Form 712 Instructions

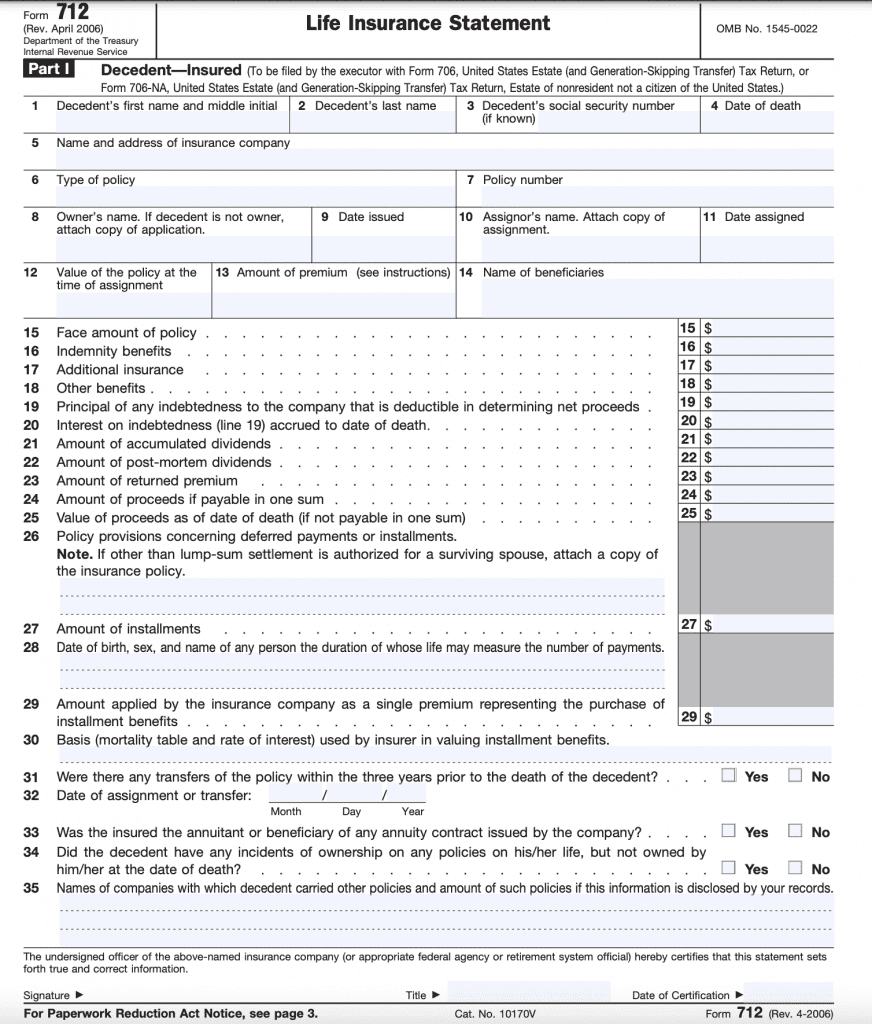

Form 712 Instructions - Web instructions to printers form 712, page 3 of 4 (page 4 is blank). The value of all policies on the decedent’s life must be reported on the estate tax. Web 1 best answer sweetiejean level 15 not on your personal tax return. This statement must be made, on behalf of the insurance company that issued the policy, by an officer of the. At the request of the estate’s. Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing and location of. Do i need to file irs form 712? Web here is the irs form 712 filing instructions you ought to follow: Specifications to be removed before printing. Step by step instructions comments if.

Do i need to file irs form 712? At the request of the estate’s. Go to the pdfliner website. Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing and location of. The latest technologies high quality electronic pubs and forms view u.s. The irs federal form 712 reports. Attach the form 712 to the back of schedule d. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web enter the amount from line 1 of your child tax credit worksheet on page 40 of the form 1040 instructions, page 36 of the form 1040a instructions, or page 21 of the form. The value of all policies on the decedent’s life must be reported on the estate tax.

