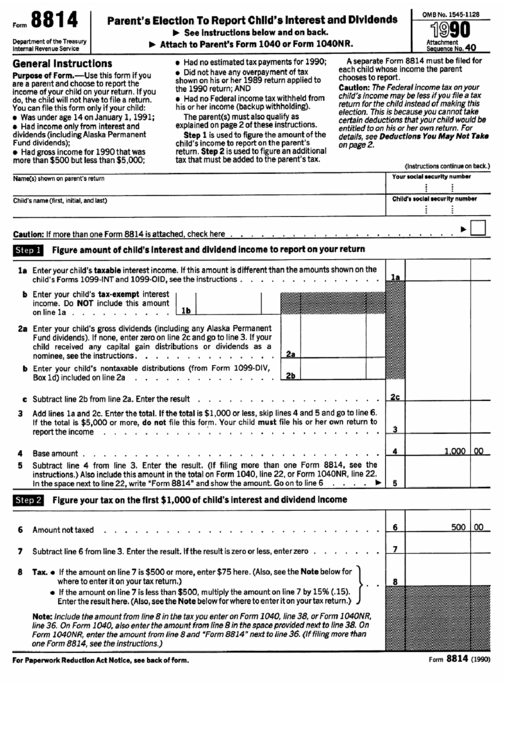

Form 8814 Tax Form

Form 8814 Tax Form - If you file form 8814 with your income tax return to report. Start completing the fillable fields and carefully. Complete line 7b if applicable. Complete line 7b if applicable. Ad access irs tax forms. Web irs form 8814 allows parents to include a passive income of their child into their tax return. If you do, your child will not have to file a return. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. It is difficult to force a child to fill out a huge form, isn’t it? Web you can get form 8814 by performing the following steps:

Web you can get form 8814 by performing the following steps: It is difficult to force a child to fill out a huge form, isn’t it? Complete, edit or print tax forms instantly. Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Web of all payments of estimated tax made on or before the last date prescribed for payment of such installment equals or exceeds: 1) click on the personal or federal tab to the left of your screen. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. 2) click on wages and income 3) click. Get ready for tax season deadlines by completing any required tax forms today.

Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. If you file form 8814 with your income tax return to report. Web what is form 8814? Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Use this form if you elect to report your child’s income on your return. 2) click on wages and income 3) click. A separate form 8814 must be filed for. Get ready for tax season deadlines by completing any required tax forms today. Start completing the fillable fields and carefully.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

This form is for income earned in tax year 2022, with tax returns due in april. Web what is form 8814, parent's election to report child's interest/dividend earnings? Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Use this form if.

Form 8814 Parent's Election to Report Child's Interest and Dividends

You can make this election if your child. 2) click on wages and income 3) click. Get ready for tax season deadlines by completing any required tax forms today. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web what is form 8814, parent's election to report child's interest/dividend earnings?

Form 8814 Parents' Election To Report Child'S Interest And Dividends

1) click on the personal or federal tab to the left of your screen. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Complete, edit or.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

That is why you may be. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Our 1040 solutions integrate with your existing tax software to boost efficiency. Get ready for tax season deadlines.

