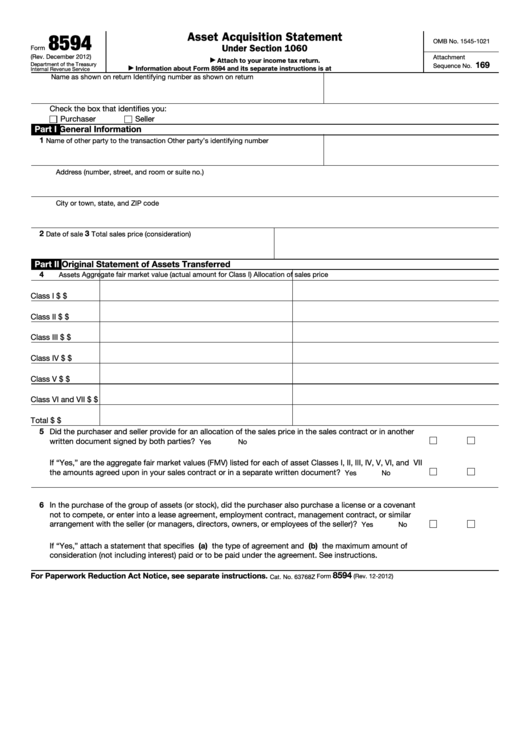

Form 8594 Pdf

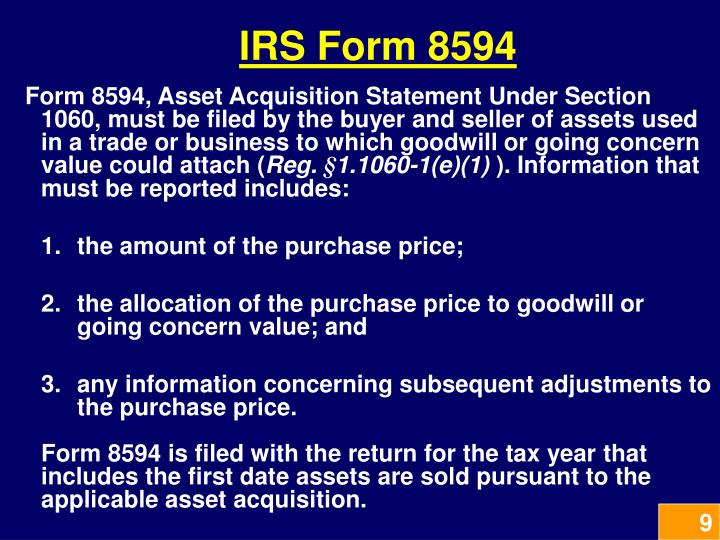

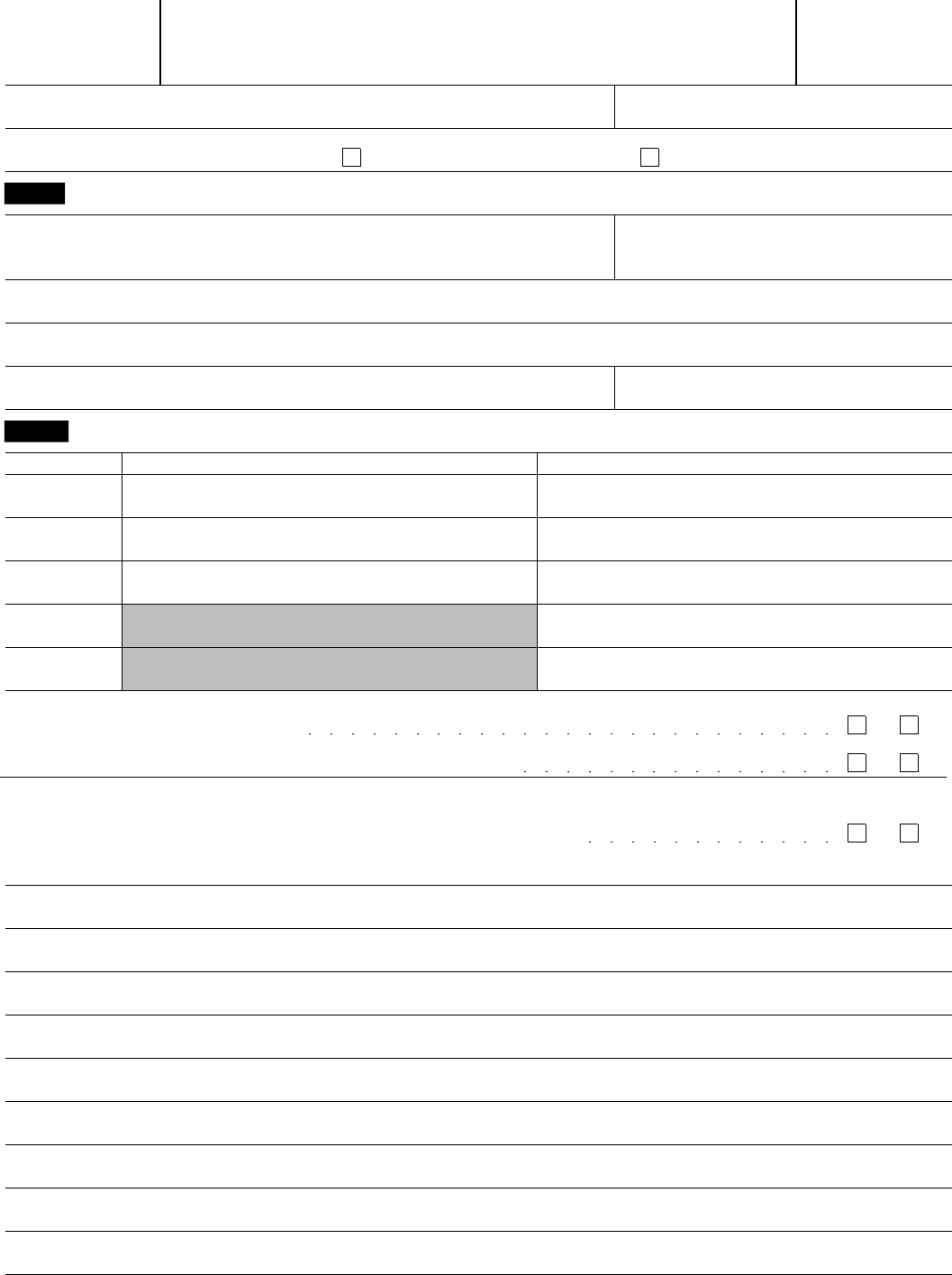

Form 8594 Pdf - Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. November 2021) department of the treasury internal revenue service. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Attach to your income tax return. Web instructions for form 8594 (rev. You can print other federal tax forms here. Get everything done in minutes. Specifications to be removed before printing instructions to printers form 8594, page 2 of 2 margins: December 2008) (for use with the february 2006 revision of form 8594) asset acquisition statement under section 1060 department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file.

Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the buyer’s basis in the assets is determined only by the amount paid for the assets (“applicable asset acquisition,” defined below). Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Specifications to be removed before printing instructions to printers form 8594, page 2 of 2 margins: Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You can print other federal tax forms here. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. December 2008) (for use with the february 2006 revision of form 8594) asset acquisition statement under section 1060 department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. November 2021) department of the treasury internal revenue service. Web when a sale or purchase of a group of assets constituting a business occurs, both entities must file form 8594, asset acquisition statement with their individual income tax returns.

Attach to your income tax return. For instructions and the latest information. Web when a sale or purchase of a group of assets constituting a business occurs, both entities must file form 8594, asset acquisition statement with their individual income tax returns. Web instructions for form 8594 (rev. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Both entities must report the total sales price of the business and must agree to the allocation of the total sales price among seven different classes of assets. November 2021) department of the treasury internal revenue service. December 2008) (for use with the february 2006 revision of form 8594) asset acquisition statement under section 1060 department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You can print other federal tax forms here. Get everything done in minutes.

Fillable Form 8594 Asset Acquisition Statement printable pdf download

November 2021) department of the treasury internal revenue service. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Both entities must report the total sales price of the business and must agree to the allocation of the total sales price among seven different classes of assets. Web.

How Many of the 5,211 Former U.S. Citizens (who Renounced in 2014 and

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web when a sale or purchase of a group of assets constituting a business occurs, both entities must file form 8594, asset acquisition statement with their individual income tax returns. Web instructions for form 8594 (rev. For paperwork reduction act notice,.

