Form 8802 Processing Time

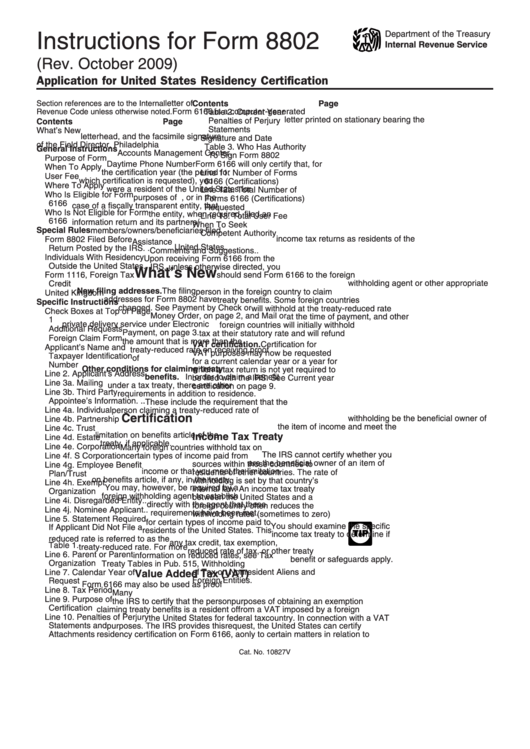

Form 8802 Processing Time - You also have to pay an $85 fee to file the form 8802. This is an irs form that applicants use to supply name, address, type of business entity, tax filing status and other details. Web you have to make a payment for form 8802. Copied, or captured in any manner and disclosed or used for any lawful government purpose at any time. There have been cases when processing takes up to 6 months. Web the instructions to form 8802 state that you should apply at least 45 days before you need the certification, but experience has shown that this process usually takes significantly longer. Form 8802 is used to request form 6166,. I haven't heard back from the irs at all since then, and it's been 2.5 months. Applicants are advised to request all forms 6166 on a single form 8802 to avoid paying the $85 user fee charged for processing a second form 8802. Please use the agency tracking id on the confirmation as the electronic confirmation number notice:

Web on january 31st, i faxed the irs form 8802 to get a tax residence certification (6166). Make sure to submit form 8802 as early as possible. Web we are now open and processing applications. The user fee can be paid by check, money order or electronic payment on the i.r.s. Web at the time of payment, and other. Web what does this processing time mean? There have been cases when processing takes up to 6 months. Processing fee the taxpayer is required to pay a nonrefundable user fee of $85 per form. Form 8802 is used to request form 6166,. Use form 8802 to request form 6166, a letter of u.s.

There have been cases when processing takes up to 6 months. Web select your form, form category, and the office that is processing your case. Web to receive a form 6166, applicants have to file a form 8802, application for united states residency certification. Web for the latest information about developments related to form 8802 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8802. Government information systems are provided for the processing of official u.s. Requests received place of your original check. Web what does this processing time mean? Processing fee the taxpayer is required to pay a nonrefundable user fee of $85 per form. Applicants are advised to request all forms 6166 on a single form 8802 to avoid paying the $85 user fee charged for processing a second form 8802. Tax residency, which certifies u.s.