Specifications to be removed before printing. If part or all of the policy proceeds are not included in the gross estate, you must explain why they were not. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance policy is transferred as. Section references are to the. Form 712 provides taxpayers and the irs with information to determine if insurance on the decedent's life is includible in the gross. Go to the pdfliner website. Web irs form 712 instructions by forrest baumhover july 17, 2023 reading time: Choose the correct version of the editable pdf. Attach the form 712 to the back of schedule d.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Step by step instructions comments if. Attach the form 712 to the back of schedule d. Web form 712, life insurance statement, must be secured from the taxpayer in all situations where a decedent was the owner of a life insurance policy. The irs federal form 712 reports. Web form 712) in lieu of any documentation issued by the postal.

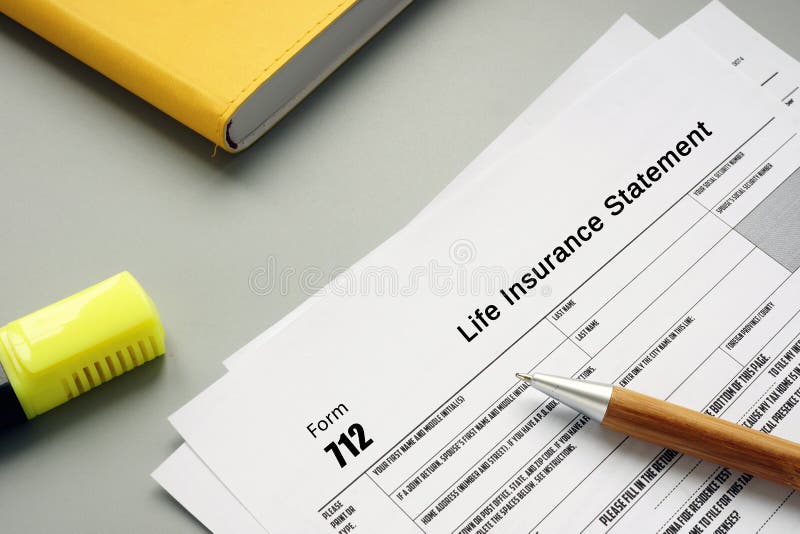

Financial Concept about Form 712 Life Insurance Statement with Phrase

The irs federal form 712 reports. Web form 712, life insurance statement, must be secured from the taxpayer in all situations where a decedent was the owner of a life insurance policy. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a.

Form 712 Life Insurance Statement (2006) Free Download

Form 712 provides taxpayers and the irs with information to determine if insurance on the decedent's life is includible in the gross. This statement must be made, on behalf of the insurance company that issued the policy, by an officer of the. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web.

