Form 760Py Instructions

Form 760Py Instructions - Web if you filed a tax due return after the filing date, you are liable for interest on the tax due amount on form 760py, line 27, from the due date to the date filed or postmarked. 4.3 satisfied (134 votes) va 760py instructions 2019: Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services. Web what form should i file | 760py and 763. 10/22 u please file electronically! Save or instantly send your ready documents. See form 760py instructions for. Web va 760py instructions 2021: You moved into virginia during the taxable year and became either an actual or domiciliary resident; Learn more about how to complete va 760py rapidly and easily.

4.3 satisfied (134 votes) va 760py instructions 2019: Here are the instructions on how to set up the program so it produces a part year state. Web va 760py instructions 2021: Web form 760py line instructions. You moved out of virginia. 10/22 u please file electronically! Web what form should i file | 760py and 763. Web va 760py instructions 2021: Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services. Web enter here and on form 760py, line 8.

Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services. Web if you filed a tax due return after the filing date, you are liable for interest on the tax due amount on form 760py, line 27, from the due date to the date filed or postmarked. 4.4 satisfied (674 votes) va 760py. 4.8 satisfied (128 votes) va 760py instructions 2020: Easily fill out pdf blank, edit, and sign them. Web form 760py line instructions. You moved into virginia during the taxable year and became either an actual or domiciliary resident; Web the py stands for part year instead of just the standard 760 resident form. See form 760py instructions for. 10/22 u please file electronically!

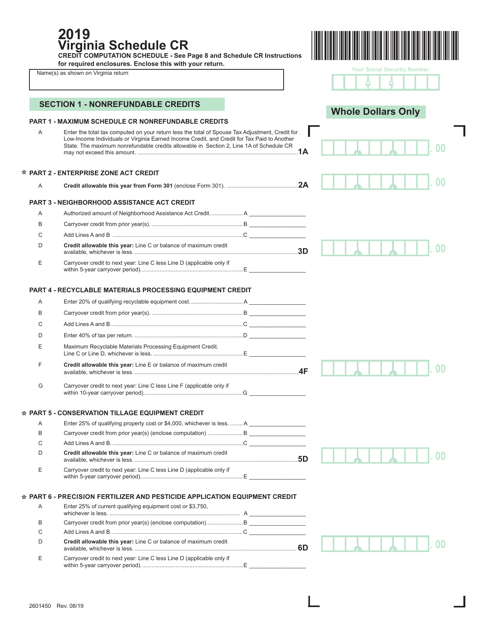

Form 760 (760PY; 763; 765) Schedule CR Download Fillable PDF or Fill

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web va 760py instructions 2021: Web virginia form 760py instructions 2021. Save or instantly send your ready documents. 4.3 satisfied (134 votes) va 760py instructions 2019:

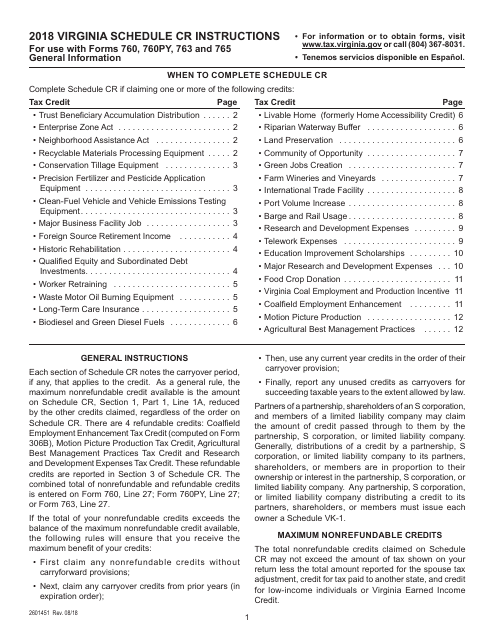

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

Web virginia form 760py instructions 2021. 10/22 u please file electronically! Web form 760py line instructions. Web if you filed a tax due return after the filing date, you are liable for interest on the tax due amount on form 760py, line 27, from the due date to the date filed or postmarked. 4.4 satisfied (674 votes) va 760py.

