Form 8621 Threshold

Form 8621 Threshold - Web except as otherwise provided by the secretary, each united states person who is a shareholder of a passive foreign investment company shall file an annual report. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Web unfiled form 8621 means an incomplete tax return. Web what is form 8621 used for? Tax form 8621 for shareholders of passive foreign investment companies who must use this form? Unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of. Web what is the income test? Web regulations.7 in addition to the $25,000 and $5,000 threshold exceptions included in the 2013 temporary regulations, the. It is due, therefore, on april 15. Form 8621 containing all of the.

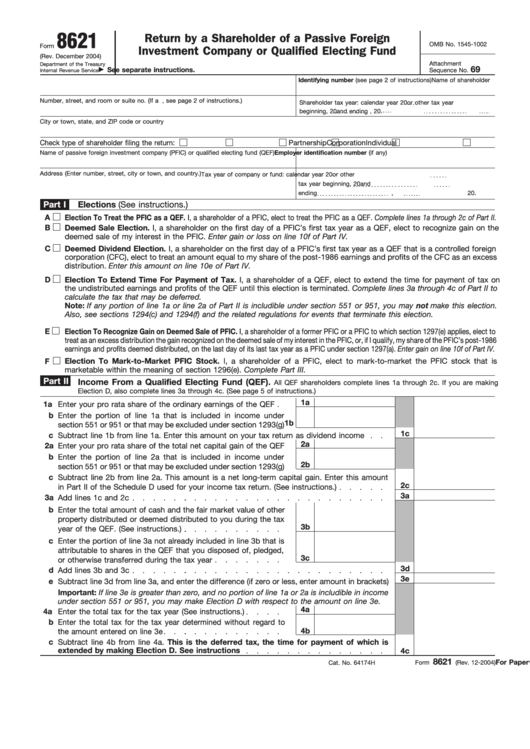

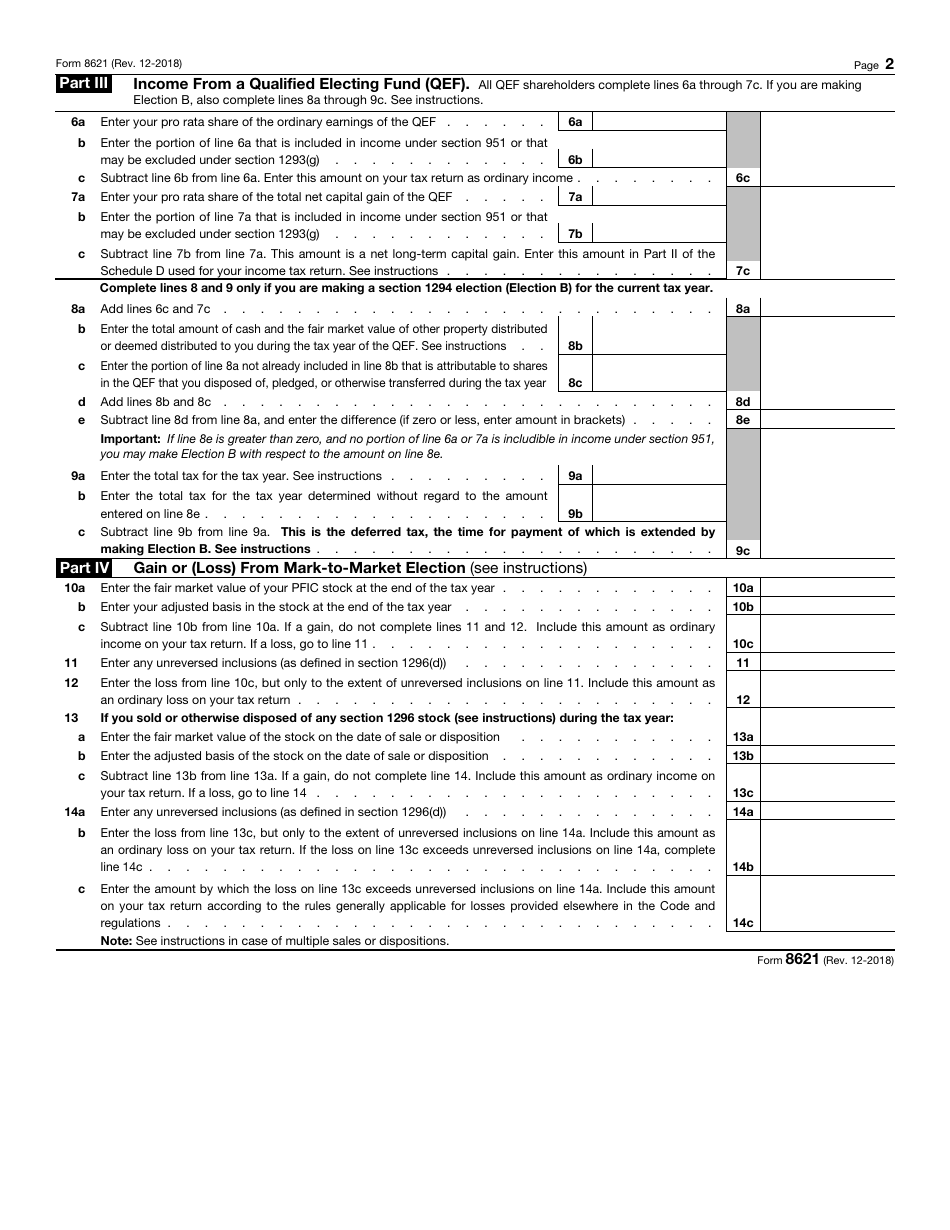

Web when a taxpayer has an excess distribution, the form 8621 is required even if the threshold for filing is below the 25,000 or $50,000 exception. Such form should be attached to the. It is not mandatory to file this form unless there is a distribution of. 2 part iii income from a qualified electing fund (qef). The form 8621 is filed as an attachment to the us person’s annual income tax return. Individualcorporation partnerships corporation nongrantor trustestate check if any. You will be required to share basic. Web form 8621 deadline and form 8621 statute of limitations. Web what is form 8621 used for? Passive foreign investment companies are taxed by the irs through a special form called form 8621.

Web direct shareholders of passive foreign investment companies have to file a form 8621. Web shareholder must file a form 8621 for each pfic in the chain. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. You will be required to share basic. In other words, in any year. Passive foreign investment companies are taxed by the irs through a special form called form 8621. If you own foreign mutual funds or other types of funds, or you have. Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. All qef shareholders complete lines 6a.

form8621calcualtorpficupdatefacebook Expat Tax Tools

The irs would consider a foreign entity a. Web shareholder must file a form 8621 for each pfic in the chain. The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. Tax form 8621 for shareholders of passive foreign investment companies who must use this form?.

Fillable Form 8621 (Rev. December 2004) Return By A Shareholder Of A

Passive foreign investment companies are taxed by the irs through a special form called form 8621. Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. Web when a taxpayer has an excess distribution, the form 8621 is required even if the threshold.

form8621calculatorupdatetwitter Expat Tax Tools

The irs would consider a foreign entity a. Form 8621 containing all of the. Tax form 8621 for shareholders of passive foreign investment companies who must use this form? 2 part iii income from a qualified electing fund (qef). The income test means that in order to qualify as a pfic:

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

It is not mandatory to file this form unless there is a distribution of. In other words, in any year. The income test means that in order to qualify as a pfic: Web what is the income test? If you own foreign mutual funds or other types of funds, or you have.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Web beginning, 20 and ending , 20 check type of shareholder filing the return: Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. If you own foreign mutual funds or other types of funds, or you have. The regulations provide a new.

