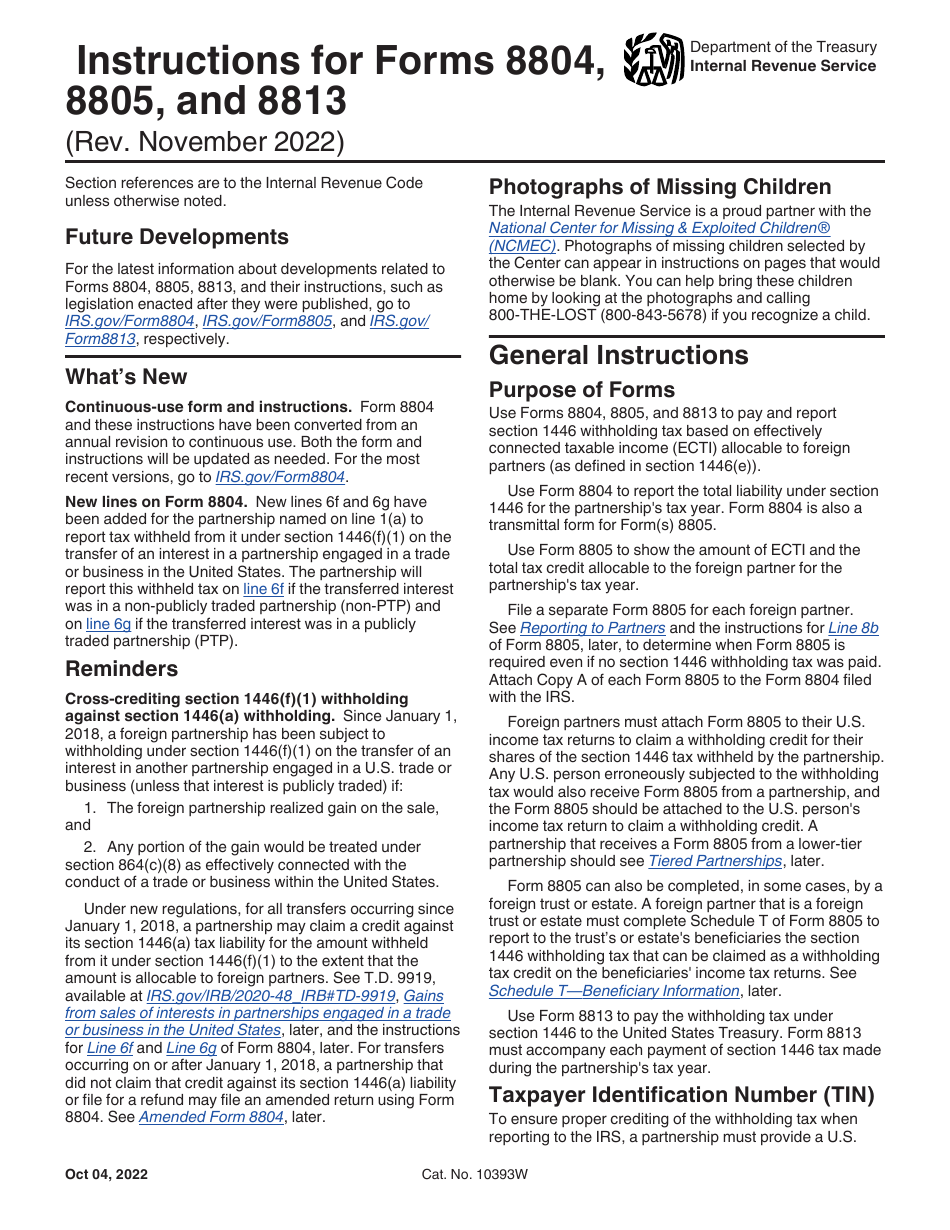

Form 8813 Instructions

Form 8813 Instructions - Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Instructions for forms 8804, 8805 and 8813 2010 inst 8804, 8805 and 8813: Web we last updated the partnership withholding tax payment voucher (section 1446) in february 2023, so this is the latest version of form 8813, fully updated for tax year 2022. Mail this voucher with a check Don't attach the forms in pdf format to the form 1065 return. Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. See separate instructions for forms 8804, 8805, and 8813. Instructions for forms 8804, 8805 and 8813 2011 inst 8804, 8805 and 8813:

Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Form 8813 must accompany each payment of section. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Mail this voucher with a check Don't attach the forms in pdf format to the form 1065 return. 10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813. Instructions for forms 8804, 8805 and 8813 2011 inst 8804, 8805 and 8813: Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Web inst 8804, 8805 and 8813: See separate instructions for forms 8804, 8805, and 8813.

Instructions for forms 8804, 8805 and 8813 2011 inst 8804, 8805 and 8813: You can print other federal tax forms here. Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Instructions for forms 8804, 8805 and 8813 2009 form 8813: Form 8813 must accompany each payment of section. Web form 8813 partnership withholding tax payment voucher (section 1446) omb no. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Don't attach the forms in pdf format to the form 1065 return. Web inst 8804, 8805 and 8813:

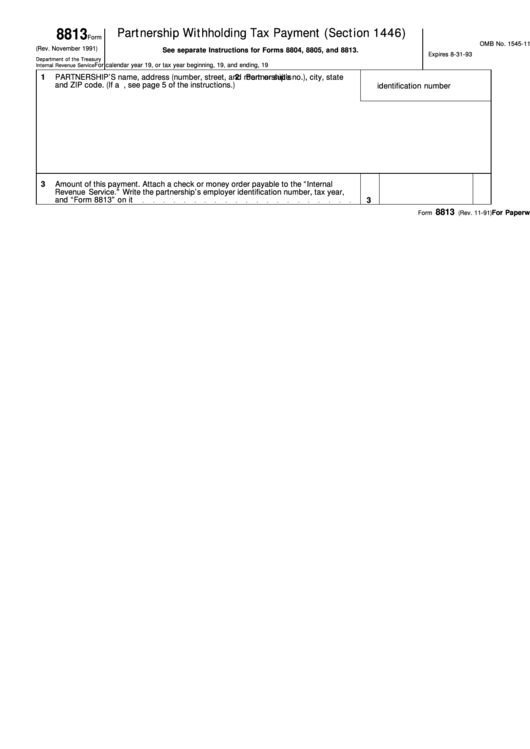

Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)…

Internal revenue service form 8813(rev. Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Mail this voucher with a check Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report.

Download Instructions for IRS Form 8804, 8805, 8813 PDF Templateroller

Instructions for forms 8804, 8805 and 8813 2010 inst 8804, 8805 and 8813: Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually.

3.21.15 Withholding on Foreign Partners Internal Revenue Service

Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. 10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813. Web this is your quick reference guide for using the electronic federal tax payment system.

Form 8813 Partnership Withholding Tax Payment (Section 1446

See separate instructions for forms 8804, 8805, and 8813. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Form 8813 must accompany each payment of section. Web file form 8813 on or before the 15th day.

