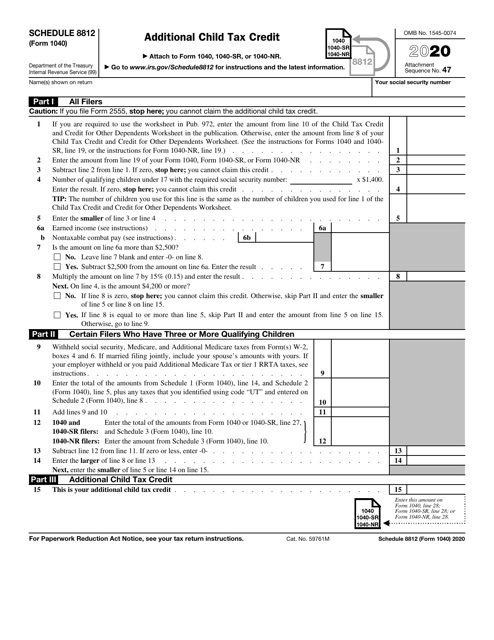

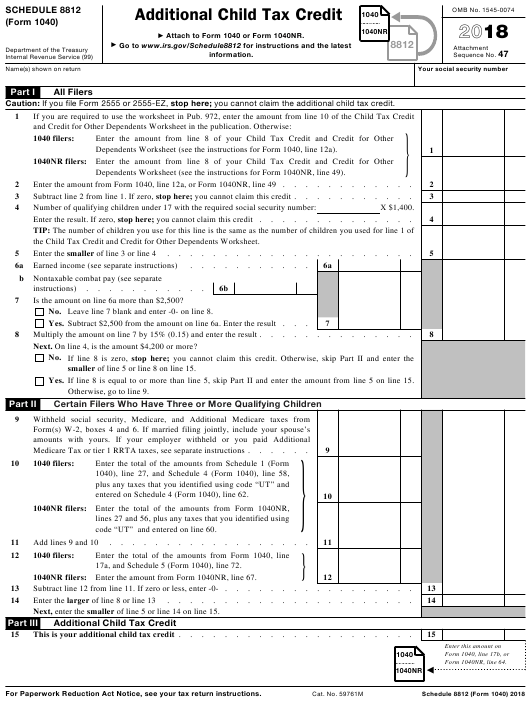

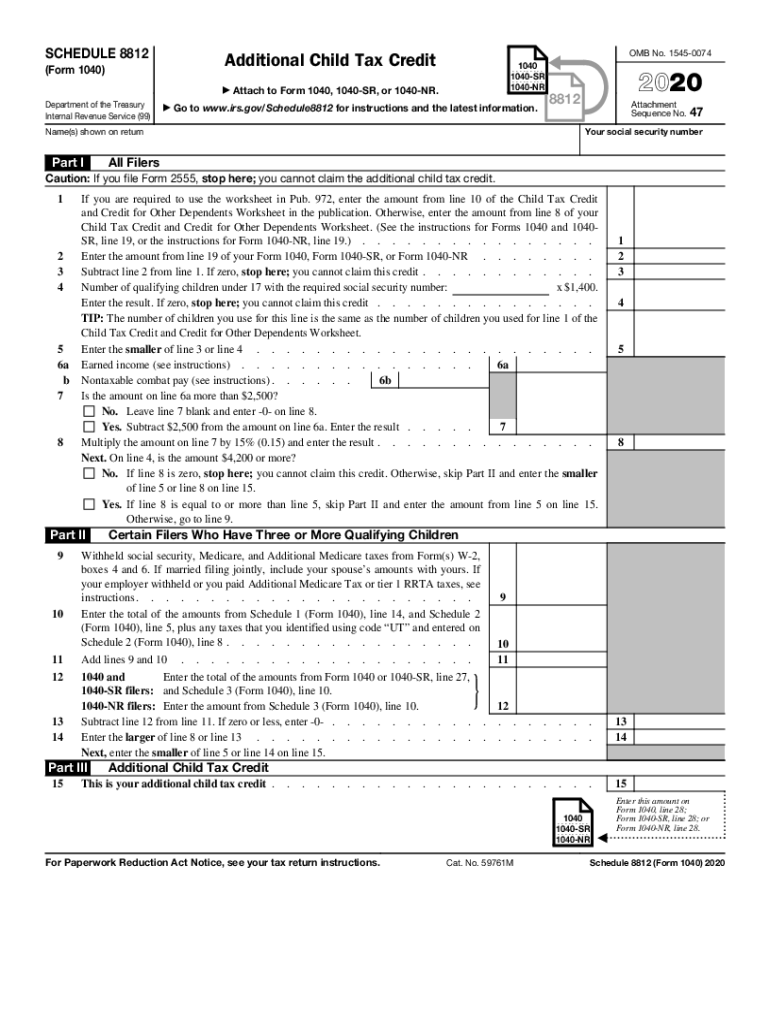

Form 8812 For 2020

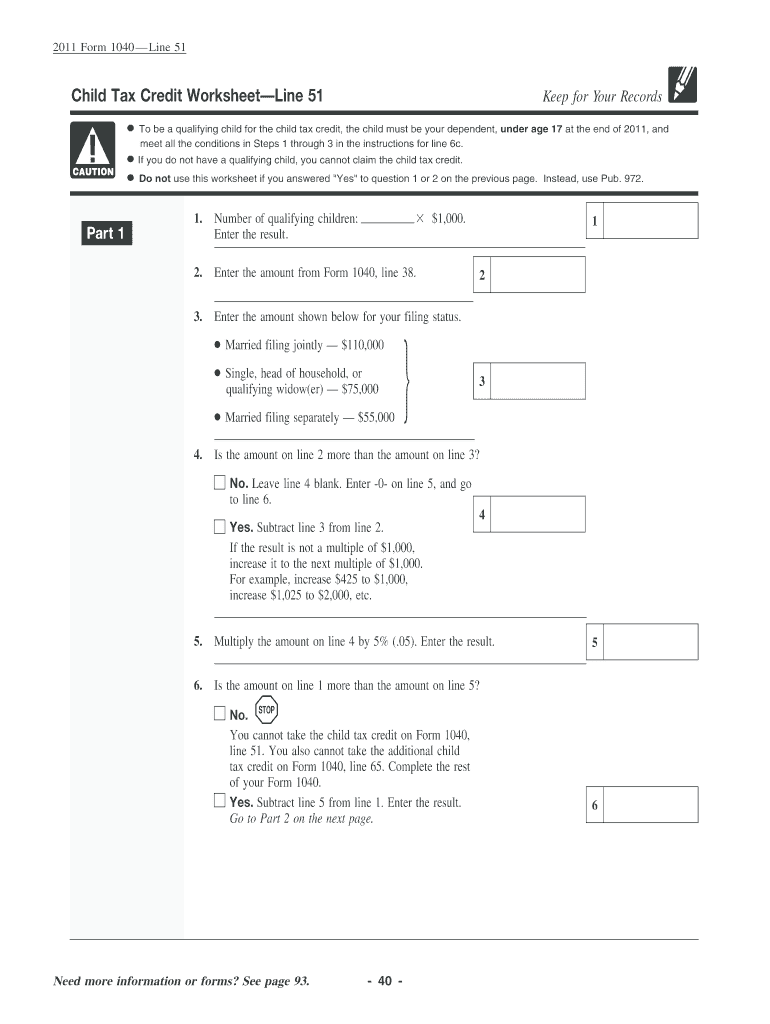

Form 8812 For 2020 - Download blank or fill out online in pdf format. The additional child tax credit may qualify a. Web you'll use form 8812 to calculate your additional child tax credit. Review your form 1040 lines 24 thru 35. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. Web enter the information for the tax return. Web editable irs 1040 schedule 8812 instructions 2020. Schedule 8812 is automatically generated in. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. The 2021 schedule 8812 is intended to be filed by all.

