Form 7202 Turbotax 2022

Form 7202 Turbotax 2022 - Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Ad premium federal filing is 100% free with no upgrades for premium taxes. Credits related to offering sick pay and family. Web if you have a simple tax return, you can file your taxes online for free. Essentially, if you worked for an employer this year, you. Web to generate and complete form 7202. Web generating form 7202 in proseries solved • by intuit • 41 • updated december 21, 2022 the credits for sick leave and family leave for certain self. Then, go to screen 38.4. Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate.

Credits related to offering sick pay and family. Web form 7202 or 7203? Maximum $200 family leave credit per day and. Web to generate and complete form 7202. Essentially, if you worked for an employer this year, you. Ad premium federal filing is 100% free with no upgrades for premium taxes. Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web generating form 7202 in proseries solved • by intuit • 41 • updated december 21, 2022 the credits for sick leave and family leave for certain self. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the.

Web no., the form 7202 may not be available yet in turbo tax as the irs is still finalizing 2020 tax forms. Credits related to offering sick pay and family. Web form 7202 or 7203? Web if you have a simple tax return, you can file your taxes online for free. Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. Ad premium federal filing is 100% free with no upgrades for premium taxes. Family leave credit = 2/3 of the paid sick leave credit. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the. The form 7202, credit for sick leave and family leave for. Maximum $200 family leave credit per day and.

Growing Wealth Gaps in Higher Education RSF

The form 7202, credit for sick leave and family leave for. Web no., the form 7202 may not be available yet in turbo tax as the irs is still finalizing 2020 tax forms. Web generating form 7202 in proseries solved • by intuit • 41 • updated december 21, 2022 the credits for sick leave and family leave for certain.

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Then, go to screen 38.4. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the. Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate..

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web to generate and complete form 7202. Web if you have a simple tax return, you can file your taxes online for free. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the. Then, go to screen 38.4. Web form 7202 or.

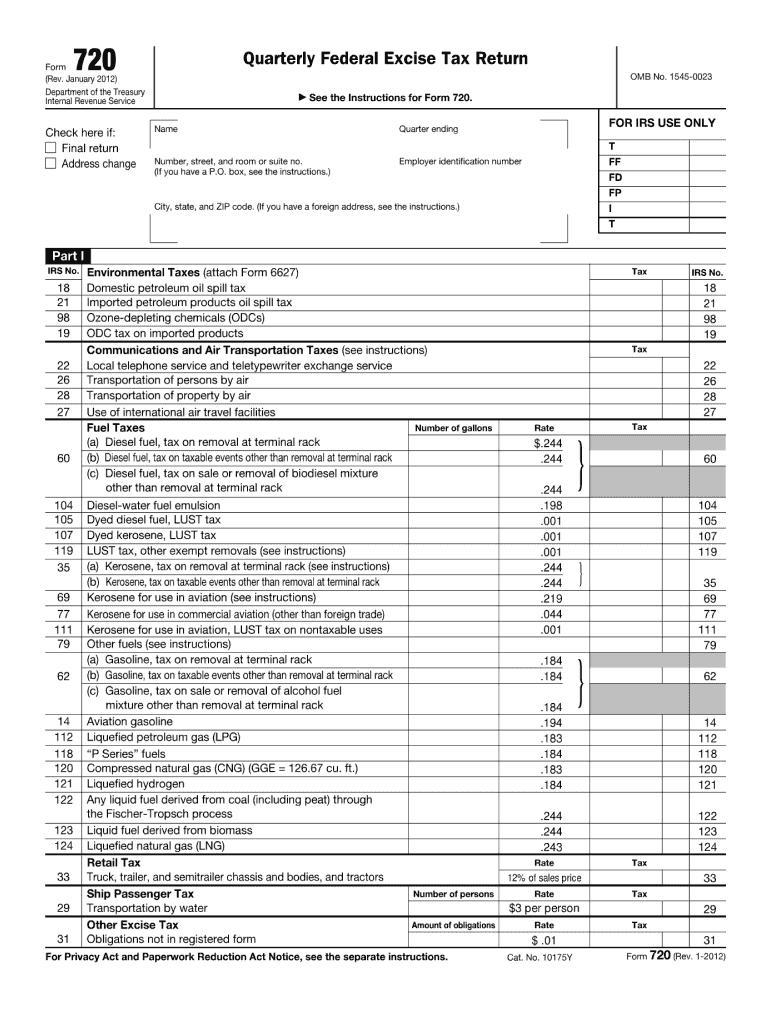

How to Complete Form 720 Quarterly Federal Excise Tax Return

The form 7202, credit for sick leave and family leave for. Web generating form 7202 in proseries solved • by intuit • 41 • updated december 21, 2022 the credits for sick leave and family leave for certain self. Ad premium federal filing is 100% free with no upgrades for premium taxes. Then, go to screen 38.4. Web download pdf.

Fill Free fillable Form 7202 for Certain SelfEmployed Individuals

Family leave credit = 2/3 of the paid sick leave credit. The form 7202, credit for sick leave and family leave for. Then, go to screen 38.4. Credits related to offering sick pay and family. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate.

Form 720 Fill Out and Sign Printable PDF Template signNow

Ad premium federal filing is 100% free with no upgrades for premium taxes. Family leave credit = 2/3 of the paid sick leave credit. Web to generate and complete form 7202. Then, go to screen 38.4. Credits related to offering sick pay and family.

Form 7202 SelfEmployed Audit Risk Form 7202 Tax Return Evidence the

Web if you have a simple tax return, you can file your taxes online for free. Web to generate and complete form 7202. Family leave credit = 2/3 of the paid sick leave credit. The form 7202, credit for sick leave and family leave for. Web form 7202 or 7203?

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

Maximum $200 family leave credit per day and. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the. Web form 7202 or 7203? Credits related to offering sick pay and family. Web if you have a simple tax return, you can file.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Web form 7202 or 7203? Ad premium federal filing is 100% free with no upgrades for premium taxes. Maximum $200 family leave credit per day and. Then, go to screen 38.4. The form 7202, credit for sick leave and family leave for.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Over 50 million returns filed, 4.8 star rating, fast refunds and user friendly. Ad premium federal filing is 100% free with no upgrades for premium taxes. Web no., the form 7202 may not be available yet in turbo tax as the irs is still finalizing 2020 tax forms. Then, go to screen 38.4. Essentially, if you worked for an employer.

Over 50 Million Returns Filed, 4.8 Star Rating, Fast Refunds And User Friendly.

The form 7202, credit for sick leave and family leave for. Web download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits under the. Essentially, if you worked for an employer this year, you. Web form 7202 or 7203?

Web Generating Form 7202 In Proseries Solved • By Intuit • 41 • Updated December 21, 2022 The Credits For Sick Leave And Family Leave For Certain Self.

Web to generate and complete form 7202. Then, go to screen 38.4. Ad premium federal filing is 100% free with no upgrades for premium taxes. Maximum $200 family leave credit per day and.

Ad With 2290 Online, You Can File Your Heavy Vehicle Use Tax Form In Just 3 Easy Steps.

Web if you have a simple tax return, you can file your taxes online for free. Web maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Family leave credit = 2/3 of the paid sick leave credit. Credits related to offering sick pay and family.