Form 8621A Return by a Shareholder Making Certain Late Elections to

The income test means that in order to qualify as a pfic: Web when a taxpayer has an excess distribution, the form 8621 is required even if the threshold for filing is below the 25,000 or $50,000 exception. Web the threshold to report your pfic holdings on form 8621 is if the combined balances of all pfics are more than.

Form 8621 Instructions 2020 2021 IRS Forms

Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. It is not mandatory to file this form unless there is a distribution of. Web beginning, 20 and ending , 20 check type of shareholder filing the return: If you own foreign mutual.

Form 8621 Information Return by a Shareholder of a Passive Foreign

Web unfiled form 8621 means an incomplete tax return. Web certain pfic held for 30days or less. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f) (that. It is not mandatory to file this form unless there is a distribution of. Tax form 8621 for shareholders of passive foreign.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of. Web shareholder must file a form 8621 for each pfic in the chain. It is not mandatory to file this form unless there is a distribution of. Web direct shareholders of passive foreign investment companies have to file a form.

Form 8621 Instructions 2020 2021 IRS Forms

It is due, therefore, on april 15. The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. Web form 8621 deadline and form 8621 statute of limitations. Form 8621 containing all of the. Web regulations.7 in addition to the $25,000 and $5,000 threshold exceptions included in.

A Single Form 8621 May Be Filed With Respect To A Pfic To Report The Information Required By Section 1298(F) (That.

Passive foreign investment companies are taxed by the irs through a special form called form 8621. Web what is form 8621 used for? Web to file form 8621, you should begin by determining how many qualifying pfics you are a shareholder of, and the value you hold in each pfic. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly.

Web Shareholder Must File A Form 8621 For Each Pfic In The Chain.

Web beginning, 20 and ending , 20 check type of shareholder filing the return: Web what is the income test? The regulations provide a new exception to filing form 8621 if the taxpayer acquires a pfic fund in the taxable year or the immediately. The irs would consider a foreign entity a.

Web The Threshold To Report Your Pfic Holdings On Form 8621 Is If The Combined Balances Of All Pfics Are More Than $25,000 On The Last Day Of The Year (This Threshold.

In other words, in any year. Tax form 8621 for shareholders of passive foreign investment companies who must use this form? All qef shareholders complete lines 6a. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).

The Form 8621 Is Filed As An Attachment To The Us Person’s Annual Income Tax Return.

Individualcorporation partnerships corporation nongrantor trustestate check if any. Form 8621 containing all of the. Web regulations.7 in addition to the $25,000 and $5,000 threshold exceptions included in the 2013 temporary regulations, the. Web certain pfic held for 30days or less.