Form 6252 Property Type Code

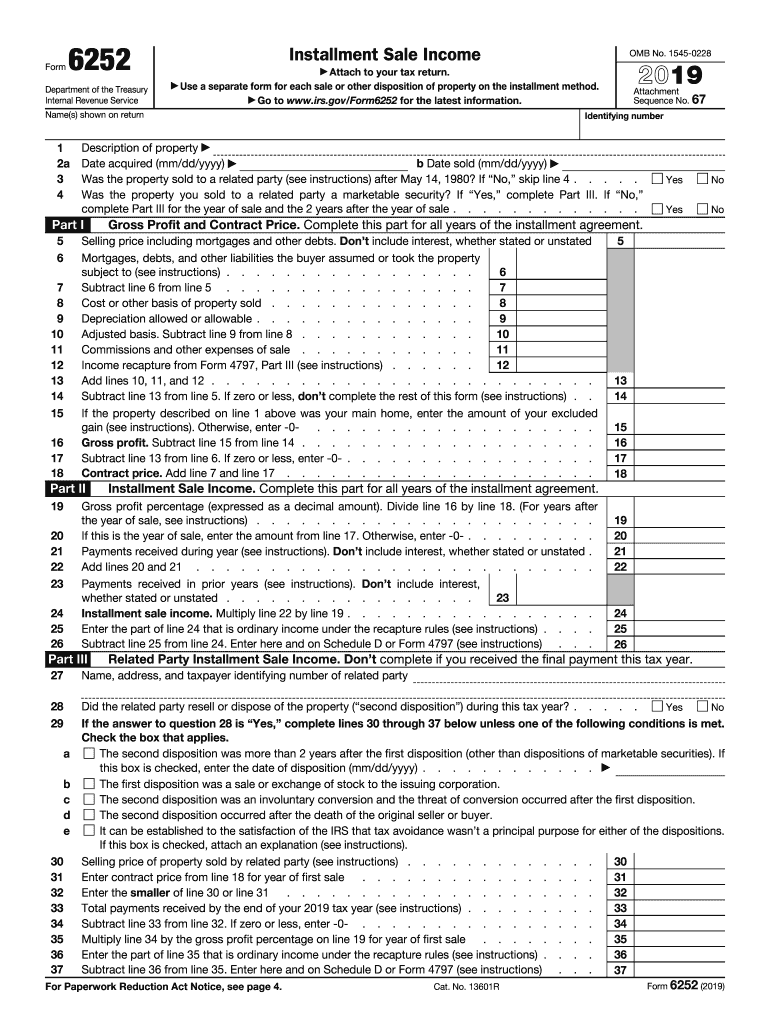

Form 6252 Property Type Code - Web department of the treasury internal revenue service installment sale income attach to your tax return. Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you haven’t yet received all the money. • report the amount from line 1 above on form 4797, line 10, column (d); In this case, you wouldn’t use form 6252. Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Or form 8824, line 12 or 16. General rules fair market value (fmv). Sale to related party if this field is marked and the sale is a loss, ultratax cs enters an item to reverse the loss on form 4797, line 2 or line 10 (depending on the holding period). It appears from the instructions @jotikat2 provided the code would be 4. Web form 6252 asks for a code for the property type.it is multifamily.what is the code?

Web form 6252 asks for a code for the property type.it is multifamily.what is the code? Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you haven’t yet received all the money. General rules fair market value (fmv). Form 6252, lines 1 through 4; Go to www.irs.gov/form6252 for the latest information. Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. • complete form 4797, line 10, columns (a), (b), and (c); Instead, report the disposition on the lines shown for form 4797. It appears from the instructions @jotikat2 provided the code would be 4.

Web department of the treasury internal revenue service installment sale income attach to your tax return. Go to www.irs.gov/form6252 for the latest information. Figuring installment sale income interest income adjusted basis and installment sale income (gain on sale) In this case, you wouldn’t use form 6252. Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Sale to related party if this field is marked and the sale is a loss, ultratax cs enters an item to reverse the loss on form 4797, line 2 or line 10 (depending on the holding period). Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item. Use a separate form for each sale or other disposition of property on the installment method. You will also need to use this form to report a sale of property that was sold using an installment plan. Any income earned from this installment plan will be reported on form 6252.

Form 6252 Installment Sale (2015) Free Download

Web department of the treasury internal revenue service installment sale income attach to your tax return. Form 6252, lines 1 through 4; General rules fair market value (fmv). • complete form 4797, line 10, columns (a), (b), and (c); Web about form 6252, installment sale income.

Form 6252Installment Sale

Use a separate form for each sale or other disposition of property on the installment method. Any income earned from this installment plan will be reported on form 6252. Sale to related party if this field is marked and the sale is a loss, ultratax cs enters an item to reverse the loss on form 4797, line 2 or line.

What is IRS Form 6252 Installment Sale TurboTax Tax Tips & Videos

Or form 8824, parts i and ii. Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item. In this case, you wouldn’t use form 6252. Generally, an installment sale is a disposition of property where at least one.

Errors on form 6252

You will also need to use this form to report a sale of property that was sold using an installment plan. Or form 8824, line 12 or 16. Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you.

Form 6252Installment Sale

Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. • report the amount from line 1 above on form 4797, line 10, column (d); Web department of the treasury internal revenue service installment sale income attach to your tax return..

6252 Fill Out and Sign Printable PDF Template signNow

Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. 67 name(s) shown on return identifying number 1 Figuring installment sale income interest income adjusted basis and installment sale income (gain on sale) Web form 6252 asks for a code for the.

Form 6252 Installment Sale (2015) Free Download

Web department of the treasury internal revenue service installment sale income attach to your tax return. Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Instead, report the disposition on the lines shown for form 4797. Go to www.irs.gov/form6252 for.

VN Club User Experience Nearby And On Demand (U.E.N.O) Planta Tipo

Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Web about form 6252, installment sale income. Go to www.irs.gov/form6252 for the latest information. Instead, report the disposition on the lines shown for form 4797. Generally, an installment sale is a.

Form 6252 Installment Sale (2015) Free Download

It appears from the instructions @jotikat2 provided the code would be 4. Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you haven’t yet received all the money. Form 6252, lines 1 through 4; Instead, report the disposition.

Form 6252Installment Sale

• complete form 4797, line 10, columns (a), (b), and (c); Web what’s an installment sale? Figuring installment sale income interest income adjusted basis and installment sale income (gain on sale) Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale,.

Web Irs Tax Form 6252 Is A Form That You Must Use To Report Income You've Acquired From Selling Something For A Price Higher Than What You Originally Paid For The Item.

Or form 8824, line 12 or 16. 67 name(s) shown on return identifying number 1 Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you haven’t yet received all the money. Web department of the treasury internal revenue service installment sale income attach to your tax return.

• Complete Form 4797, Line 10, Columns (A), (B), And (C);

Installment sale income is an internal revenue service (irs) form used to report income from the sale of real or personal property coming from an installment sale with the. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Web what’s an installment sale? Any income earned from this installment plan will be reported on form 6252.

Figuring Installment Sale Income Interest Income Adjusted Basis And Installment Sale Income (Gain On Sale)

You will also need to use this form to report a sale of property that was sold using an installment plan. In this case, you wouldn’t use form 6252. • report the amount from line 1 above on form 4797, line 10, column (d); Web form 6252 asks for a code for the property type.it is multifamily.what is the code?

Use This Form To Report Income From An Installment Sale On The Installment Method.

Use a separate form for each sale or other disposition of property on the installment method. Web about form 6252, installment sale income. General rules fair market value (fmv). Instead, report the disposition on the lines shown for form 4797.