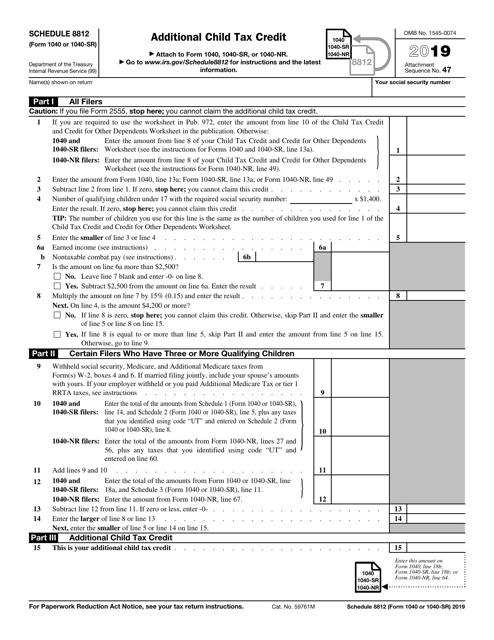

Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Complete, sign, print and send your tax documents easily with us legal. Web filling out schedule 8812. Schedule 8812 is automatically generated in. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. Should be completed by all filers to claim the basic. To preview your 1040 before filing: Web generating the additional child tax credit on form 8812 in proconnect intuit proconnect will automatically compute the additional child tax credit (ctc) based on. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The 2021 schedule 8812 is intended to be filed by all.