Download Instructions for IRS Form 8594 Asset Acquisition Statement

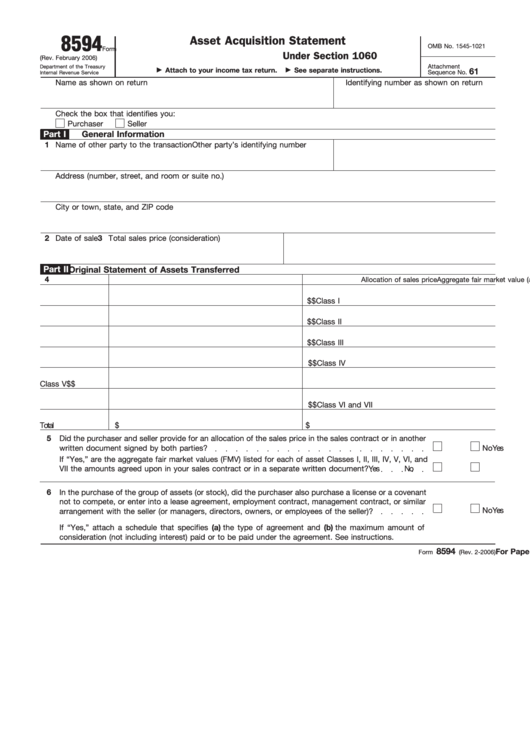

Web instructions for form 8594 (rev. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Get everything done in minutes. December 2008) (for use with the february 2006 revision of form 8594) asset acquisition statement under section 1060 department of.

Fillable Form 8594 (Rev. February 2006) Asset Acquisition Statement

For instructions and the latest information. Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the buyer’s basis in the assets is determined only by the amount.

Irs Form Purchase Of Business Leah Beachum's Template

Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Web instructions for form 8594 (rev. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a.

IRS Form 1041 Reporting an Tax Return for a Deceased Taxpayer

Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web we.

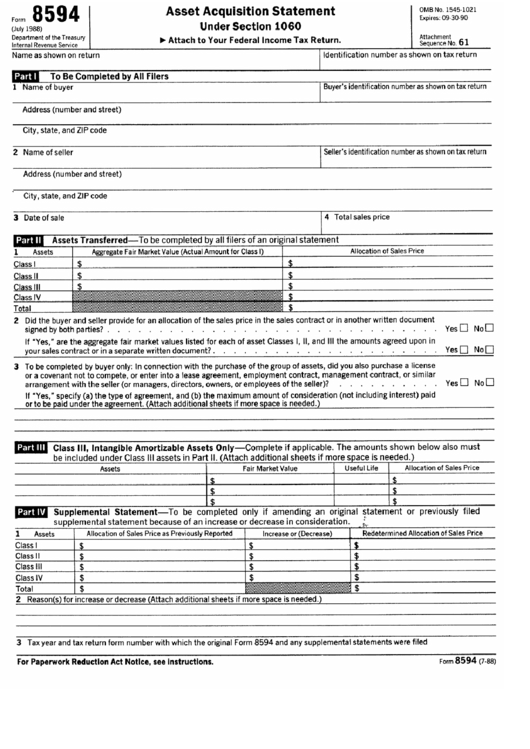

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

November 2021) department of the treasury internal revenue service. General instructions purpose of form Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the.

PPT Taxable Acquisitions PowerPoint Presentation ID3850409

Get everything done in minutes. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. For instructions and the latest information. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. The.

Instructions for Form 8594

For paperwork reduction act notice, see separate instructions. Both entities must report the total sales price of the business and must agree to the allocation of the total sales price among seven different classes of assets. Web instructions for form 8594 (rev. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the.

Form 8594 Edit, Fill, Sign Online Handypdf

The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web instructions for form 8594 (rev. Web when a sale or purchase of a group of assets.

Get Everything Done In Minutes.

Attach to your income tax return. For instructions and the latest information. Web when a sale or purchase of a group of assets constituting a business occurs, both entities must file form 8594, asset acquisition statement with their individual income tax returns. November 2021) department of the treasury internal revenue service.

You Can Print Other Federal Tax Forms Here.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the buyer’s basis in the assets is determined only by the amount paid for the assets (“applicable asset acquisition,” defined below). The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches.

December 2008) (For Use With The February 2006 Revision Of Form 8594) Asset Acquisition Statement Under Section 1060 Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web instructions for form 8594 (rev. For paperwork reduction act notice, see separate instructions. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022.

General Instructions Purpose Of Form

Specifications to be removed before printing instructions to printers form 8594, page 2 of 2 margins: Both entities must report the total sales price of the business and must agree to the allocation of the total sales price among seven different classes of assets. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets.