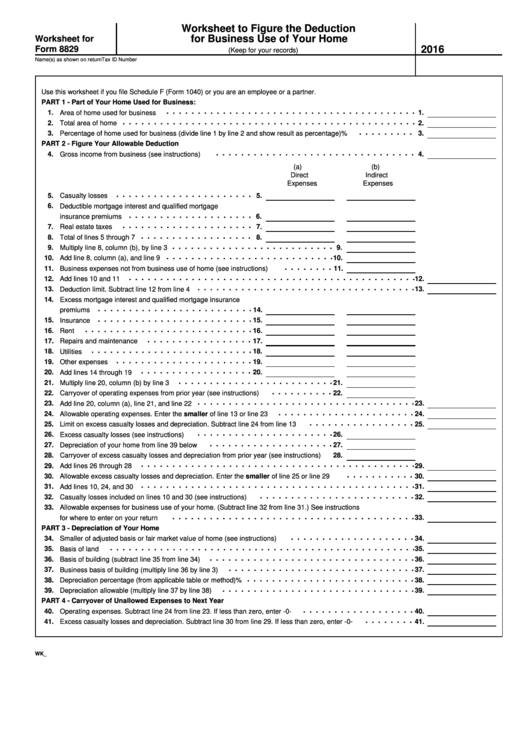

Form 8829 Worksheet

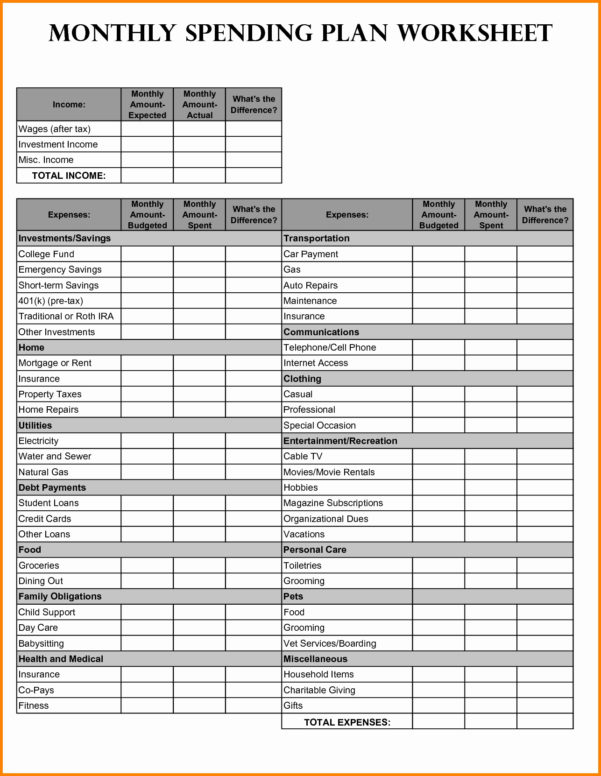

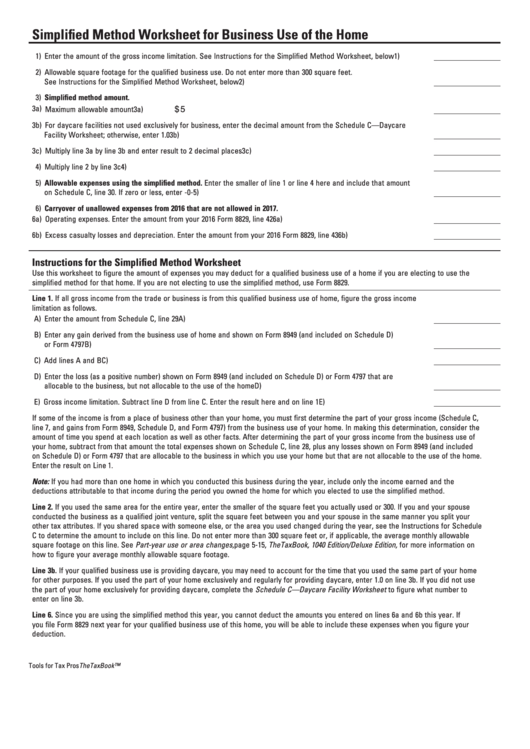

Form 8829 Worksheet - Go to www.irs.gov/form8829 for instructions and the latest information. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Use a separate form 8829 for each home you used for business during the year. Web department of the treasury internal revenue service file only with schedule c (form 1040). Use a separate form 8829 for each home you used for the business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. How can i enter multiple 8829's? Web irs form 8829 is the form used to deduct expenses for your home business space. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing.