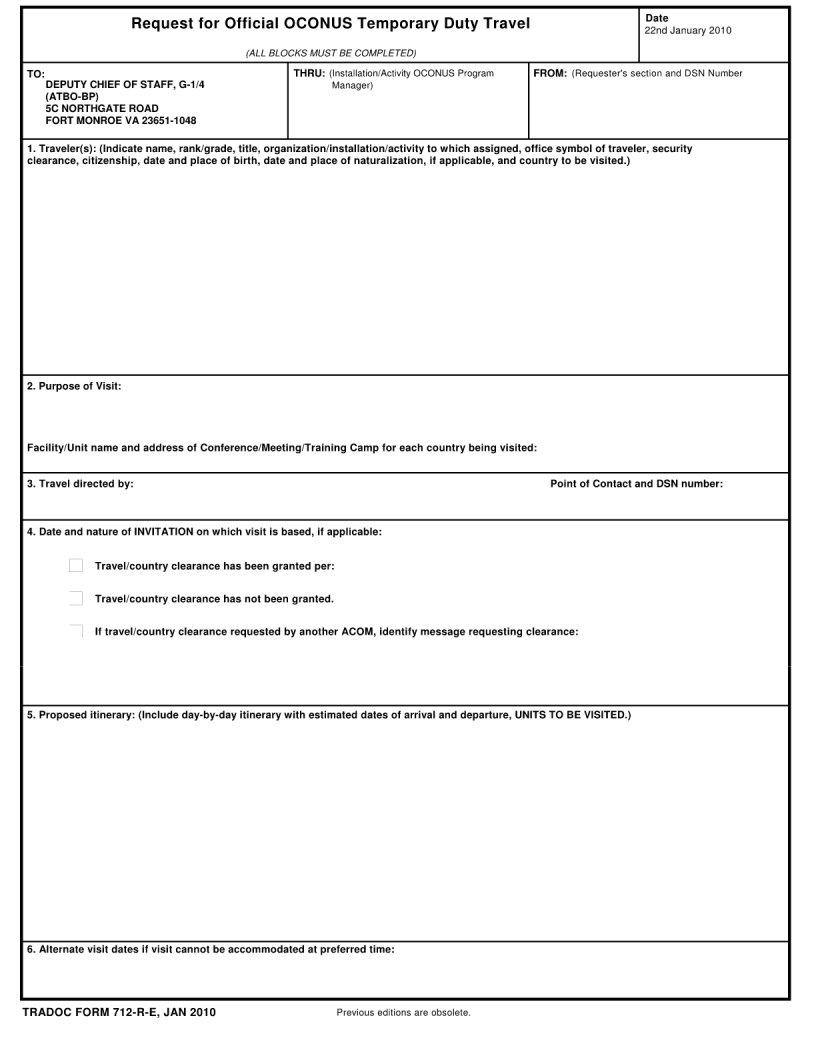

Tradoc Form 712 R E ≡ Fill Out Printable PDF Forms Online

Choose the correct version of the editable pdf. Web estate tax filing instructions use these instructions to help you with the washington state estate and transfer tax return (rev 85 0050). Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time.

