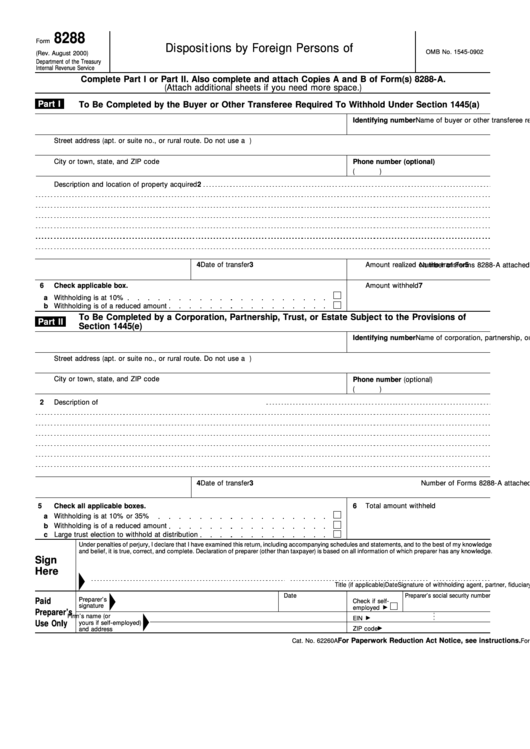

Form 8288 B

Form 8288 B - If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. A buyer or other transferee of a u.s. Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Real property interests please type or print. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. Real property interests) for each person subject to withholding. The tax withheld on the acquisition of a u.s. Report only one disposition on each form 8288 filed. Web to apply for the firpta exemption: The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding.

February 2016) application for withholding certificate for dispositions by foreign persons of u.s. The irs will normally act on an application by the 90th day after a complete application is received. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Withholding tax return for dispositions by foreign persons of u.s. Real property interests, before or on the date of closing. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Web information about form 8288, u.s. Attach additional sheets if you need more space. Report only one disposition on each form 8288 filed. Generally, transferees must file form 8288 by the 20th day after the date of the disposition.

If the withholding certificate is received prior to the sale, the buyer can rely on the withholding certificate for. Withholding tax return for dispositions by foreign persons of u.s. Web information about form 8288, u.s. A buyer or other transferee of a u.s. Or suite no., or rural route. If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. Real property interests, including recent updates, related forms and instructions on how to file. Name of transferor (attach additional sheets if more than one transferor) identification number.

Form 8288B Application for Withholding Certificate for Dispositions

The irs will normally act on an application by the 90th day after a complete application is received. Real property interests) for each person subject to withholding. Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s. If the withholding certificate is received prior to the.

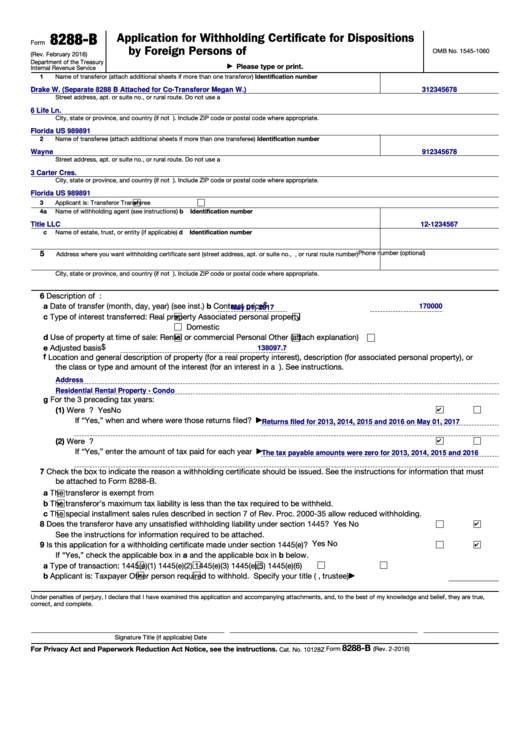

Form 8288B Application for Withholding Certificate for Dispositions

Real property interests, before or on the date of closing. Real property interests, including recent updates, related forms and instructions on how to file. Or suite no., or rural route. Generally, transferees must file form 8288 by the 20th day after the date of the disposition. The irs will normally act on an application by the 90th day after a.

Form 8288B Processing Time

A buyer or other transferee of a u.s. Real property interests, before or on the date of closing. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. The 15% will be held in escrow while the.

Form 8288B Application for Withholding Certificate for Dispositions

Real property interests please type or print. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for dispositions by foreign persons of u.s. Attach additional sheets if you need more space. Real property interests, before or on the date of closing.

Irs form 8288 b instructions

Name of transferor (attach additional sheets if more than one transferor) identification number. Web information about form 8288, u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interests, before or on the date of closing. Real property interest, and a corporation, qualified investment entity, or fiduciary that.

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Web to apply for the firpta exemption: Name of transferor (attach additional sheets if more than one transferor) identification number. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. February.

Form 8288B Where to File?

Web information about form 8288, u.s. Withholding tax return for dispositions by foreign persons of u.s. Web to apply for the firpta exemption: Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. The irs will normally act on an application by the 90th day after a complete application is received.

Fillable Form 8288B Application For Withholding Certificate For

Real property interests please type or print. Real property interests) for each person subject to withholding. The tax withheld on the acquisition of a u.s. Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Report only one disposition on each form 8288 filed.

Form 8288B Where to File?

February 2016) application for withholding certificate for dispositions by foreign persons of u.s. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Attach additional sheets if you need more space. The irs will normally act on an application by the 90th day after a complete application is received. The tax withheld on the acquisition.

What Is IRS Form 8288B?

If the withholding certificate is received prior to the sale, the buyer can rely on the withholding certificate for. Real property interest from a foreign person is reported and paid using form 8288. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Foreign persons use this form to apply for.

Withholding Tax Return For Dispositions By Foreign Persons Of U.s.

Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Real property interests, including recent updates, related forms and instructions on how to file. Web complete the withholding agent information and part i through part v, as applicable. The irs will normally act on an application by the 90th day after a complete application is received.

Real Property Interests Please Type Or Print.

Attach additional sheets if you need more space. Real property interests) for each person subject to withholding. Report only one disposition on each form 8288 filed. Or suite no., or rural route.

The 15% Will Be Held In Escrow While The Firpta Unit Approves Or Rejects The Application For Reduced Withholding.

Web to apply for the firpta exemption: Web information about form 8288, u.s. Real property interest from a foreign person is reported and paid using form 8288. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to.

If The Withholding Certificate Is Received Prior To The Sale, The Buyer Can Rely On The Withholding Certificate For.

Real property interests, before or on the date of closing. A buyer or other transferee of a u.s. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. The tax withheld on the acquisition of a u.s.