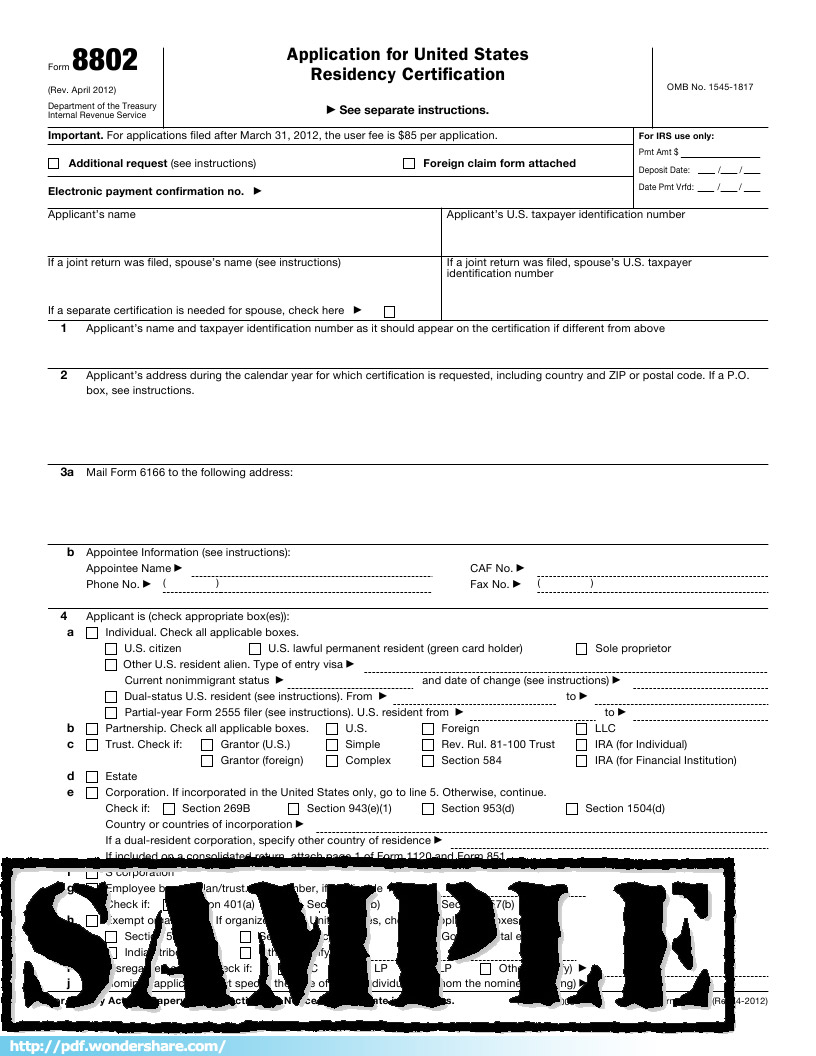

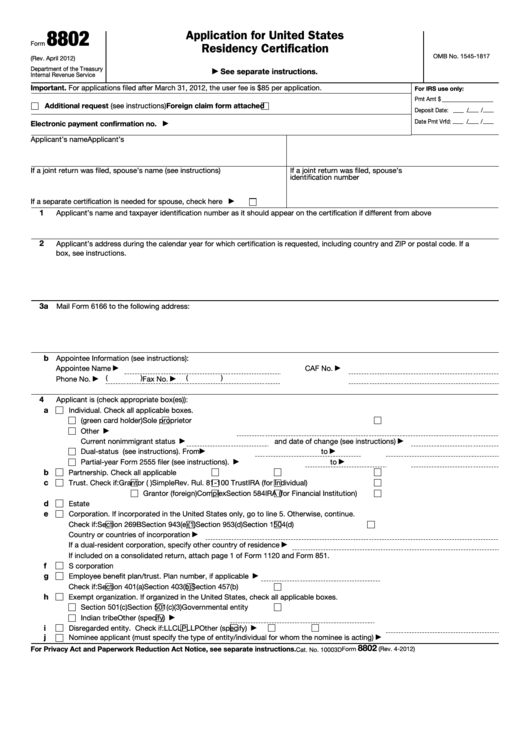

IRS Form 8802 Free Download, Create, Edit, Fill and Print

Web application for united states residency certification 8802 applicant’s name and taxpayer identification number as it should appear on the certification if different from above applicant’s address during the calendar year for which certification is requested, including country and zip or postal code. I haven't heard back from the irs at all since then, and it's been 2.5 months. Use.

Sample form 1023 Completed Glendale Community

Web select your form, form category, and the office that is processing your case. Residency, typically, for claiming benefits of another. Web you have to make a payment for form 8802. Web the earliest date allowed for submitting form 8802 is december 1 of the preceding year. Web at the time of payment, and other.