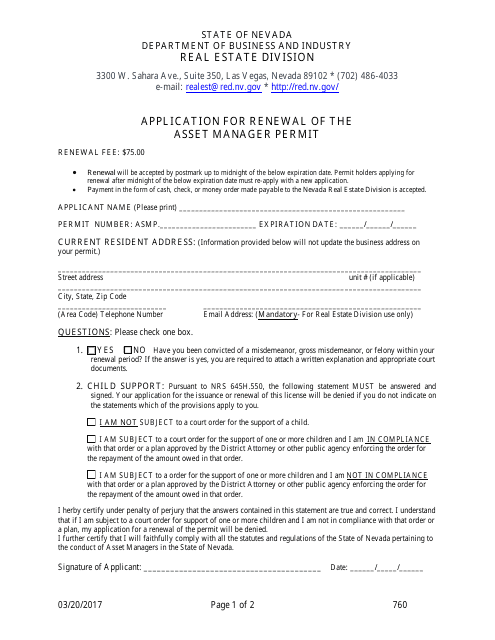

Form 760 Download Fillable PDF or Fill Online Application for Renewal

See form 760py instructions for. Save or instantly send your ready documents. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services..

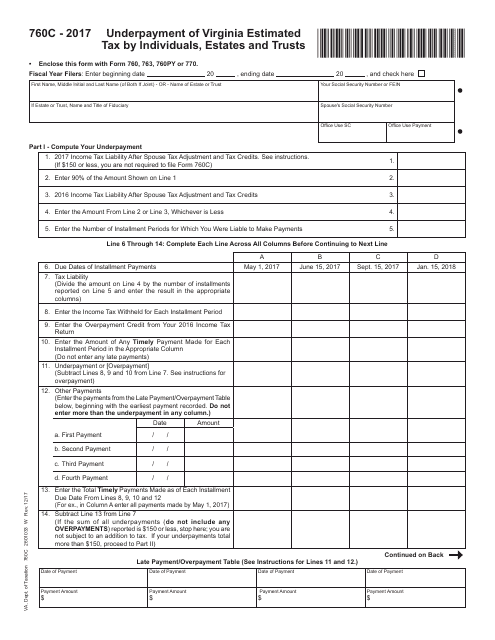

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

Save or instantly send your ready documents. 4.3 satisfied (134 votes) va 760py instructions 2019: Web virginia form 760py instructions 2021. Easily fill out pdf blank, edit, and sign them. 4.4 satisfied (674 votes) va 760py.