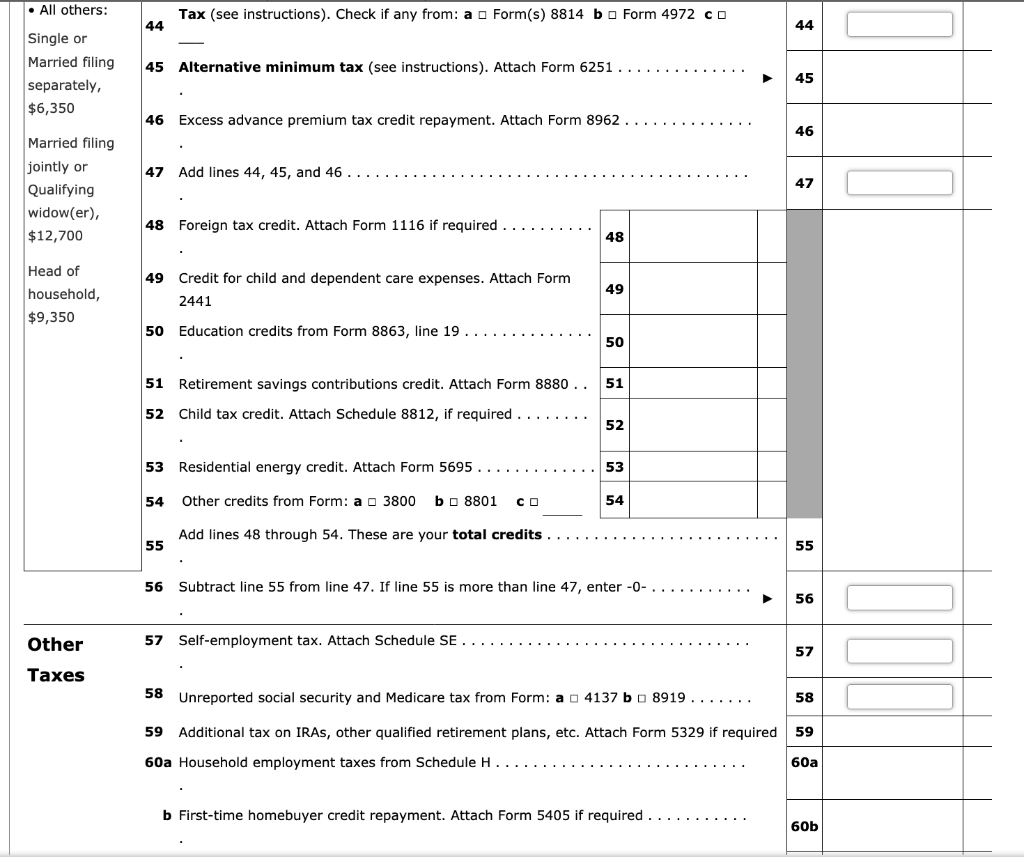

Note This Problem Is For The 2017 Tax Year. Janic...

Don't attach the forms in pdf format to the form 1065 return. Web form 8813 partnership withholding tax payment voucher (section 1446) omb no. Partnership withholding tax payment voucher (section 1446) Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of.

8813

10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813. Don't attach the forms in pdf format to the form 1065 return. Web use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Web inst.

Texas Blue Form 2022

Partnership withholding tax payment voucher (section 1446) Don't attach the forms in pdf format to the form 1065 return. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Web form 8813.

Scantron Form No 882 E Instructions Universal Network

Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s. Web form 8813 is.

Form 8813 Instructions 2022 Fill online, Printable, Fillable Blank

Web we last updated the partnership withholding tax payment voucher (section 1446) in february 2023, so this is the latest version of form 8813, fully updated for tax year 2022. Don't attach the forms in pdf format to the form 1065 return. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on.

LEGO Battle at the Pass Set 8813 Instructions Comes In Brick Owl

Instructions for forms 8804, 8805 and 8813 2010 inst 8804, 8805 and 8813: You can print other federal tax forms here. Web inst 8804, 8805 and 8813: Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. 10681h partnership withholding tax payment voucher (section 1446).

Mail This Voucher With A Check

Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Web form 8813 partnership withholding tax payment voucher (section 1446) omb no. Web form 8813 is used by a partnership to pay the withholding tax under section 1446.

Instructions For Forms 8804, 8805 And 8813 2009 Form 8813:

Instructions for forms 8804, 8805 and 8813 2010 inst 8804, 8805 and 8813: You can print other federal tax forms here. Don't attach the forms in pdf format to the form 1065 return. 10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813.

See Separate Instructions For Forms 8804, 8805, And 8813.

Form 8813 must accompany each payment of section. Internal revenue service form 8813(rev. Web use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Web inst 8804, 8805 and 8813:

Partnership Withholding Tax Payment Voucher (Section 1446)

Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Web we last updated the partnership withholding tax payment voucher (section 1446) in february 2023, so this is the latest version of form 8813, fully updated for tax year 2022. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s.