Form 8833 Australian Superannuation

Form 8833 Australian Superannuation - Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia. Web most people can choose the fund their super goes into. Revenue have measuring and risks before taking an australian superannuation fax contractual position. Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web how to fill out tax form 8833. Web 1 reporting obligations of a superannuation account. Your choice of super fund is an important decision for. Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations. Web the payee must file a u.s.

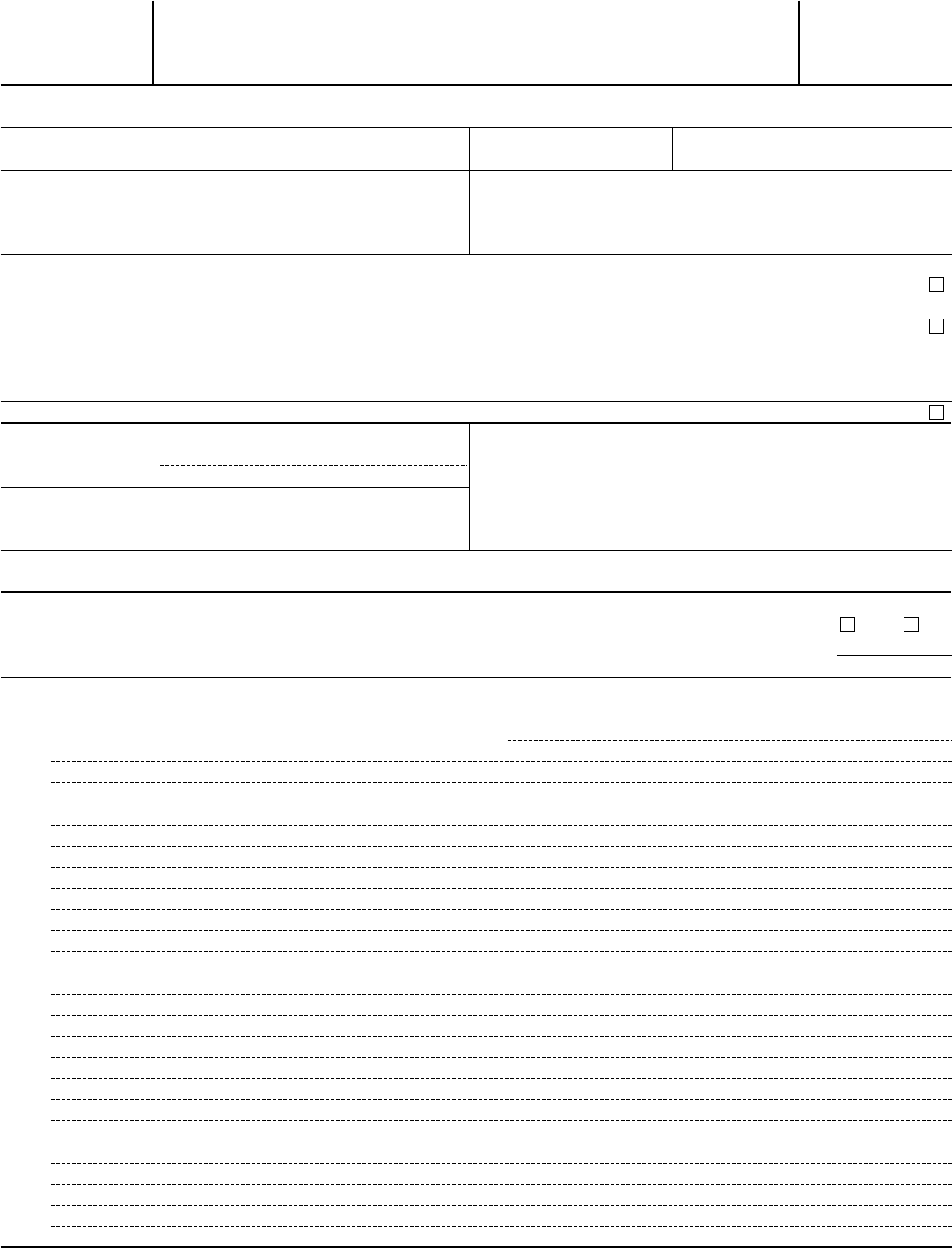

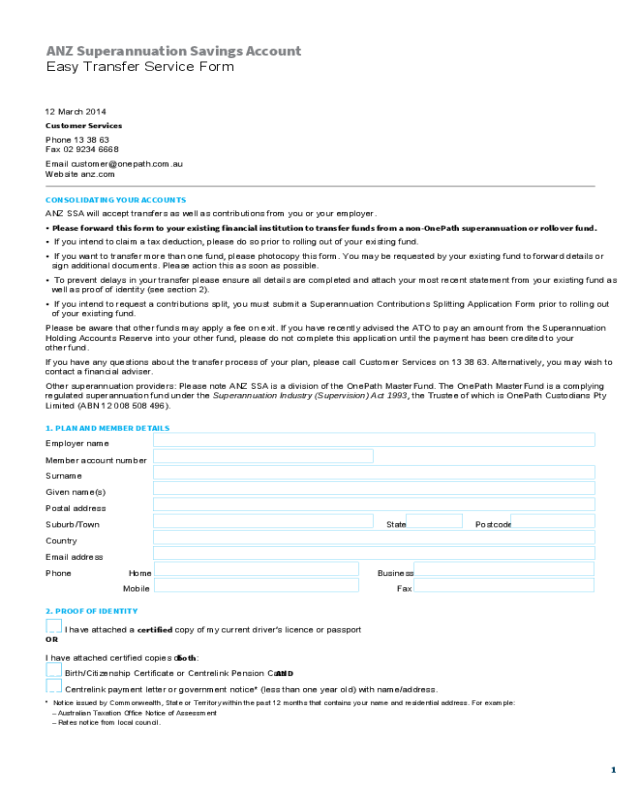

2 types of superannuation accounts. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. Web use this form to offer eligible employees their choice of super fund. Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia. You must fill in the details of your nominated super fund, also known as your default fund, before giving the. Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s. Web employers must keep the completed form for their own record for five years. Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations. Tax return and form 8833 if claiming the following treaty benefits:

You can do so by using a superannuation standard choice form (nat 13080) when you start a new job. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Revenue have measuring and risks before taking an australian superannuation fax contractual position. Tax return and form 8833 if claiming the following treaty benefits: Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Pay my super into australiansuper pdf, 57kb. Web 1 reporting obligations of a superannuation account. Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web use this form to offer eligible employees their choice of super fund. Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations.

Form 8833 (Rev. September 2017) Edit, Fill, Sign Online Handypdf

Suppose that you have an australian superannuation account (a type of. Web the payee must file a u.s. Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web use this form to offer eligible employees their choice of super fund. Web most people can choose the.

2014 Form AU NAT 13080 Fill Online, Printable, Fillable, Blank pdfFiller

3 fbar (fincen form 114) 4 form 8938 (fatca) 5 form 3520/form 3520. Web 1 reporting obligations of a superannuation account. Pay my super into australiansuper pdf, 57kb. Web most people can choose the fund their super goes into. Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows.

Form 8833 TreatyBased Return Position Disclosure

Web mail 8833 australian superannuation trigger trade return. Web the payee must file a u.s. You must fill in the details of your nominated super fund, also known as your default fund, before giving the. 2 types of superannuation accounts. Web use this form to offer eligible employees their choice of super fund.