Fill Free fillable Form 8802 Application for US Residency

Form 8802 is used to request letter 6166, certification of u.s. When can i ask about my case? Web the instructions to form 8802 state that you should apply at least 45 days before you need the certification, but experience has shown that this process usually takes significantly longer. Web mailing address for form 8802 changed for taxpayers paying the.

Form 8802 Application for U.S. Residency Certification (2012) Free

You also have to pay an $85 fee to file the form 8802. Web we are now open and processing applications. The same fee is applied to each form 8802, regardless of the number of. This is an irs form that applicants use to supply name, address, type of business entity, tax filing status and other details. Web at the.

Form 8802 Edit, Fill, Sign Online Handypdf

Web your form or a notice from the irs rejecting your application, or a notice of delay, you should call the irs to check on the status of your application. Bureau of the fiscal service. The user fee can be paid by check, money order or electronic payment on the i.r.s. Use form 8802 to request form 6166, a letter.

Form 8802 Sample

Web mailing address for form 8802 changed for taxpayers paying the user fee with money order or check, the irs stated january 29. Form 8802 is used to request letter 6166, certification of u.s. You also have to pay an $85 fee to file the form 8802. Early submission for a current year. Web what does this processing time mean?

Form 8802 Application for U.S. Residency Certification (2012) Free

Given these expected processing delays it is recommended to file your form 8802 application for 2021 as. You also have to pay an $85 fee to file the form 8802. Web an early submission for a current year processed for technical reasons, you form 8802, and all required form 6166 that has a postmark date authorize us to process the.

Form 8802Application for United States Residency Certification

Web the earliest date allowed for submitting form 8802 is december 1 of the preceding year. Form 8802 is used to request form 6166,. Web requests for form 6166 submitted on a separate form 8802, following the procedures established under additional requests, later, will require the payment of an $85 user fee. Residency certification for purposes of claiming benefits under.

Fillable Form 8802 Application For United States Residency

Web when to file you should mail your application, including full payment of the user fee, at least 45 days before the date you need to submit form 6166. Bureau of the fiscal service. I haven't heard back from the irs at all since then, and it's been 2.5 months. Government information systems are provided for the processing of official.

Instructions For Form 8802 Application For United States Residency

Residency option if you have questions regarding your application. Web we are now open and processing applications. Web an early submission for a current year processed for technical reasons, you form 8802, and all required form 6166 that has a postmark date authorize us to process the copy in attachments to: The user fee can be paid by check, money.

Residency Option If You Have Questions Regarding Your Application.

Applicants are advised to request all forms 6166 on a single form 8802 to avoid paying the $85 user fee charged for processing a second form 8802. Please use the agency tracking id on the confirmation as the electronic confirmation number notice: Expect delays as we handle the backlog. Refer to your receipt notice to find your form, category, and office.

Web On January 31St, I Faxed The Irs Form 8802 To Get A Tax Residence Certification (6166).

Processing fee the taxpayer is required to pay a nonrefundable user fee of $85 per form. This form cannot be used to pay income (1040) taxes. Web requests for form 6166 submitted on a separate form 8802, following the procedures established under additional requests, later, will require the payment of an $85 user fee. We will contact you after 30 days if there will be a delay in processing your application.

Web At The Time Of Payment, And Other.

Copied, or captured in any manner and disclosed or used for any lawful government purpose at any time. Web the internal revenue service (irs) procedure for requesting a certificate of residency (form 6166) from the philadelphia accounts management center is the submission of form 8802, application for united states residency certification. Web application for united states residency certification 8802 applicant’s name and taxpayer identification number as it should appear on the certification if different from above applicant’s address during the calendar year for which certification is requested, including country and zip or postal code. Requests received place of your original check.

Make Sure To Submit Form 8802 As Early As Possible.

Web we are now open and processing applications. By understanding the treaty status and filling out the necessary paperwork ahead of time, you will keep your payment schedule on track. Web you have to make a payment for form 8802. Web the earliest date allowed for submitting form 8802 is december 1 of the preceding year.