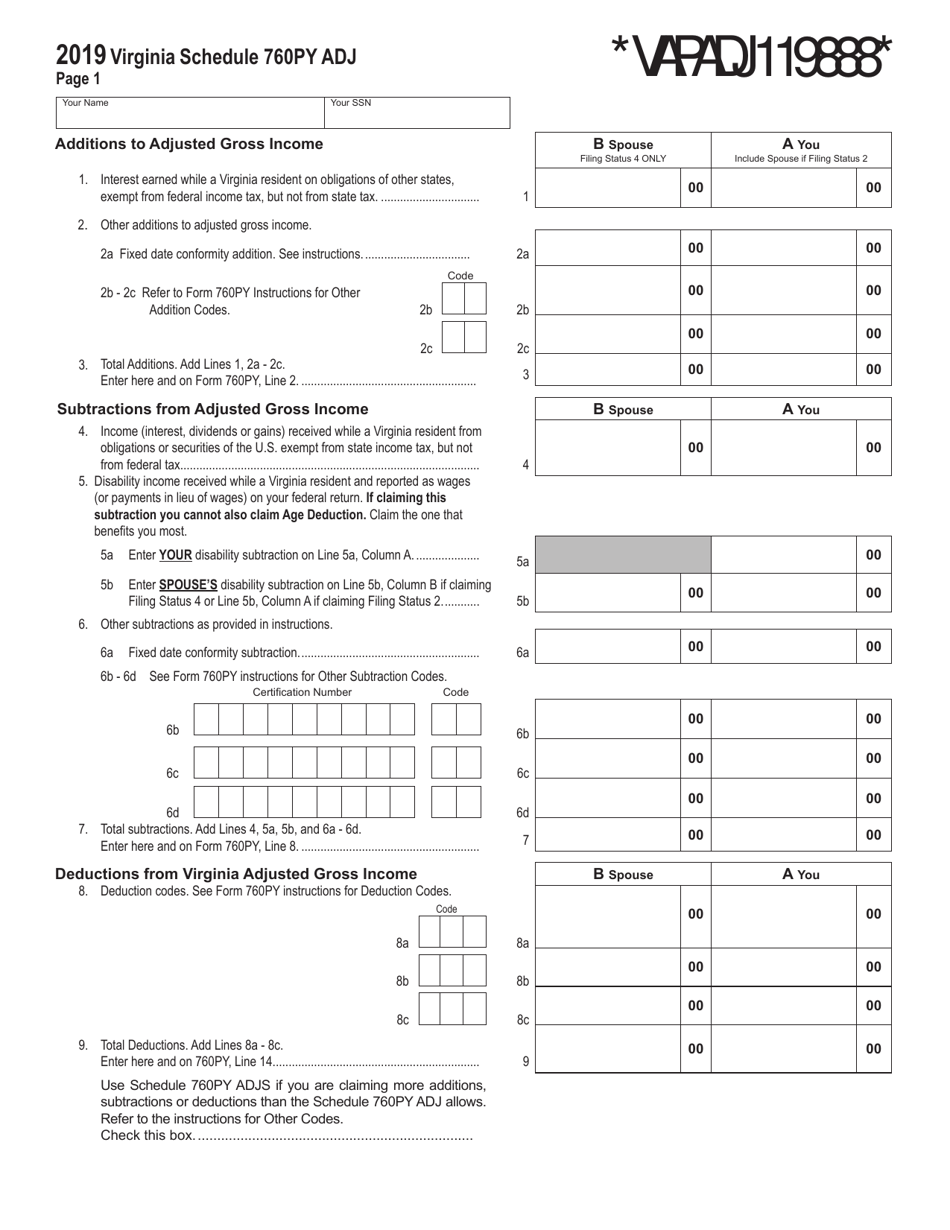

Schedule 760PY ADJ Download Fillable PDF or Fill Online Schedule of

Easily fill out pdf blank, edit, and sign them. U filing on paper means waiting. Web va 760py instructions 2021: Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. Learn more about how to complete va 760py rapidly and easily.

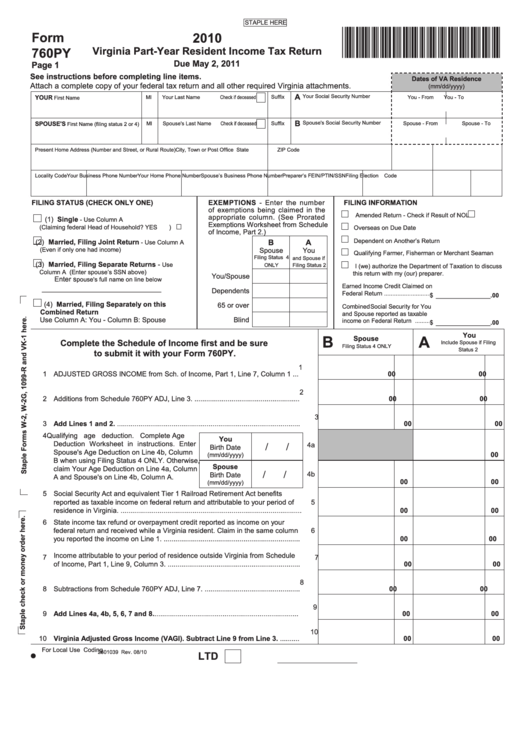

Form 760py Virginia PartYear Resident Tax Return 2010

Web the py stands for part year instead of just the standard 760 resident form. 4.4 satisfied (674 votes) va 760py. 4.3 satisfied (134 votes) va 760py instructions 2019: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web enter here and on form 760py, line 8.