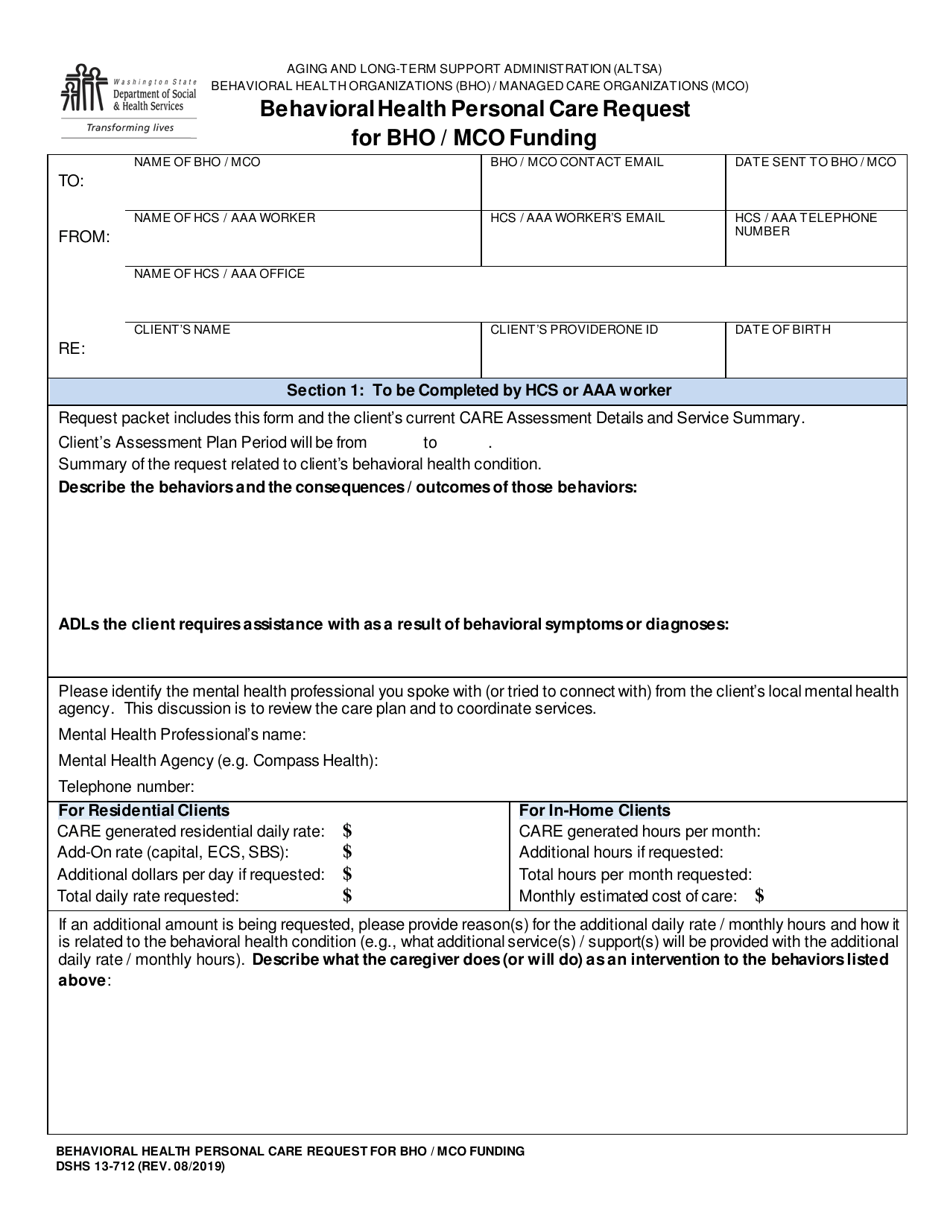

DSHS Form 13712 Download Printable PDF or Fill Online Behavioral

The irs federal form 712 reports. Choose irs form 712 from the list of available forms. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance policy is transferred as. Step by step instructions comments if. Web form.