Web filling out schedule 8812. Web editable irs 1040 schedule 8812 instructions 2020. The 2021 schedule 8812 is intended to be filed by all. Download blank or fill out online in pdf format. Web you'll use form 8812 to calculate your additional child tax credit. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. Web get a 1040 schedule 8812 (2020) here. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web what is the child tax credit/additional child tax credit (8812)?

Additional Tax Credit carfare.me 20192020

Your refund is reported on form 1040 line 35a. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any.

IRS Form 1040 Schedule 8812 Download Fillable PDF or Fill Online

Should be completed by all filers to claim the basic. Complete, sign, print and send your tax documents easily with us legal. Complete, sign, print and send your tax documents easily with us legal forms. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). To.

credit limit worksheet Fill Online, Printable, Fillable Blank form

Web the child tax credit is a valuable tax benefit claimed by millions of american parents with the goal of offsetting the costs of raising a child. Complete, sign, print and send your tax documents easily with us legal forms. Complete, sign, print and send your tax documents easily with us legal. Download blank or fill out online in pdf.

Child Tax Credit Worksheet Form 8812 Additional Child Tax Credit

Your refund is reported on form 1040 line 35a. The ctc and odc are. The child tax credit is. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Web most taxpayers are required to file a yearly income tax return in april to both the internal.

Schedule 8812 Credit Limit Worksheet A

Should be completed by all filers to claim the basic. The ctc and odc are. Web the child tax credit is a valuable tax benefit claimed by millions of american parents with the goal of offsetting the costs of raising a child. The ctc and odc are. Web irs schedule 8812 is the section on form 1040 that needs to.

2015 Child Tax Credit Worksheet worksheet

Web generating the additional child tax credit on form 8812 in proconnect intuit proconnect will automatically compute the additional child tax credit (ctc) based on. The 2021 schedule 8812 is intended to be filed by all. Web enter the information for the tax return. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes.

2017 Form 8812 Online PDF Template

For 2022, there are two parts to this form: Download blank or fill out online in pdf format. Schedule 8812 is automatically generated in. The ctc and odc are. Web the calculations for the amount reported on line 28 are on form 8812, line 14i (us residents) or 15h (non us residents).

Credit Limit Worksheets A Form

Download blank or fill out online in pdf format. Web filling out schedule 8812. The ctc and odc are. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Download blank or fill out online in pdf format.

8812 Worksheet

Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. For 2022, there are two parts to this form: Web you'll use form 8812 to calculate your additional child tax credit. The additional child tax credit may qualify a. Lacerte will automatically generate schedule.

What Is A 1040sr Worksheet

Web filling out schedule 8812. Download blank or fill out online in pdf format. Web generating the additional child tax credit on form 8812 in proconnect intuit proconnect will automatically compute the additional child tax credit (ctc) based on. Web what is the child tax credit/additional child tax credit (8812)? The 2021 schedule 8812 is intended to be filed by.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

The child tax credit is. Web irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit. Web the calculations for the amount reported on line 28 are on form 8812, line 14i (us residents) or 15h (non us residents). Web filling out schedule 8812.

Review Your Form 1040 Lines 24 Thru 35.

Download blank or fill out online in pdf format. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web editable irs 1040 schedule 8812 instructions 2020. The ctc and odc are.

The Ctc And Odc Are.

The 2021 schedule 8812 is intended to be filed by all. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. To preview your 1040 before filing: Web the child tax credit is a valuable tax benefit claimed by millions of american parents with the goal of offsetting the costs of raising a child.

For 2022, There Are Two Parts To This Form:

Download blank or fill out online in pdf format. Web generating the additional child tax credit on form 8812 in proconnect intuit proconnect will automatically compute the additional child tax credit (ctc) based on. Web get a 1040 schedule 8812 (2020) here. Web enter the information for the tax return.