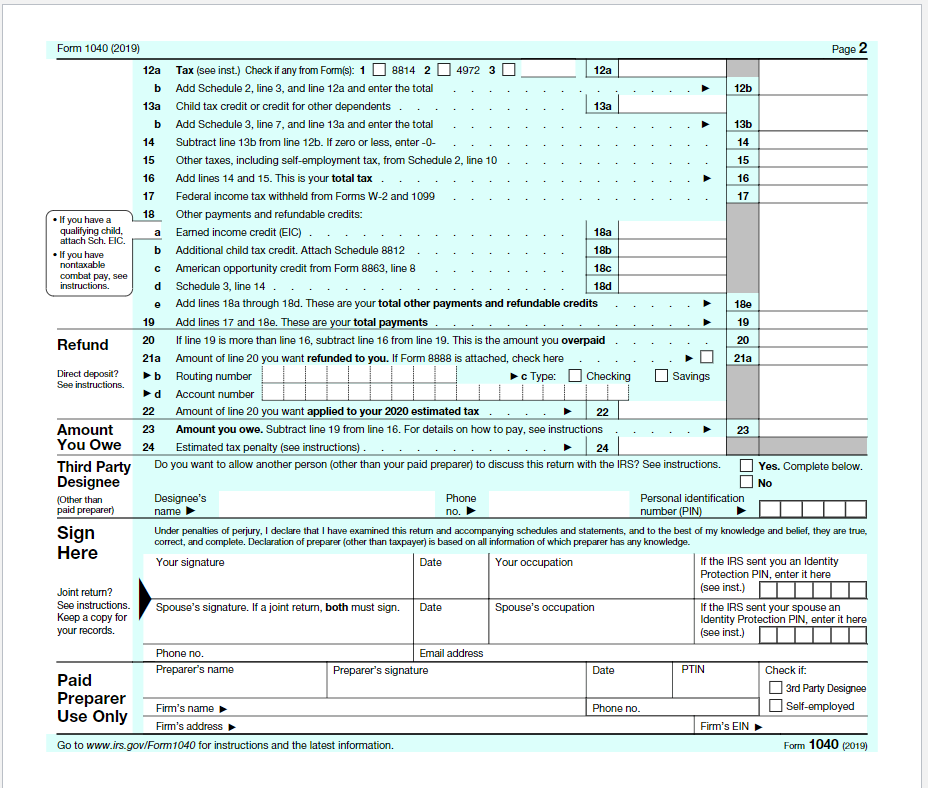

Tax Return Tax Return Qualified Dividends

Web of all payments of estimated tax made on or before the last date prescribed for payment of such installment equals or exceeds: Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. It is difficult to force a child to fill out a huge form, isn’t it? Web to make the election, complete.

Form 8814 Parent's Election to Report Child's Interest and Dividends

If you file form 8814 with your income tax return to report your. If you do, your child will not have to file a return. 1) click on the personal or federal tab to the left of your screen. Ad access irs tax forms. Complete line 7b if applicable.