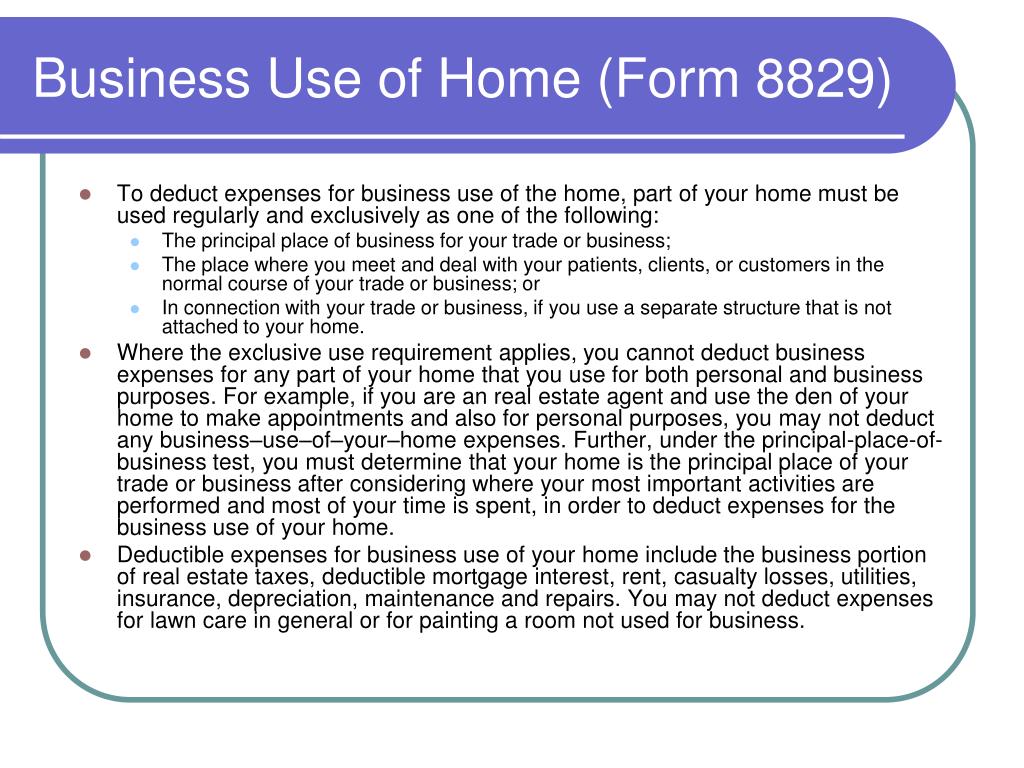

Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? 176 name(s) of proprietor(s) your social security number The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return. Web there are two ways to claim the deduction: Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year. You must meet specific requirements to deduct expenses for the business use of your home. Use a separate form 8829 for each home you used for the business during the year. Web department of the treasury internal revenue service file only with schedule c (form 1040). Form 8829—business use of home.

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return. 176 name(s) of proprietor(s) your social security number Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web there are two ways to claim the deduction: Use a separate form 8829 for each home you used for the business during the year. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction.

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year. Web common questions about form 8829 in proseries solved • by intuit • 28.

Major Hykr See You On the Trail!

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Go to www.irs.gov/form8829 for instructions and the latest information. Use a separate form 8829 for each home you used for business during the year. Use form 8829 to figure the allowable expenses for business use of your.

worksheet. Form 8829 Worksheet. Worksheet Fun Worksheet Study Site

Form 8829—business use of home. 176 name(s) of proprietor(s) your social security number Web there are two ways to claim the deduction: Use a separate form 8829 for each home you used for business during the year. Go to www.irs.gov/form8829 for instructions and the latest information.

Home Daycare Tax Worksheet

Web there are two ways to claim the deduction: 176 name(s) of proprietor(s) your social security number Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? Web information about form 8829,.

Solved Trying to fix incorrect entry Form 8829

176 name(s) of proprietor(s) your social security number Web there are two ways to claim the deduction: The irs determines the eligibility of an allowable home business space using two criterion: Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Use a.

For a new LLC in service this year, where my property has been

Web there are two ways to claim the deduction: Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is.

Solved Trying to fix incorrect entry Form 8829

The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Use a separate form 8829 for each home you used for business.

8829 Simplified Method (ScheduleC, ScheduleF)

Use a separate form 8829 for each home you used for the business during the year. Web department of the treasury internal revenue service file only with schedule c (form 1040). Web irs form 8829 is the form used to deduct expenses for your home business space. Web overview one of the many benefits of working at home is that.

Simplified Method Worksheet For Business Use Of The Home printable pdf

Web department of the treasury internal revenue service file only with schedule c (form 1040). Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Use a separate form 8829 for each home you used for business during the year. Go to www.irs.gov/form8829 for instructions and the.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Use a separate form 8829 for each home you used for the business during the year. Web overview one of the.

Use A Separate Form 8829 For Each Home You Used For The Business During The Year.

Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. How can i enter multiple 8829's? Web irs form 8829 is the form used to deduct expenses for your home business space. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Web Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To 2023 Of Amounts Not Deductible In 2022.

Web there are two ways to claim the deduction: Use a separate form 8829 for each home you used for business during the year. The irs determines the eligibility of an allowable home business space using two criterion: Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction.

Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts.

Web department of the treasury internal revenue service file only with schedule c (form 1040). Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Form 8829—business use of home. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return.

You Must Meet Specific Requirements To Deduct Expenses For The Business Use Of Your Home.

The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? 176 name(s) of proprietor(s) your social security number Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes.