Form 7203 Stock Block

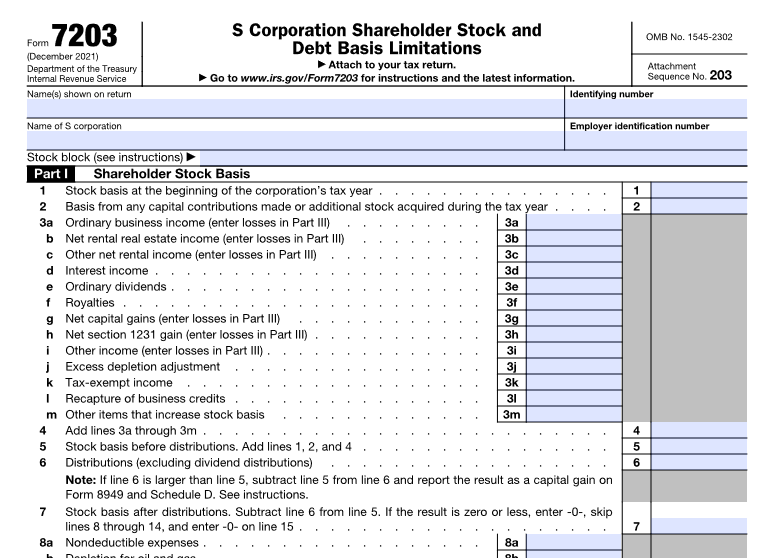

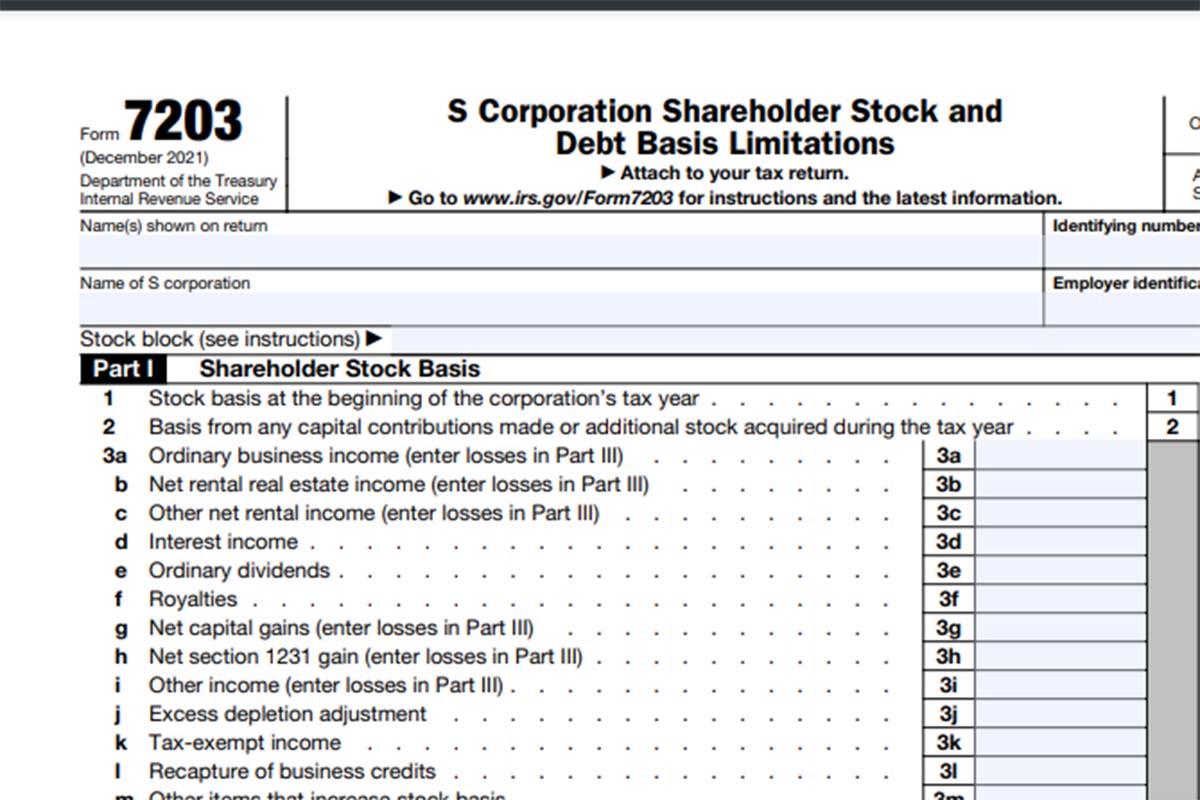

Form 7203 Stock Block - December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. S corporation shareholder stock and debt basis limitations. This form is required to be. S corporation shareholders use form 7203 to figure the potential. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Form 7203 is generated for a 1040 return when: In 2022, john decides to sell 50 shares of company a stock. Web once the form is saved to your computer, go to the tab and click on the critical diagnostic beginning form 7203 to upload and attach your pdf. To enter basis limitation info in the individual return:

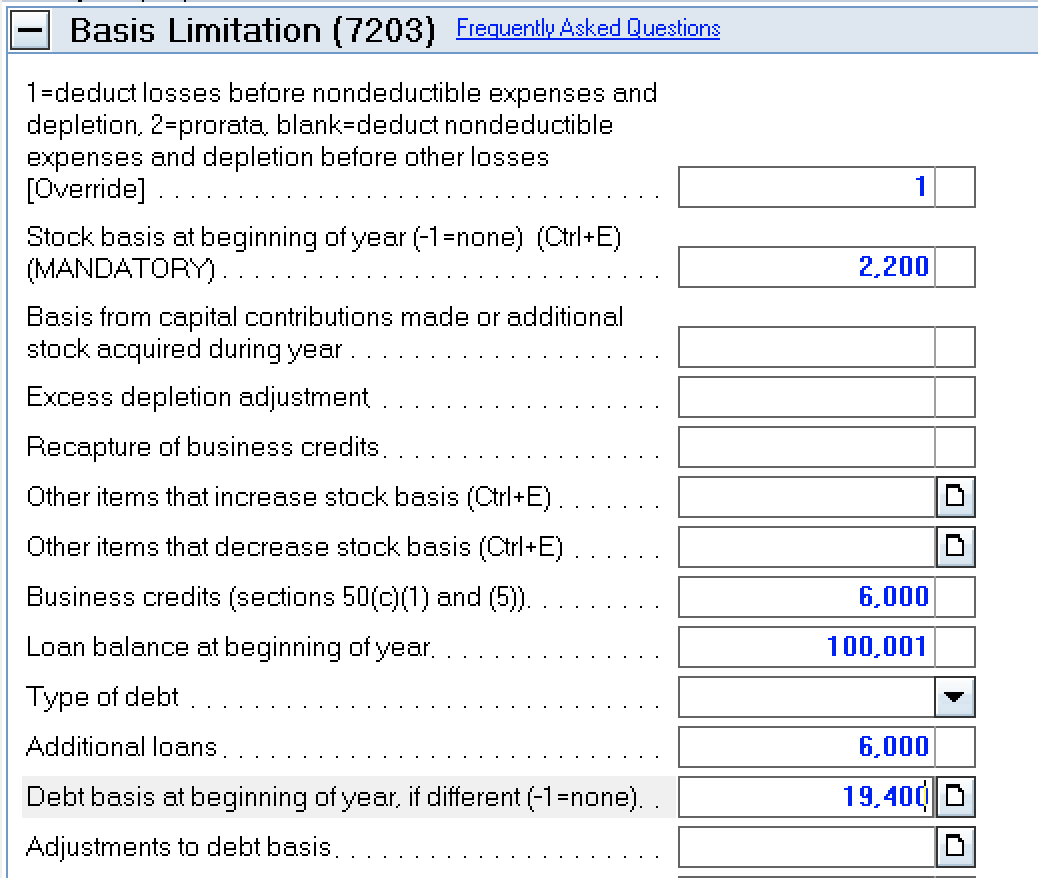

Basis limitation (7203) stock basis at. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Form 7203 is generated for a 1040 return when: S corporation shareholder stock and debt basis limitations. In 2022, john decides to sell 50 shares of company a stock. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web form 7203 has three parts: Web about form 7203, s corporation shareholder stock and debt basis limitations.

Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. See for help attaching a pdf to. Form 7203 is generated for a 1040 return when: Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. In 2022, john decides to sell 50 shares of company a stock. Basis limitation (7203) stock basis at. S corporation shareholders use form 7203 to figure the potential. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web form 7203 has three parts: Basis limitation (7203) stock basis at. S corporation shareholders use form 7203 to figure the potential. Form 7203 is generated for a 1040 return when:

IRS Form 7203 Fileable PDF Version

Basis limitation (7203) stock basis at. In 2022, john decides to sell 50 shares of company a stock. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web the stock.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

In 2022, john decides to sell 50 shares of company a stock. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Web form 7203 has three parts: Form 7203 is generated for a 1040 return when: Web about.

Form7203PartI PBMares

See for help attaching a pdf to. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Form 7203 is generated for a 1040 return when: Web the irs recently issued a new draft form 7203, s corporation shareholder.

How to complete Form 7203 in Lacerte

Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. S corporation shareholders use form 7203 to figure the potential. See for help attaching a pdf to. Web once the form is saved to your computer, go to the tab and click on the critical.

EDGAR Filing Documents for 000078401120000045

Web form 7203 has three parts: Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web using form 7203,.

Form 4137 H R Block Fill Online, Printable, Fillable, Blank pdfFiller

S corporation shareholder stock and debt basis limitations. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web the stock block.

More Basis Disclosures This Year for S corporation Shareholders Need

See for help attaching a pdf to. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Basis limitation (7203) stock basis at. This form is required to be. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury.

National Association of Tax Professionals Blog

Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web about form 7203, s corporation shareholder stock and debt basis limitations. In 2022, john decides to sell 50 shares of company a stock. Web form 7203 is used to calculate.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 7203 is generated for a 1040 return when: This form is required to be. See for help attaching a pdf to. S corporation shareholders use form 7203 to figure the potential. Web once the form is saved to your computer, go to the tab and click on the critical diagnostic beginning form 7203 to upload and attach your pdf.

Web Starting In Tax Year 2021, Form 7203 Replaces The Shareholder's Basis Worksheet (Worksheet For Figuring A Shareholder’s Stock And Debt Basis) In The 1040 Return.

This form is required to be. Web about form 7203, s corporation shareholder stock and debt basis limitations. See for help attaching a pdf to. S corporation shareholder stock and debt basis limitations.

Web Purpose Of Form Use Form 7203 To Figure Potential Limitations Of Your Share Of The S Corporation's Deductions, Credits, And Other Items That Can Be Deducted On Your.

Web generate form 7203, s corporation shareholder stock and debt basis limitations. Form 7203 is generated for a 1040 return when: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web form 7203 has three parts:

Basis Limitation (7203) Stock Basis At.

Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. To enter basis limitation info in the individual return: In 2022, john decides to sell 50 shares of company a stock. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax.

S Corporation Shareholders Use Form 7203 To Figure The Potential.

Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Web once the form is saved to your computer, go to the tab and click on the critical diagnostic beginning form 7203 to upload and attach your pdf. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items.