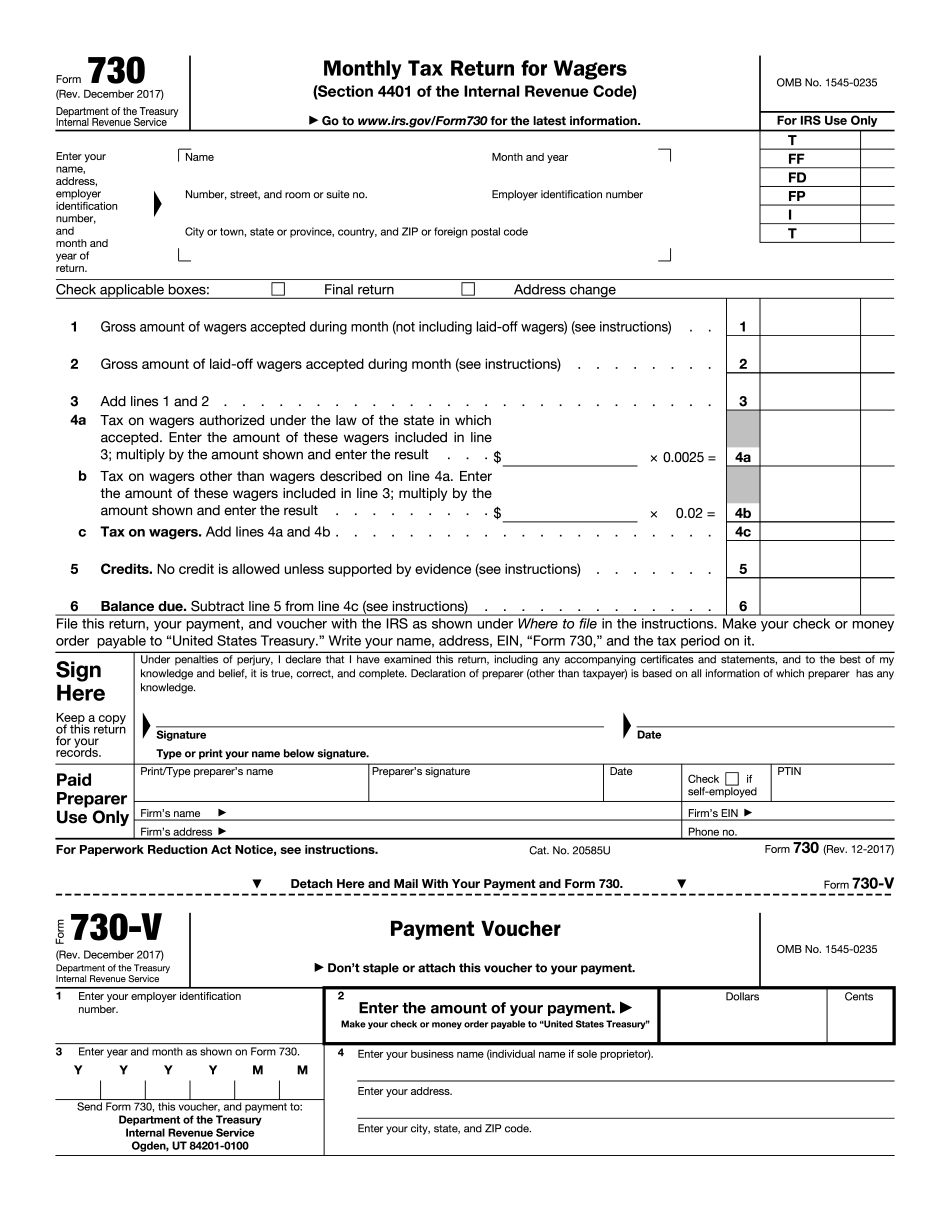

Printable 2290 Tax Form 2021 Printable Form 2022

Complete line 7b if applicable. Web you can get form 8814 by performing the following steps: Web irs form 8814 allows parents to include a passive income of their child into their tax return. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. It is difficult to force a child to fill out.

8814 form Fill out & sign online DocHub

Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Web what is form 8814, parent's election to report child's interest/dividend earnings? Get ready for tax season deadlines by completing any required tax forms today. Web of all payments of estimated tax made on or before the last date prescribed for.

Solved This is a taxation subject but chegg didn't give a

Use get form or simply click on the template preview to open it in the editor. Our 1040 solutions integrate with your existing tax software to boost efficiency. Under penalties of perjury, i declare that the above information and any attached supplement is true, complete, and correct. Taxpayer name address city, state zip. Web enter “form 8814” on the dotted.

Irs Form 1040 Head Of Household Form Resume Examples

Complete, edit or print tax forms instantly. Web irs form 8814 allows parents to include a passive income of their child into their tax return. Web what is form 8814? Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Web what.

Web What Is Form 8814, Parent's Election To Report Child's Interest/Dividend Earnings?

A separate form 8814 must be filed for. If you file form 8814 with your income tax return to report. A) 90 percent of the tax shown on the return (form. Ad access irs tax forms.

If You Do, Your Child Will Not Have To File A Return.

Web irs form 8814 allows parents to include a passive income of their child into their tax return. Web you can get form 8814 by performing the following steps: It is difficult to force a child to fill out a huge form, isn’t it? Complete line 7b if applicable.

2) Click On Wages And Income 3) Click.

Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file.

Complete, Edit Or Print Tax Forms Instantly.

Get ready for tax season deadlines by completing any required tax forms today. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Use this form if you elect to report your child’s income on your return. Use get form or simply click on the template preview to open it in the editor.