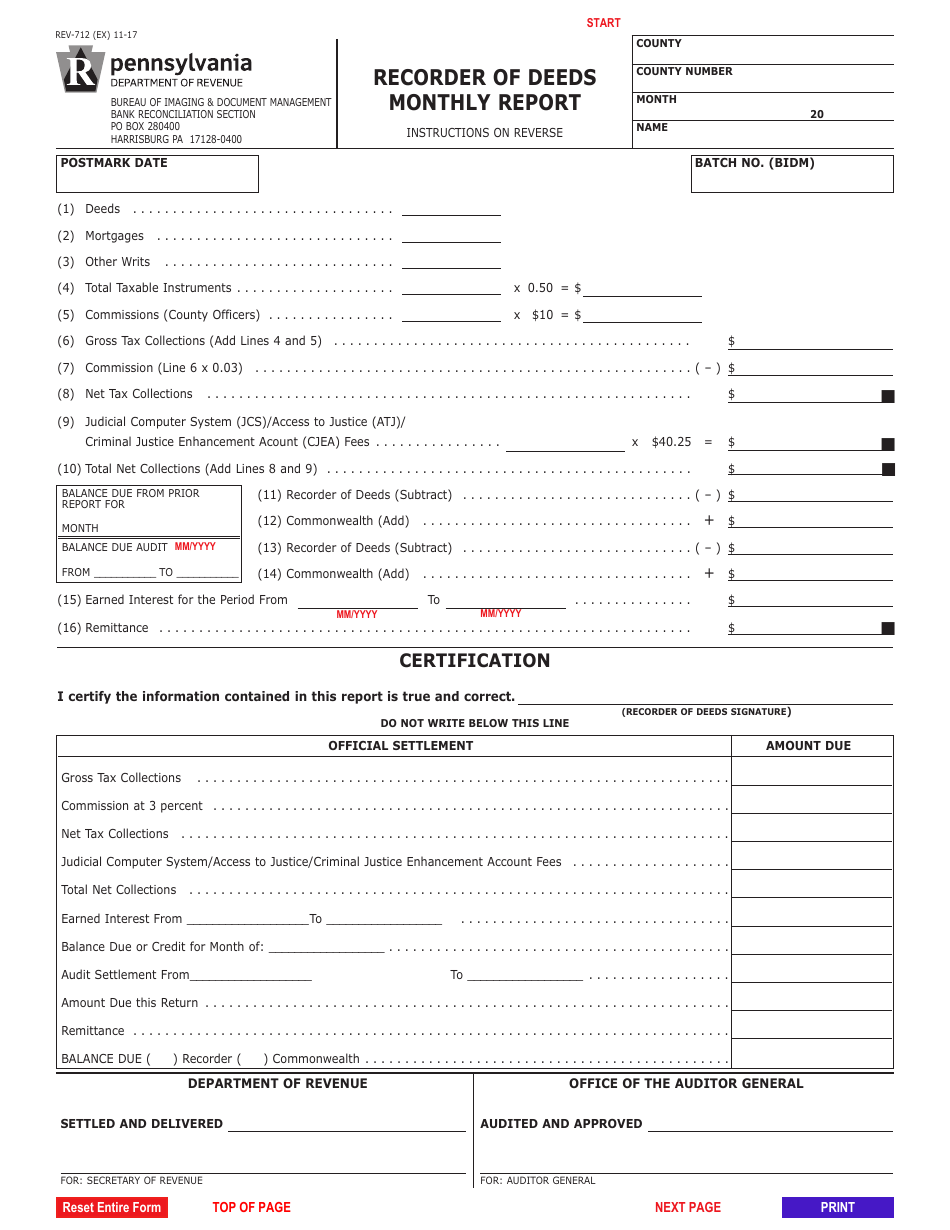

Form REV712 Download Fillable PDF or Fill Online Recorder of Deeds

Web instructions to printers form 712, page 3 of 4 (page 4 is blank). Web enter the amount from line 1 of your child tax credit worksheet on page 40 of the form 1040 instructions, page 36 of the form 1040a instructions, or page 21 of the form. Web find and fill out the correct form 712 life insurance statement..

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Choose irs form 712 from the list of available forms. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Choose the correct version of the editable pdf. Section references are to the. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final.

IRS Form 945 Instructions

Web estate tax filing instructions use these instructions to help you with the washington state estate and transfer tax return (rev 85 0050). Form 712 provides taxpayers and the irs with information to determine if insurance on the decedent's life is includible in the gross. This statement must be made, on behalf of the insurance company that issued the policy,.

What is form 712? Protective Life

Web enter the amount from line 1 of your child tax credit worksheet on page 40 of the form 1040 instructions, page 36 of the form 1040a instructions, or page 21 of the form. Specifications to be removed before printing. Web we last updated the life insurance statement in february 2023, so this is the latest version of form 712,.

IRS Form 712 A Guide to the Life Insurance Statement

Do i need to file irs form 712? Web here is the irs form 712 filing instructions you ought to follow: Step by step instructions comments if. Web enter the amount from line 1 of your child tax credit worksheet on page 40 of the form 1040 instructions, page 36 of the form 1040a instructions, or page 21 of the.

Web We Last Updated The Life Insurance Statement In February 2023, So This Is The Latest Version Of Form 712, Fully Updated For Tax Year 2022.

This statement must be made, on behalf of the insurance company that issued the policy, by an officer of the. Go to the pdfliner website. Step by step instructions comments if. The value of all policies on the decedent’s life must be reported on the estate tax.

Web The Irs Form 712 Is A Statement That Provides Life Insurance Policy Values As Of The Date Of An Insured's Or Policy Owner's Death, Or At A Time A Life Insurance Policy Is Transferred As.

Section references are to the. Web form 712) in lieu of any documentation issued by the postal service, provided, that the certifcate bears the postal service postmark, showing the date of mailing and location of. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web form 712, life insurance statement, must be secured from the taxpayer in all situations where a decedent was the owner of a life insurance policy.

Form 712 Provides Taxpayers And The Irs With Information To Determine If Insurance On The Decedent's Life Is Includible In The Gross.

At the request of the estate’s. Choose the correct version of the editable pdf. Attach the form 712 to the back of schedule d. 6 minutes watch video get the form!

Web Irs Form 712 Instructions By Forrest Baumhover July 17, 2023 Reading Time:

It goes to the estate executor for use in filing any estate tax returns if required. You can download or print. The latest technologies high quality electronic pubs and forms view u.s. Web 1 best answer sweetiejean level 15 not on your personal tax return.