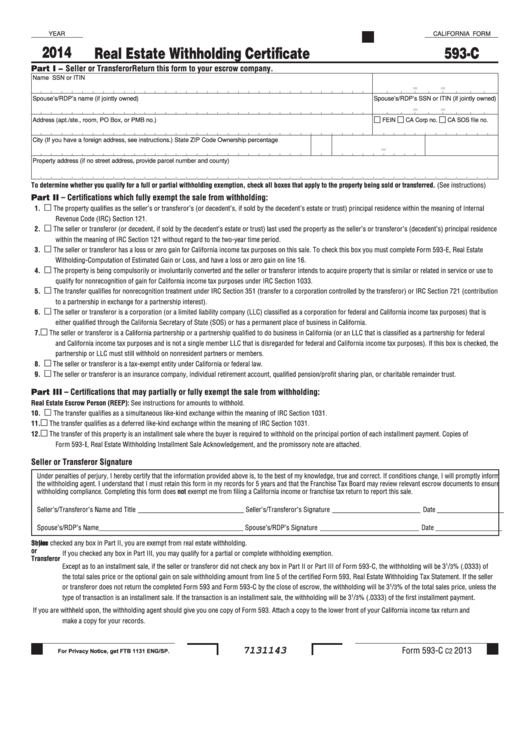

Confirm only california income tax withheld is claimed. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. The new form is a combination of the prior: Web your california real estate withholding has to be entered on both the state.

California Form 593I Real Estate Withholding Installment Sale

Web california real estate withholding. Web on january 1, 2020, our new form 593, real estate withholding statement went live. Web the organization should submit form 2553: File your california and federal tax returns online with turbotax in minutes. The new form is a combination of the prior:

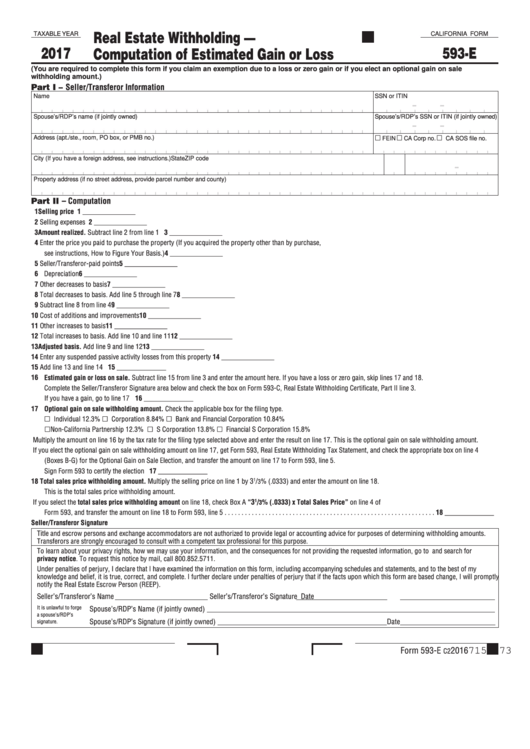

Fillable California Form 593E Real Estate Withholding Computation

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web california real estate withholding. Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. Purpose use form 593 to report real estate.

593 V Form California Franchise Tax Board Ft Ca Fill Out and Sign

593 real estate withholding tax statement report withholding on real estate sales or transfers. Web amount or see instructions for form 540, line 71. Web your california real estate withholding has to be entered on both the state and the federal return. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made.

Form 593, Real Estate Withholding.

Sign it in a few clicks draw your signature, type it,. Payment voucher for real estate withholding. Web on january 1, 2020, our new form 593, real estate withholding statement went live. Web amount or see instructions for form 540, line 71.

The New Form Is A Combination Of The Prior:

Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web $100,000 or less in foreclosure seller is a bank acting as a trustee see form 593, part iii for a complete list of full exemptions, and part iv for full or partial exemptions.

Confirm Only California Income Tax Withheld Is Claimed.

• the transfer of this. Web the organization should submit form 2553: Web california real estate withholding. See instructions for form 593, part iv.

2 Months And 15 Days Past The Start Of The Tax Year In Which The Election Is To Be Effective.

Web your california real estate withholding has to be entered on both the state and the federal return. When you reach take a. First, complete your state return. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of.