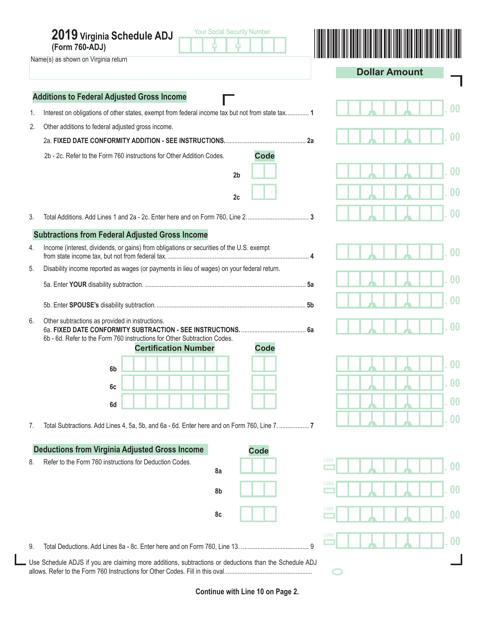

Form 760 Schedule ADJ Download Fillable PDF or Fill Online Virginia

Web what form should i file | 760py and 763. 7 00 00 deductions from virginia adjusted gross income b spouse a you 8. Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services. Easily fill out pdf blank, edit, and sign them. Web.

2012 Form VA 760PY Instructions Fill Online, Printable, Fillable, Blank

Web residents of virginia must file a form 760. Here are the instructions on how to set up the program so it produces a part year state. Web virginia form 760py instructions 2021. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. 10/22 u please file electronically!

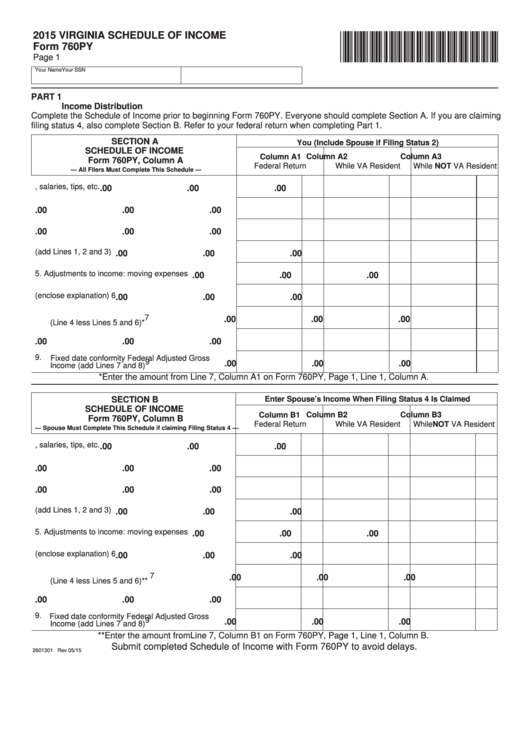

Fillable Form 760py Virginia Schedule Of 2015 printable pdf

Easily fill out pdf blank, edit, and sign them. 4.8 satisfied (128 votes) va 760py instructions 2020: U filing on paper means waiting. Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. Learn more about how to complete va 760py rapidly and easily.

VA 760PY Instructions 2019 Fill out Tax Template Online US Legal Forms

Save or instantly send your ready documents. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). 4.8 satisfied (128 votes) va 760py instructions 2020: 10/22 u please file electronically! Web video instructions and help with filling out and completing va form 760py.

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

4.3 satisfied (134 votes) va 760py instructions 2019: 4.8 satisfied (128 votes) va 760py instructions 2020: Web what form should i file | 760py and 763. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year).

4.8 Satisfied (128 Votes) Va 760Py Instructions 2020:

Learn more about how to complete va 760py rapidly and easily. Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. 10/22 u please file electronically! Web enter here and on form 760py, line 8.

U Filing On Paper Means Waiting.

Web residents of virginia must file a form 760. Save or instantly send your ready documents. See form 760py instructions for. 4.4 satisfied (674 votes) va 760py.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web i/we authorize the sharing of certain information from form 760py and schedule hci (as described in the instructions) with the department of medical assistance services. Web if you filed a tax due return after the filing date, you are liable for interest on the tax due amount on form 760py, line 27, from the due date to the date filed or postmarked. Based on the information you have provided, it appears that you should file: 7 00 00 deductions from virginia adjusted gross income b spouse a you 8.