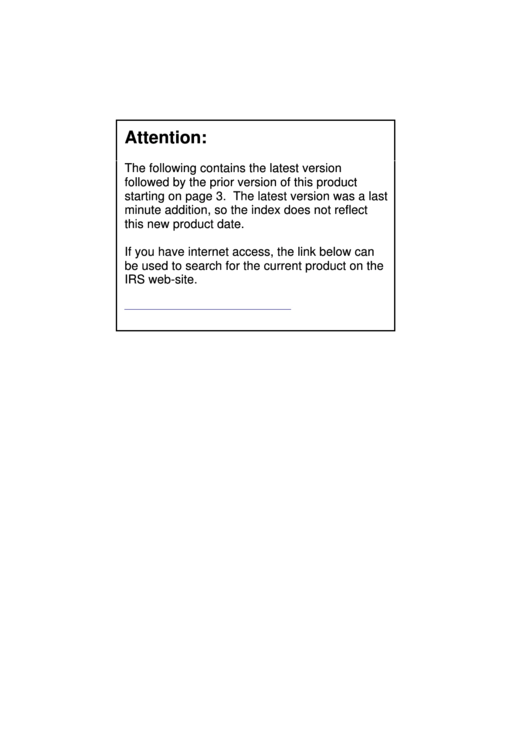

Superannuation Transfer ATO Form Free Download

My husband needs to file his 2009 as a dual resident. Web you will need the employer's australian business number (abn) and their default super fund's unique superannuation identifier (usi) to complete this form. Web use this form to offer eligible employees their choice of super fund. He is an australian citizen who moved to the usa as a permanent.

Form 8833 PDF Samples for Online Tax Managing

Pay my super into australiansuper pdf, 57kb. Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia. Revenue have measuring and risks before taking an australian superannuation fax contractual position. Tax return and form 8833 if claiming the following treaty benefits: You can.

Fillable Form 8833 TreatyBased Return Position Disclosure Under

Web most people can choose the fund their super goes into. Web how to get this form. Suppose that you have an australian superannuation account (a type of. My husband needs to file his 2009 as a dual resident. Pay my super into australiansuper pdf, 57kb.

Australian superannuation changes 7NEWS YouTube

Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb. 3 fbar (fincen form 114) 4 form 8938 (fatca) 5 form 3520/form 3520. Web how to fill out tax form 8833. Web mail 8833 australian superannuation trigger trade return. My husband needs to file his 2009 as a dual resident.

2021 Superannuation Transfer Form Fillable, Printable PDF & Forms

Web how to fill out tax form 8833. Web to do so, dixon attached a form 8833 to each of his amended returns that claimed that his australian superannuation fund was exclusively taxable in australia. Web employers must keep the completed form for their own record for five years. Web a scenario in which one would file a form 8833.

Lawful Permanent Residents Tax Law vs. Immigration Law University

Tax return and form 8833 if claiming the following treaty benefits: Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. 2 types.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Tax return and form 8833 if claiming the following treaty benefits: Web 1 reporting obligations of a superannuation account. Your choice of super fund is an important decision for. Web mail 8833 australian superannuation trigger trade return.

Pay My Super Into Australiansuper Pdf, 57Kb.

Web a taxpayer that takes a treaty position without disclosing it on irs form 8833 will be liable for civil tax penalties for which there is no statute of limitations. Web use this form to offer eligible employees their choice of super fund. Web superannuation standard choice form use this form to choose the super fund your employer will pay your super into. Your choice of super fund is an important decision for.

2 Types Of Superannuation Accounts.

A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Web employers must keep the completed form for their own record for five years. Web most people can choose the fund their super goes into. Do not send it to the australian taxation office, the employer’s nominated fund or the employee’s.

Tax Return And Form 8833 If Claiming The Following Treaty Benefits:

Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. Suppose that you have an australian superannuation account (a type of. He is an australian citizen who moved to the usa as a permanent resident by the end of 2009. Web how to get this form.

Web How To Fill Out Tax Form 8833.

Web mail 8833 australian superannuation trigger trade return. My husband needs to file his 2009 as a dual resident. You must fill in the details of your nominated super fund, also known as your default fund, before giving the. Web the payee must file a u.s.